Nonprofit Credit Card Policy Template

Employees shall process credit card bills promptly and return them to the cfo s minimum of ten 10 days prior to the payment due date so as to avoid late fees and interest charges.

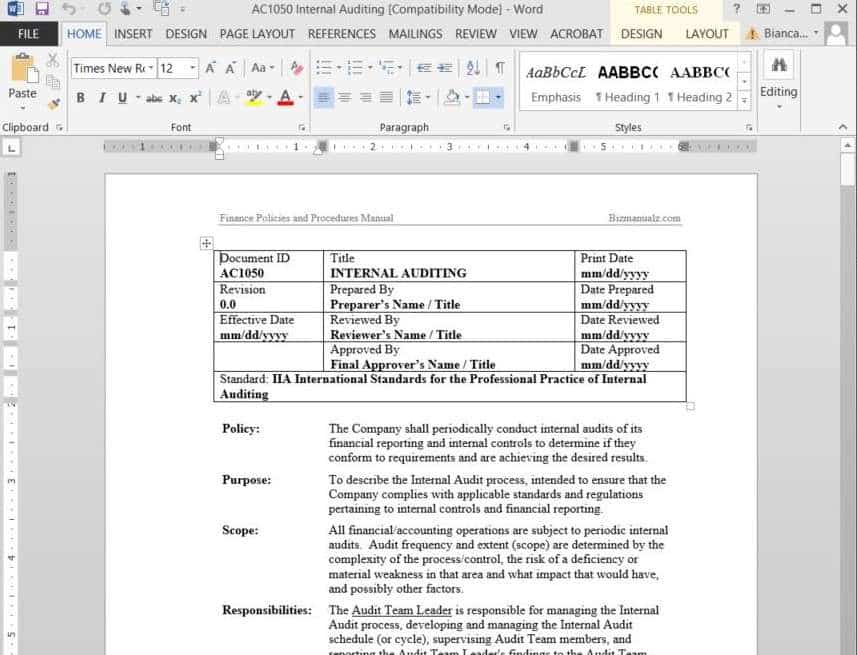

Nonprofit credit card policy template. Although some sample policies are included this document is designed primarily to be a conversation starter with prompting questions included in each section. Current policy authorizes one user the nonprofit network executive director. Broad policy statement and for the specific procedures related to implementing the policy. Procedure but think of one as intent and the other as the mechanics of carrying out the intent.

The agreement is styled to be favorable to the employer and holds the employee personally responsible for charges associated with misuse of the card. Credit card policy and procedures the purpose of this policy is to provide employees with information about the credit card program and to provide a guide for the use of their vassar issued credit card in a manner which is consistent and fair to each employee while managing costs and ensuring compliance with federal and state regulations and college policies. That begins with establishing a formal credit card policy. Creating thoughtful policies is a fundamental risk management strategy and a hallmark of good stewardship.

Organization issued credit cards shall not be used for personal expenses. Credit cards will be used only for business purposes. Credit cards will only be issued in the name of specific employees with specific credit limits as appropriate and will be adequately safeguarded at all times. Credit card nonprofit agency inc.

The goal of this tool is to serve as a basic framework and a starting point for discussion. To improve managerial reporting related to credit card purchases. Every company that uses corporate credit cards for their staff should have a clear effective and detailed employee credit card policy to head off any misuse of the card by employees. May maintain credit card accounts to facilitate efficient operations.

The card will have a credit limit of 1000. The board of directors will approve the issuance of all nonprofit network credit cards. To improve efficiency and reduce costs of payables processing. A formal credit card policy is particularly critical for social service organizations which frequently have charges similar to those an individual would make for his or her own purposes for example food clothing or household goods.

Church credit cards will be issued to ministers and staff only upon approval of the finance committee. Credit cards will be issued in the name of the employee or board officer. Why you need rules. Policies should be clearly written to make the accountability intent apparent.

/GettyImages-992942100-0c064a3251614868b2d5effc3847cde7.jpg)

/creditcardjacquesloicGettyImages-140359950-578ea7593df78c09e98149ae.jpg)