New Mexico Gross Receipts Tax 2018

Gross receipts tax rates nm taxation and revenue department 11725.

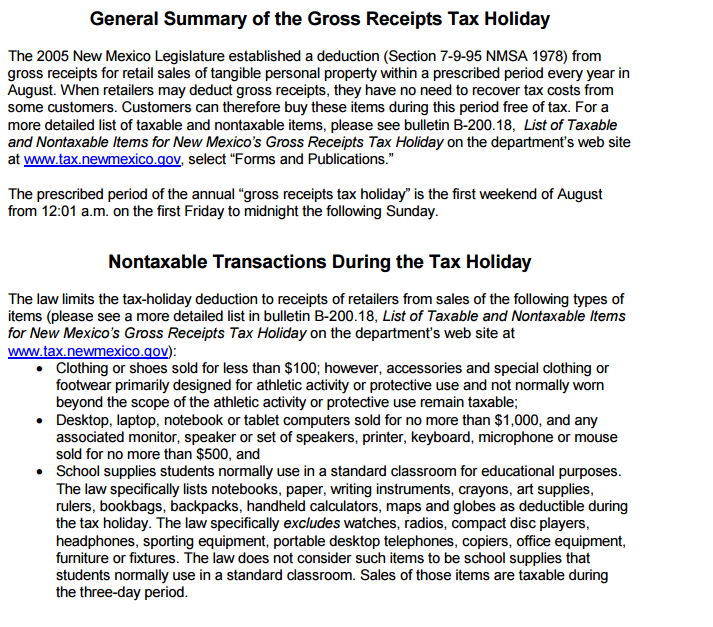

New mexico gross receipts tax 2018. Welcome to new mexico taxation revenue department nm taxation and revenue department 5157. Gross receipts location code and tax rate map. Register your business nm taxation and revenue department 5637. Anyone who operates a business in new mexico is familiar with the gross receipts tax or grt a tax not on sales but on companies and people who do business here.

2018 new mexico statutes chapter 7 taxation article 9 gross receipts and compensating tax section 7 9 43 imposition and rate of tax. Gross receipts tax rates nm taxation and revenue. Posted on march 22 2015 by taura costidis. New mexicos gross receipts tax by the numbers.

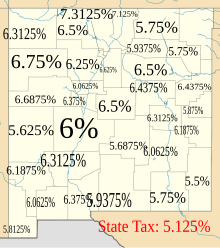

New mexico has a lower than average state sales tax rate of 5125 but the actual combined sales tax rates are higher than average when local sales taxes from new mexicos 114 local tax jurisdictions are taken into account. Justia free databases of us laws codes statutes. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. Denomination as governmental gross receipts tax.

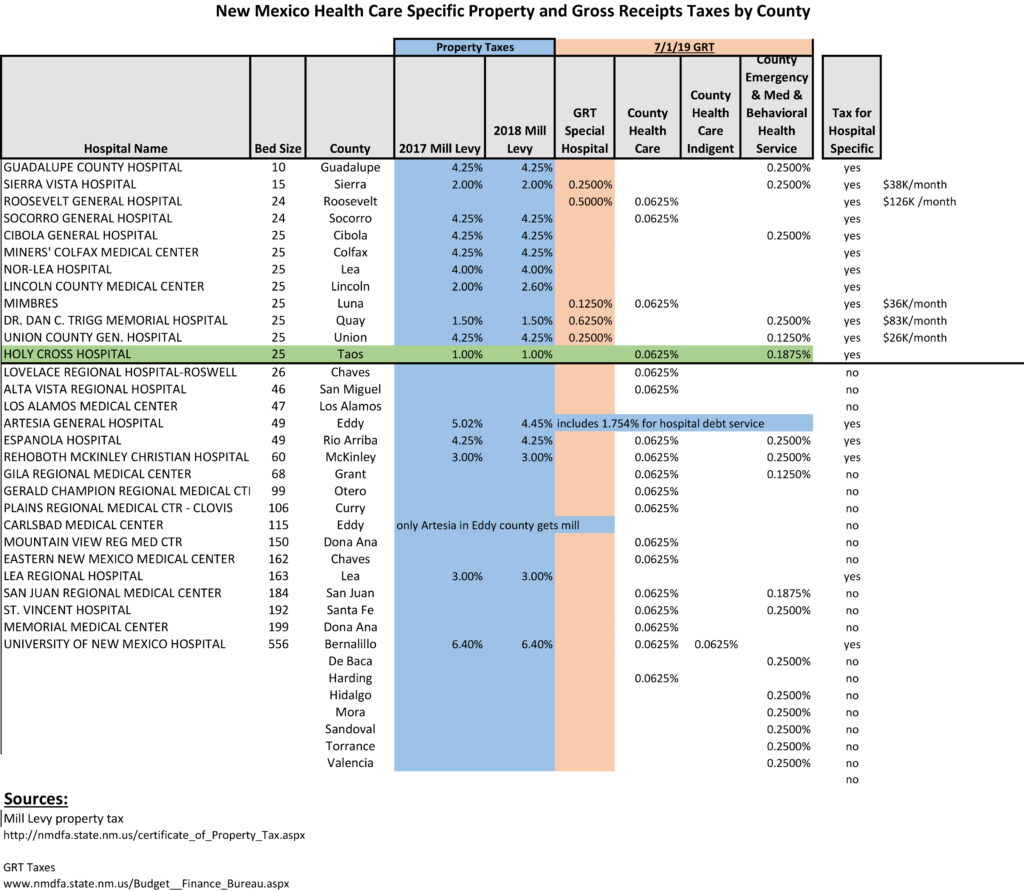

Nm taxation and revenue department 5440. In state veteran preference certification. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. New mexico taxation and revenue department fyi 105 rev.

