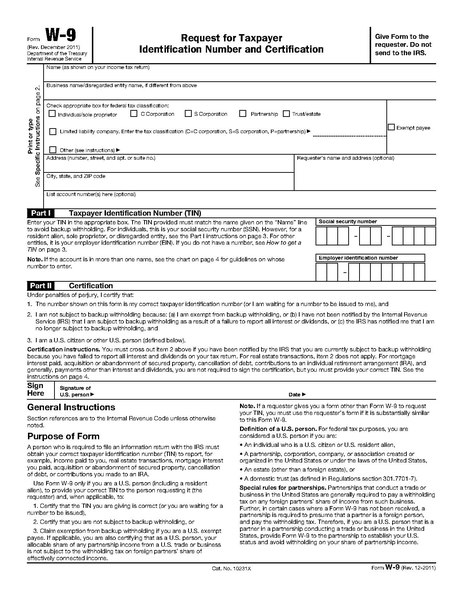

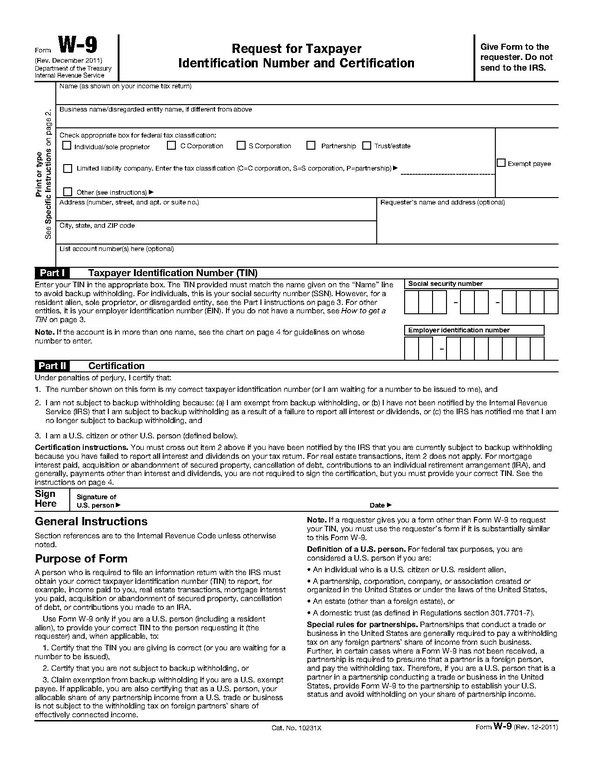

Irs W 9 Form 2018 Printable

Instructions for form w 9 pdf form w 2.

