Nebraska Inheritance Tax Worksheet

That employs an inheritance tax.

Nebraska inheritance tax worksheet. Furthermore the extent to which such portion is subject to tax depends on the decedents relation to the beneficiary. Nebraska taxes property that is left by deceased nebraska residents or by nonresidents who owned real estate or other tangible property in the state. Posts related to nebraska probate form 500 inheritance tax worksheet nebraska inheritance tax worksheet form 500. Nebraska inheritance tax worksheet and learn about nebraska inheritance tax laws.

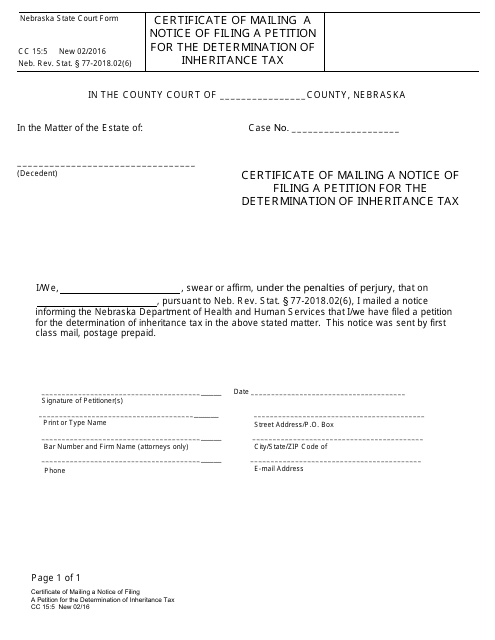

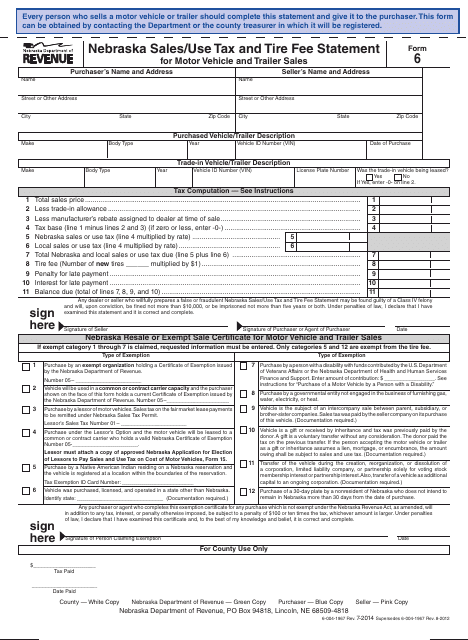

The inheritance tax rate depends on how closely the person who inherits the property was related to the deceased person. Aside from this though the state has a fairly typical set of inheritance and intestate succession laws that mostly dictate how an estate is inherited if there is no will. The constitution of the state of nebraska distributes the judicial power of the state among the supreme court court of appeals district courts and county courts. An inheritance tax worksheet called probate form 500 must be filed with the county court of the county in which the decedent resided or in which the decedents real or personal property is located.

Determine the relationship of the beneficiary to the decedent. Nebraska is one of just six states in the us. Generally the nebraska adjusted basis will be the cost of the item including sales tax freight charges and. Nebraska adjusted basis is the adjusted basis for federal income tax purposes increased by the amount of the depreciation amortization or deduction under section 179 of the internal revenue code taken on the personal property.

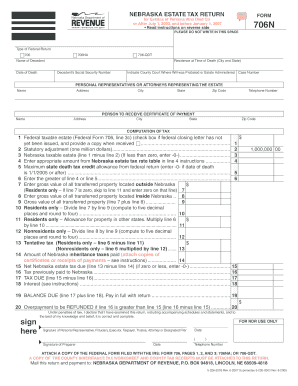

Unlike a typical estate tax nebraska inheritance tax is measured by the value of the portion of a decedents estate that will be received by a beneficiary. The tax is levied dependent on the worth of the assets that were bequeathed and is assessed depending on the heirs classification below the inheritance tax statutes of the state. All state courts operate under the administrative direction of the supreme court. The form must be filed and inheritance taxes must be paid within twelve months after the decedents date of the death.

The treasurers office will accept the court order or other written application to the county court or the inheritance tax worksheet that is completed with name of deceased date of death book and page number the tentative amount of inheritance tax due and the required consent of the county attorneys office.

/omaha-nebraska-city-view-164333914-57851fbe5f9b5831b5e92f5f.jpg)

:max_bytes(150000):strip_icc()/skyline-of-des-moines-iowa-usa-140339419-57852f9b3df78c1e1f76310f.jpg)