Retail Tax Certificate

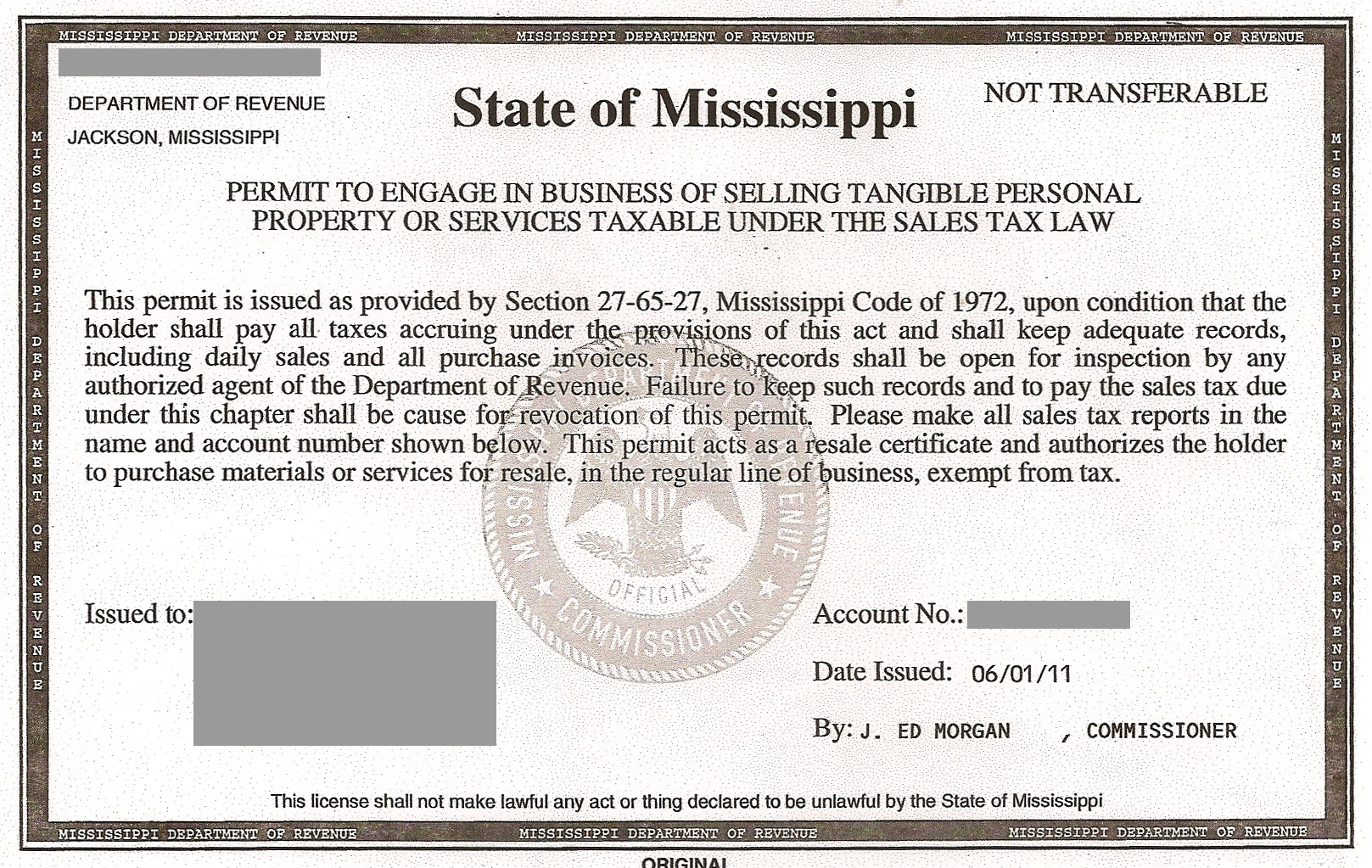

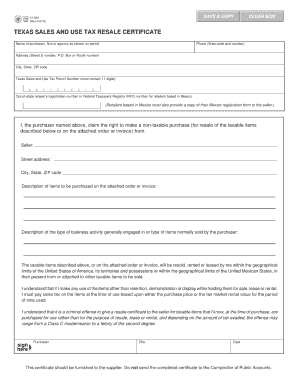

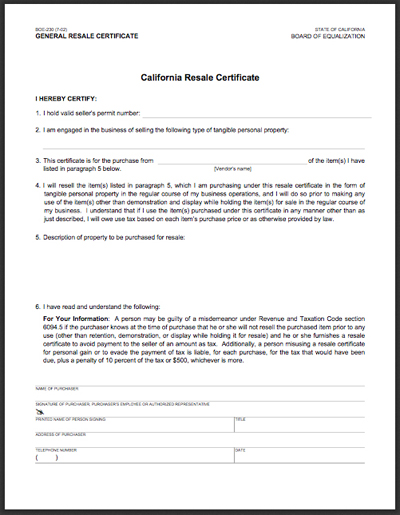

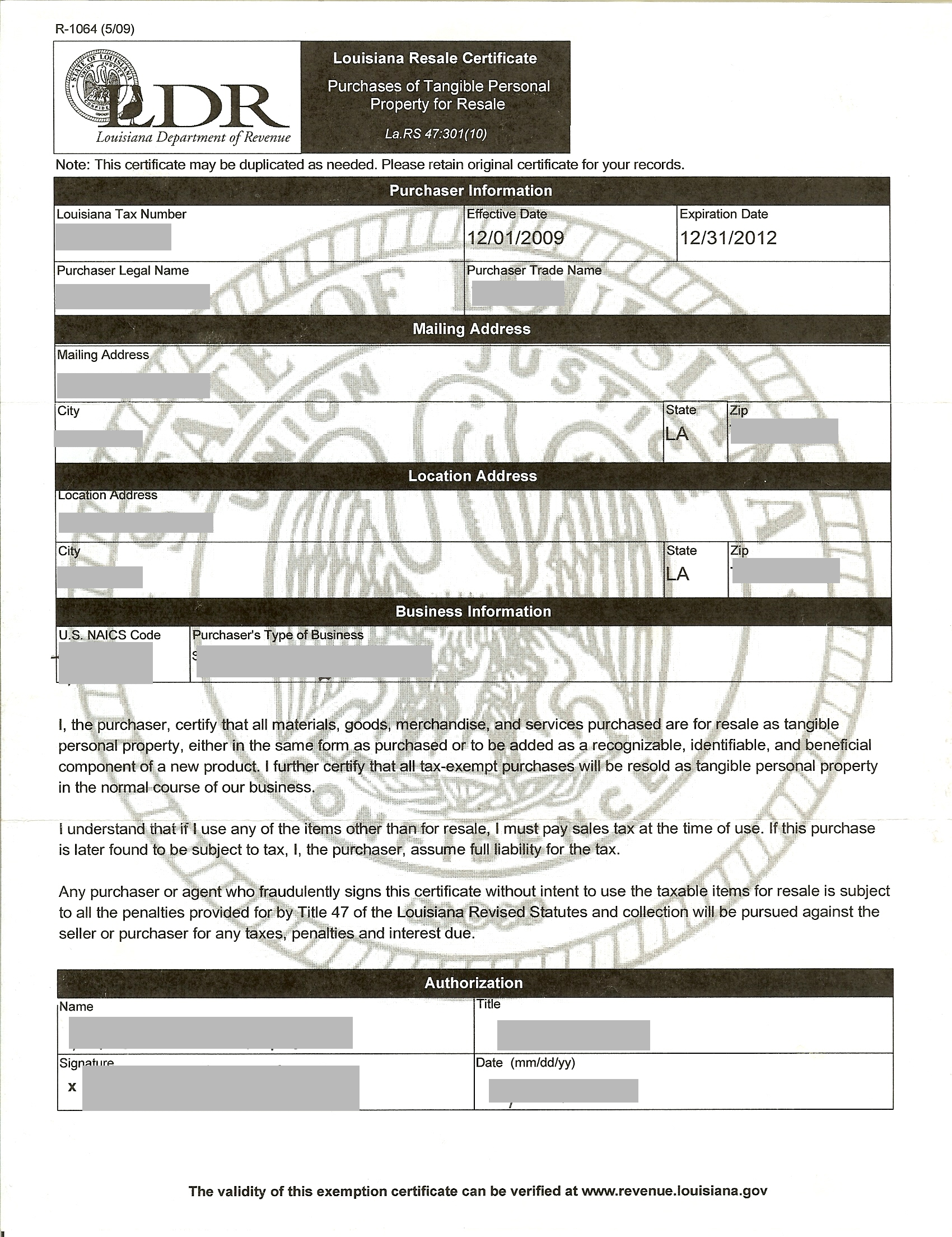

However if the seller receives a resale certificate signed by the purchaser stating that the property is purchased for resale the liability for the sales tax shifts from the seller to the purchaser.

