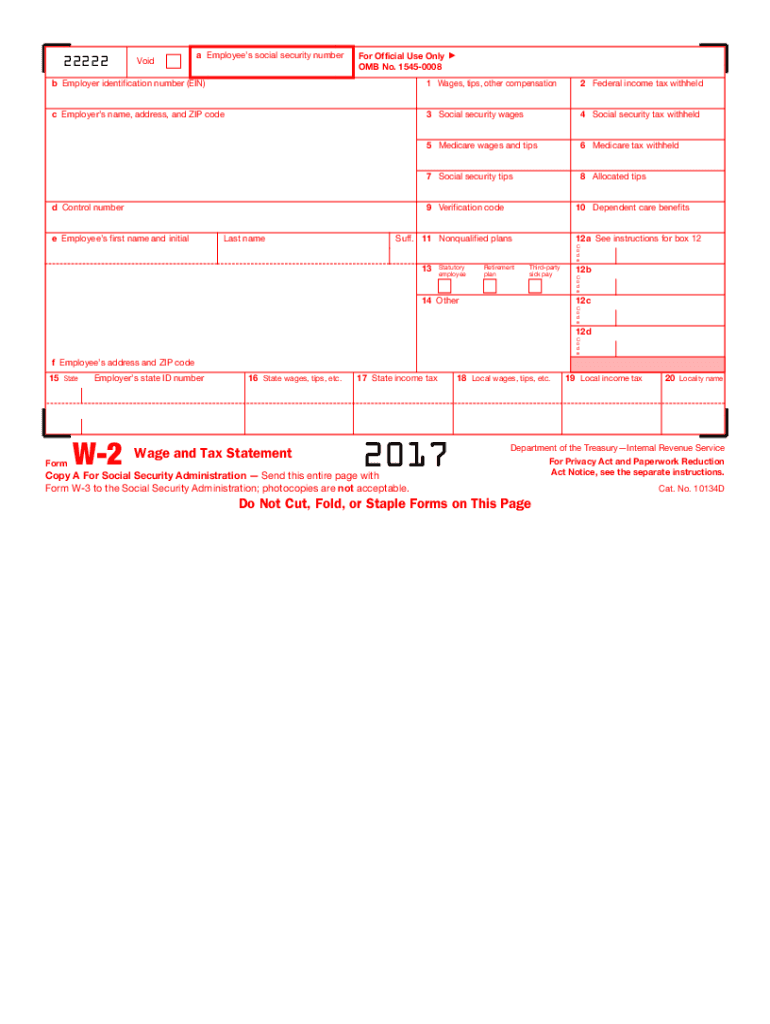

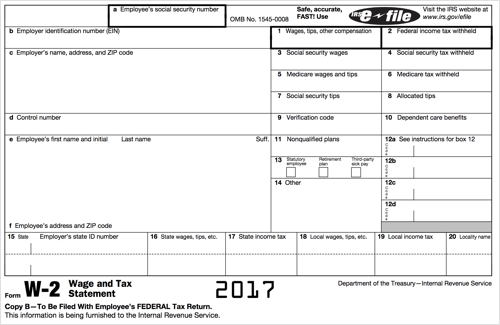

Irs W2 Form 2017 Printable

See the penalties section in the current.

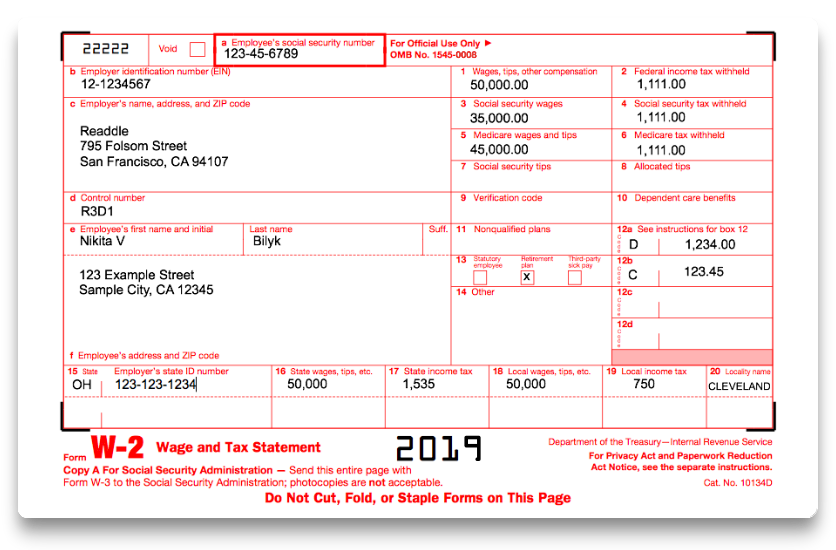

Irs w2 form 2017 printable. Wage and tax statement. May be imposed for filing forms that cant be scanned. Information about form w 2 wage and tax statement including recent updates related forms and instructions on how to file. 15 state employers state id number 16 state wages tips etc.

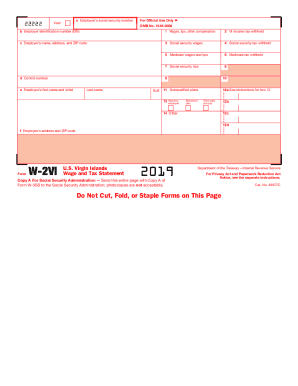

File copy b of this form with your 2017 american samoa income tax return. Wage and tax statement. 17 state income tax 18 local wages tips etc. Department of the treasuryinternal revenue service.

Keep copy c for your records. Internal revenue service center austin tx 73301 0215 usa. However if you are required to file form 1040 with the united. Employers must file a form w 2 for each employee from whom income social security or medicare tax was withheld.

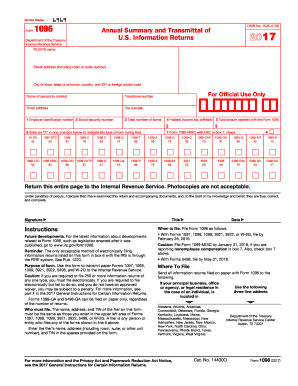

Form w 2 is filed by employers to report wages tips and other compensation paid to employees as well as fica and withheld income taxes. Print and file copy a downloaded from this website with the ssa. Allow 10 business days from the irs received date to receive the transcript. 19 local income tax 20 locality name form w 2 wage and tax statement 2017 department of the treasuryinternal revenue service copy bto be filed with employees federal tax return.

Form 4137 social security and medicare tax on unreported tip income form 8027 employers annual information return of tip income and allocated tips form 8850 pre screening notice and certification request for the work opportunity and welfare to work credits. Check the box for form w 2 specify which tax years you need and mail or fax the completed form. Wage and income transcripts are available for up to 10 years but current tax year information may not be complete until july. If your name social.

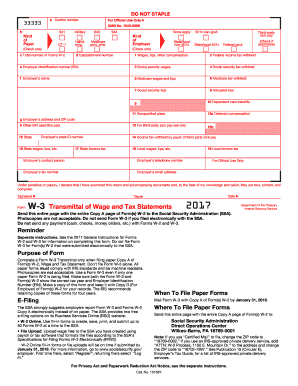

To order official irs information returns such as forms w 2 and w 3 which include a.