Printable Rut 25 Form

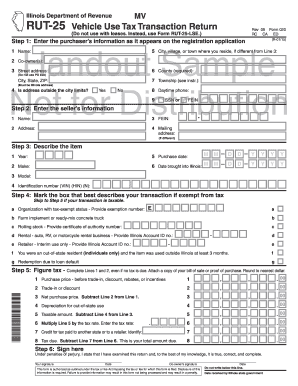

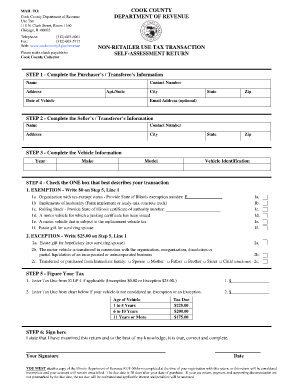

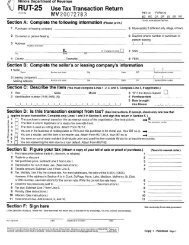

Instead use form rut 50 private party vehicle use tax transaction for a private party vehicle sale and form rut 75 aircraftwatercraft use tax transaction return for a private party aircraft or watercraft sale.

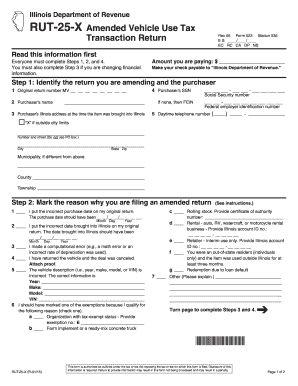

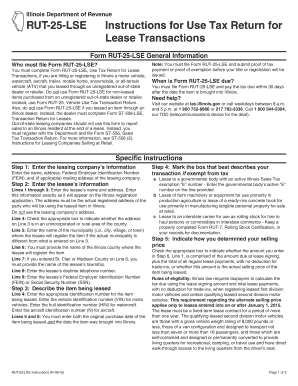

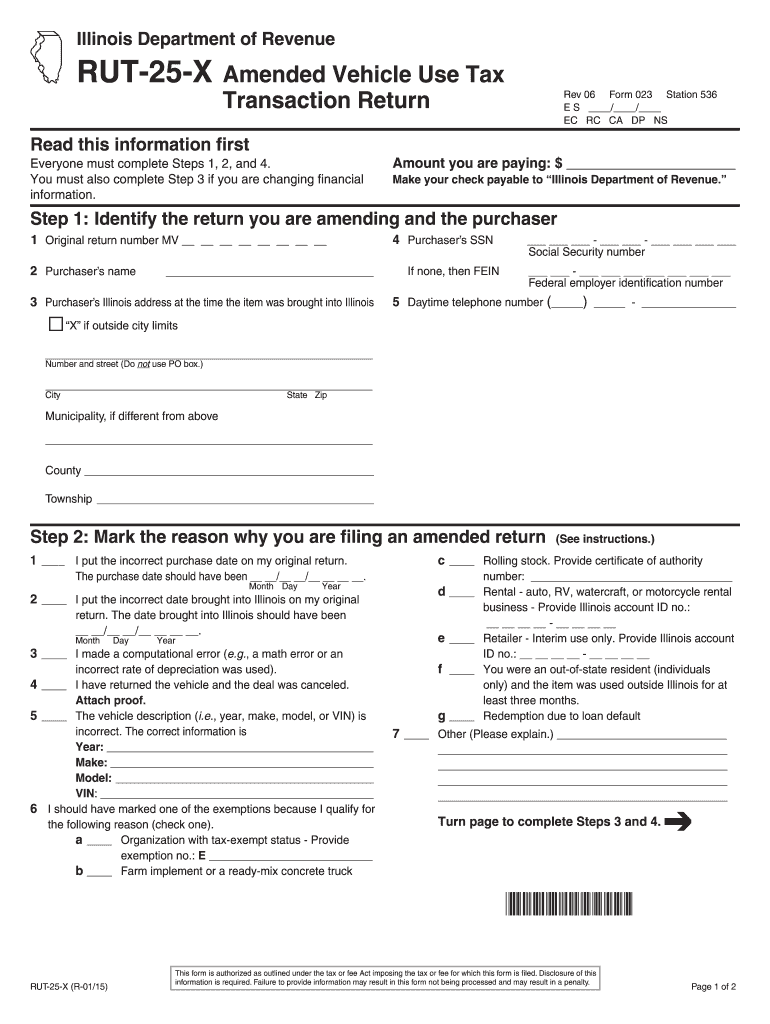

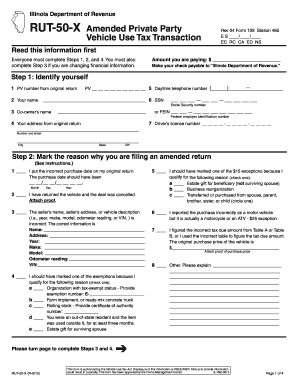

Printable rut 25 form. Also do not use form rut 25 lse if you leased an item through an illinois dealer. Instead the dealer must complete form st 556 lse transaction return. Do not use form rut 25 lse for non leased items purchased from an unregistered out of state dealer or retailer. The form was last revised in january 1 2015 and is available for digital filing.

