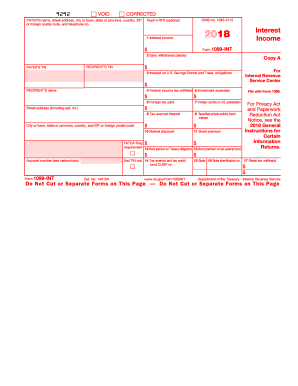

Printable 1099 Int Form 2018

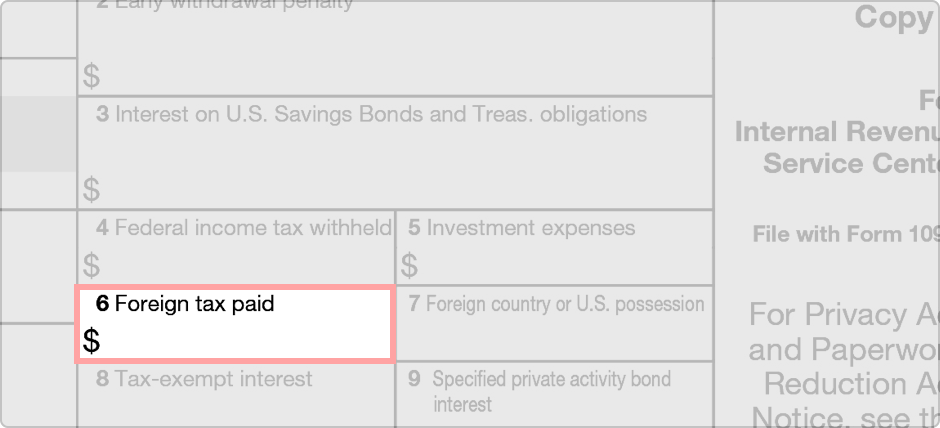

The form details interest payments related expenses and taxes owed.

Printable 1099 int form 2018. Amounts shown may be subject to self employment se tax. The latest version of the form was released in january 1 2018. The advanced tools of the editor will direct you through the editable pdf template. From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment.

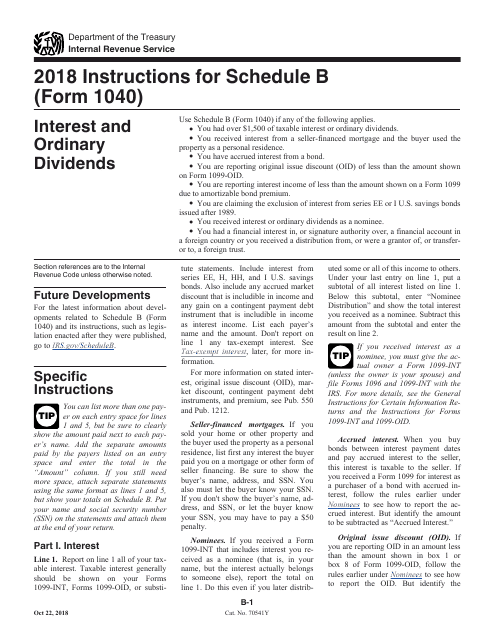

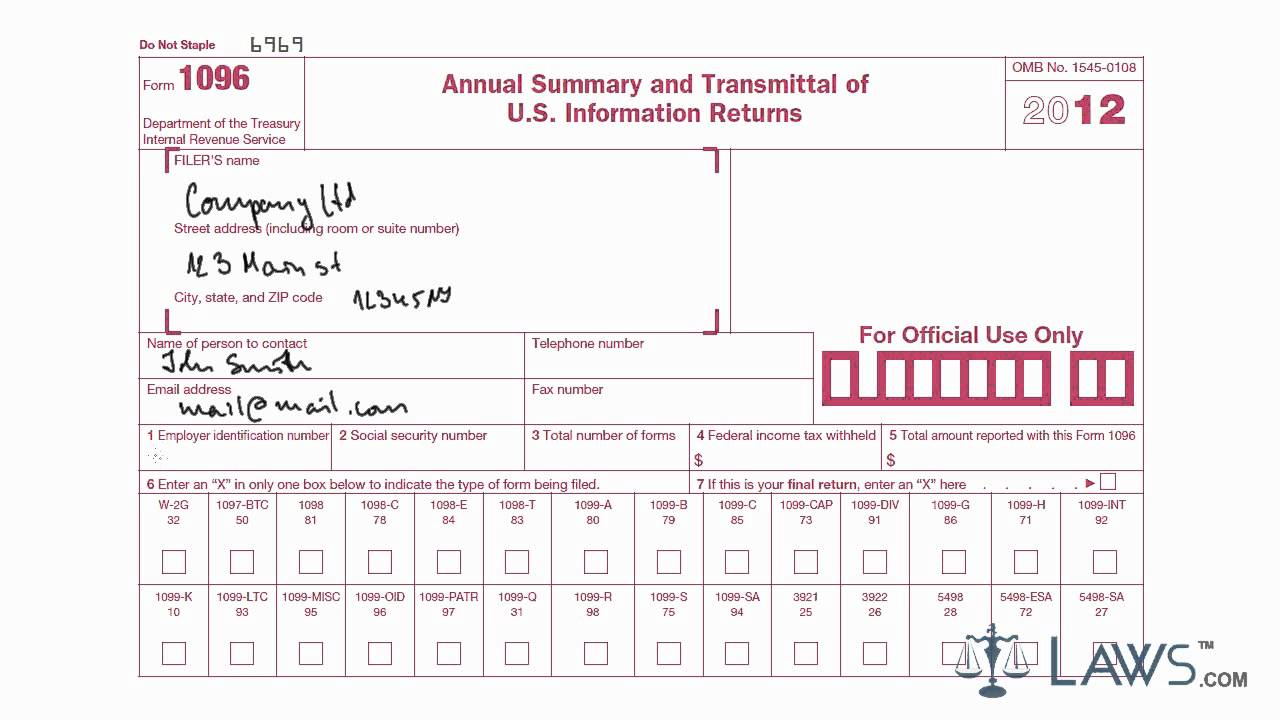

To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10 or at least 600 of interest paid in the course of your trade or business described in the instructions for box 1. There are few exemptions. To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10 for whom you withheld and paid any foreign tax on interest or. Do not send a form 1099 5498 etc containing summary subtotal information with form 1096.

