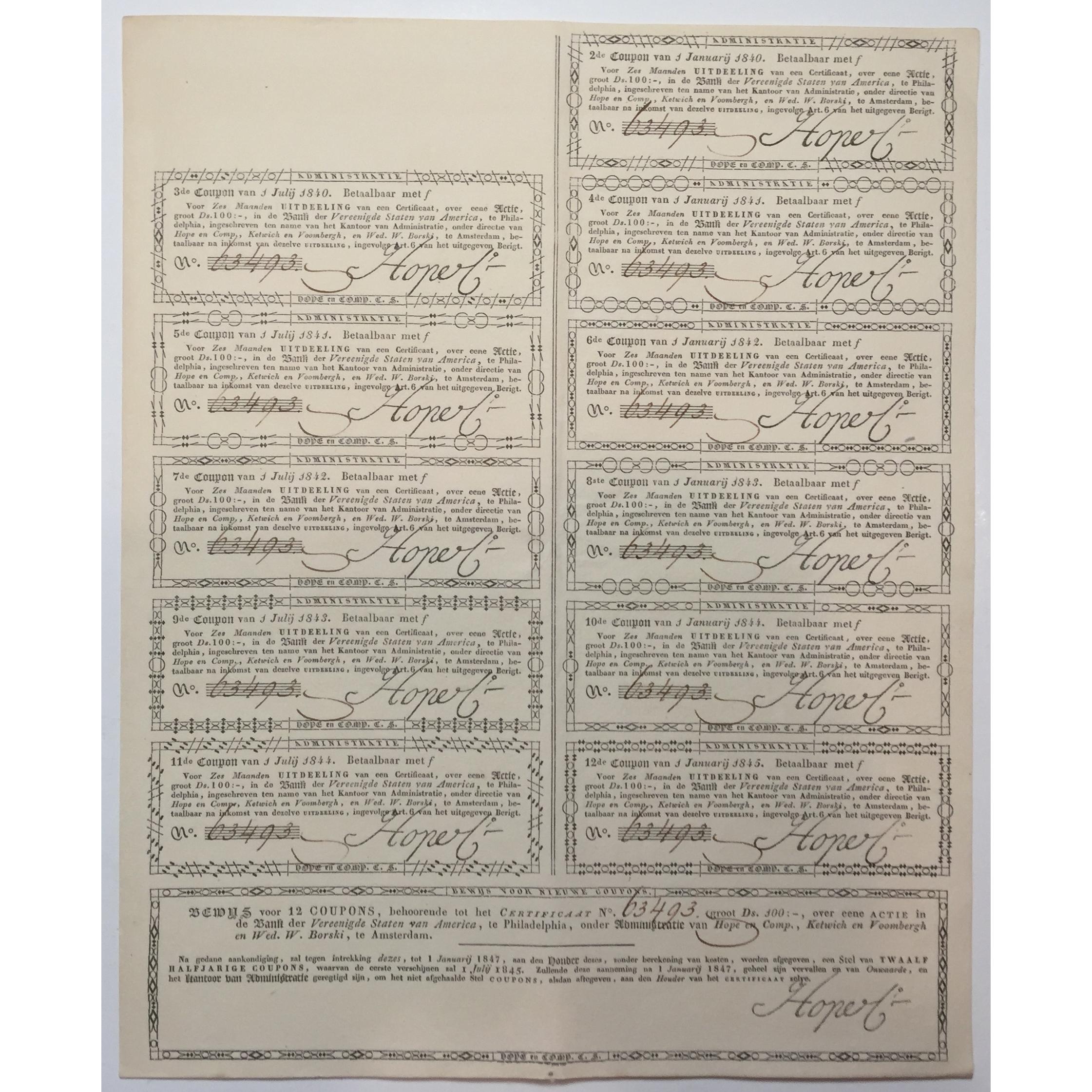

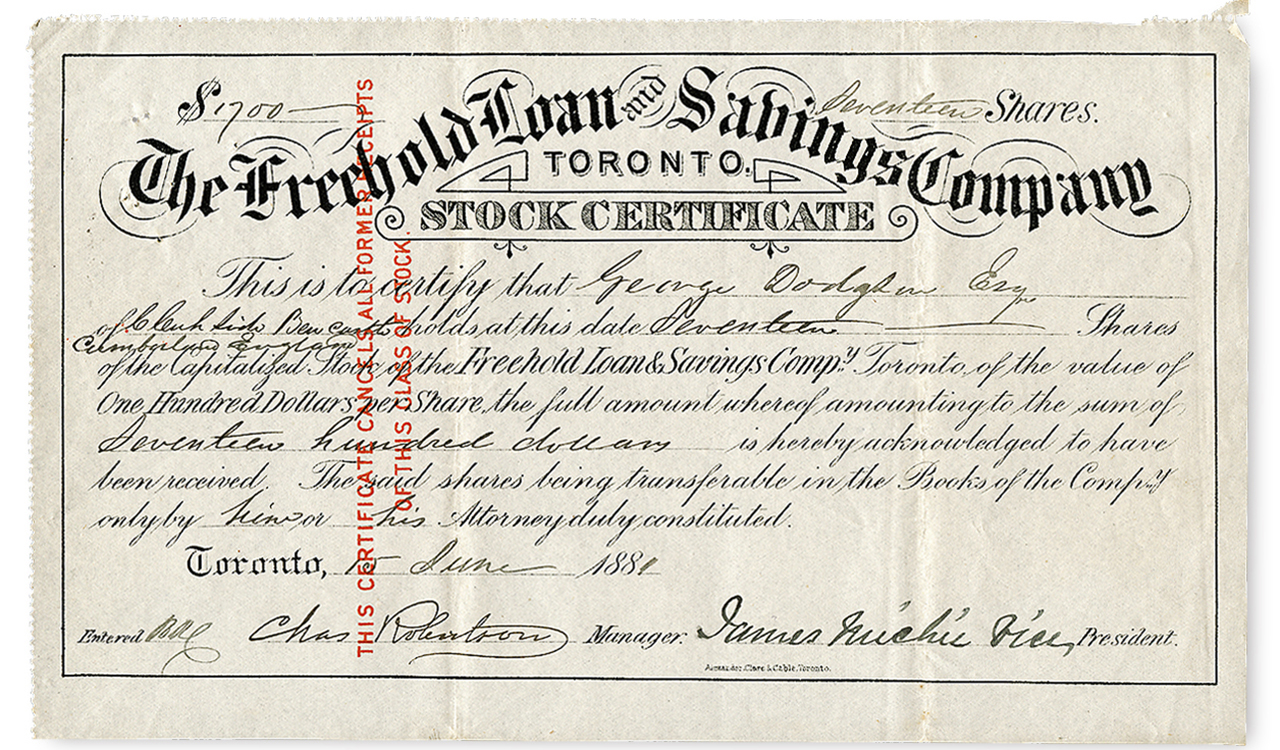

Share Certificate Loan

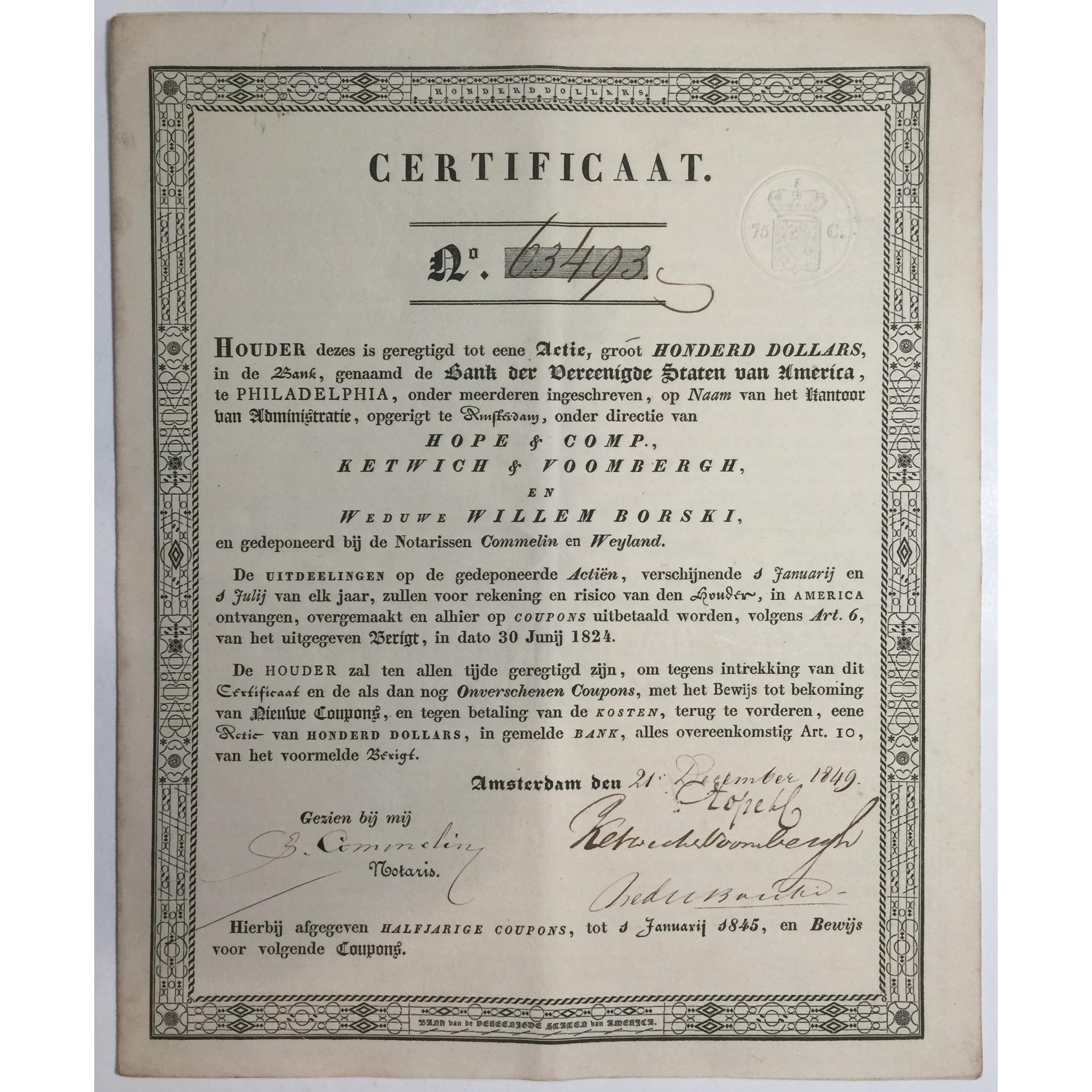

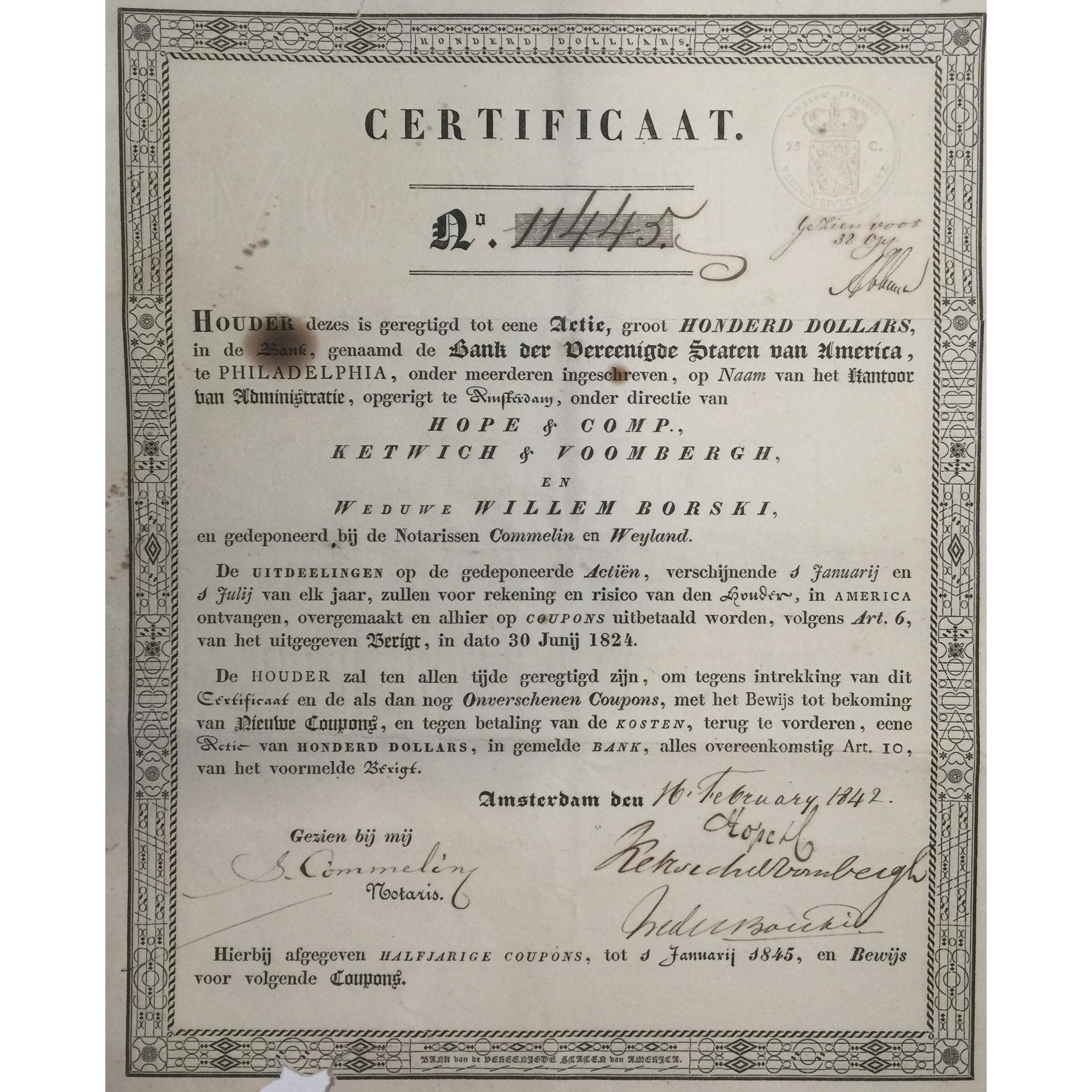

A certificate secured loan is a loan provided through a credit union that is secured by the amount available on deposit in the borrowers share account.

Share certificate loan. A share secured loan can offer a lower rate than other types of loans because it uses funds in a savings account either a share account share certificate account or money market account as collateral for your loan. Credit life and disability insurance available at a reasonable cost. Borrow up to 100 of the available balance in your savings or certificate. Borrow against your own funds in your share savings account or a share certificate.

With a share secured loan. When you take out share secured loans. Depending on the credit union and their specific policies. Funds borrowed can be used for virtually anything.