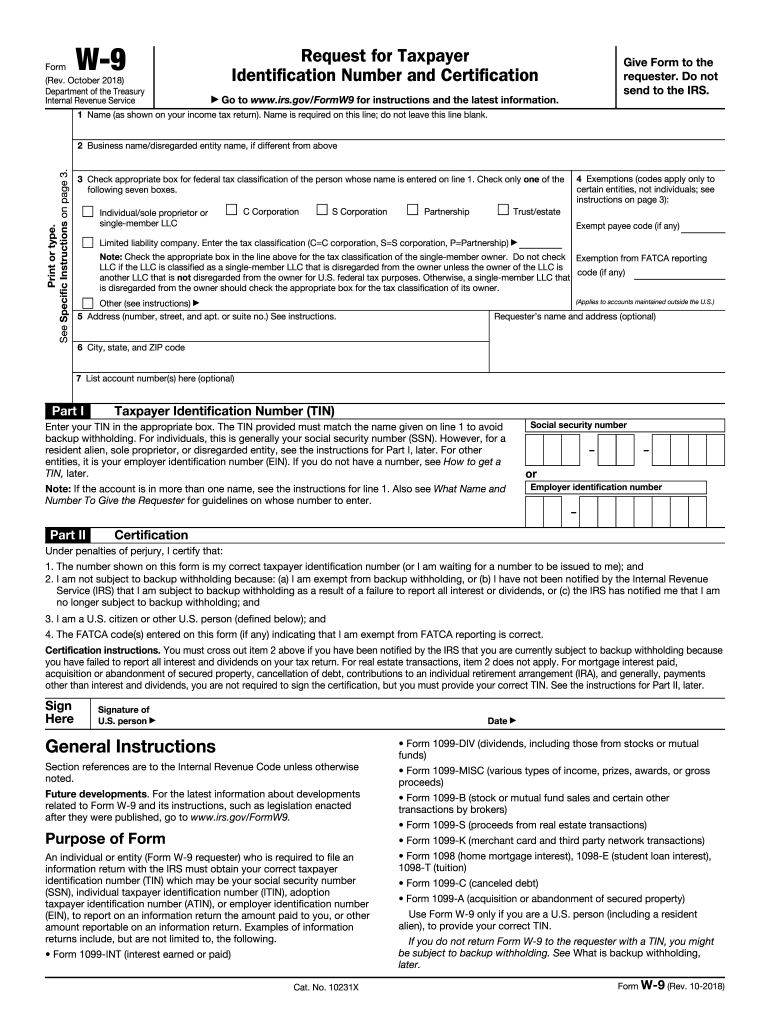

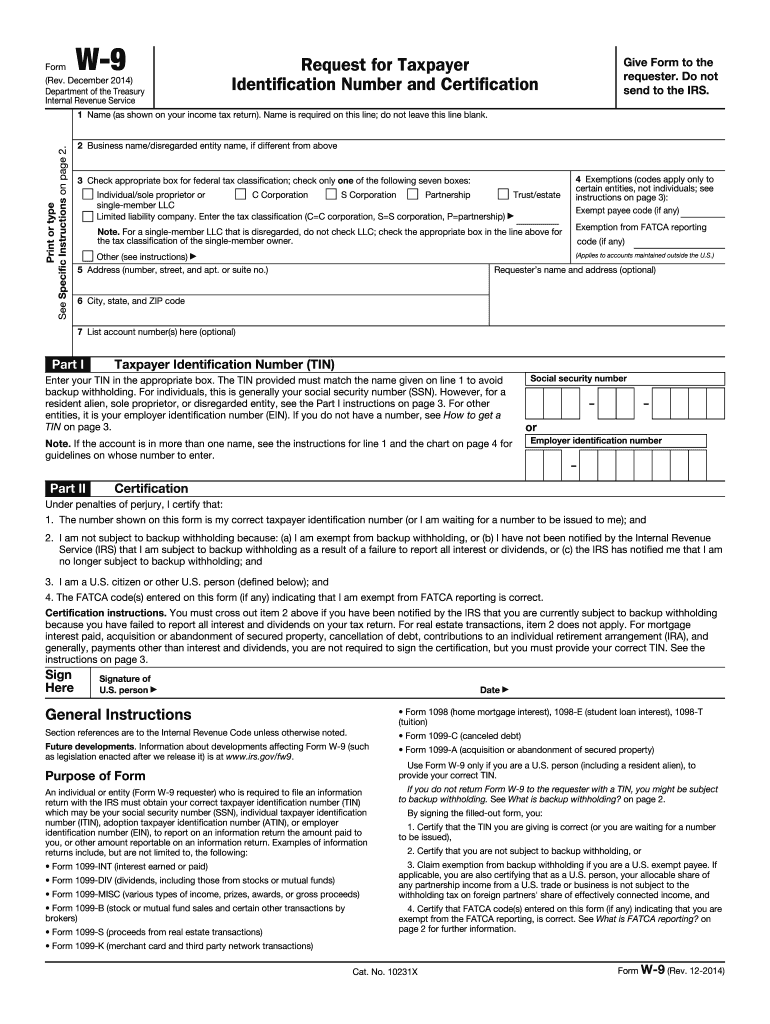

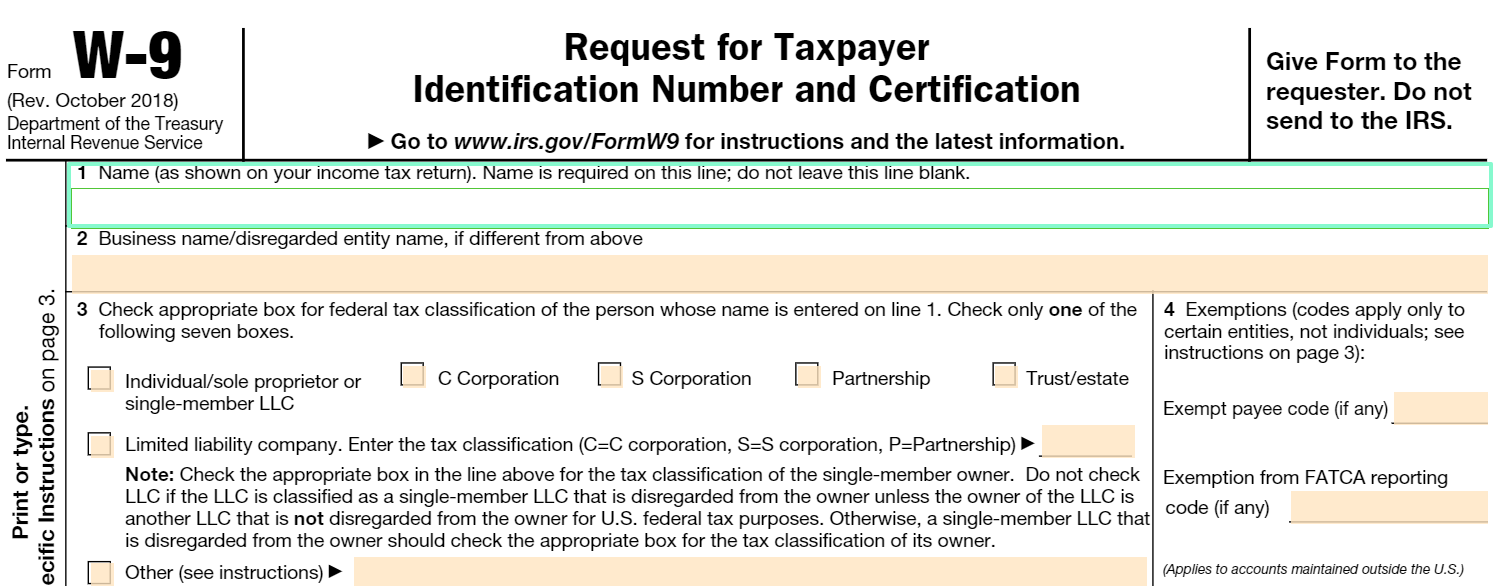

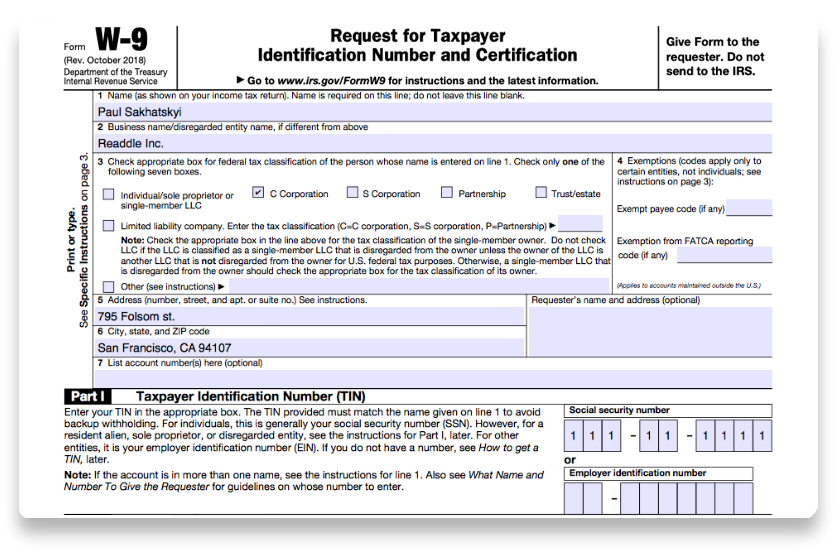

Irs w 9 form 2018 printable. October 2018 department of the treasury internal revenue service. Wage and tax statement. Create fill out and download current w 9 form 2017 2018 online on your computer and mobile. Searching for a printable blank w 9 form.

