Life Insurance Needs Assessment Worksheet

Life insurance needs analysis worksheet date.

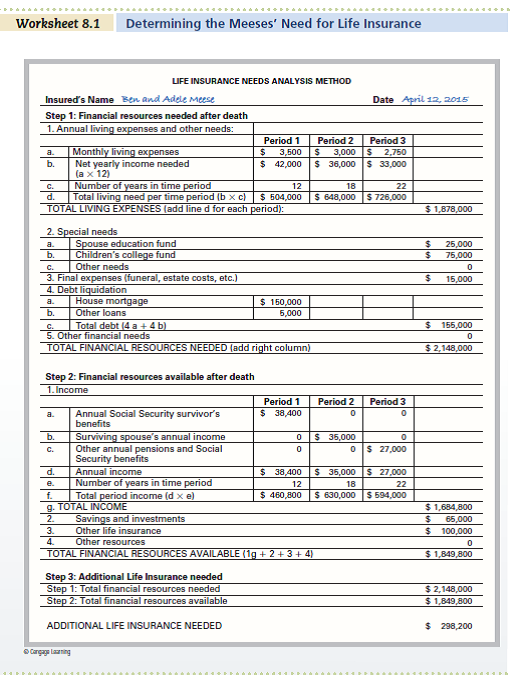

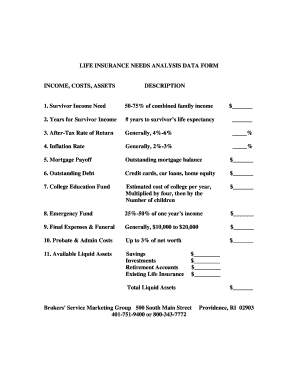

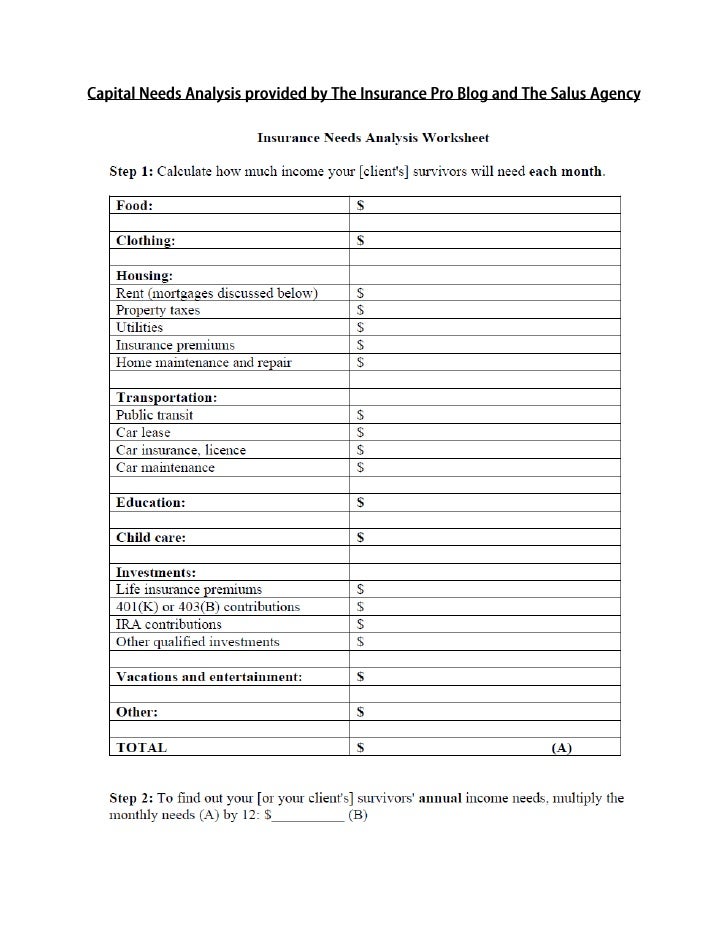

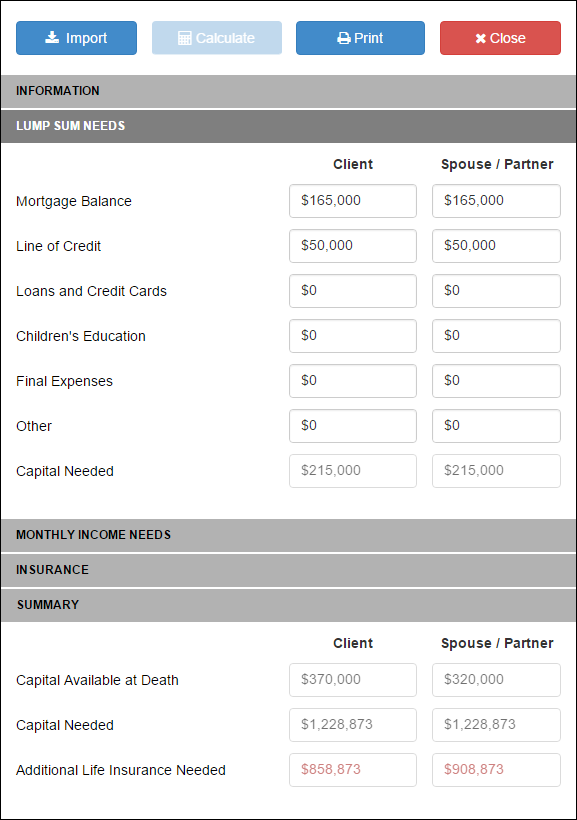

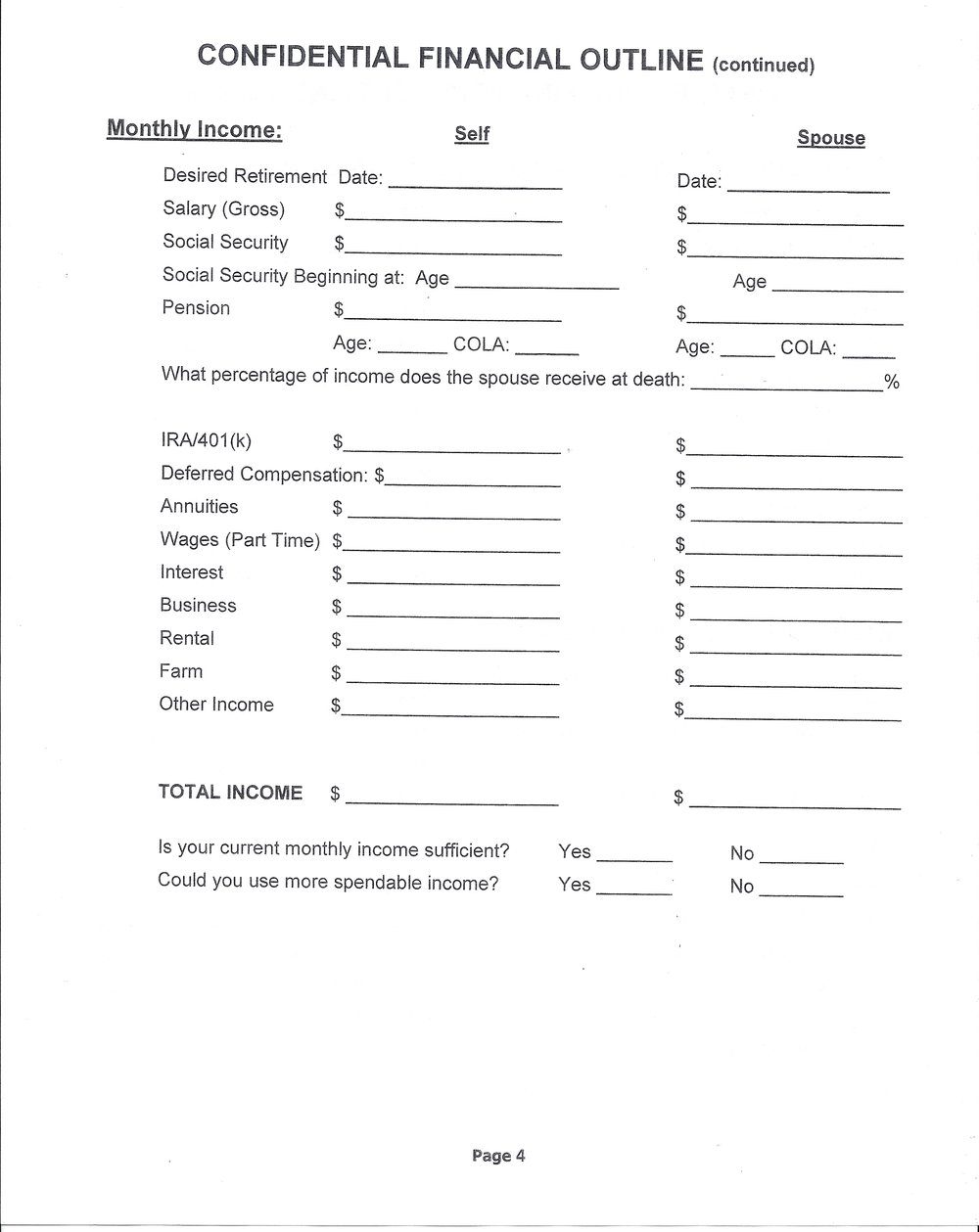

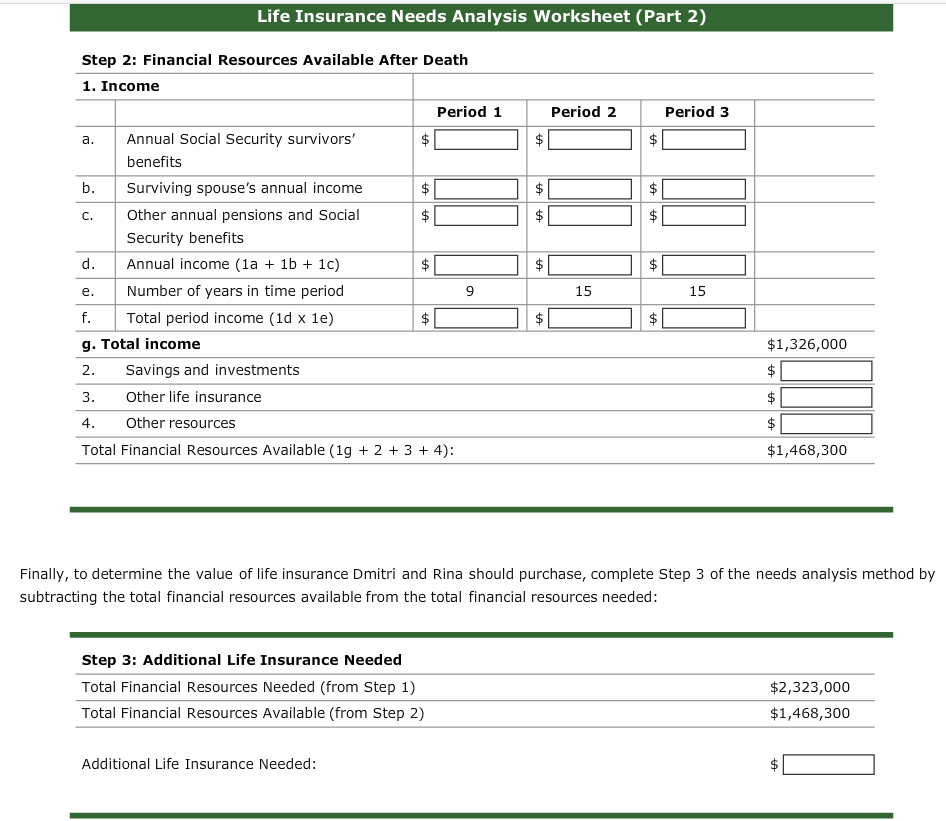

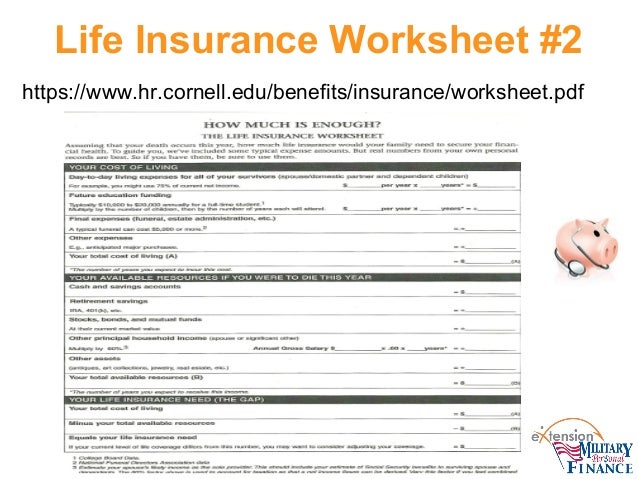

Life insurance needs assessment worksheet. Disability insurance needs determines the income needed to sustain your current standard of living should you become disabled and unable to work. First enter potential funeral costs and estate taxes. My insurance coverage has to be rev. Life insurance needs assesses how much capital your family will need when you die to both meet immediate financial obligations and keep the household running.

You can assess your needs and the needs of your loved ones and make a calculated assessment. A b c your life insurance needs and my understanding of my future financial needs in the event of my death. Along with calculating future income and expenses you will need to estimate your life expectancy. It is strictly for reference and i may decide to take out a life insurance policy with a coverage.

