Printable 2017 W2

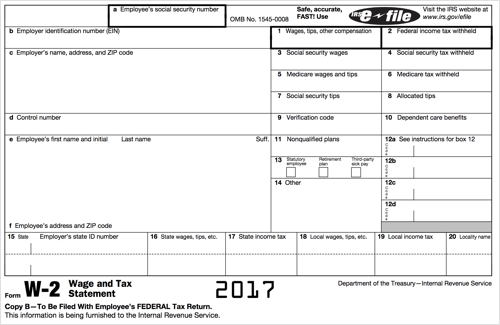

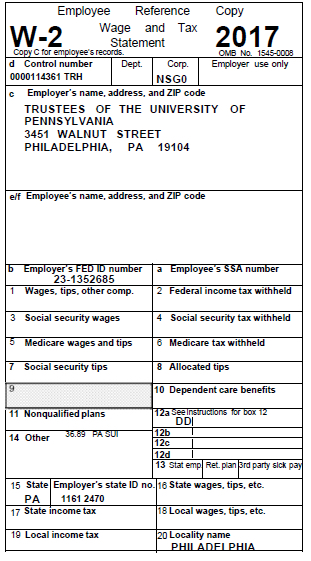

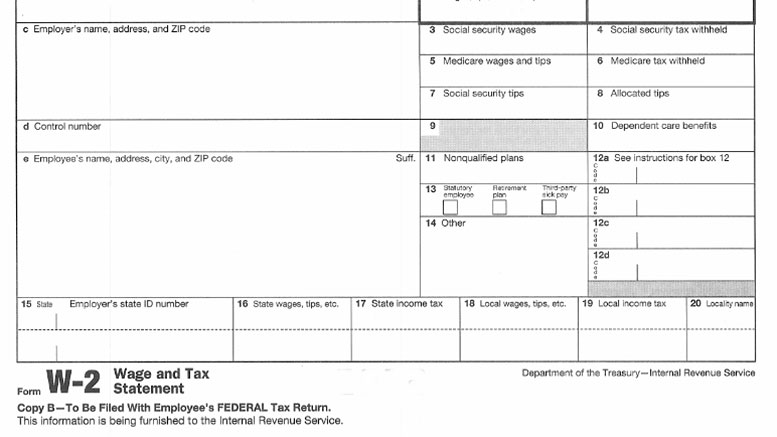

Form w 2 wage and tax statement 2017 department of the treasuryinternal revenue service copy bto be filed with employees federal tax return.

Printable 2017 w2. The quickest way to obtain a copy of your current year form w 2 is through your employer. You may also print out copies for filing with state or local governments distribution to your employees and for your records. You may file forms w 2 and w 3 electronically on the ssas employer. Fillable form w2 2017 form w 2 officially the wage and tax statement is an internal revenue service irs tax form used in the united states to report wages paid to employees and the taxes withheld from them.

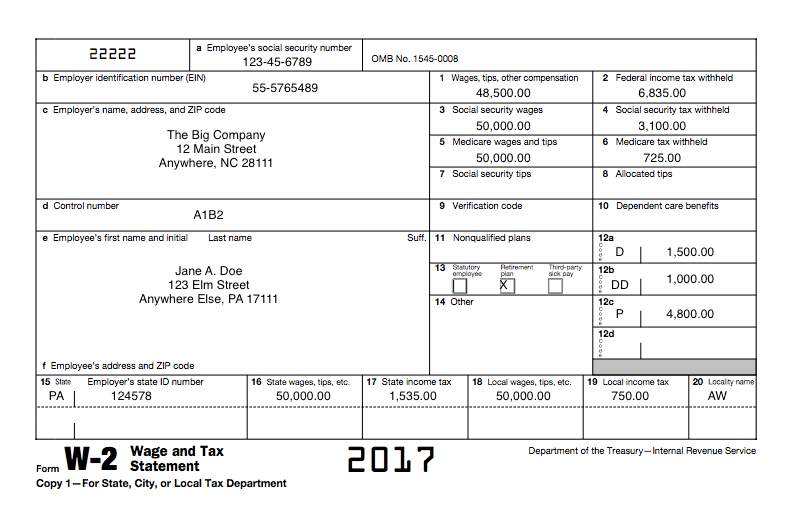

W2 form online is the wage and tax statement which is provided to the employees by their respective employers to complete their tax return. Copy a for social security administration. Copy bto be filed with employees federal tax return. Employers must also file a copy with the social security administration to keep them aware of an employees earnings.

Copy a of this form is provided for informational purposes only. Copy a of this form is. Forms w 2 must be provided to employees before january 31. Enter your information in the boxes as instructed pay for the w2 form and get it in your mailbox.

Information about form w 2 wage and tax statement including recent updates related forms and instructions on how to file. Please note that photocopies are not acceptable. Form w 2 is filed by employers to report wages tips and other compensation paid to employees as well as fica and withheld income taxes. Copy a appears in.

Otherwise youll need to contact your employer or ssa for a copy. If you e filed your tax return or you didnt attach your form w 2 to your paper return then use one of the transcript options above. Wage and tax statement. Forms w 2 and w 3 for filing with ssa.

You may also print out copies for filing with state or local governments distribution to your employees and for your records. Along with the w2 online copy employers are required to file a copy of the social security administration to keep the government aware of the employees earnings. You may also print out copies for filing with state or local governments distribution to your employees and for your records. Form w 2 must contain certain information including wages earned and state federal and other taxes withheld from an employees earnings.

You are required to submit this 2017 w2 along with form w3 to the social security administration. Department of the treasuryinternal revenue service. This information is being furnished to the internal revenue service.