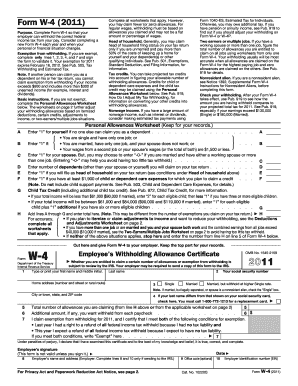

Printable W 4 Document

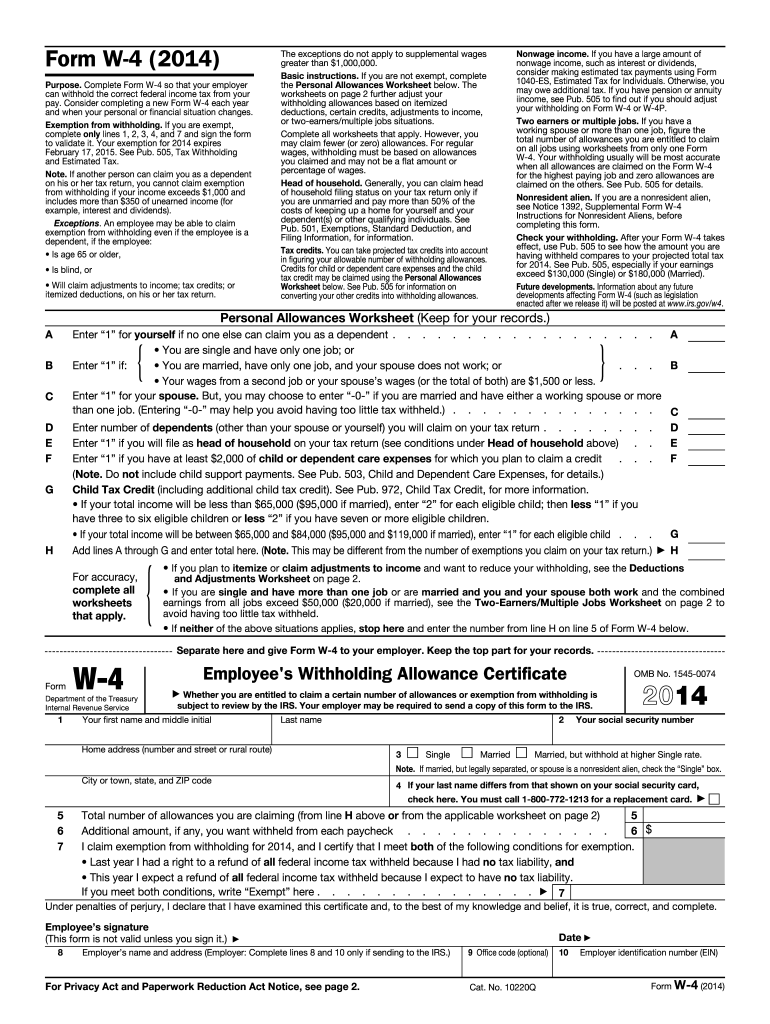

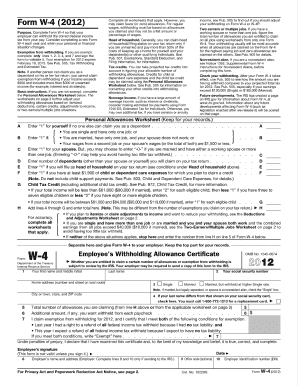

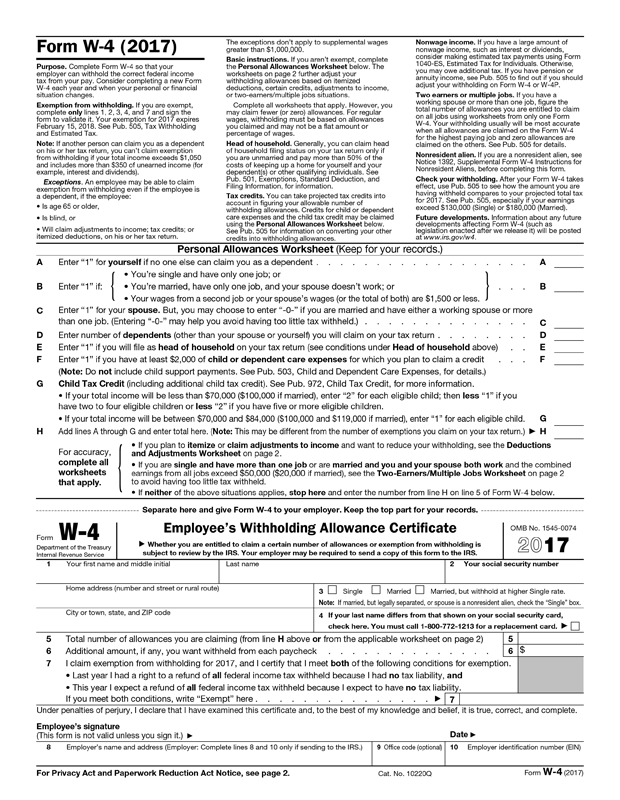

