Printable Irs Form 1040 Schedule D

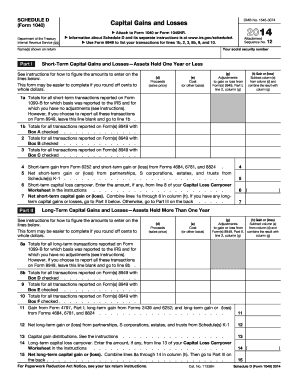

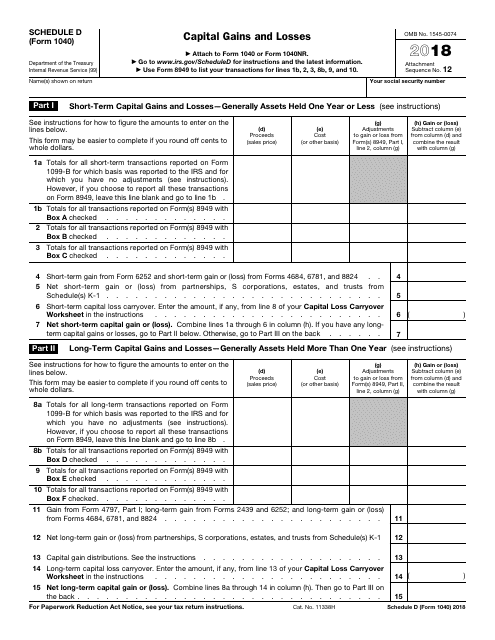

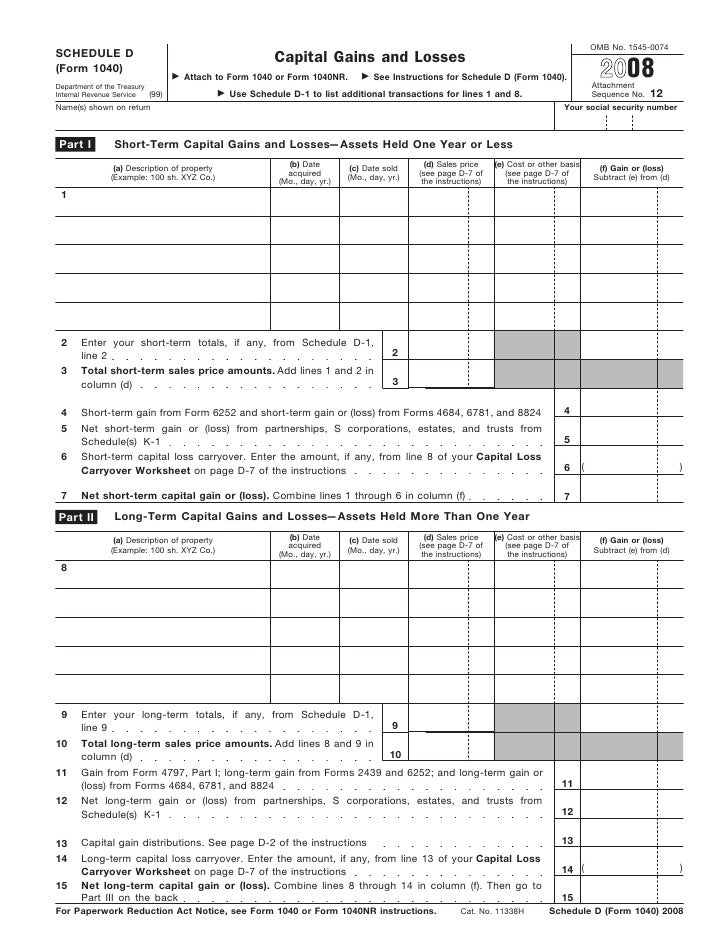

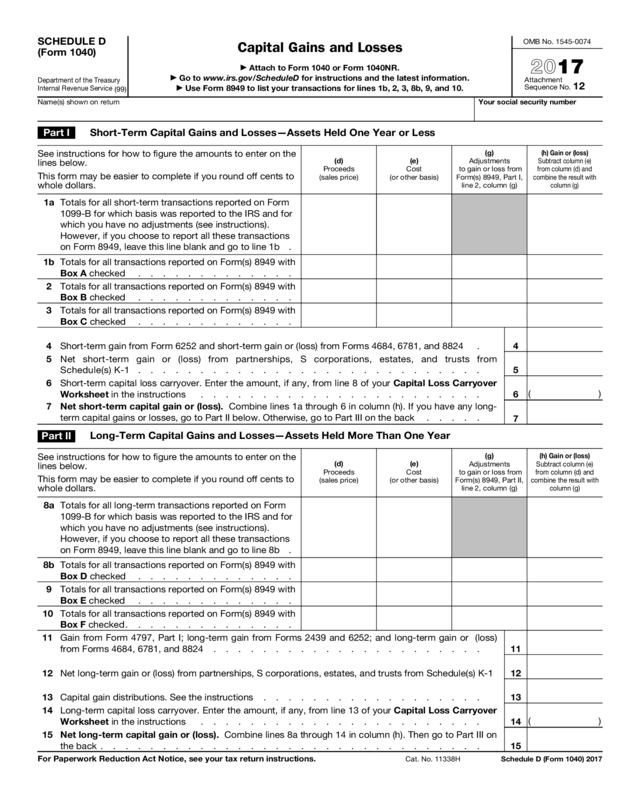

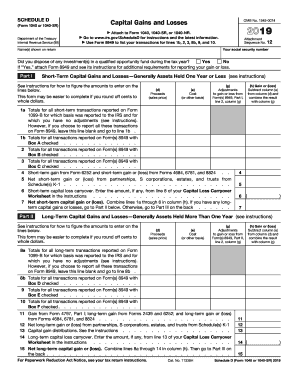

