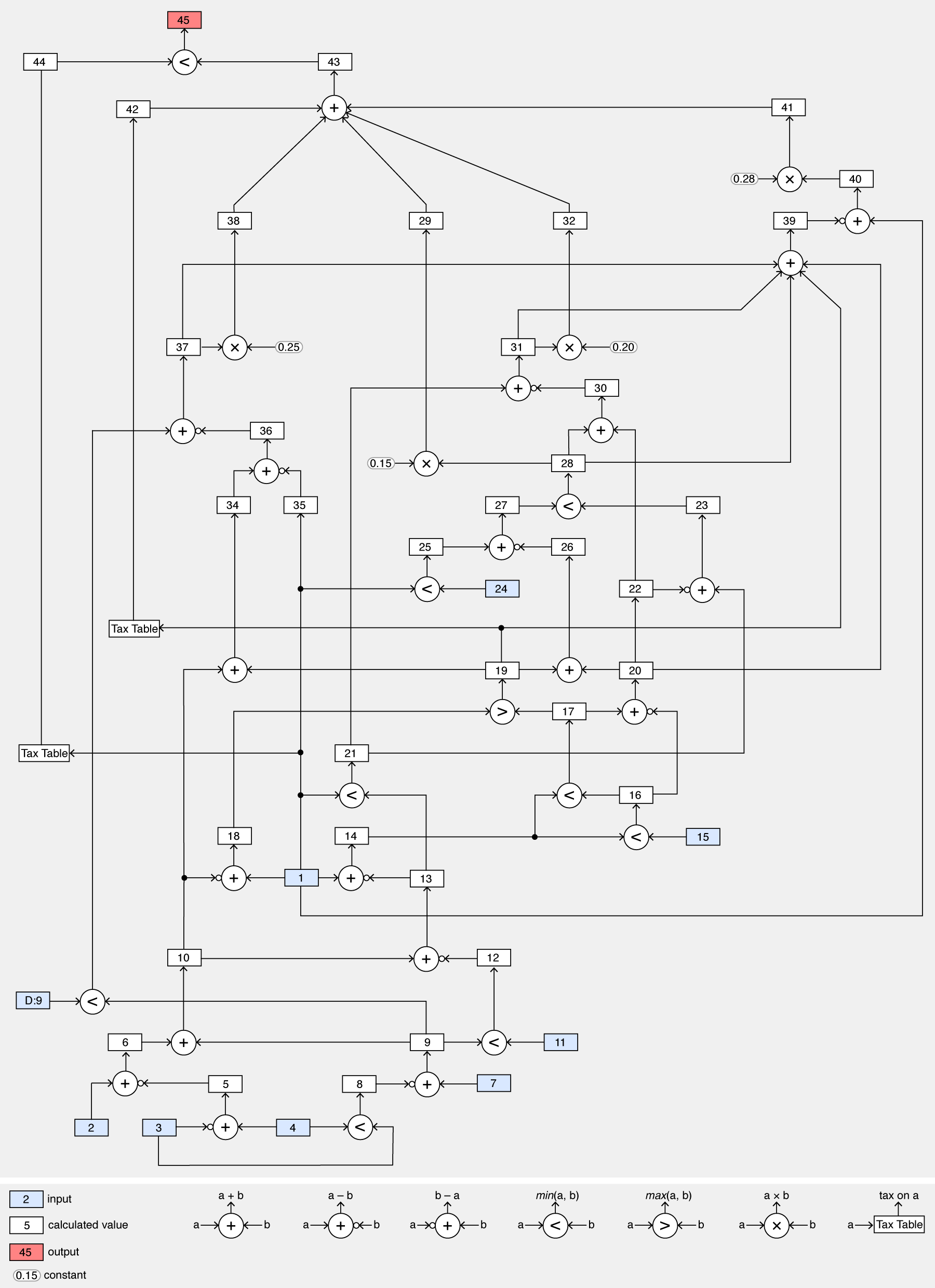

Schedule D Tax Worksheet

How to fill out a schedule d tax worksheet.

