Printable Schedule C

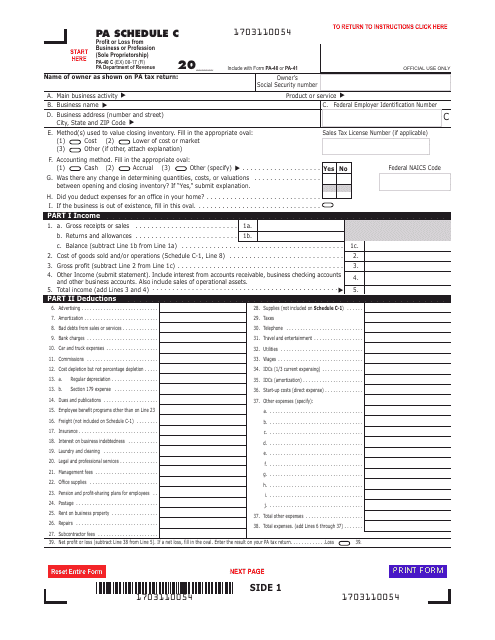

Lower of cost or market c.

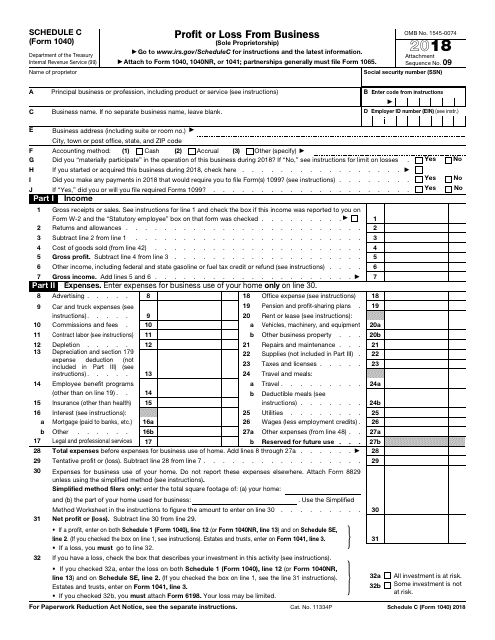

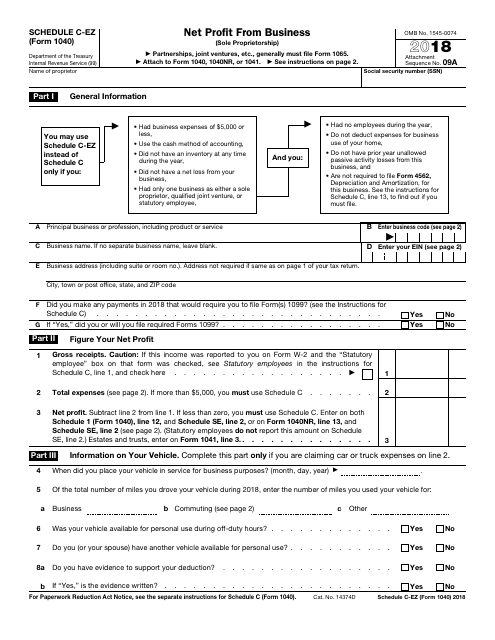

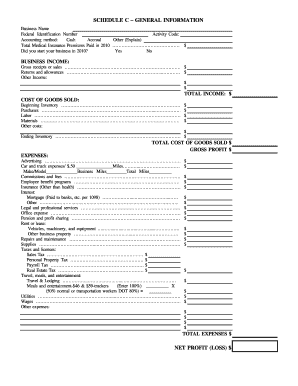

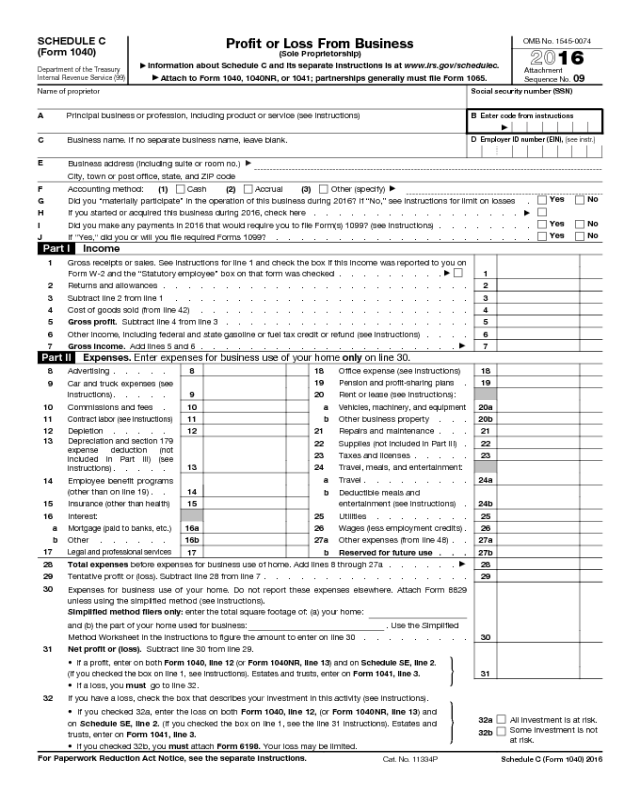

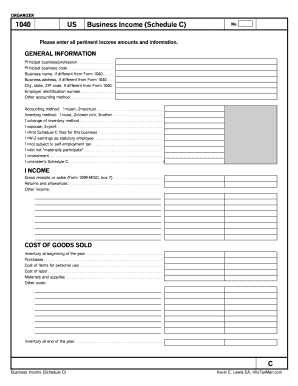

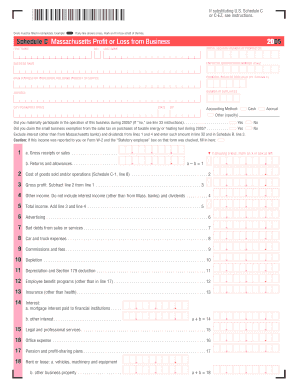

Printable schedule c. Page 2 part iii cost of goods sold see instructions 33. If you are unsure as to which form to file we suggest that you simply print and read the instructions for both. Schedule c form 1040 is used to report income or loss from a business operated or a profession practiced as a sole proprietor. Schedule c form 1040 or 1040 sr 2019.

Schedule c form 1040 2018. Start a free trial now to save yourself time and money. Schedule c form 1040 2017. Lower of cost or market c.

Schedule c 2018 pdf. This form is for income earned in tax year 2019 with tax returns due in april 2020we will update this page with a new version of the form for 2021 as soon as it is made available by the federal government. Schedule c form 1040 2017. Page 2 part iii cost of goods sold see instructions 33.