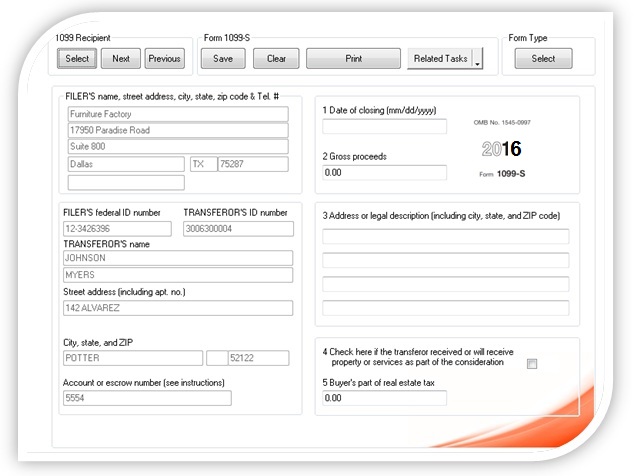

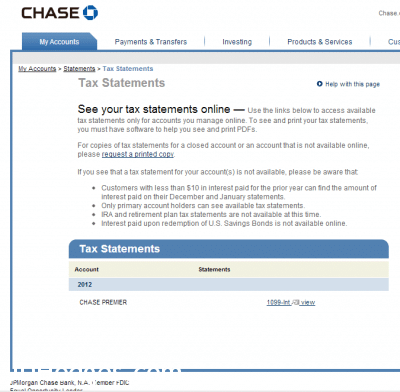

The way to complete the 1099 int fillable form 2017 2018 on the internet. The advanced tools of the editor will lead you through the editable pdf template. For internal revenue service center. Form 1099 int is used by taxpayers to report interest income to the irs.

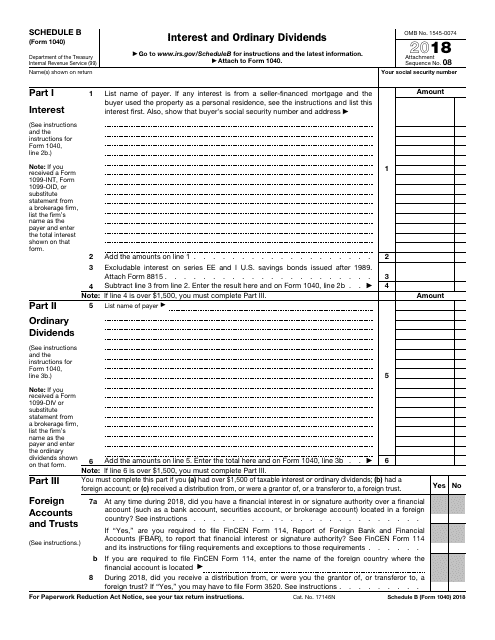

See the instructions for form 8938. File form 1099 int interest income for each person. Fill out 1099 int for 2018. File this form for each person.

For instance it is not necessary for you to file 1099 int in case you made payments to such payees as corporations tax exempt organizations or any individual retirement arrangement ira. Department of the treasury internal revenue service. To start the document utilize the fill sign online button or tick the preview image of the blank. Enter your official contact and identification details.

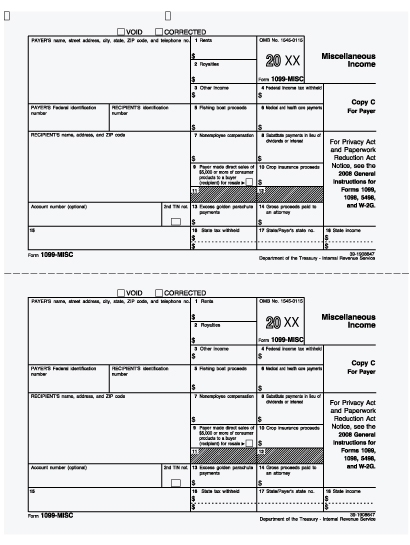

You also may have a filing requirement. Form 1099 int includes all types of interest income earned during a year and all related expenses. Irs form 1099 int interest income is a tax form issued by the united states internal revenue service. Print and file copy a downloaded from this website.

Is reporting on this form 1099 to satisfy its chapter 4 account reporting requirement. File with form 1096. Summary information for the group of forms being sent is entered only in boxes 3 4 and 5 of form 1096. Any payer of interest income should issue a 1099 int form by january 31st of the following year to any party paid at least 10 of interest.

Enter your official contact and. How to complete the 1099 int 2018 form on the web. Specific instructions for form 1099 int. We recommend you file forms 1099 misc reporting nec separately from 1099 misc forms not reporting nec.

About form 1099 int interest income. To get started on the form use the fill sign online button or tick the preview image of the form.