Non Profit Organization Donation Receipt

Make sure to give a receipt for donations exceeding 250 so your donor will be able.

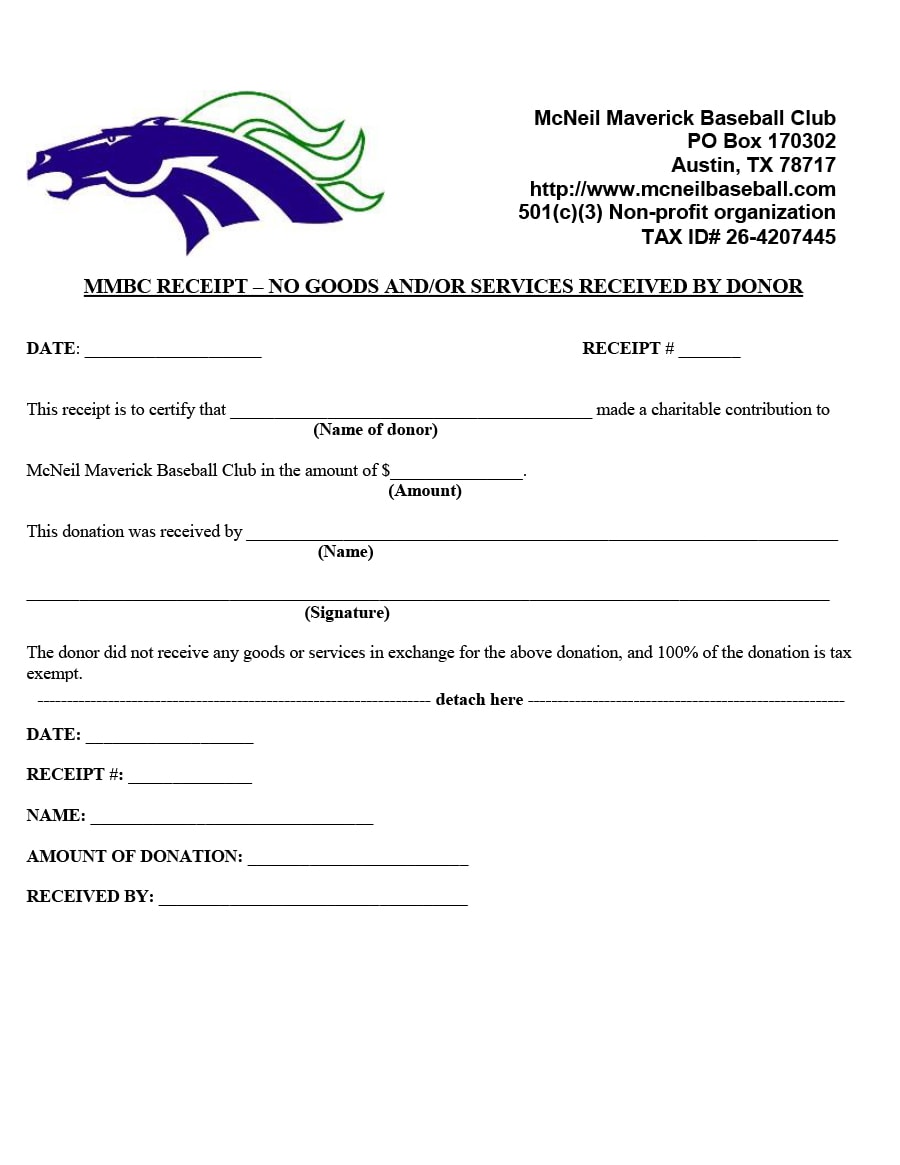

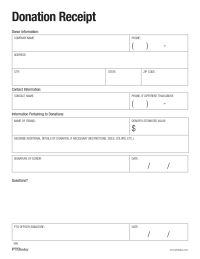

Non profit organization donation receipt. Give a donation receipt for a donation of at least 75 which is used to buy goods or services. In order for a donor to take advantage of this benefit however your organization must provide a 501c3 treasury regulation compliant receipt you could theoretically provide a receipt for each. A charitable organization is required to provide a written disclosure to a donor who receives good or services in exchange for a single payment in excess of 75. Strengthening of bond another advantage of using a.