Available for pc ios and android. Schedule c form 1040 2018. Was there any change in determining quantities costs or valuations between opening and closing inventory. Schedule c form 1040 or 1040 sr 2019.

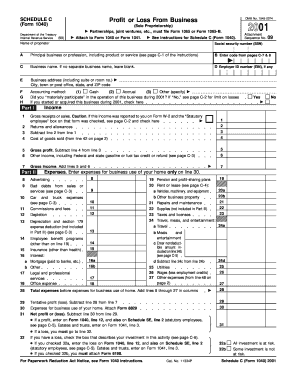

Known as a profit or loss from business form it is used to provide information about both the profit and the loss sustained in business by the sole proprietor. Other attach explanation 34. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. A schedule c form is a supplemental form that is sent with a 1040 when someone is a sole proprietor.

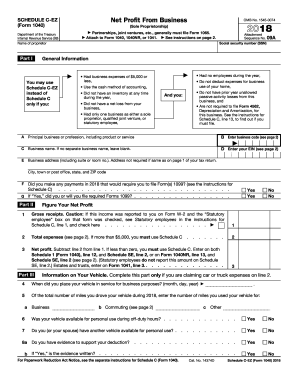

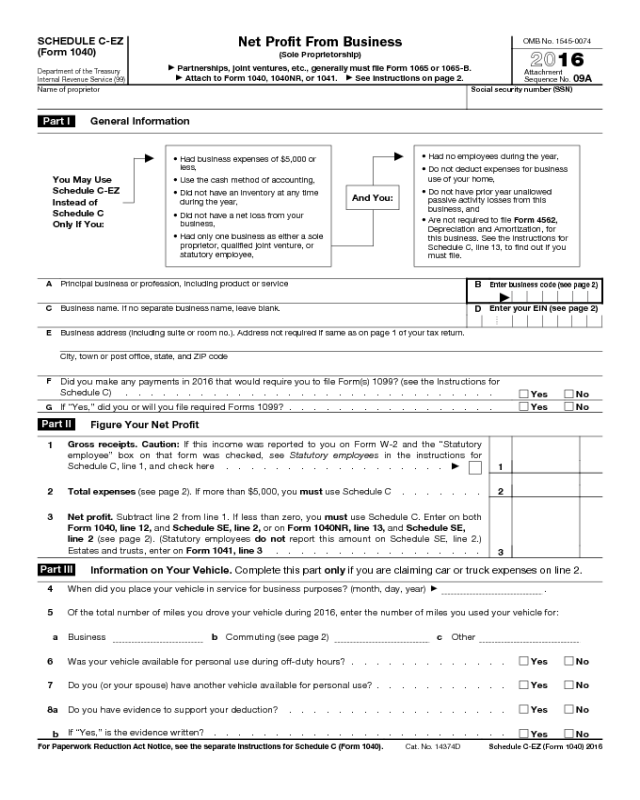

Schedule c is the long version of the simplified easy schedule c ez form. Lower of cost or market c. Methods used to value closing inventory. Page 2 part iii cost of goods sold see instructions 33.

We last updated federal 1040 schedule c in december 2018 from the federal internal revenue service. Other attach explanation 34. Methods used to value closing inventory. Fill out securely sign print or email your schedule c 2018 form instantly with signnow.

Other attach explanation 34. If you are unsure as to which form to file we suggest that you simply print and read the instructions for both.