Receipt For Donation To Nonprofit Organizations

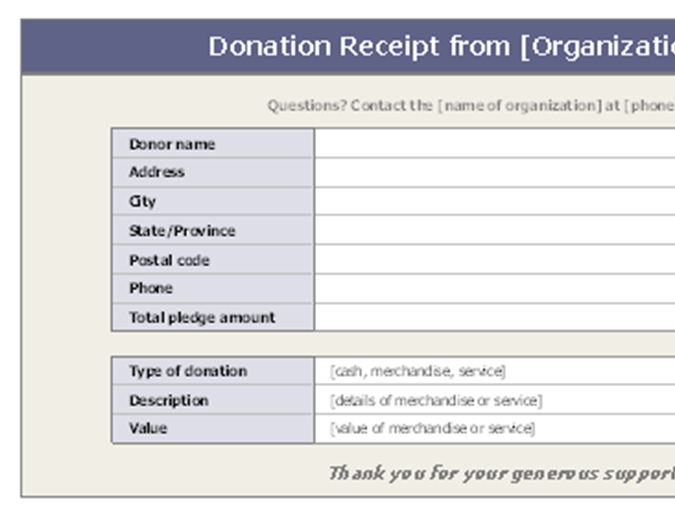

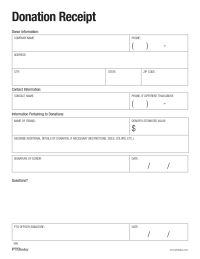

Information about the donor including name and address.