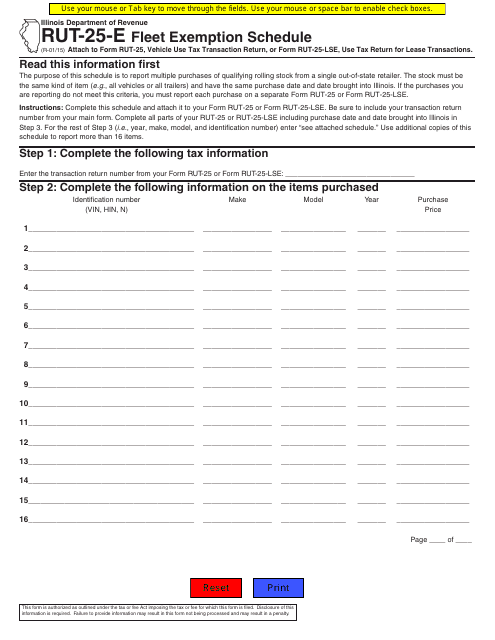

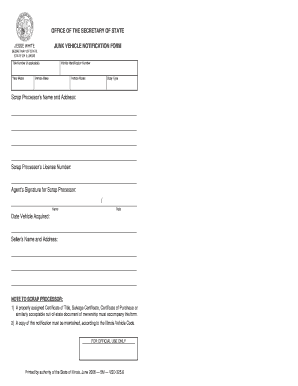

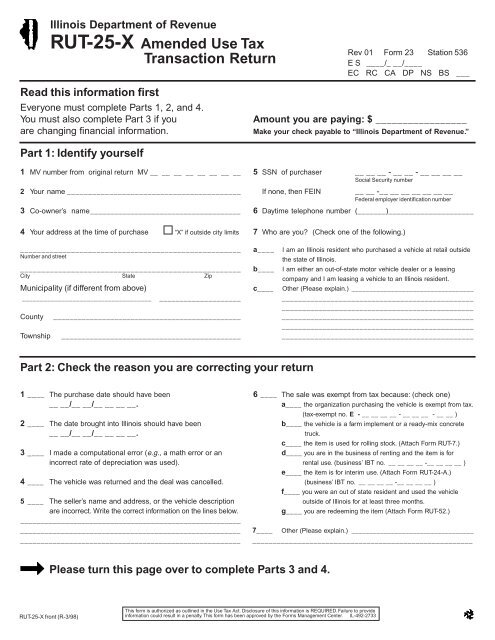

Illinois rut 25 form illinois department of revenue rut 25 x amended vehicle use tax transaction return read this information rst everyone must complete steps 1 2 and 4. Form rut 25 e or the fleet exemption schedule is a form issued by the illinois department of revenue. Sales use tax forms currently selected. If purchased from a dealer you must complete tax form rut 25.

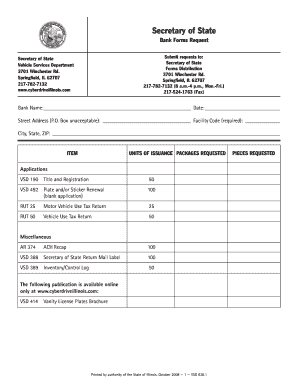

Forms rut 25 rut 25 lse and rut 50 are generally obtained when you license and title your vehicle at the applicable state facility or at a currency exchange. This form has a unique transaction number that should not be duplicated. Doing so could delay processing. Doing so could delay processing.

Download an up to date form rut 25 e in pdf format down below or look it up on the illinois department of revenue forms website. Instead use form rut 25 vehicle use tax transaction return. Mark rut 25 lse instructions for use tax return for lease transactions t. Purchased an item from an out of state dealer other retailer lending institution or leasing company selling items that are required to be titled andor registered or moved into illinois with an item he or she owns that was originally purchased from an out of state dealer.

Do not make copies of the forms prior to completing. If you need to obtain the form prior to registering the item send us an email request or call our 24 hour forms order line at 1 800 356 6302. One of these forms must be presented with a separate tax payment made out to the illinois department of revenue at the time you apply for title and registration. These forms have unique transaction numbers that should not be duplicated.

Withholding payroll tax forms. Rut 25 rut 25 lse and rut 50 illinois department of revenue forms rut 25 rut 25 lse and rut 50 are generally obtained when you license and title your vehicle at the applicable state facility or at a currency. Out of state dealer or retailer. Also do not use form rut 25 if you purchased a motor vehicle or an aircraft or watercraft from an individual or private party.

To determine the amount of tax due refer to the rut 75 instructions.