Online Printable W2 Forms

From the left menu select taxes then payroll tax.

Online printable w2 forms. How to accomplish a form w 2 on the internet. Select the appropriate mailing address depending on the type of w 2 and the carrier you choose eg us. You can quickly access and print w 2 forms. In the forms section select the annual forms link.

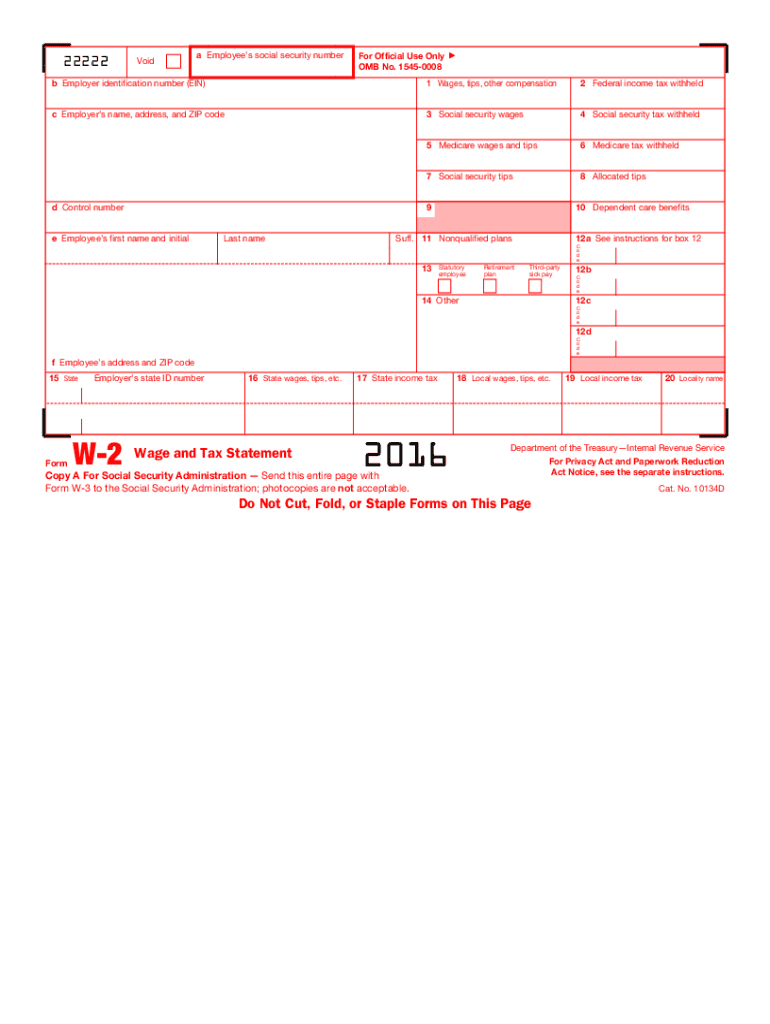

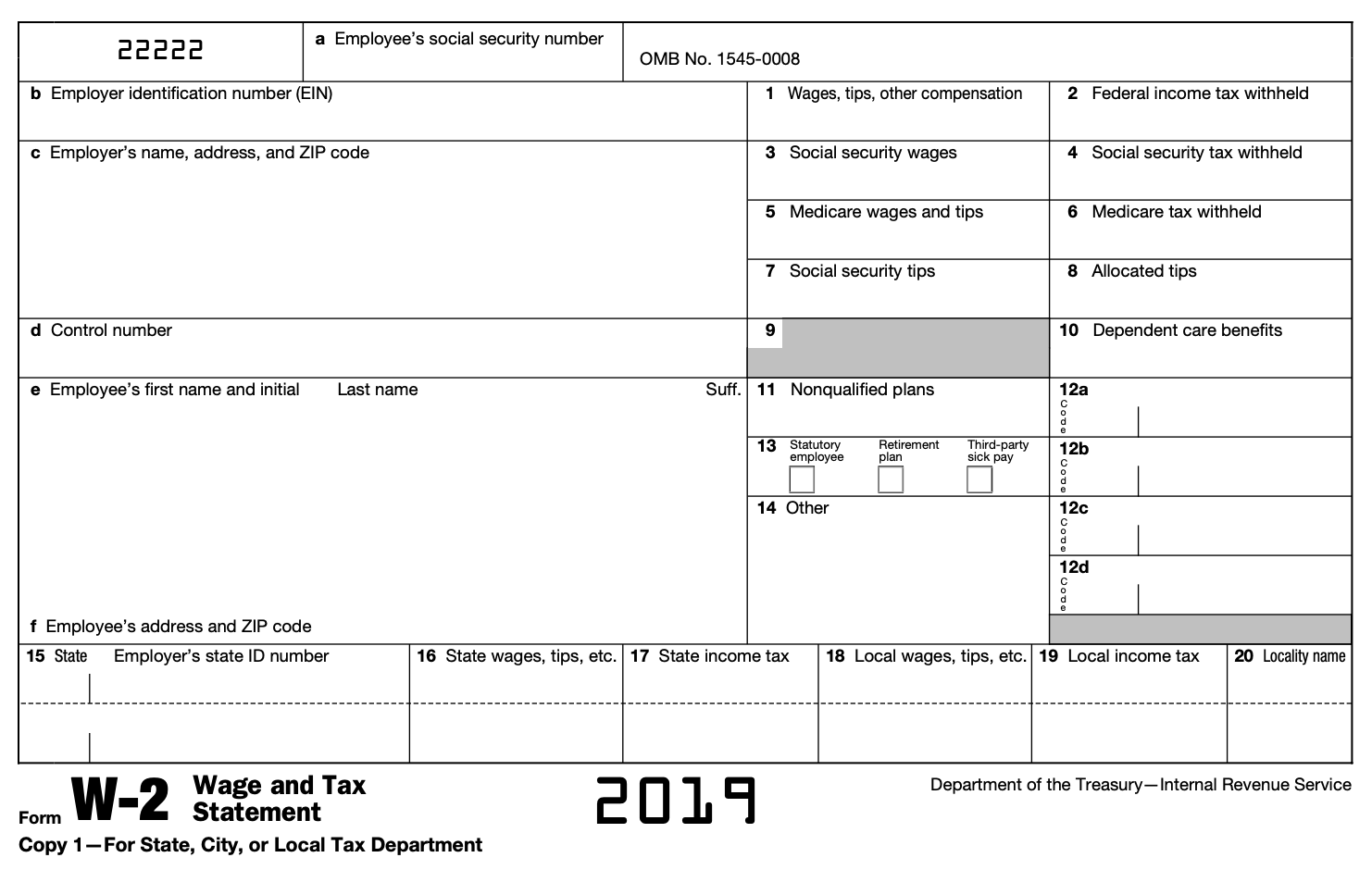

Select the w 2 copies b c 2 link. Form w 2 is a payroll or employment tax return form that is filed electronically with the ssa social security administration by employers for their employees each year. Select either all employees or a specific employee name from the drop down menu provided. A w2 is a tax form that documents money paid to you and money withheld from your paycheck.

Print and file copy a downloaded from this website with the ssa. It includes your commissions tips wages and the taxes that were withheld from your income for federal state and social security purposes. Along with the w2 online copy employers are required to file a copy of the social security administration to keep the government aware of the employees earnings. In product support for federal form is available only with an enhanced level subscription or a basic subscription that started before april 1 2013.

Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or medicare tax was withheld for services performed by an employee must file a form w 2 for each employee even if the employee is related to the employer from whom. The official printed version of this irs form is scannable but the online version of it printed from this website is not. Copy a appears in red similar to the official irs form. Go along with the short guide in an effort to entire form w 2 steer clear of glitches and furnish it within a well timed manner.

Postal service or a private carrier such as fedex or ups. Note intuit online payroll. Online alternatives make it easier to to arrange your document management and enhance the efficiency of ones workflow. W 2 forms along with w 3 form must be submitted to ssa no later than january 31 of the following year.

The ssa mandates that employers report employee wages and salary information on form w 2 and that a copy must be sent to all employees. Where to file paper w 2w 2cs. Copy a of this form is provided for informational purposes only.