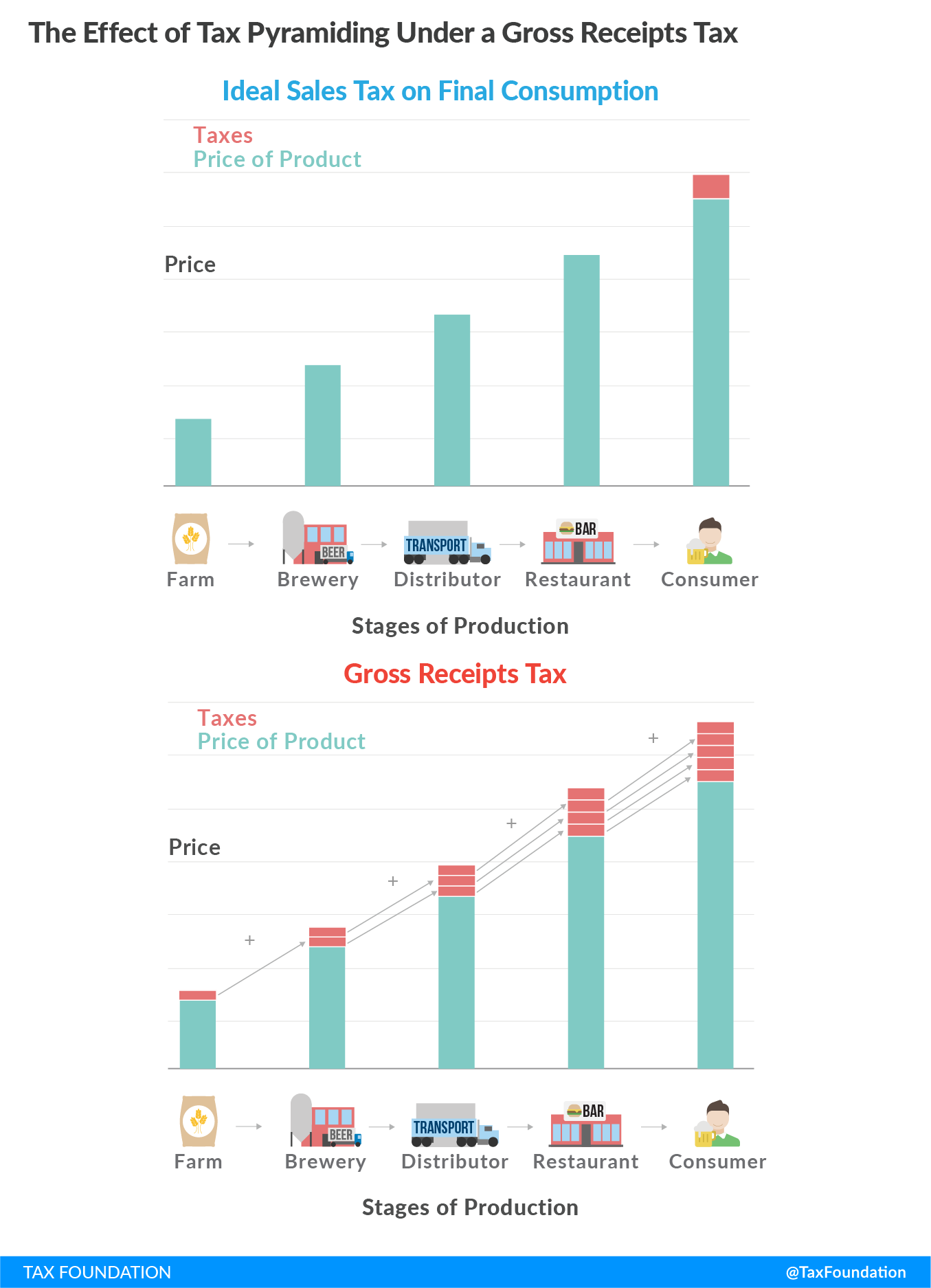

Oil natural gas and mineral extraction taxes. New mexico first adopted a version called a gross receipts tax in 1933 and since that time the rate has risen to 5125 percent. Selling research and development services performed outside new mexico the product of which is initially used in new mexico. By finance new mexico.

Nm taxation and revenue department 5450. New mexico taxation and revenue department. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. Register your business nm taxation and revenue department 5624.

Get a handle on gross receipts tax if doing business in new mexico. Gross receipts means the total amount of money or other consideration received from the above activities. Gross receipts tax rate changes effective july 1 2018 the gross receipts tax rates will increase for the following locations. 062019 page 2 introduction this publication includes a description of gross receipts and compensating taxes.