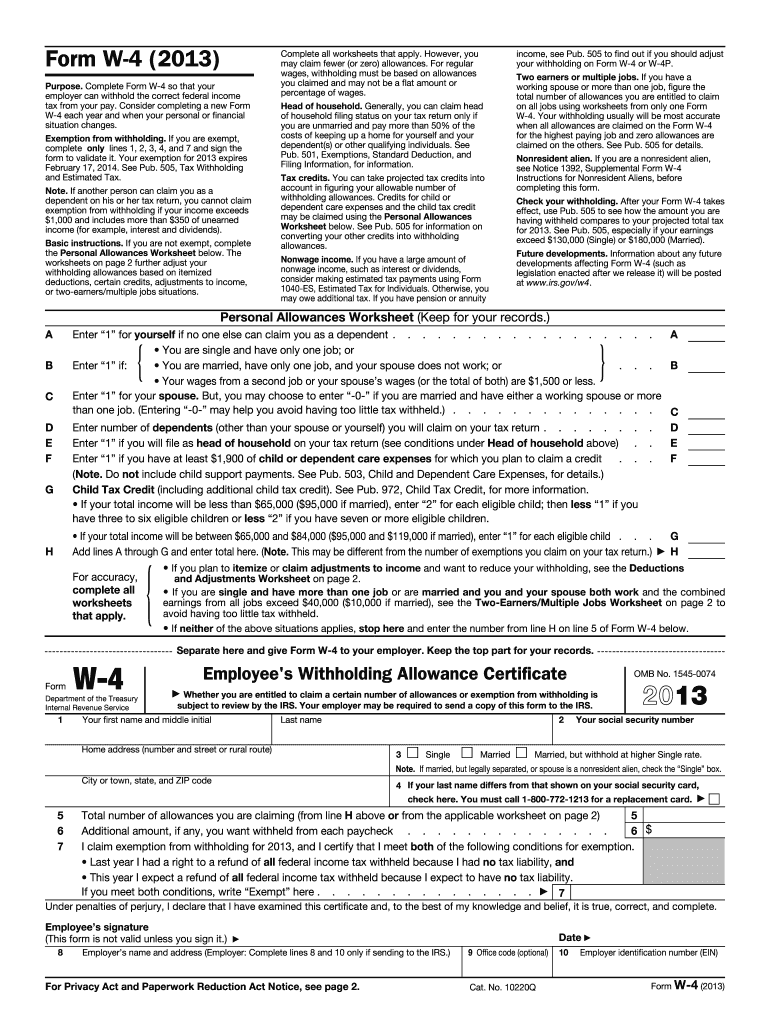

W 4 form is possibly the most important form that you need to file once you get a new job or after there are changes to your salary.

