Printable Arkansas Income Tax Forms

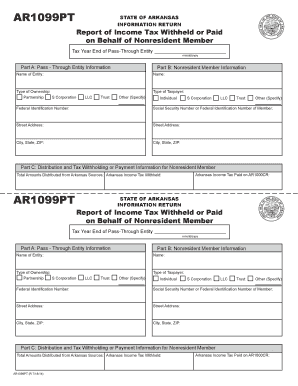

Small business corporate sub s withholding tax branch.

Printable arkansas income tax forms. The current tax year is 2018 and most states will release updated tax forms between january and april of 2019. Arkansas has a state income tax that ranges between 090 and 690. General instructions for forms w 2 and w 3 pdf. Ar1000 co check off contributions schedule.

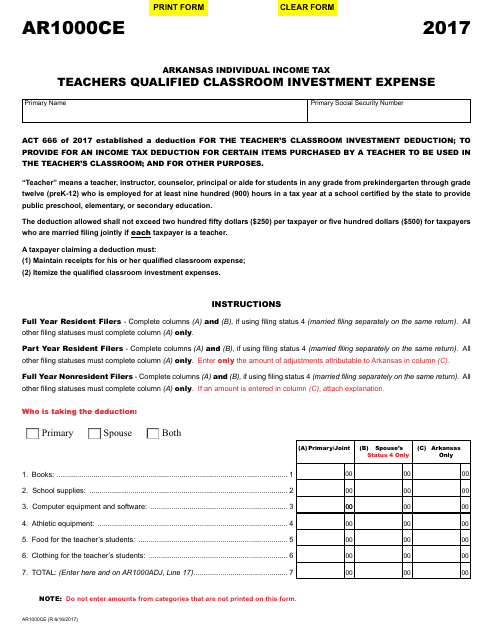

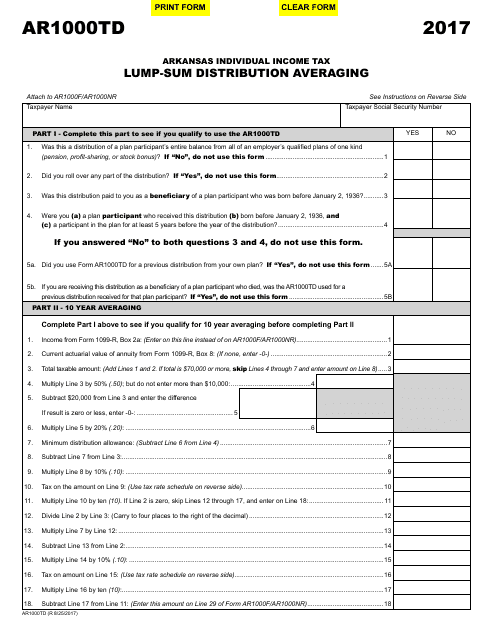

2018 arkansas printable income tax forms 40 pdfs. Form ar2220 underpayment of estimated tax. Form ar1100ct corporation income tax return. Ar4506 request for copies of arkansas tax returns 03072018.

