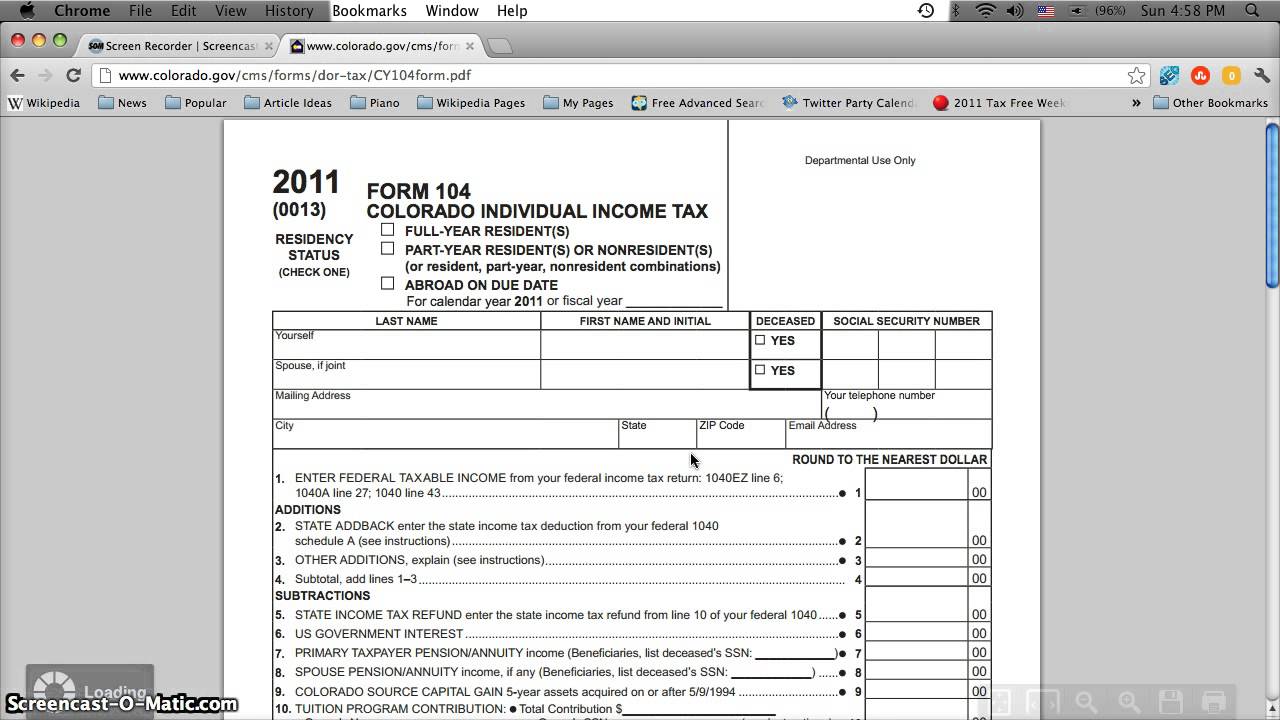

Printable Colorado Income Tax Form 104

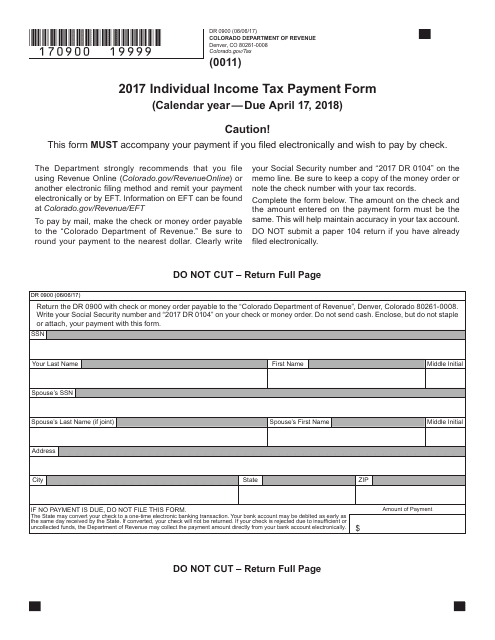

You may file by mail with paper forms or efile online.