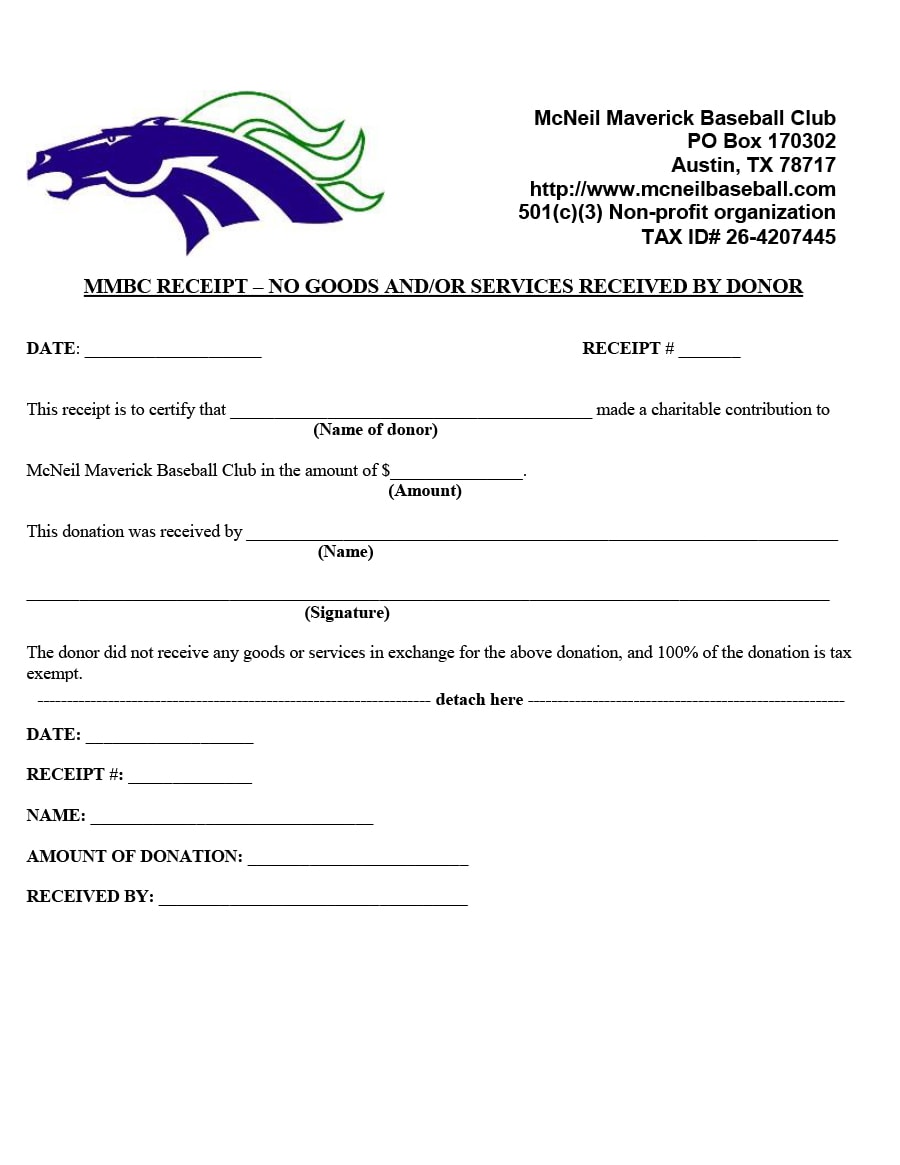

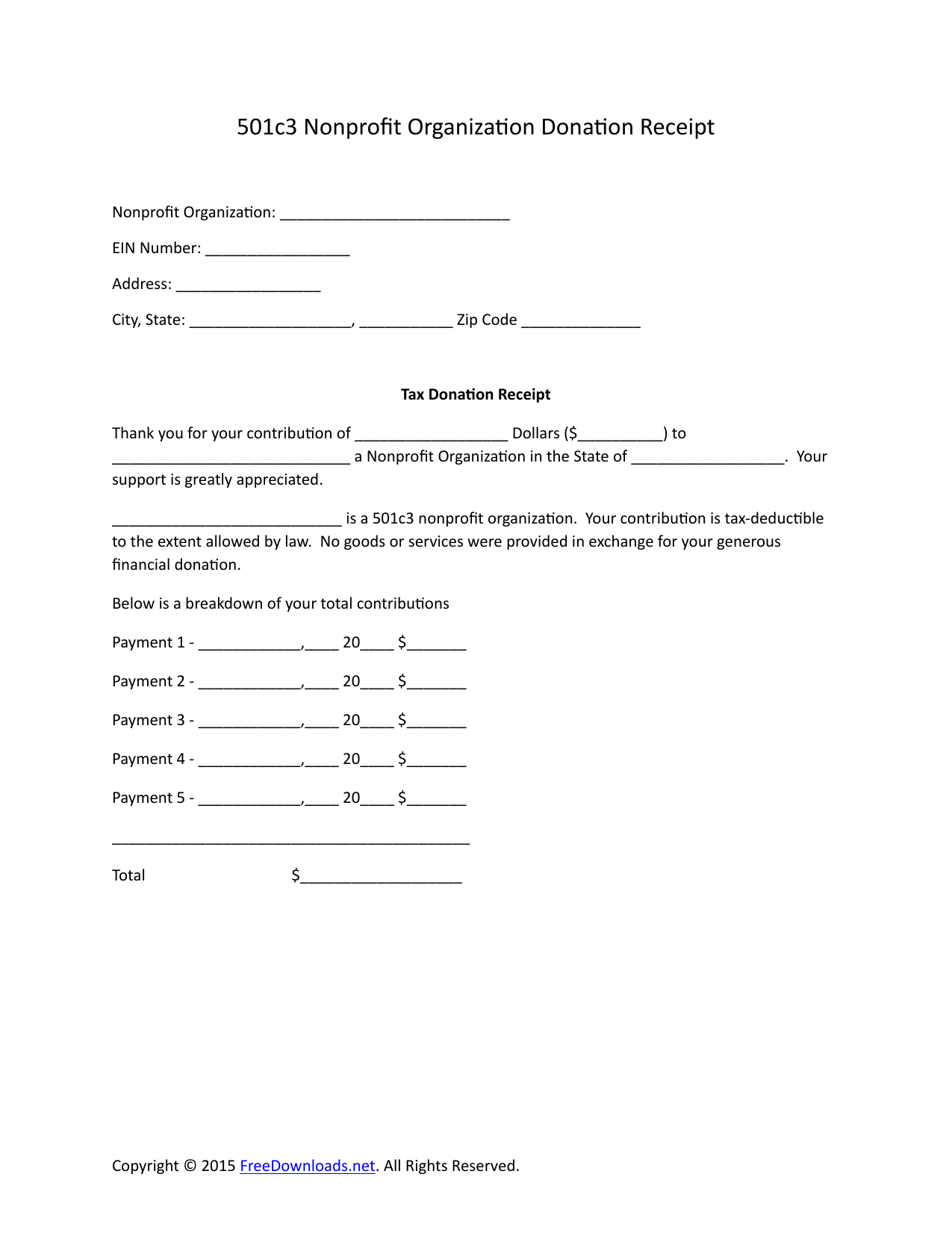

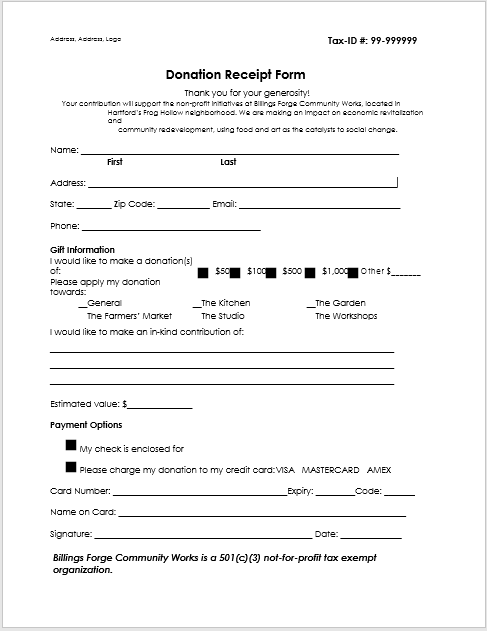

Receipt for donation to nonprofit organizations. To those outside the nonprofit realm a donation receipt is often a convenience something to be used for a small tax break come the end of the year. Most at times these receipts are emails or letters directed to supporters once donations are made. A charitable organization is required to provide a written disclosure to a donor who receives good or services in exchange for a single payment in excess of 75. First things first incorporate your organizations name and category.

