Printable 1099 Forms For 2018

If your net income from self employment is 400 or more you must file a return and compute your se tax on schedule se form 1040.

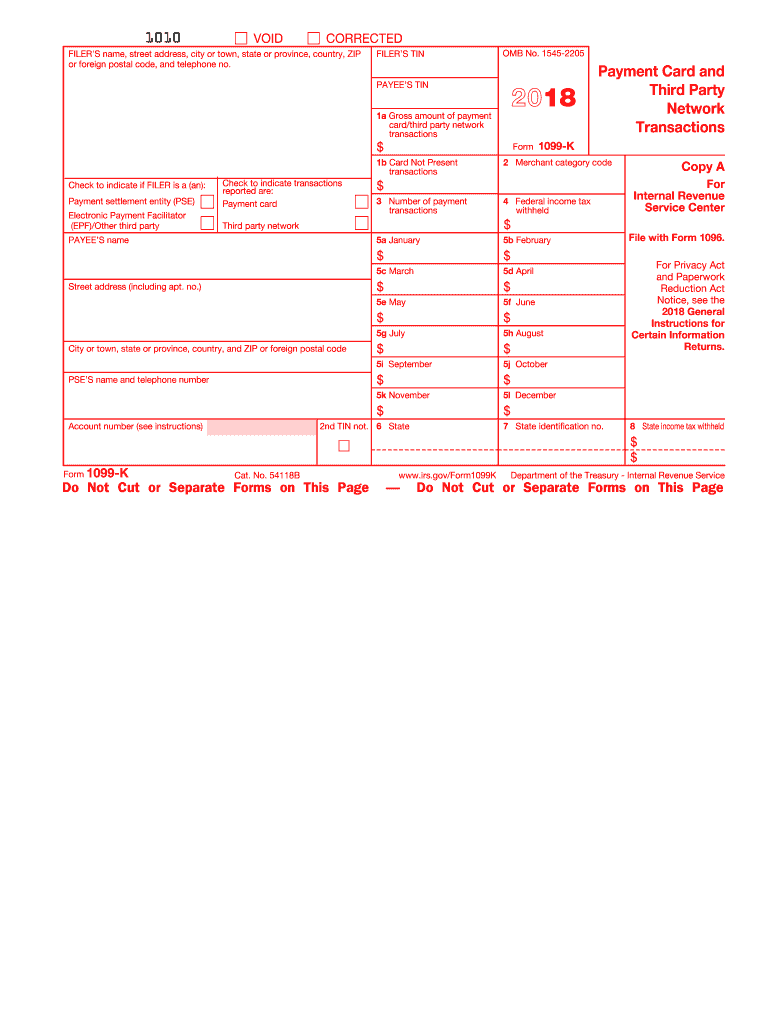

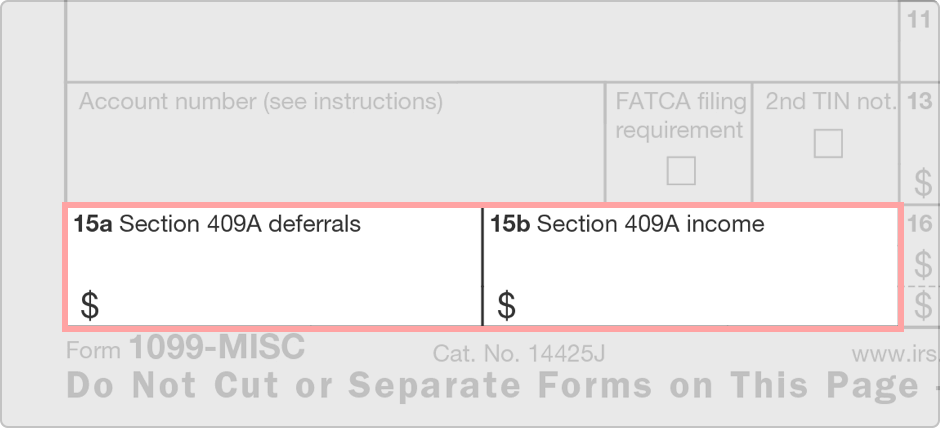

Printable 1099 forms for 2018. Medical and health care payments. During 2018 on the credit allowance dates march 15 june 15 september 15 and december 15. Verify all 1099 information by viewing the 1099 reports. Any amount included in box 12 that is currently taxable is also included in this box.

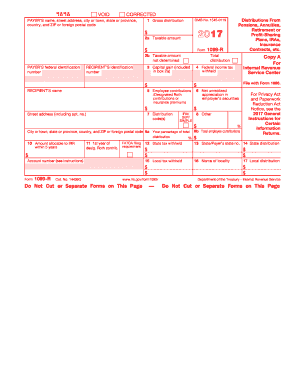

Payers use form 1099 misc miscellaneous income to. Report the amount on form 1040 or 1040nr on the line for iras pensions and annuities or the line for taxable amount and on form 8606 as applicable. Form 1099 nec as nonemployee compensation. After you have printed all of the copy 1 forms for each vendor then load and print the copy 2 forms.

