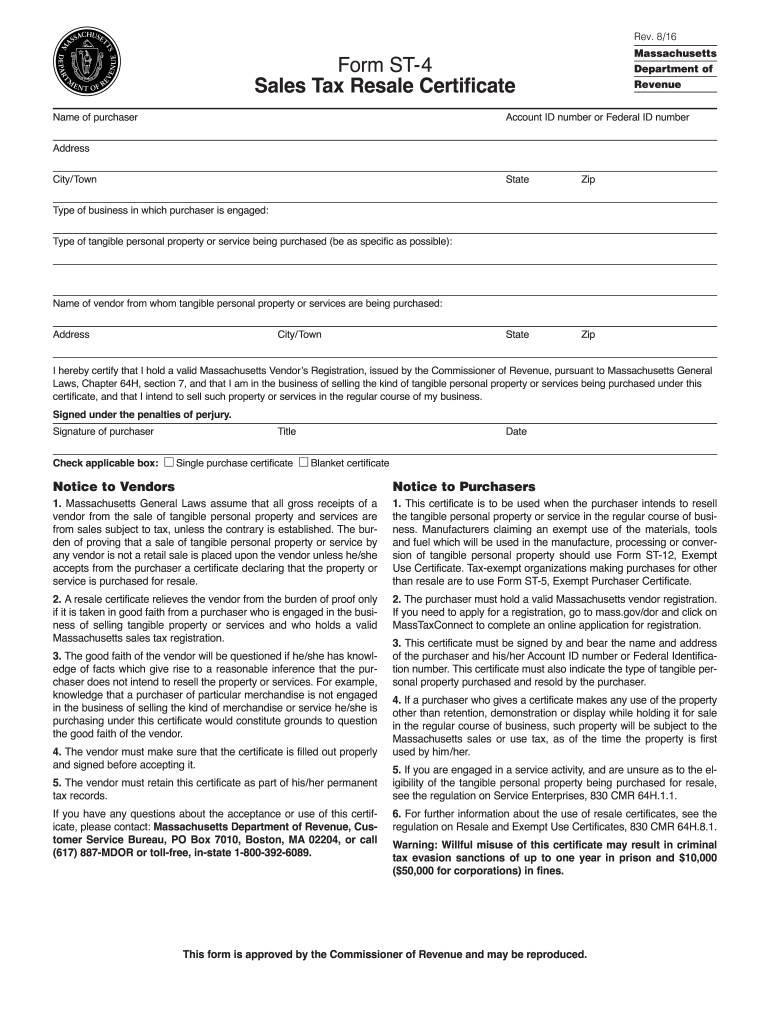

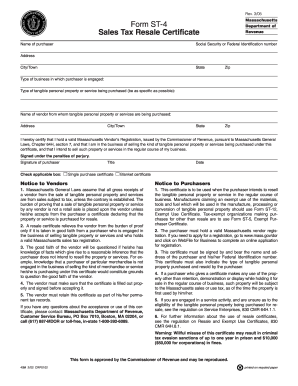

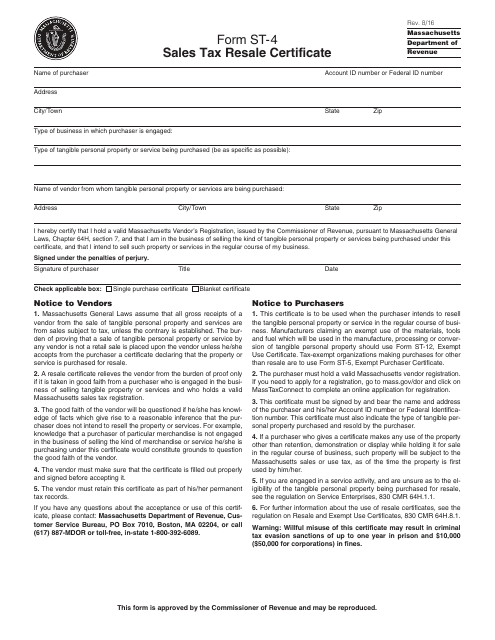

Massachusetts Resale Certificate

A certificate form st 1 or mt 1 does not serve as a substitute for the form st 4.

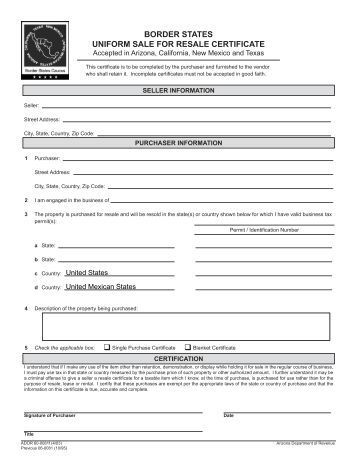

Massachusetts resale certificate. Name of vendor from. If audited the massachusetts department of revenue requires the seller to have a correctly filled out st 4 resale certificate. Resale exemption certificate document title. This guide is intended to give you what you need to know to buy products for resale and to sell products for resale in massachusetts.

Masstaxconnect is the recommended method to file and pay form st 6. The purchaser must hold a valid massachusetts vendor regis tration. Filling out the st 4 is pretty straightforward but is critical for the seller to gather all the information. 4th floor chelsea ma 02150.

Dor trustee tax bureau contact center 200 arlington st. What you need for verify a sales or meals tax certificate if your business has received a form st 4 from a potential buyer you can find out if that buyer is registered with the massachusetts department of revenue to collect sales or meals tax. If you need to apply for a registration go to massgovdor and click on masstaxconnect to complete an online application for registration. In massachusetts this process involves presenting an massachusetts sales tax resale certificate to the merchant from whom youre buying the merchandise to be resold.

Than resale are to use form st 5 exempt purchaser certificate. Type of tangible personal property or service being purchased be as specific as possible. This certificate must be signed by and bear the name and ad dress.