The next important thing to place is a space. Fortunately for those who like to give charitable donations are tax deductible as long as they are itemized and recorded. Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. In order to realize this benefit the donor must receive a properly written receipt as record of the transaction.

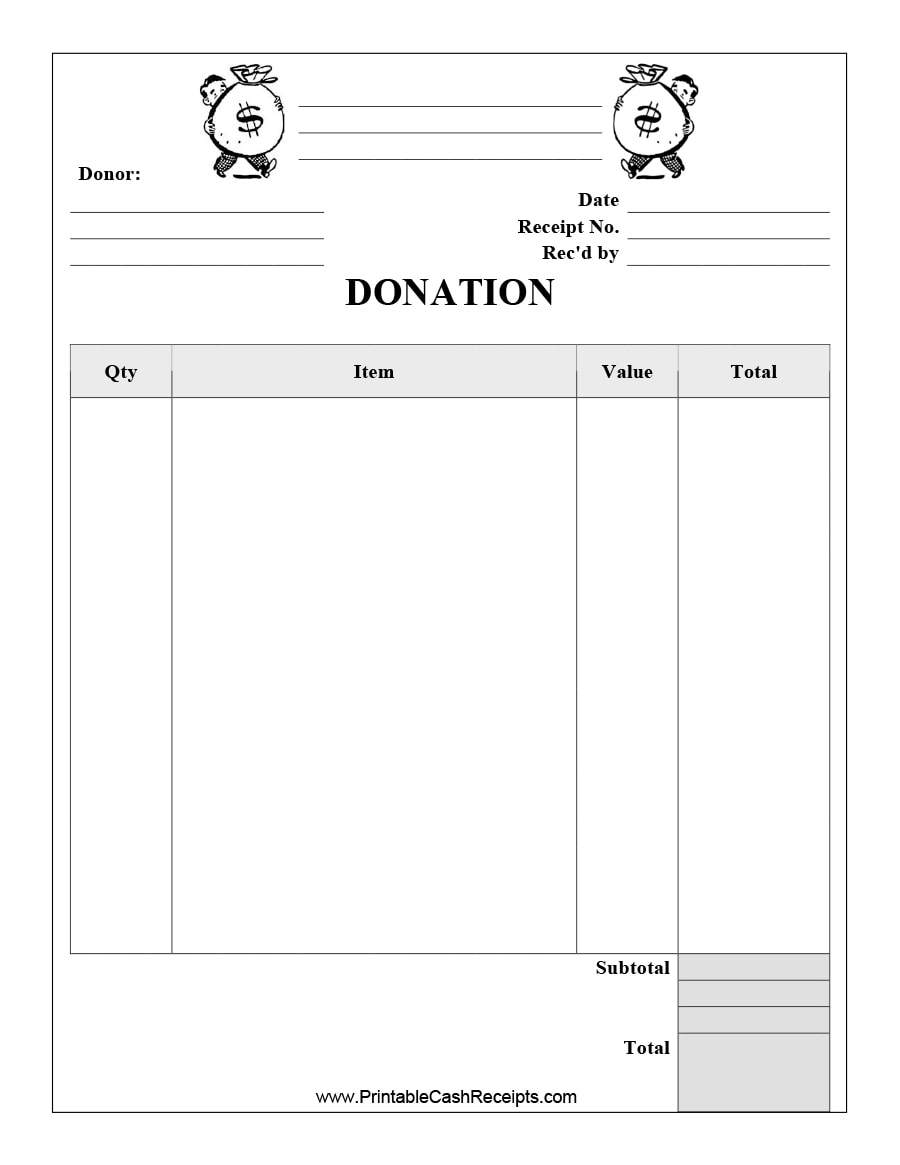

Donations involving a motor vehicle boat or airplane that has a value that exceeds 500 are handled differently. These can be given in the form of an email a postcard or a written document from the nonprofit organization. The receipt can take a variety of written forms letters formal receipts postcard computer generated forms etc. As previously stated a donation receipt can be in the form of a letter or an email.

Heres a simple step by step guide on how to make a donation receipt template for your own use. The nonprofit donation receipt template gives you all necessary information so that you only have to fill out the following information when you create donation receipts. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction. Eligible amount of.

Best practices for creating a 501c3 tax compliant donation receipt. To nonprofit organizations donation receipts are an essential part of bookkeeping and maintaining their nonprofit status.