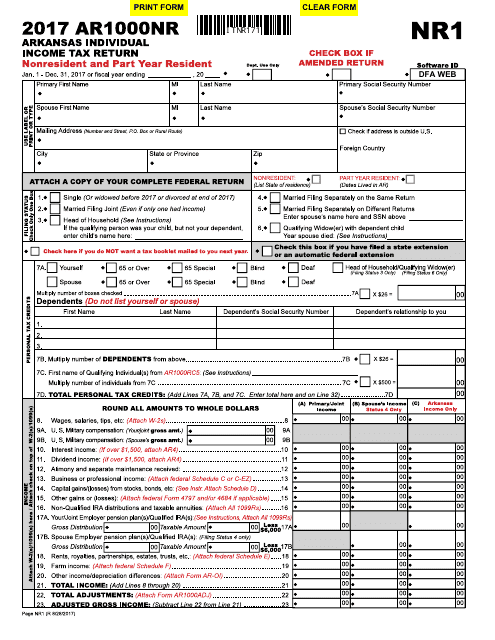

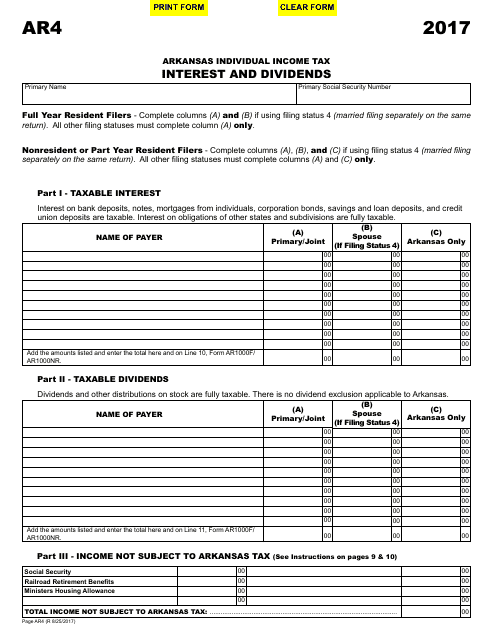

Printable arkansas state tax forms for the 2019 tax year will be based on income earned between january 1 2019 through december 31 2019. Fiduciary and estate income tax forms. Home income tax individual income tax forms. For more information about the arkansas income tax see the arkansas income tax page.