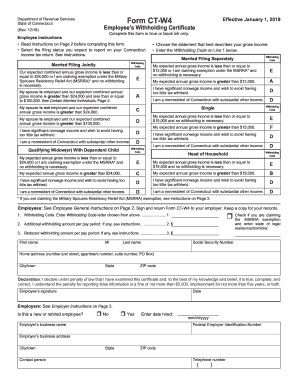

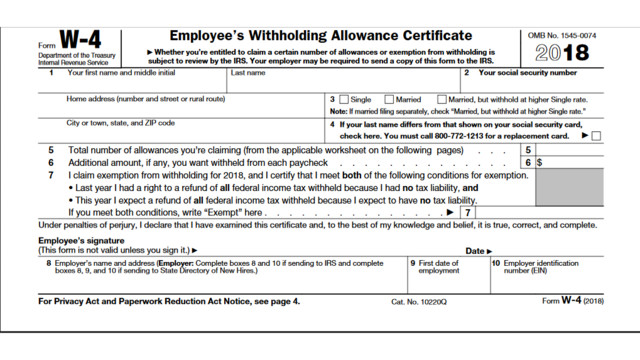

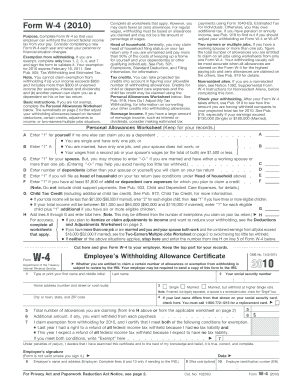

Printable w 4 document. The form should be used for tax year 2018 and beyond as it reflects changes from the tax cuts and jobs act. Withholding certificate for pension or annuity payments 2019 02042019 form w 4p. If you or your spouse have self employment income including as an independent contractor use the estimator. For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your form w 4 and your spouse should enter zero 0 on lines 5 and 6 of his or her form w 4.

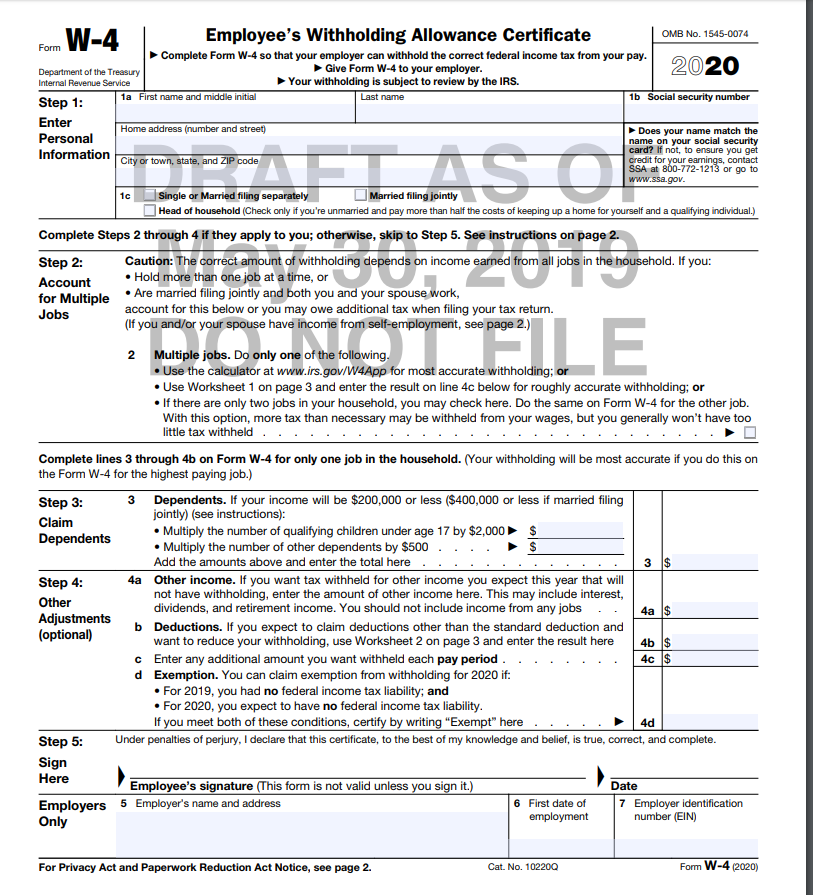

To be accurate submit a 2020 form w 4 for all other jobs. Other things that may require you to file a new w 4 form include getting married having a child divorcing or having a second job. Forms w 4 filed for all other jobs. For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your form w 4 and your spouse should enter zero 0 on lines 5 and 6 of his or her form.

There is no exception to the w 4 form employees withholding allowance certificate. Forms w 4 filed for all other jobs. Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file. There is likely going to be a new form for 2020 but it appears to be more detailed and complex as it takes more time than expected and it is something unusual for the irs.

Download printable w 4 form 2020. Printable version of the new w 4 form issued by the irs. Irs w 4 form 2020 printable. Withholding certificate for pension or annuity payments 2018 02052019 form w 4s.

Leave those steps blank for the other jobs. Complete steps 34b on form w 4 for only one of these jobs. The irs or any other agency of the federal government for that matter is responsible for providing each document and form to those who need to fulfill their duties. Whichever irs form you need the agency offers them for free without any login or charge at all from its website.

Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. The irs works with the treasury department on form w 4 employees withholding allowance certificate whenever it needs an update.