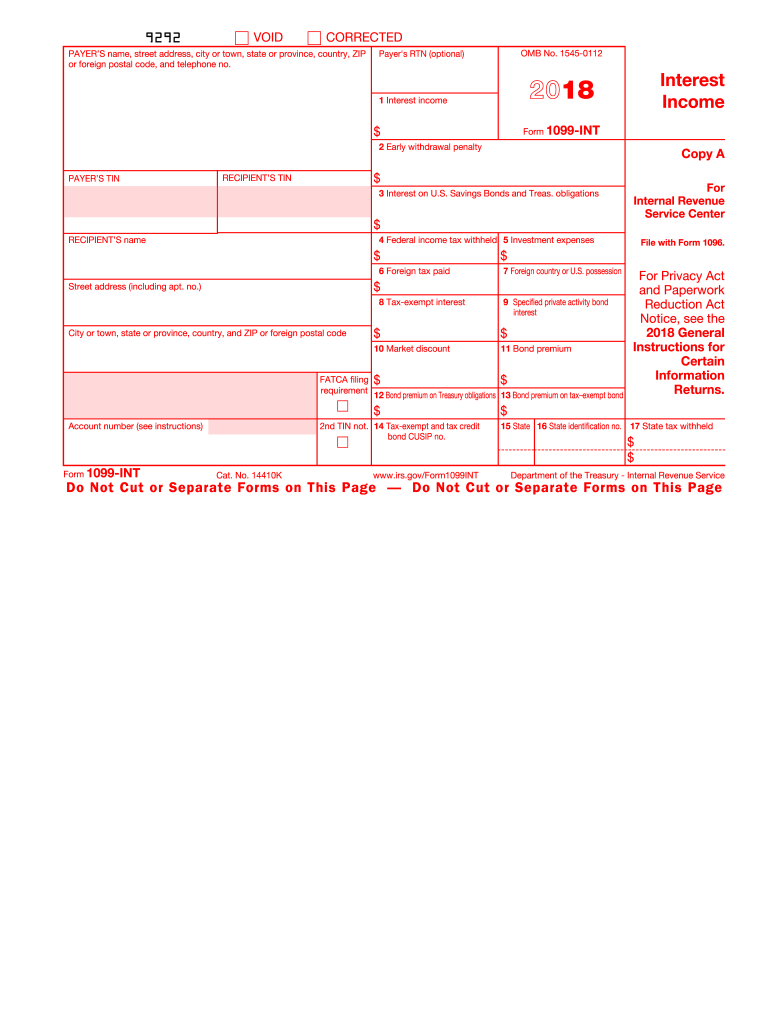

Services performed by someone who is not your employee. Shows interest or principal forfeited because of early withdrawal of time savings. Make sure you have blank 1099 misc forms designed for printers. For more information see form 8912.

At least 10 in royalties or broker payments in lieu of dividends or tax exempt interest. If you havent reached minimum retirement age report your disability payments on the line for wages. This income is also subject to a substantial additional tax to be reported on form 1040 1040 sr or 1040 nr. You also may have a filing requirement.

1099 misc for 2018 2017 2016. Start by loading all of the copy 1 forms. The 1099 misc form is a specific version of this that is used for anyone working for you that is not a true employee. Load enough blank 1099 misc forms in your printer as you load your letterheads.

See the instructions above for a taxable covered security acquired at a premium. At least 600 in. If the figures appear incorrect double click the amount in the total column to view the individual transactions. However if this is a lump sum distribution see form 4972.

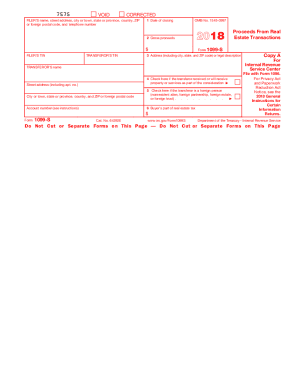

Report payments of 10 or more in gross royalties or 600 or more in rents or compensation. File form 1099 misc for each person to whom you have paid during the year. Report payments made in the course of a trade or business to a person whos not an employee or to an unincorporated business. Amounts shown may be subject to self employment se tax.

If you have a continuous feed printer you may need to adjust for the additional thickness due to the copies. See the instructions for forms 1040 and 1040 sr or the instructions for form 1040 nr. A 1099 form is a tax form used for independent contractors or freelancers. Form 1099 misc is a printable irs information return that reports income for services performed for a business by an individual not classified as an employee.

From the reports menu select vendors payables then choose 1099 summary.