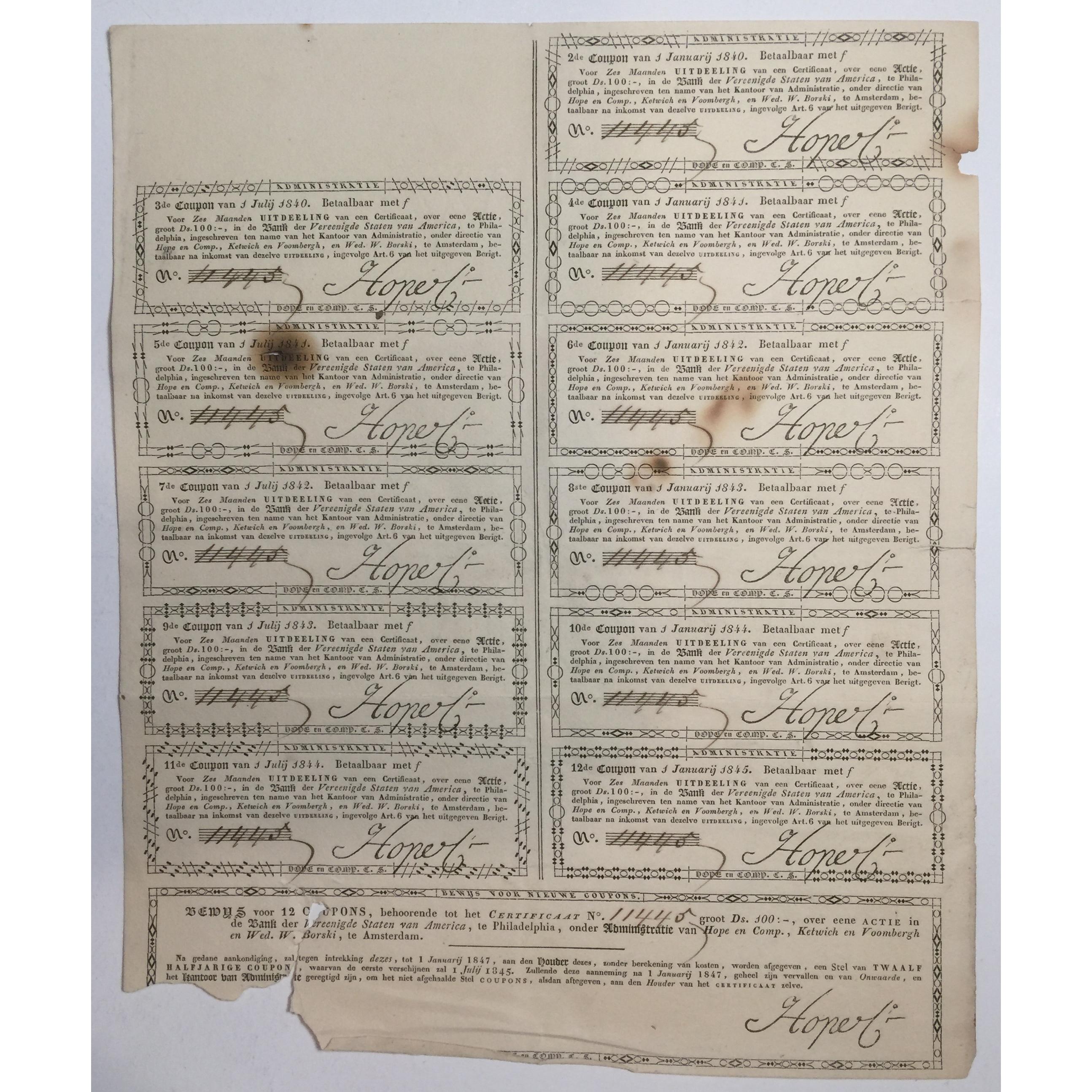

Share certificate loans. Shares are released as principal is paid. Make payments while away using shared branching. Great terms and rates.

Secured by 100 of the loan amount with your shares. We offer secured loans to members who wish to borrow against their deposited funds such as sharesavings premium savings or certificate of deposit. Maximum term is 5 years depending on initial balance and the minimum payment is 10000 per month. Mortgage and land loan home equity loan heloc disclosure auto loan payday alternative loans motorcycle and atv loan boat and rv loan signature line of credit helping hand computer loan visa credit card share secured share certificate online loan application.

