Kansas Resale Certificate

Does a kansas resale certificate expire.

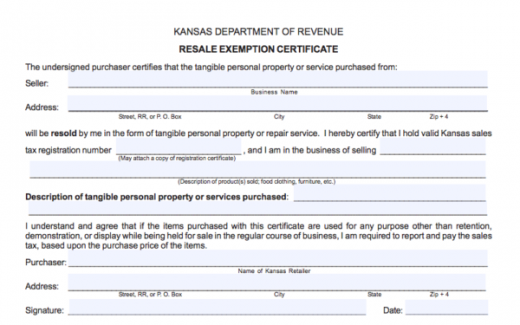

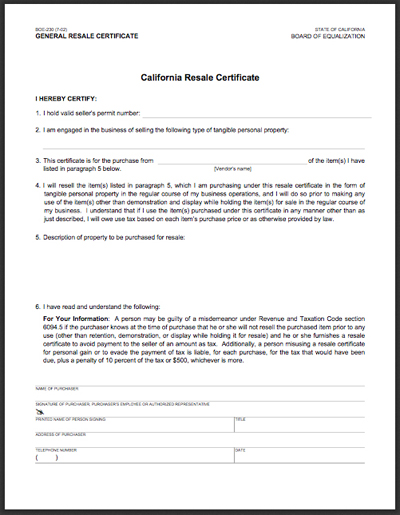

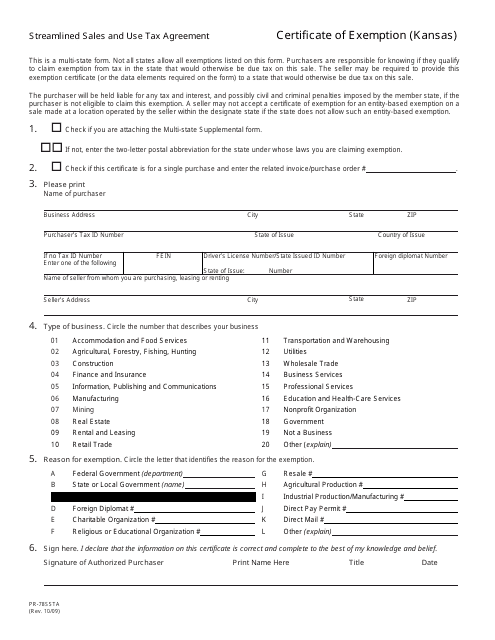

Kansas resale certificate. The kansas department of revenue has developed separate certificates for many of the exemptions this certificate is designed to cover the remaining exempt transactions that require an. Acceptance of uniform sales tax certificates in kansas. Either on this certificate or the multi jurisdiction exemption certificate for the sale to be exemptif the out of state retailer does not have sales tax nexus with kansas it may provide the third party vendor a resale exemption certificate evidencing qualification for a resale exemption regardless. Are sellers required to accept resale certificates.

How to accept a kansas resale certificate. Exemption certificate enter your sales or use tax registration number and the exemption certificate number you wish to verify. Kansas application for sales tax exemption certificates ks 1528 kansas exemption booklet ks 1520 this publication assists businesses to properly use kansas sales and compensating use tax exemption certificates. It explains the exemptions currently authorized by kansas law and includes the exemption certificates to use.

Sign in or register with the kansas department of revenue customer service center. Your kansas tax registration number. Exemption certificates pub ks 1520 rev. Ensure the resale certificate is properly filled out depending on where your buyer is based you may receive either the kansas resale exemption certificate or the kansas multi jurisdiction exemption certificate.

Certificates do not need to be renewed or updated if there is a recurring business relationship where the buyer purchases from the seller at least once every 12 months. A new certificate does not need to be made for each transaction. This certificate may be used to claim any sales or use tax exemption authorized by kansas sales tax law. Exemption certificate welcome page.

Even online based businesses shipping products to kansas residents must collect sales tax. It is designed for informational purposes only. Complete and submit an exemption certificate application. You will need to.

Select one of the below exemption certificate types. Kansas tax exemption kansas resale certificate kansas sale and use tax kansas wholesale certificate etc. The resale certificate is kept on file by the seller and is not filed with the state. Most businesses operating in or selling in the state of kansas are required to purchase a resale certificate annually.

Kansas does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor.