Oregon Living Trust Template

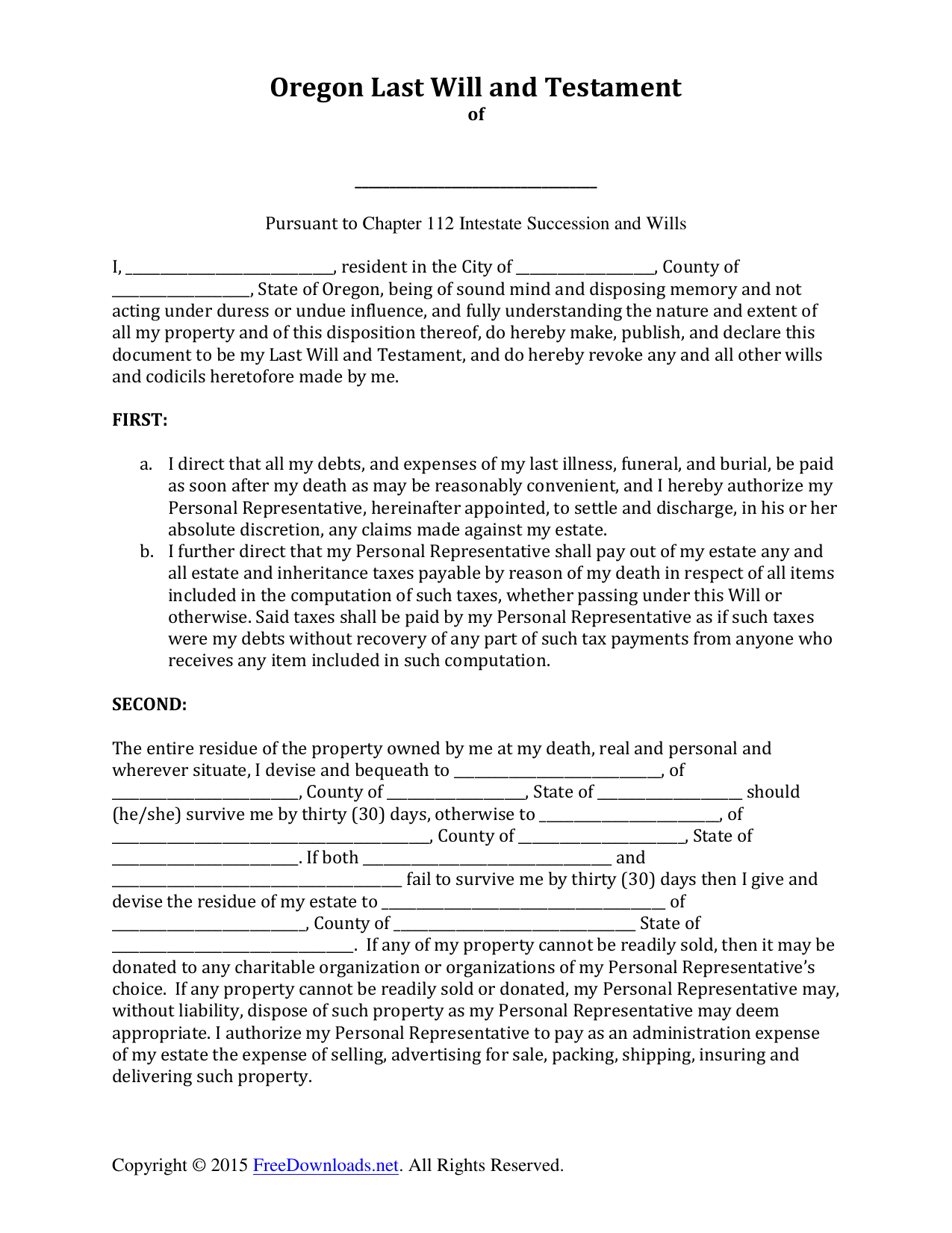

Remember that estate tax is levied on the estate before its distributed whereas inheritance tax is paid by heirs after the estate has been distributed.