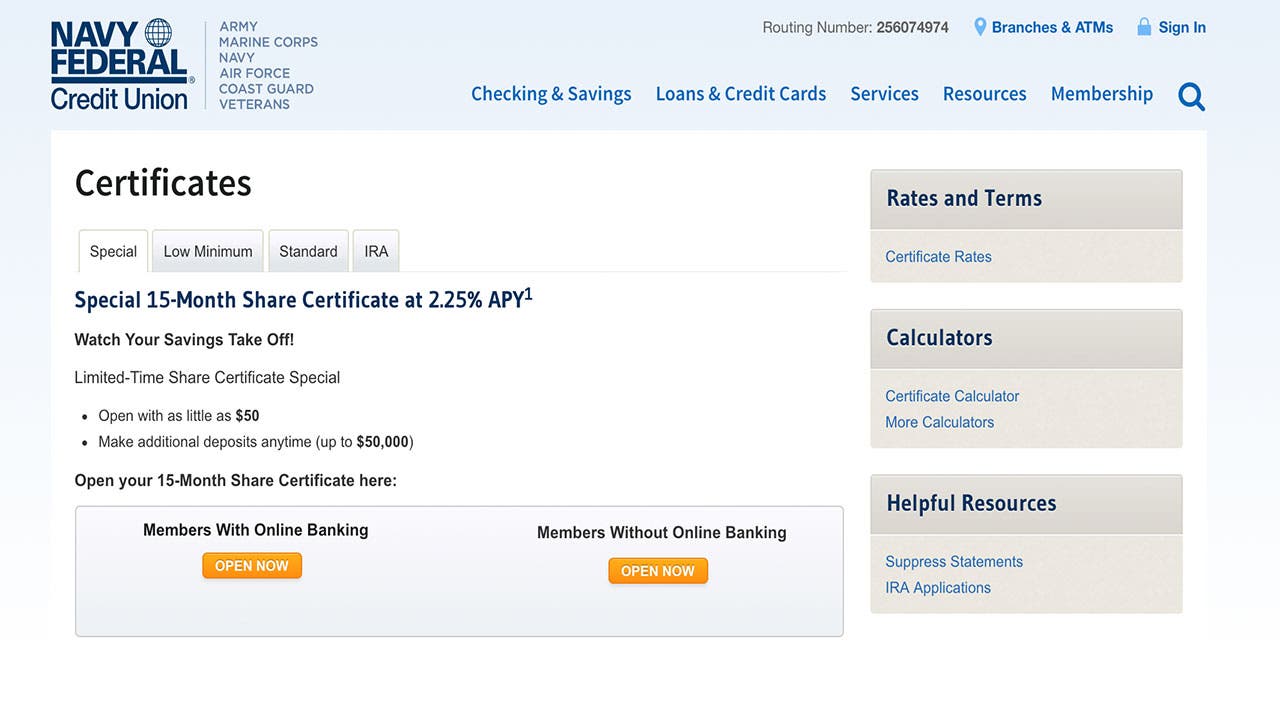

Use your share certificate as collateral on a low interest loan while continuing to earn the higher yielding dividends. A secured line of credit uses assets such as your house as collateral for a loan. Interest rate for the loan is 3 percentage points above the dividend rate on the certificate. Annual percentage yield apy this is the effective annual rate earned for this certificate.

Put your money to work while continuing to earn the highest rate of return. A share secured loan uses the assets in a share account otherwise known as a savings account to back up the loan. A certificates apy depends on the frequency of compounding and the rate. A share certificate account is similar to a certificate of deposit cd but it is issued by a credit union rather than a bank.

Both banks and credit unions offer loans backed by savings. Interest rate is 250 above the highest regular share rate at the time the loan is made and may not be refinanced to a lower rate. You cannot withdraw your funds during the pre selected length of the term without penalty but you will most likely earn a higher rate than any of the above mentioned options. Interest rates are 2 above current share savings and share certificate dividend rates.