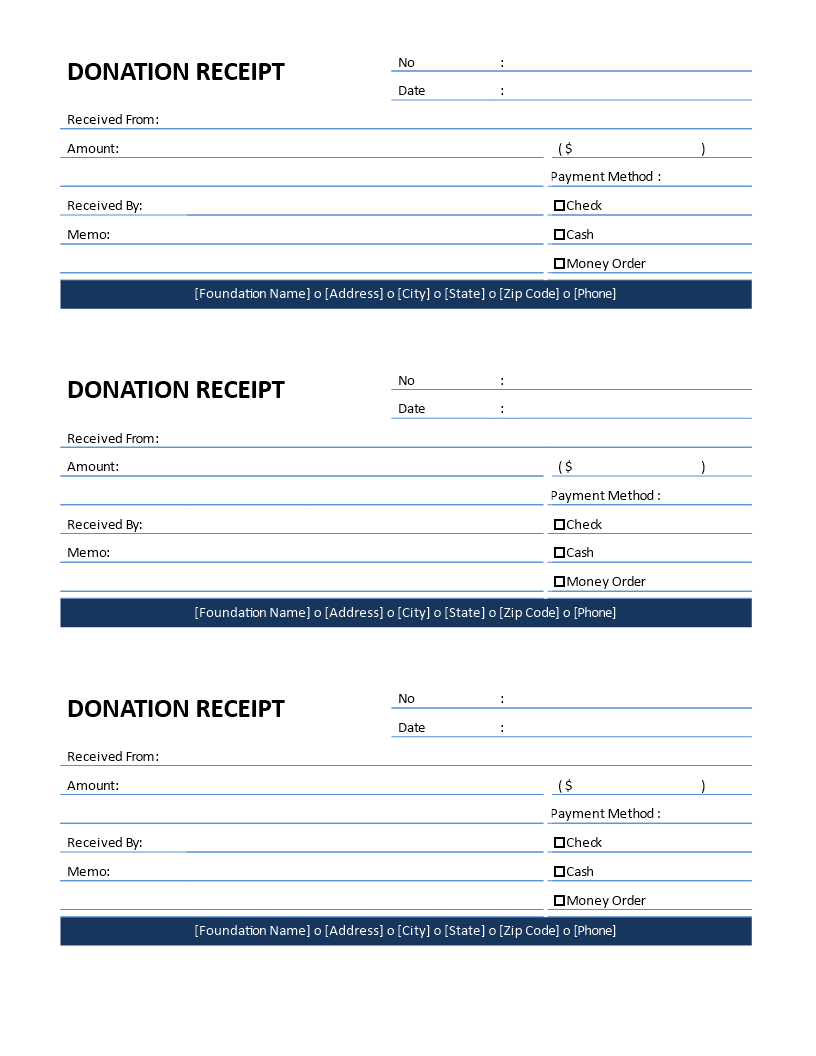

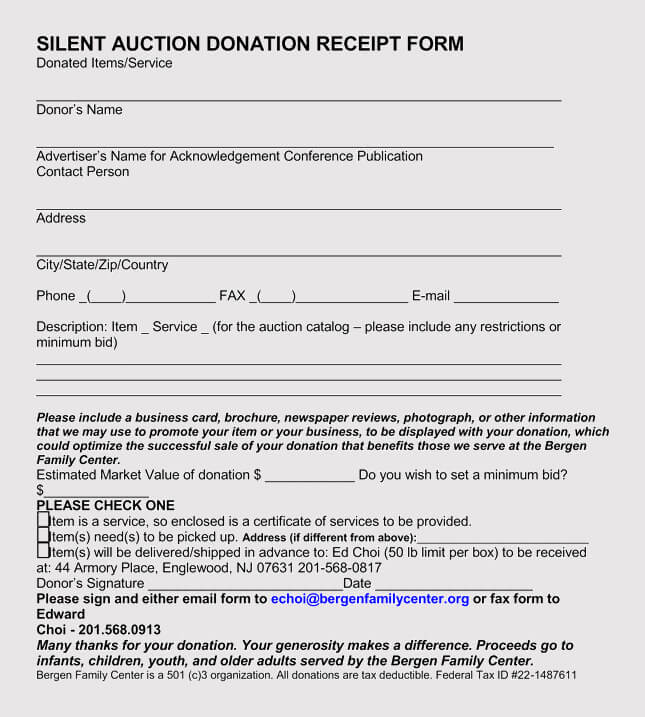

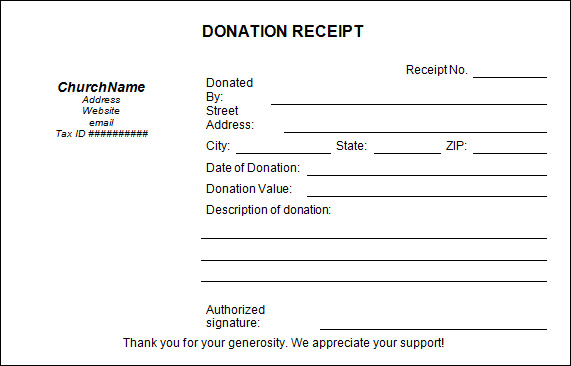

This includes both receipts for every individual donation and consolidated receipts of the entire year of donations. Tax exemption the act of donating a certain amount of funds or property without renumeration can. Record keeping this receipt can also help the donor keep track of hisher finances by. This nonprofit donation receipt template helps you create donation receipts quickly and easily.