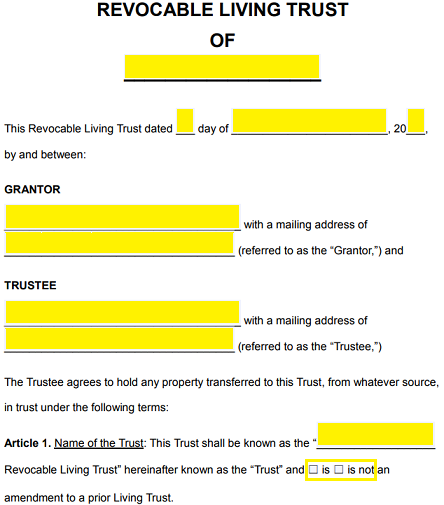

Oregon living trust template. Choose whether to make an individual or shared trust. Oregon living trust forms download an oregon living trust form which allows you to place certain of your assets and property into a separate entity which is managed by a trustee. It cant hurt though to look into the oregon estate tax and the oregon inheritance tax when youre planning your estate. The oregon living trust is an arrangement in which the creator the grantor places their assets into a living trust so that their estate can be distributed without probate.

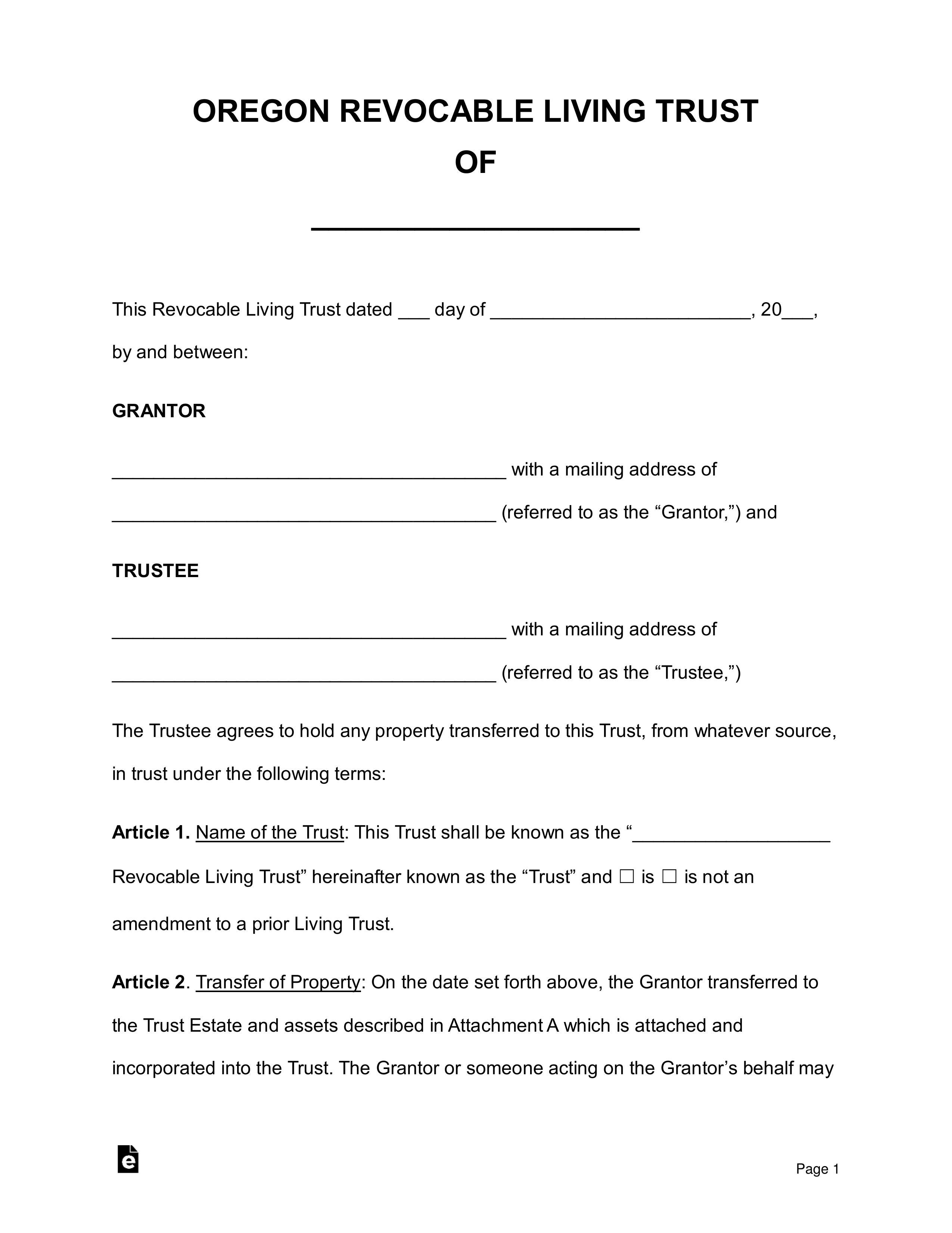

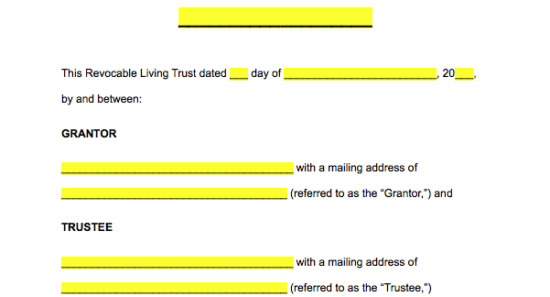

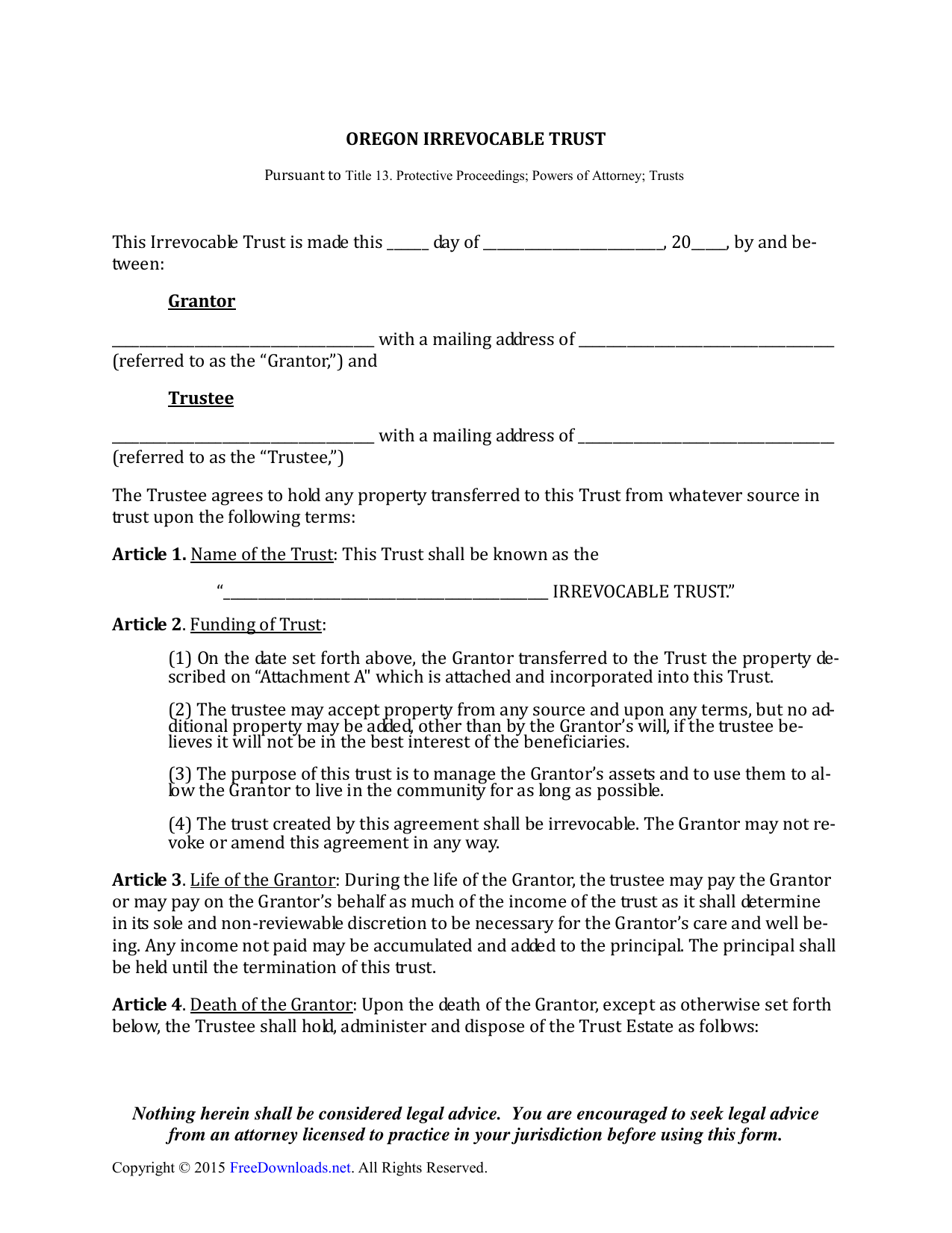

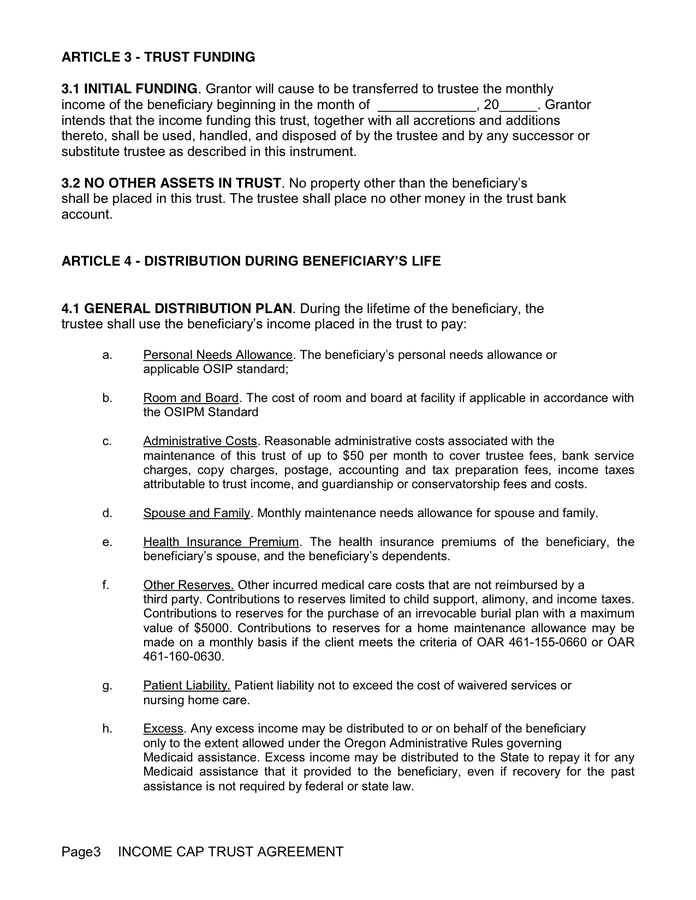

Any property not placed in the trust will still be subject to probate when the grantors estate is distributed. To show you what a living trust could look like here is a sample trust using fictional names and situations. A living document is a document which you may continually edit and update. The term revocable means that you may revoke or terminate the living trust at any time.