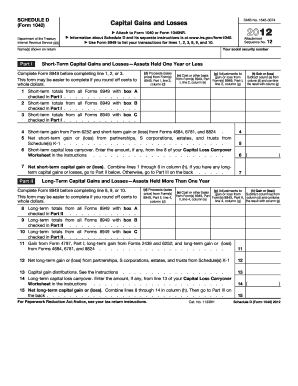

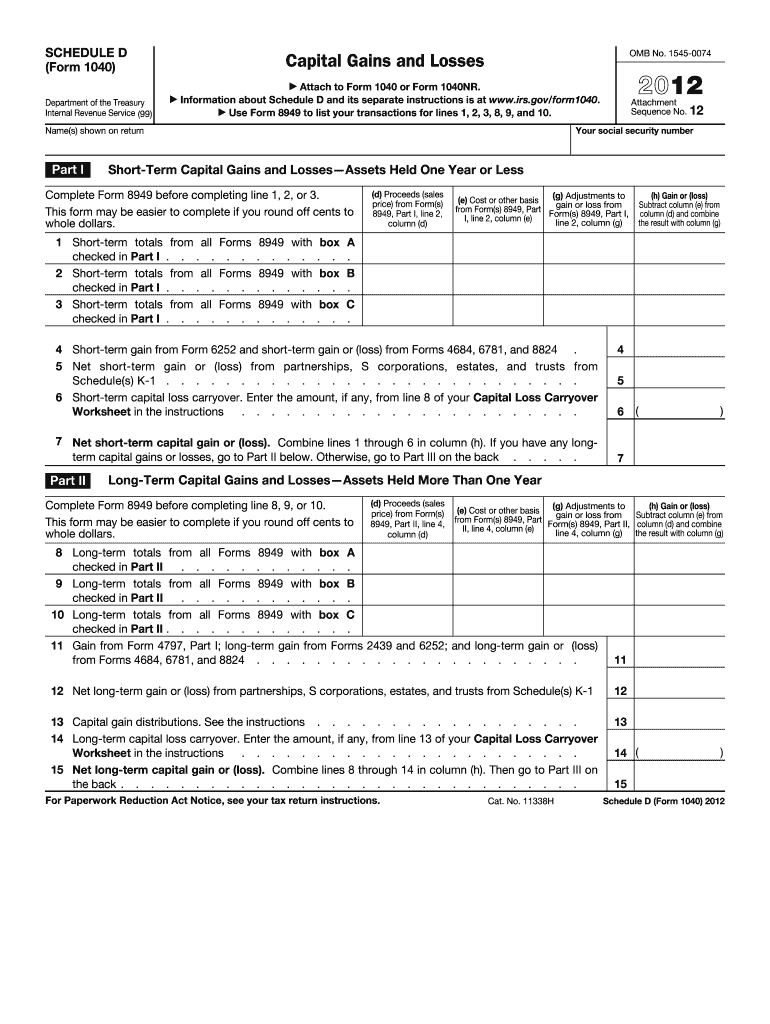

Use schedule d to report sales exchanges or some involuntary conversions of capital assets certain capital gain distributions and nonbusiness bad debts.