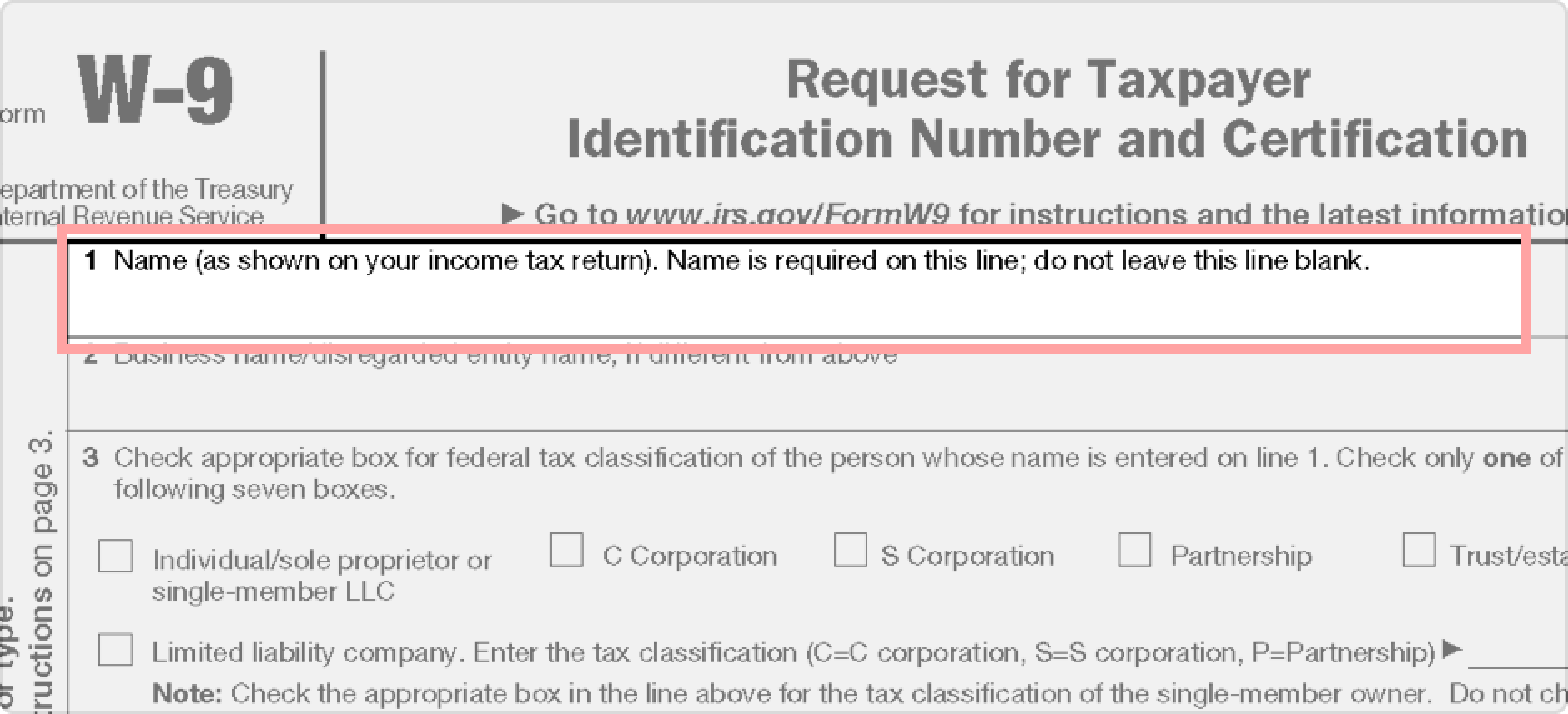

Do not leave this line blank. Fill out w 9 sample rev. Give form to the requester. Name as shown on your income tax return.

Employees withholding allowance certificate whether youre entitled to claim a certain number of allowances or exemption from withholding is subject to review by the irs. Fast procedure no installation. October 2018 request for taxpayer identification number and certification department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted. Information about form w 9 request for taxpayer identification number tin and certification including recent updates related forms and instructions on how to file.

Get ready for the 2018 tax season. Form w 9 pdf related. Requester of form w 9rev. Access irs forms instructions and publications in electronic and print media.

Form w 9 is used to provide a correct tin to payers or brokers required to file information returns with irs. Department of the treasury internal revenue service. Instructions for the requestor of form w 9 request for taxpayer identification number and certification 1018 10292018 form w 9 sp solicitud y certificacion del numero de identificacion del contribuyente 1018 11072018 inst w 9 sp instrucciones para el solicitante del formulario w 9sp solicitud y certificacion del numero de. Name is required on this line.

Your employer may be required to send a copy of this form to the irs. Skip to main content an official website of the united states government. Do not send to the irs. Sign the ready irs document print it or send via email or fax in no time.

Irs form w 9 is a federal document that you as a contractor are obliged to complete and submit to the entity from which you received over 600 in the current tax year. .