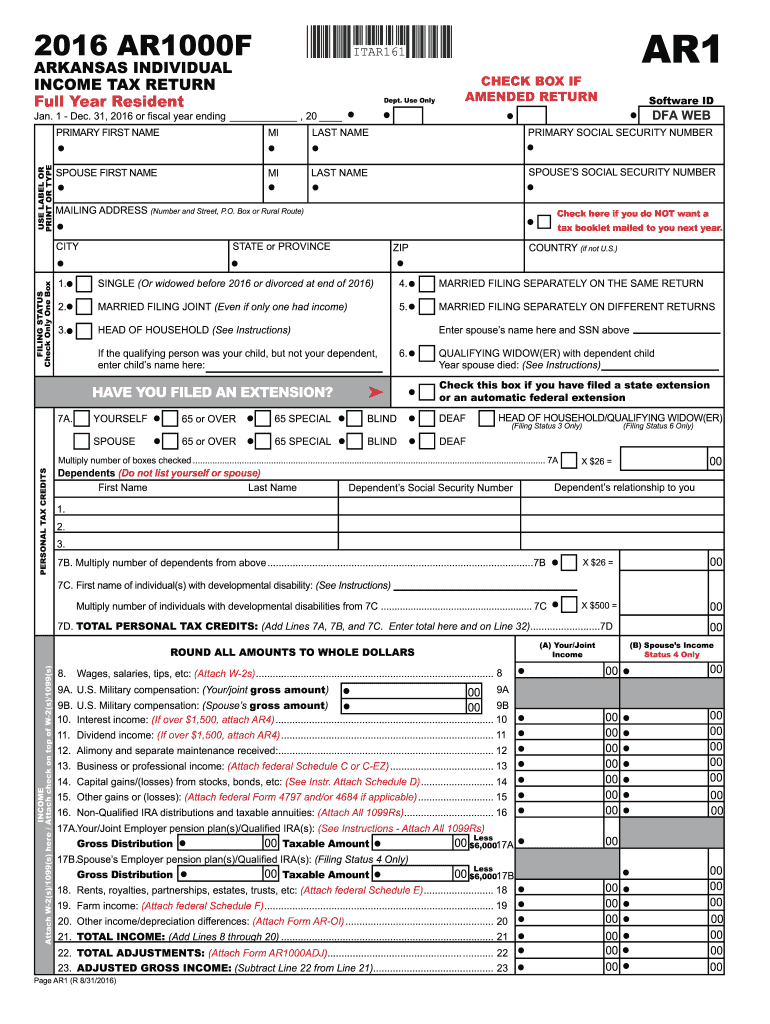

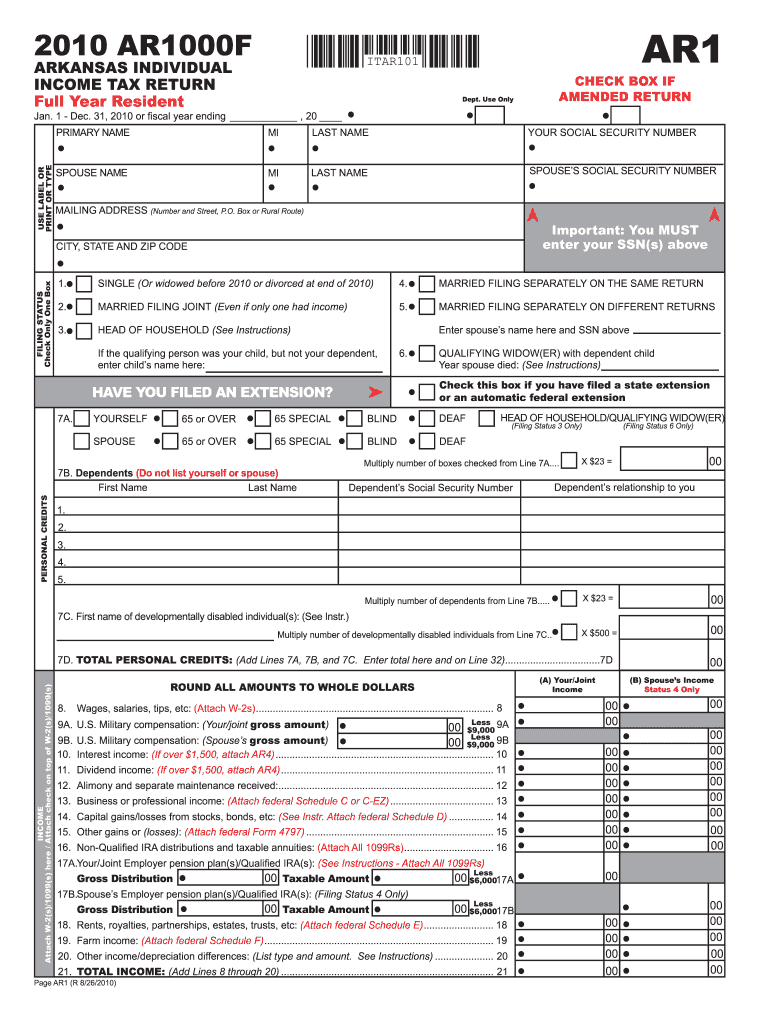

Printable arkansas income tax form ar1000f. Individuals with simple tax returns may instead file a simplified return form ar1000s. Taxformfinder provides printable pdf copies of 40 current arkansas income tax forms. Individual income tax penalty waiver request form.

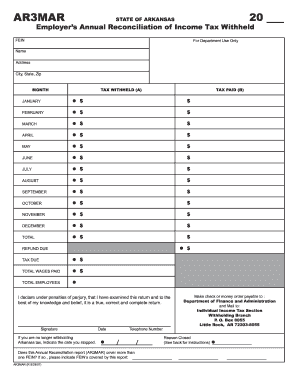

Collecting and maintaining a records of employer payments into accounts set. The individual income tax section is responsible for technical assistance to the tax community in the interpretation of individual partnership fiduciary and limited liability company tax codes and regulations. Form w 2 pdf related. The current tax year is 2018 with tax returns due in april 2019.

Ark 1 arkansas shareholder partner or beneficiarys share of income deductions credits etc. Arkansas has a state income tax that ranges between 09 and 69 which is administered by the arkansas department of revenue. Wage and tax statement. Form ar2220a annualized income for underpayment of estimated tax.

The arkansas income tax rate for tax year 2019 is progressive from a low of 2 to a high of 69. Preparing and distributing tax forms and instructions to individuals and businesses necessary to complete individual partnership fiduciary limited liability and employer tax returns. Home income tax individual income tax forms forms archive. Withholding tax forms and instructions.

Employers must file a form w 2 for each employee from whom income social security or medicare tax was withheld. Forms nameaddress change penalty waiver request and request for copies of tax returns title. Individual income tax name and address change form.