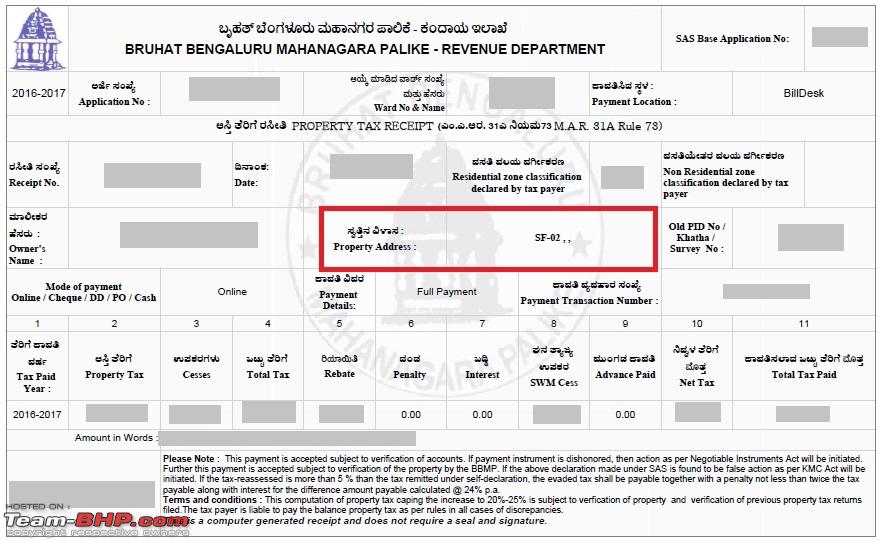

Paid Property Tax Receipt

When you pay your taxes the collectors office will send you a tax receipt by mail after your payment has posted to your account.

Paid property tax receipt. You will receive a property tax bill if you pay the taxes yourself and have a balance. If a bank or mortgage company pays your property taxes they will receive your property tax bill. 2019 20 village and school taxes remaining unpaid after 1115 were relevied with interest onto the 2020 property taxes. Tax receipts can be found on the current statement page or by clicking on the property tax receipts button.

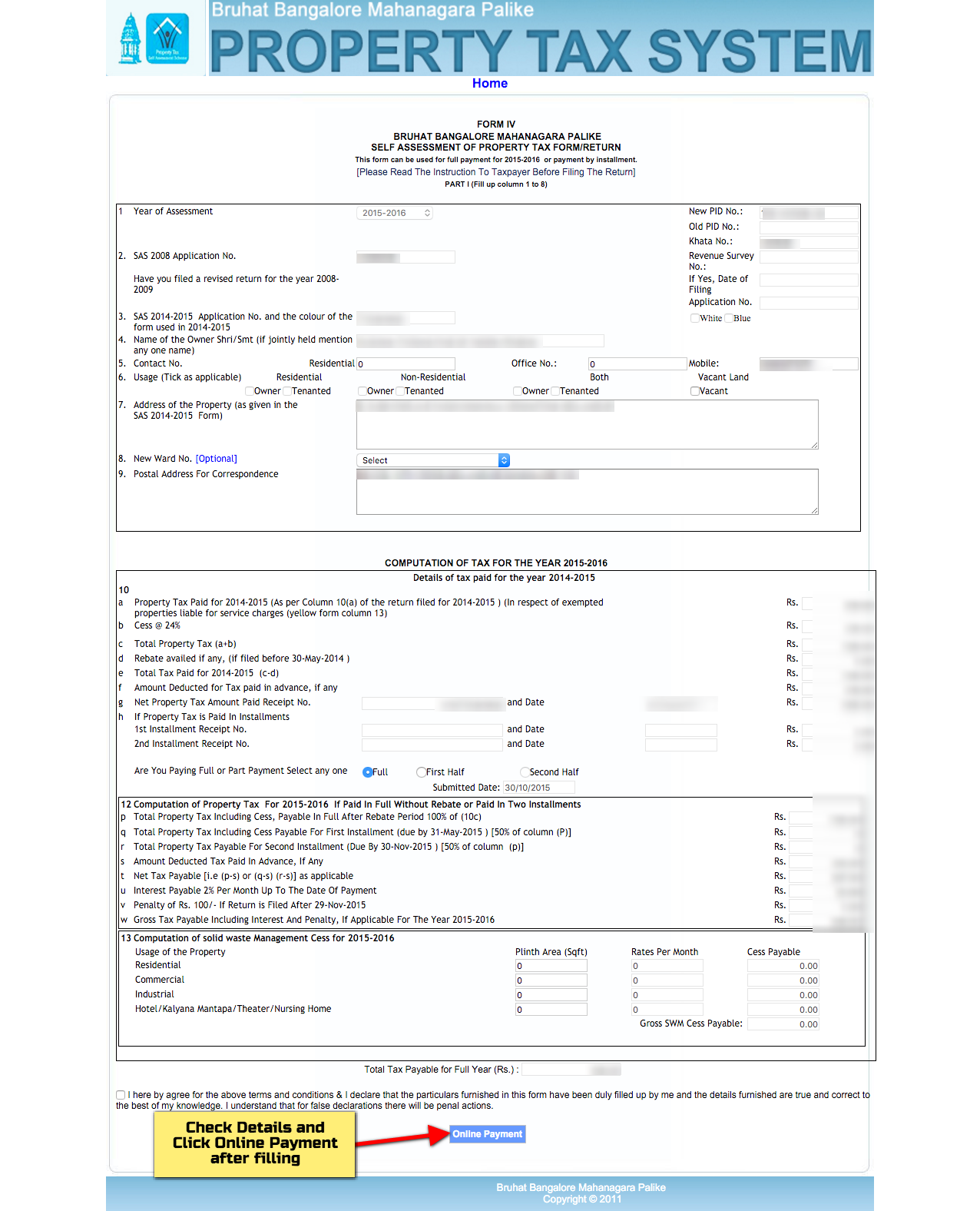

Property taxpayers may use credit cards debit cards or e checks to pay their taxes. Bills are generally mailed and posted on our website about a month before your taxes are due. After the payment has posted which can take up to five business days for online and telephone payments personal property tax receipts are available either by mail online or at our offices. To download your property tax payment receiptchallan and application.

How to get a duplicate property tax payment receipt. Kingadmin bootstrap admin dashboard theme. 2020 real property taxes. Therefore you will need to contact your local county collector andor assessor regarding changes of address payment and billing tax receipts and all other questions regarding your account.

The united states postal service postmark determines the timeliness of payment. If you own property you have to pay property taxes. Option to file revised property tax return for current year in case of structuralusage changes is available under revised return menu explore our useful links zonal classifications 2008 09 to 2015 16 2016 17. Receipt print challan print application print.

Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than december 31 each year. Any online queries please e mail to appsupportghmc at cgggovin. Its important to keep records of the payment of the property taxes or keep the receipt showing the property taxes having been paid.