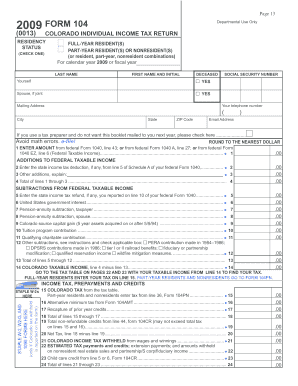

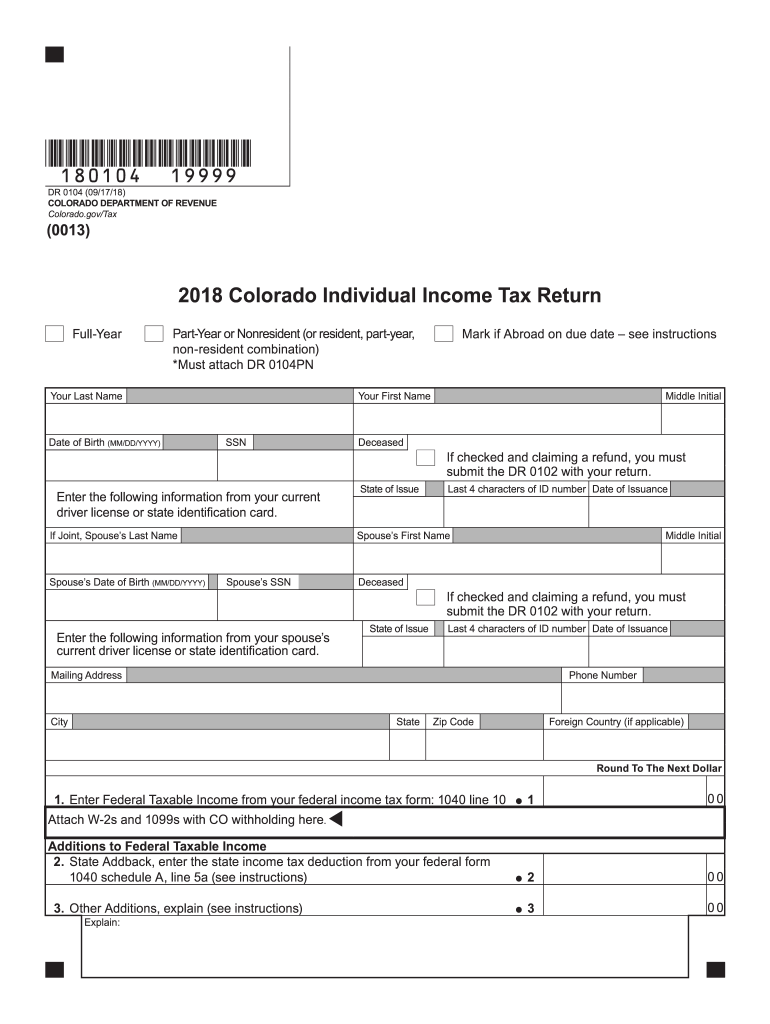

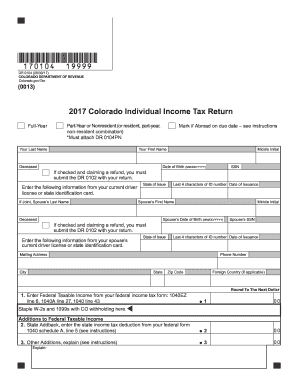

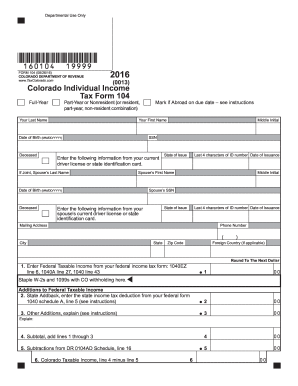

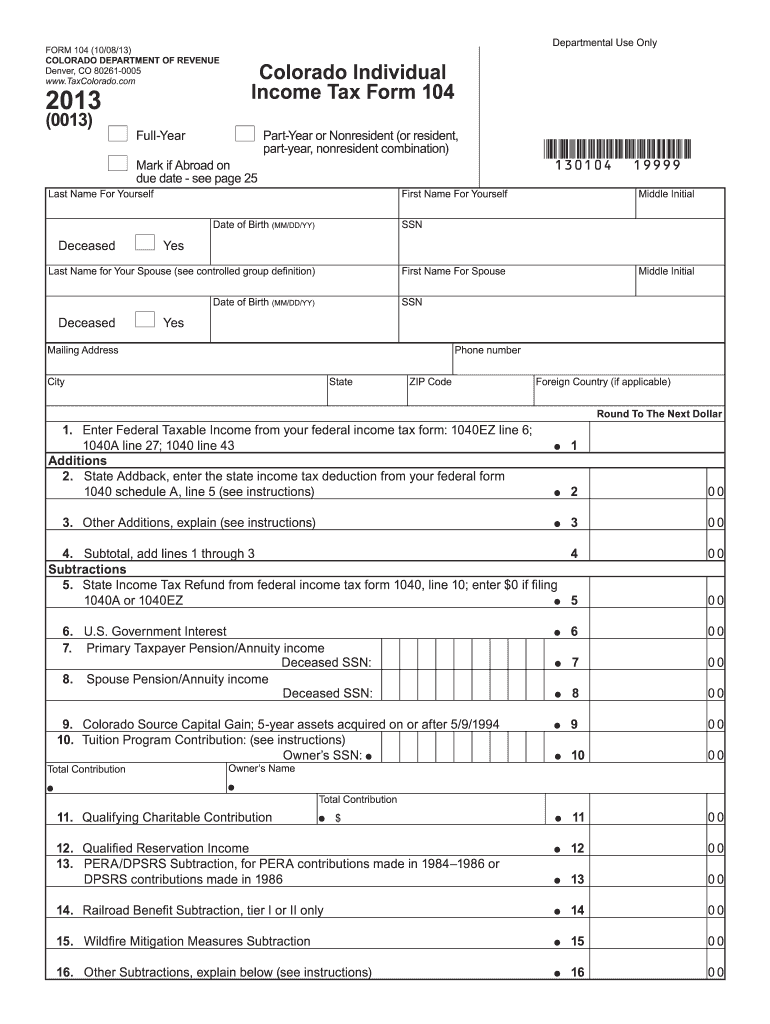

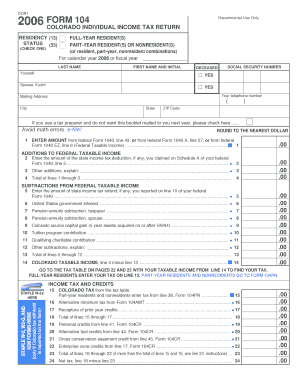

Printable colorado income tax form 104. Taxformfinder has an additional 64 colorado income tax forms that you may need plus all federal income tax forms. The current tax year is 2018 and most states will release updated tax forms between january and april of 2019. Colorado taxable income subtract line 5 from line 4 6 00 tax prepayments and credits. Colorado form 104 is designed for state individuals to report their annual income.

These related forms may also be needed with the colorado form 104. By filling out the form you will see whether or not you owe money to the state or if you will receive a refund. Enter amount from form 1040 line 7. Printable colorado state tax forms for the current tax year will be based on income earned between january 1 2018 through december 31 2018.

The form features space to include your income marital status as well as space to report any children or dependents you may have. Related colorado individual income tax forms. Colorado adjusted gross income. Printable colorado income tax form 104 form 104 is the general and simplest income tax return for individual residents of colorado.