Always give a. Donations involving a motor vehicle boat or airplane that has a value that exceeds 500 are handled differently. Organizations using donorbox our powerful and effective donation software can very easily generate 501c3 compliant tax receipts. Its utilized by an individual that has donated cash or payment personal property or a vehicle and seeking to claim the donation as a tax deduction.

Some of the allure of donating to a 501c3 non profit organization is that a donor may be able to deduct the value of their donation from their taxes. There are also some legalities regarding when to give donation receipts and they are as follows. The 501c3 donation receipt is required to be completed by charitable organizations when receiving gifts in a value of 250 or more. Give a receipt for a donation of 75 that buys goods or services.

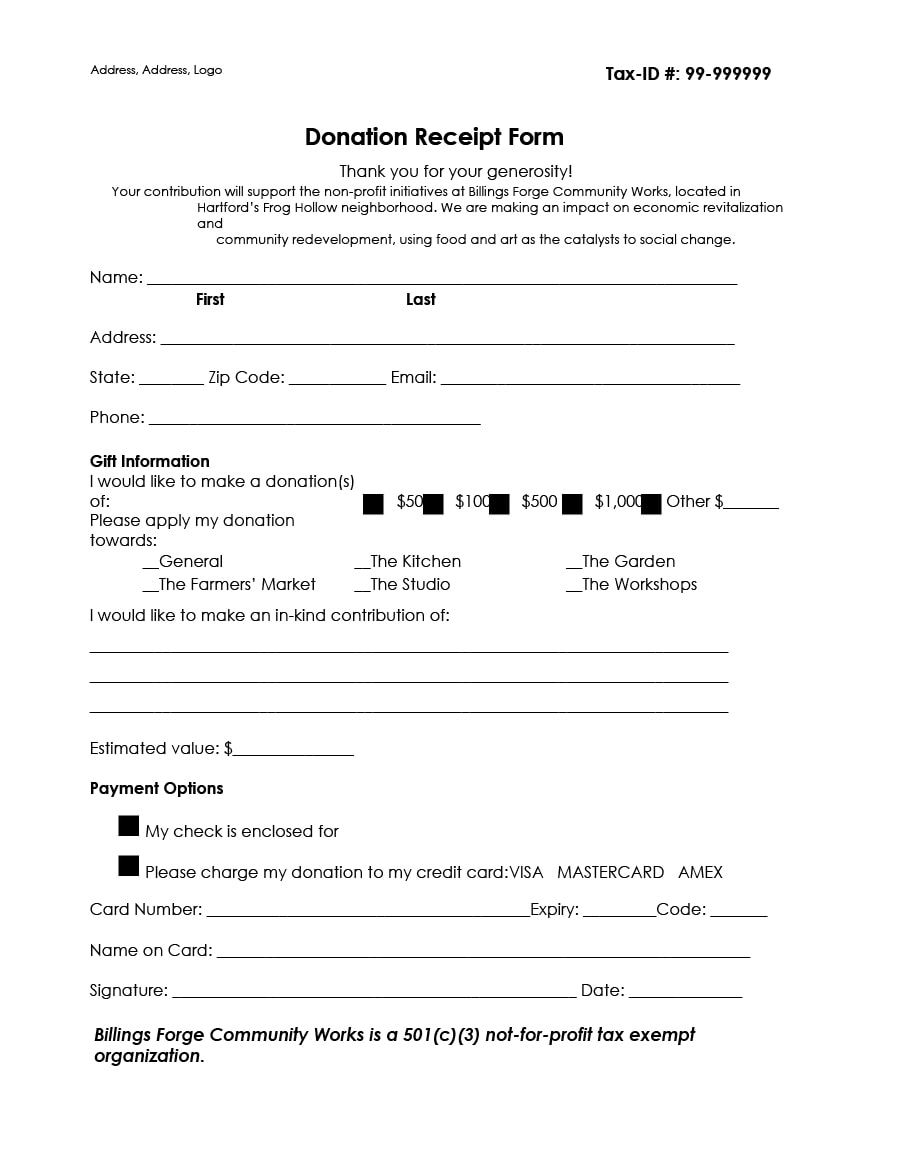

It is a microsoft word document so that you can easily customize it to make it work based on your needs. That means that if the donor pays 75 and receives a calender or a dinner for example you must provide a receipt under law. Donation receipt your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. If you provide a good or service in return for a donation of 75 or more you are required to provide a receipt to the donor.

Customize the nonprofit donation receipt template. Tax exempt nonprofits have certain requirements to follow including providing donors with a donation receipt often called an acknowledgment letter.