Modified Adjusted Gross Income Worksheet

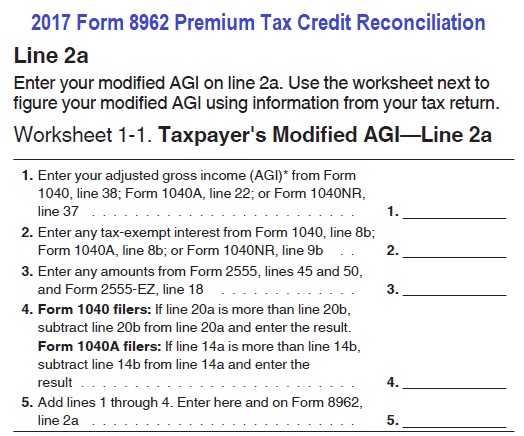

You can use worksheet 1 1 to figure your modified agi.

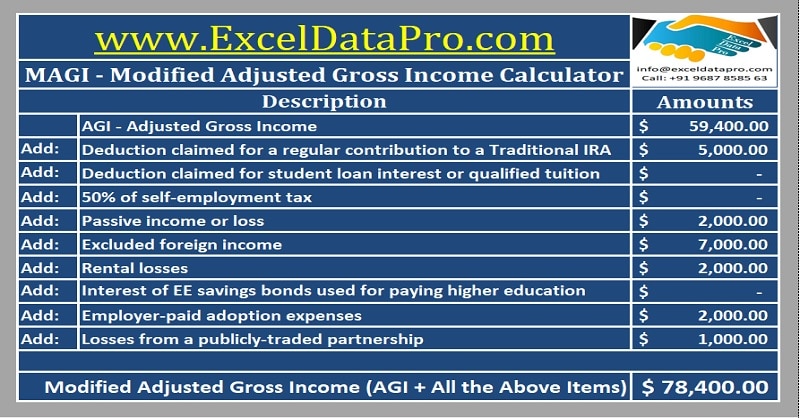

Modified adjusted gross income worksheet. Form 1040a line 22. Modified adjusted gross income agi. Know your modified adjusted gross income so you can determine whether you can make tax deductible contributions to individual retirement accounts. Modified adjusted gross income agi.

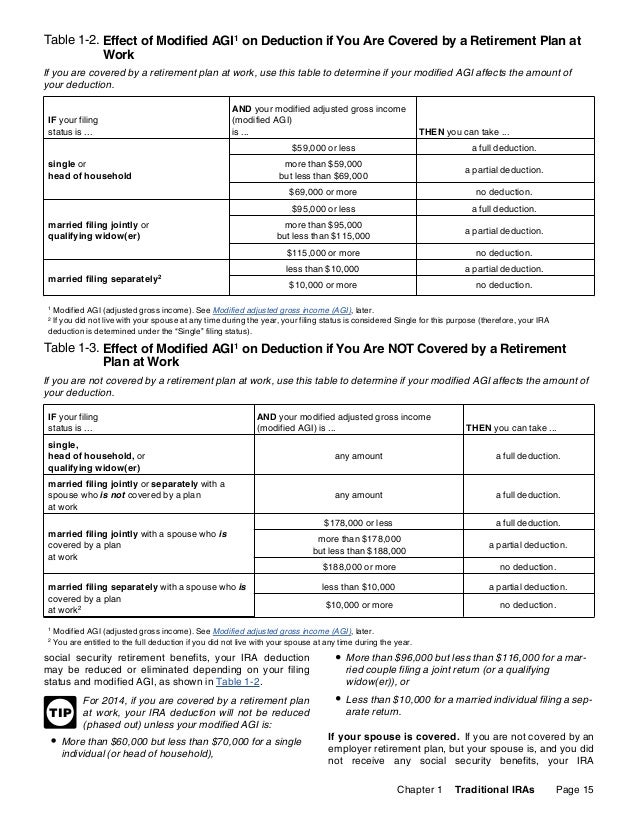

You may be able to use worksheet 17 1 to figure your modified agi. Or form 1040nr line 36. For example as of 2019 if you are a single or head of household filer on your tax return and are covered by a retirement plan at work you arent eligible to take an ira deduction if you had a magi of 74000 or higher. What is a modified adjusted gross income.

Enter any income resulting from the conversion of an ira other than a roth ira to a. Modified adjusted gross income magi the figure used to determine eligibility for premium tax credits and other savings for marketplace health insurance plans and for medicaid and the childrens health insurance program chip. Determine if any persons income is exempt. Modified adjusted gross income not adjusted gross income will be used in determining eligibility for your health insurance tax credits.

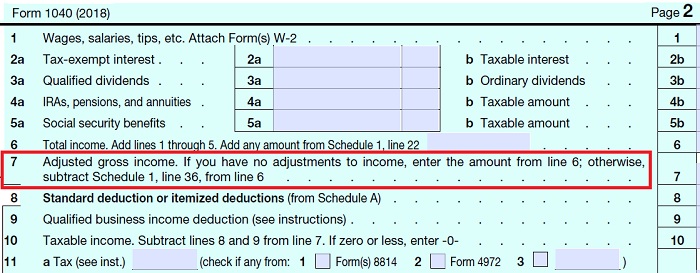

Your agi is generally calculated by finding your household income and making certain adjustments. Next to calculate your modified adjusted gross income magi take your agi and add back certain deductions. Review a table to determine if your modified adjusted gross income agi affects the amount of your deduction from your ira. Fill in all applicable income and expenses for each person included in the individuals magi household identified in step 1 line 1.

Calculate income for each person listed in step 1 in the individuals magi household. When completing your federal income tax return two terms that you will encounter are adjusted gross income agi and modified adjusted gross income or magi. If youre covered by a retirement plan at work use this table to determine if your modified agi affects the amount of your deduction. If you made contributions to your ira for 2018 and received a distribution from your ira in 2018 see both contributions for 2018 and distributions in 2018 later.

Many of these deductions are rare so its possible your agi and magi can be identical. Modified adjusted gross income is a measure used by the irs to determine if a taxpayer is eligible to use certain deductions credits or retirement plans.