Living trusts and taxes in oregon. In addition to bypassing probate the distribution of a trust estate is kept private whereas a will is made public. It is unlikely that a living trust will impact your taxes. The trustee is chosen by the person creating the trust the grantor and he or she has an obligation to make sure the provisions of the trust are carried out for the benefit of the beneficiaries.

Oregon revocable living trust form the oregon revocable living trust is used as a primary means of distributing a persons estate in order to avoid the probate process. By betsy simmons hannibal attorney. Decide what property to include in the trust. Oregons requirements for a living trust arent unlike other jurisdictions.

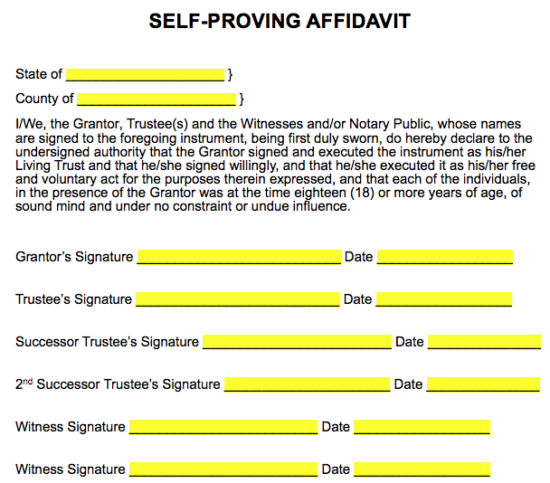

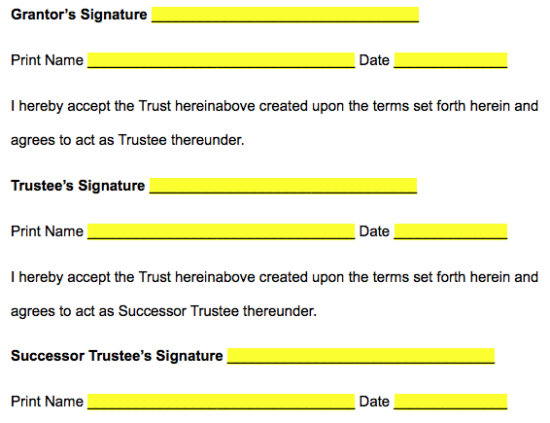

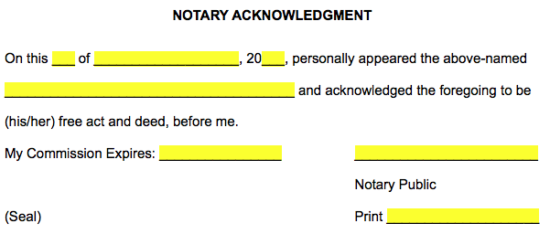

Sign the document in front of a notary public. Probate also involves the expenses of an attorney an executor and court fees. Probate is a court procedure that approves a will and puts it into effect. Here is an example of a nolo living trust made for a fictional person.

Oregon living trust forms make your living trust today. A living trust oregon allows you to bypass probate for the assets in your trust. Choose a successor trustee. Create the trust document.

Sample individual living trust. A living trust is a trust established during a persons lifetime in which a persons assets and property are placed within the trust usually for the purpose of estate planning. Moreover a living trust in oregon must have a settlor trust funds and beneficiaries. Decide who will be the trusts beneficiaries who will get the trust property.

Your trust document will look different because it will be tailored to your situation and the. To make a living trust in oregon you. The oregon living trust is an estate planning tool designed to avoid probate while providing long term property management.