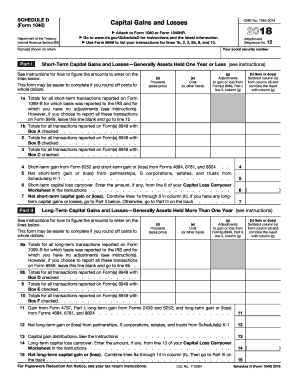

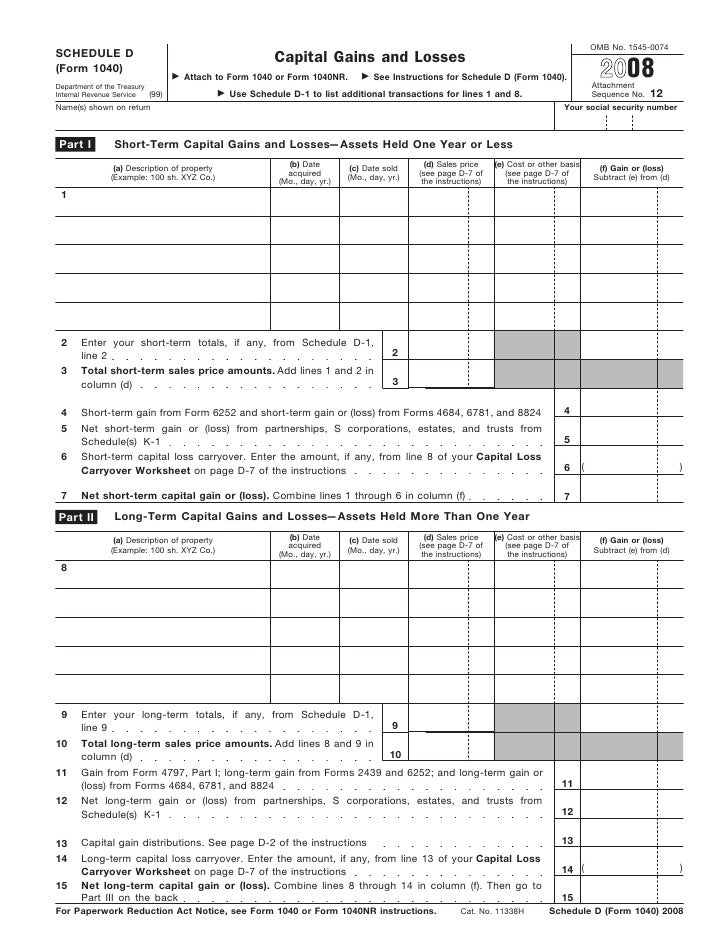

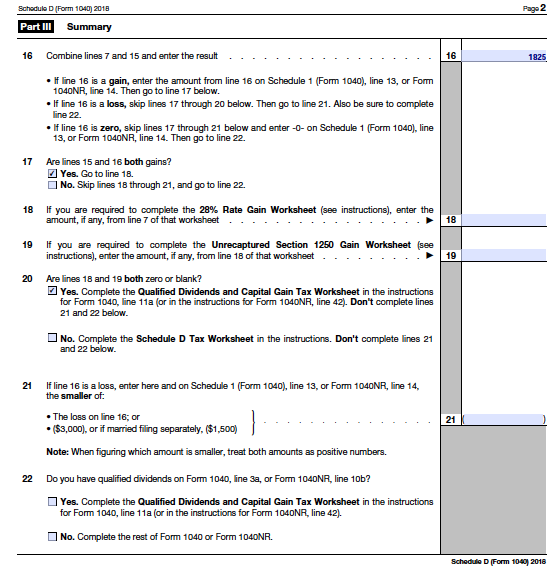

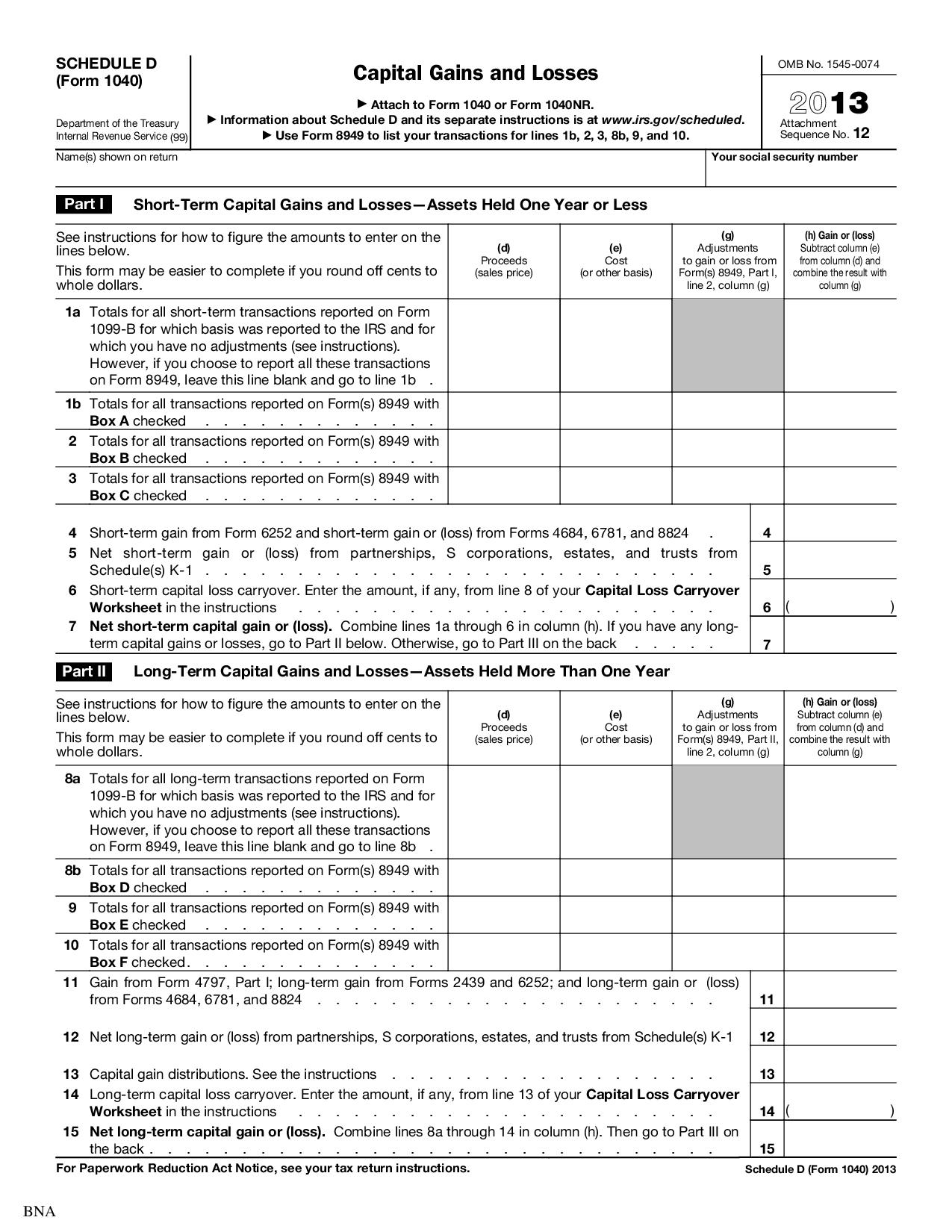

Schedule d tax worksheet. 2014 schedule d tax worksheet form 1040 schedule d instructions page d 15. Line 15 of the schedule d tax worksheet is not more than line 14 of the schedule d tax worksheet those lines were not impacted. Tools or tax ros thetaxook schedule d tax worksheet 2018 complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains. Schedule d tax worksheet view worksheet.

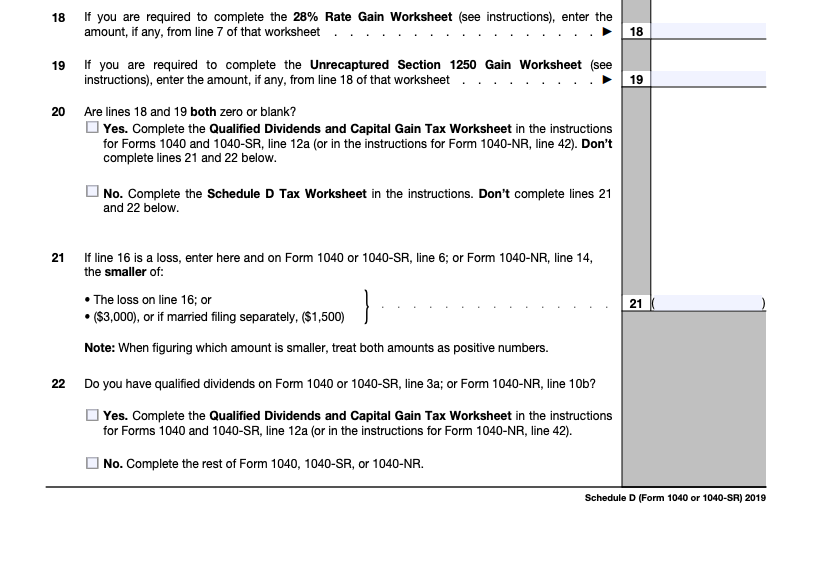

2013 schedule d tax worksheet form 1040 schedule d instructions page d 14. Schedule d form 1040 or 1040 sr department of the treasury. Otherwise complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040 line 11a or in the instructions for form 1040nr. In the instructions for forms 1040 and 1040 sr line 12a or in the instructions for form 1040 nr line 42.

2019 instructions for schedule dcapital gains and losses these instructions explain how to complete schedule d form 1040 or 1040 sr. Line 18 of the original schedule d tax worksheet line 18 a of the corrected schedule d tax worksheet is not more than 157500 315000 if married filing jointly or a qualifying widower. If there is an amount on line 18 from the 28 rate gain worksheet or line 19 from the unrecaptured section 1250 gain worksheet of schedule d form 1040 according to the irs the tax is calculated on the schedule d tax worksheet instead of the qualified dividends and capital gain tax worksheet. A capital gain or loss.

Qualified dividends and capital gain tax worksheet. Otherwise complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040 line 11a or in the instructions for form 1040nr line 42 to figure your tax. Schedule d designed to be submitted with form 1040 is a form used to report your capital gains and losses during the tax year. Complete lines 21 and 22 below.

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains. 2012 schedule d tax worksheet form 1040 schedule d instructions page d 13. To figure the overall gain or loss from transactions reported on form 8949. Use schedule d to report sales exchanges or some involuntary conversions of capital assets certain capital gain distributions and nonbusiness bad debts.

Complete form 8949 before you complete line 1b 2 3 8b 9 or 10 of schedule d.