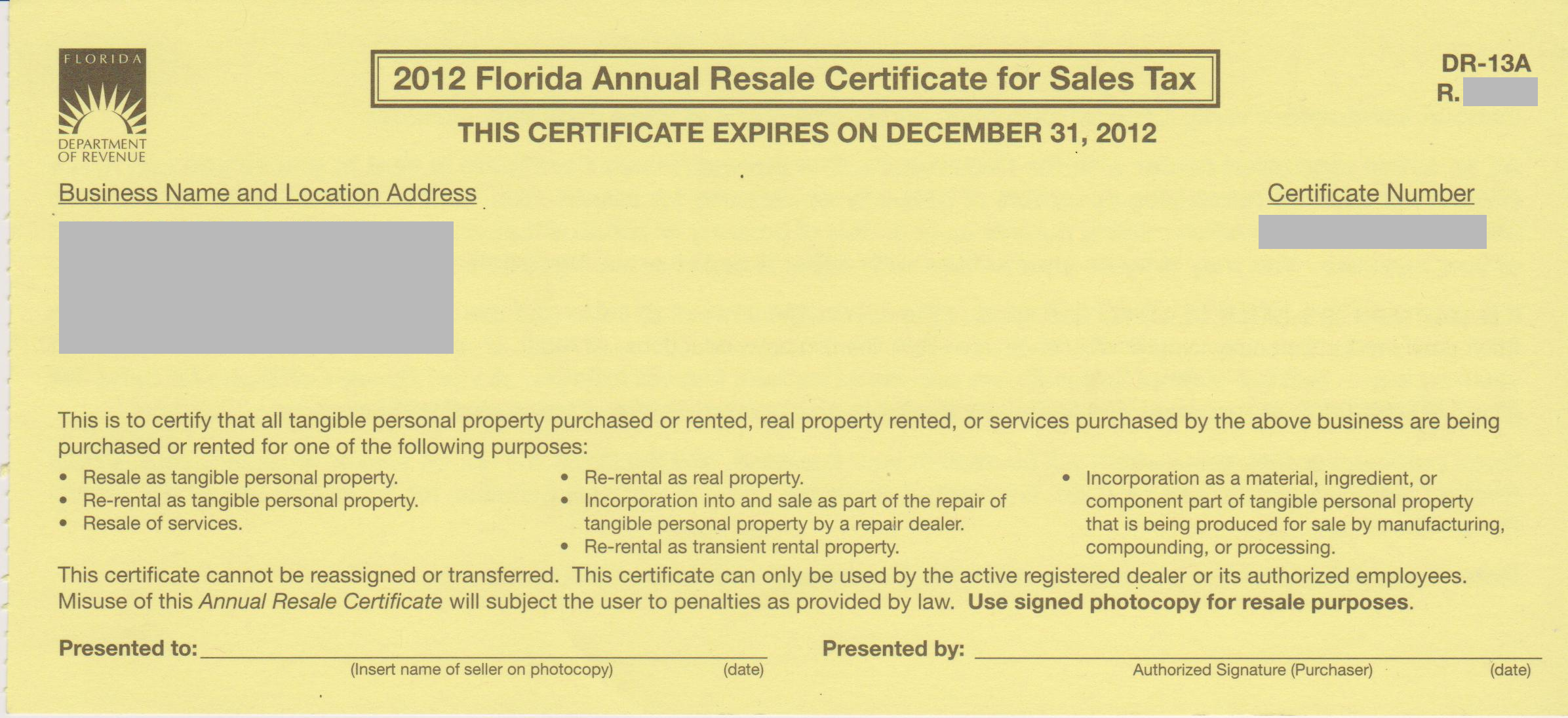

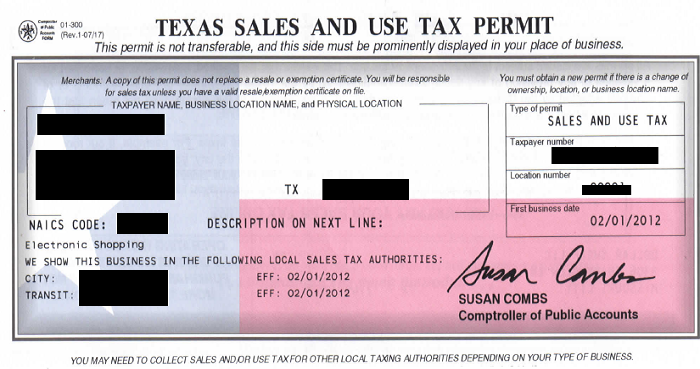

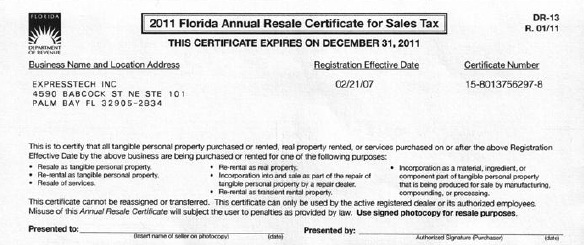

Retail tax certificate. A business cannot use a resale certificate to purchase merchandise that they will use and consume in the conduct of business. To get started juanita needs to file a business tax application with the indiana department of revenue and indicate she will be collecting sales tax. Businesses that register with the florida department of revenue to collect sales tax are issued a florida annual resale certificate for sales tax annual resale certificate. A sales tax exemption certificate is for an exemption from sales tax for a specific type of product.

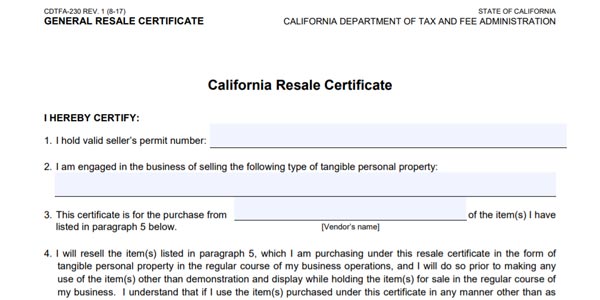

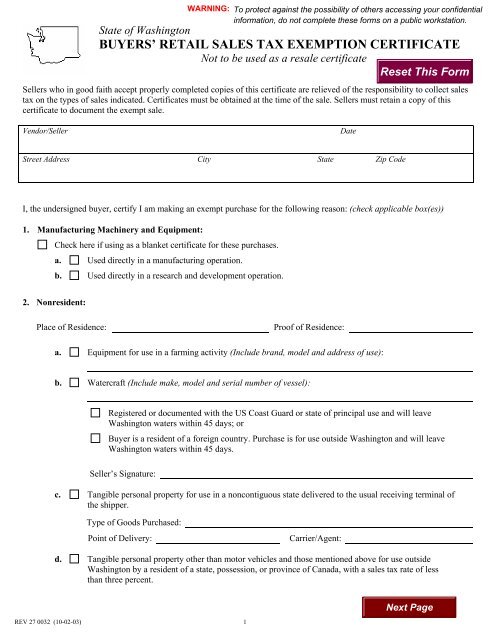

Arizona resale certificate the purpose of the certificate is to document the purchase of tangible personal property for resale in the purchasers regular course of business. A business which is registered for sales and use tax can use a resale certificate only when the merchandise being purchased is to be resold by the business. Depending on the state you live in it can also be called a resellers permit resellers license resellers certificate resale license sales tax id or sales tax permit. This certificate is intended for use by licensed retail merchants purchasing tangible personal property for resale lease or rental purposes.

Retail sales and use tax in general all sales leases and rentals of tangible personal property in or for use in virginia as well as accommodations and certain taxable services are subject to virginia sales and use tax unless an exemption or exception is established. States vary in the products and services that may be considered exempt from sales tax. A resale certificate is an official document that easily instills confusion in many online resellers. For example some states exempt the purchase of computers for resale.

O single use you need to show this certificate each time you buy an exempt item. The certificate allows business owners or their representatives to buy or rent property or services tax free when the property or service is resold or re rented. To document tax exempt purchases of such items retailers must keep in their books and records a certificate of resale. Re 2 32 21 form buyers retail sales tax exemption certificate not used to make resale purchases this certificate is for.

It is to be filled out completely by the purchaser and furnished to the vendor.

:brightness(10):contrast(5):no_upscale()/GettyImages-723519755-5a2198d04e46ba001a00bd58.jpg)