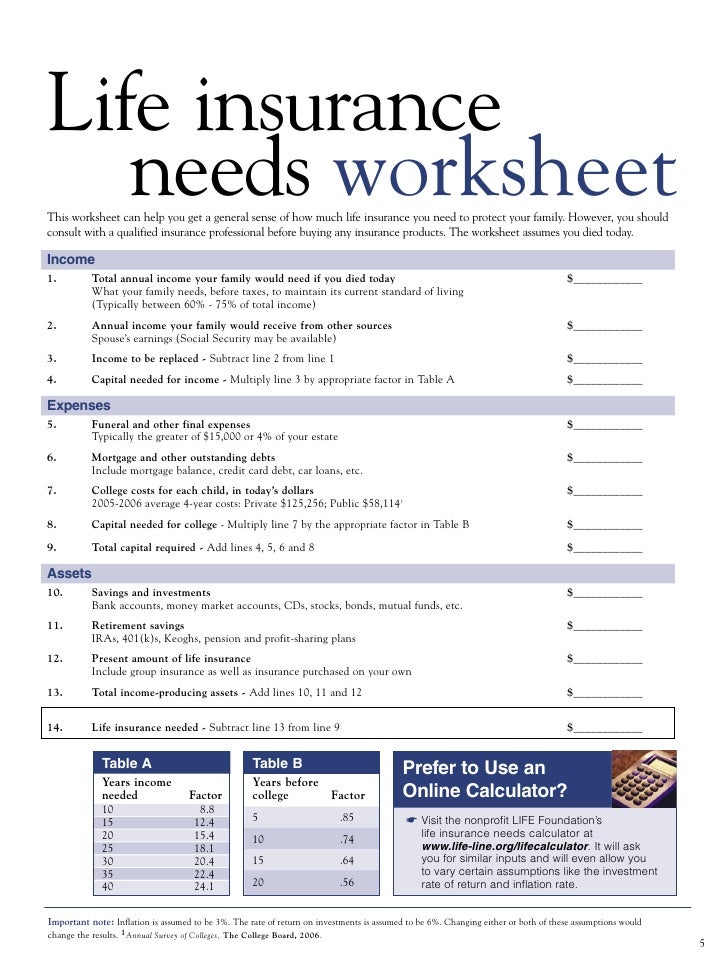

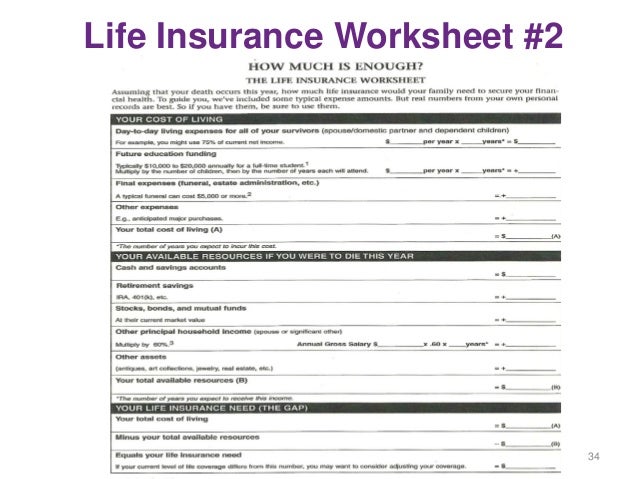

How much life insurance do you need worksheet. Your needs will need to be adjusted at certain milestones such as children graduating from college retirement moving etc. Use the following information and worksheet to help determine how much life insurance you and your spouse need to protect your familys standard of living. There are many factors to consider when deciding how much life insurance you need.

The needs estimator walks you through typical costs like a funeral the. Life insurance needs worksheet this piece has been reproduced with the permission of life happens a nonprofit organization dedicated to helping consumers make smart insurance decisions to safeguard their families financial futures. Determining the amount life insurance that you need is something that should be taken seriously and considered carefully. The first step is to estimate how much you family will need when you are gone.

Then include amounts needed for non mortgage debt emergency expenses and college funds. Different from the one illustrated above. The type and amount of information required to be collected will vary depending on each clients particular circumstances. Life happens does not endorse any insurance company product or advisor.

Life insurance can help provide funds to meet your familys immediate and ongoing needs in the event of either spouses premature death. If youre relatively healthy term insurance is quite affordable so if in doubt about the appropriate amount of life insurance you need or for how long buy as much coverage as you can afford. This calculator will help you determine what your life insurance needs are. Click here to download and print the calculating your life insurance needs worksheet.

We suggest doing a separate calculation. This worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. Life insurance needs assessment worksheet purchasing life insurance is an important step toward protecting your family.