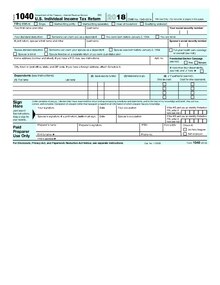

Printable irs form 1040 schedule d. Form 1040 department of the treasuryinternal revenue service 99 us. The sale or exchange of a capital asset not reported on another form or schedule. 6 extension college tuition misc. Irs use onlydo not write or staple in this space.

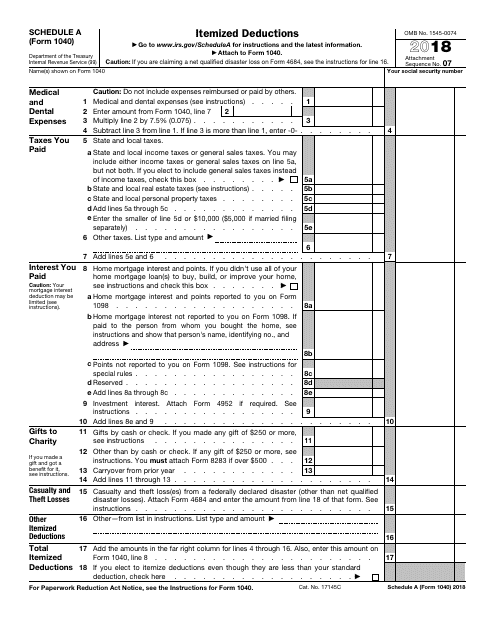

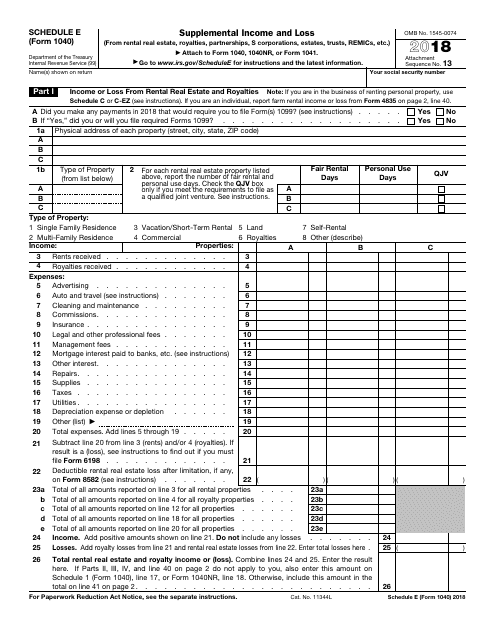

Part 1 of form schedule d is used to calculate your net short term capital gain or loss for assets held one year or less. Gains from involuntary conversions other than from casualty or theft of capital assets not held for business or profit. 8 video how to file your taxes online. Additional income examples include state and local tax credits alimony received unemployment compensation and income reported on various sub forms such as schedule c schedule c ez schedule d.

This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the federal government. We last updated federal 1040 schedule d in december 2018 from the federal internal revenue service. Information about schedule d form 1040 capital gains and losses including recent updates related forms and instructions on how to file. Schedule d form 1040 or 1040 sr department of the treasury internal revenue service 99 capital gains and losses attach to form 1040 1040 sr or 1040 nr.

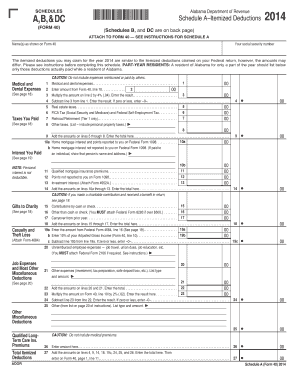

Individual income tax return. Instructions for form 1040 or form 1040 sr us. 2 new printable irs 1040 tax forms schedules instructions. 5 inheritance estate gift tax forms.

1 the best way to get your irs tax forms. 4 employer employee tax forms. Inst 1040 schedule d instructions for schedule d form 1040 capital gains and losses 2019 12092019 form 1040 schedule e supplemental income and loss 2019 10082019. Individual income tax return 2019 11272019 inst 1040.

You can not file schedule d with one of the shorter irs forms such as form 1040a or form 1040ez. Attach form 1040 schedule 1 to your federal income tax return if you have additional income and adjustments to income to report. Form 1040 schedule 1 additional income and adjustments to income. 3 old irs 1040 tax forms instructions.

Schedule d form 1040 department of the treasury internal revenue service 99 capital gains and losses attach to form 1040 or form 1040nr. 7 get the right irs tax forms automatically.

:max_bytes(150000):strip_icc()/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)