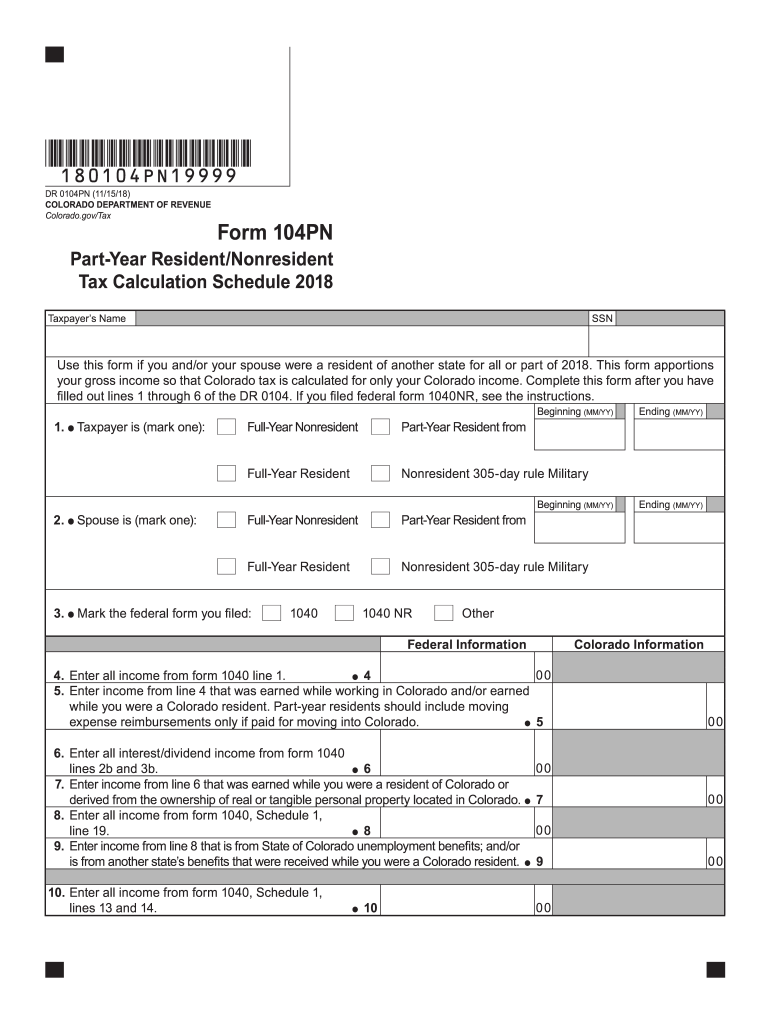

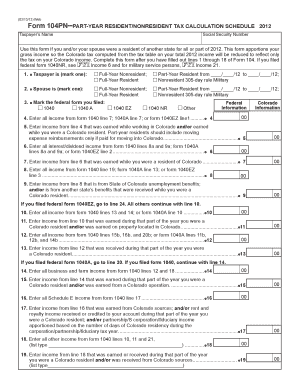

We last updated colorado form 104 in january 2019 from the colorado department of revenue. Part year residents or nonresidents go to the dr 0104pn. Additions to colorado adjusted gross income. This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the colorado government.

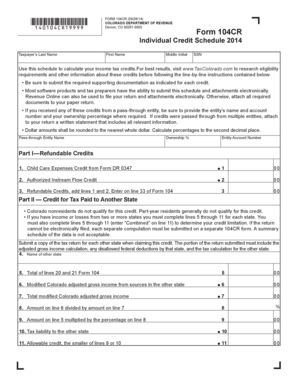

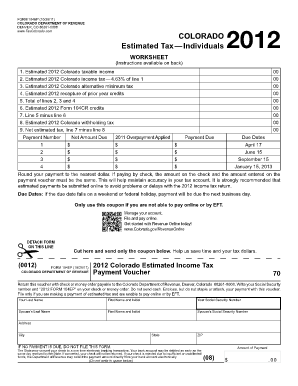

Enter the amount from line 3 of colorado form 104 excluding any charitable contribution adjustments. We last updated colorado form 104ep in january 2019 from the colorado department of revenue. Full year residents continue to line 7 line 7 colorado tax. The colorado income tax rate for 2018 is a flat 463 of your federal taxable income.

Taxformfinder provides printable pdf copies of 65 current colorado income tax forms. This is your colorado taxable income and is the figure used to determine how much colorado tax is owed if any. Colorado tax from tax table or the dr 0104pn line 36 you must submit the dr 0104pn with your return if applicable. Colorado has a flat state income tax of 463 which is administered by the colorado department of revenue.

The colorado state tax table can be found inside the co form 104 instructions booklet below. Additions to adjusted gross income. The income tax rate is currently 463. Subtract the amount on line 23 of form 104pn from the amount on line 21 of form 104pn.