Sox Risk Assessment Template

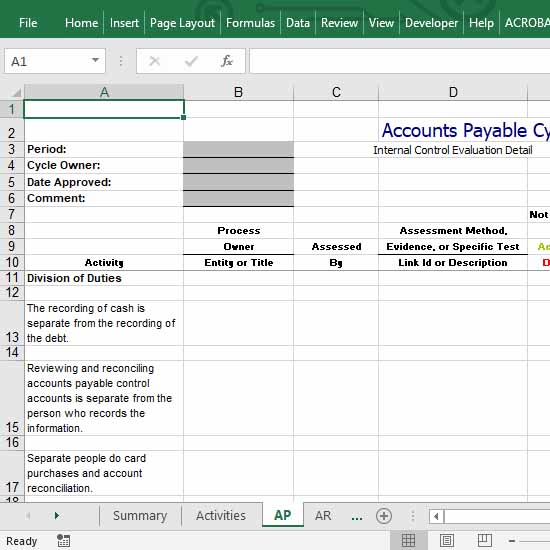

The right approach to identify the exact scope and extent of testing for sarbanes oxley itgc is to perform a detailed risk assessment focused on the risks associated with each general control process area.

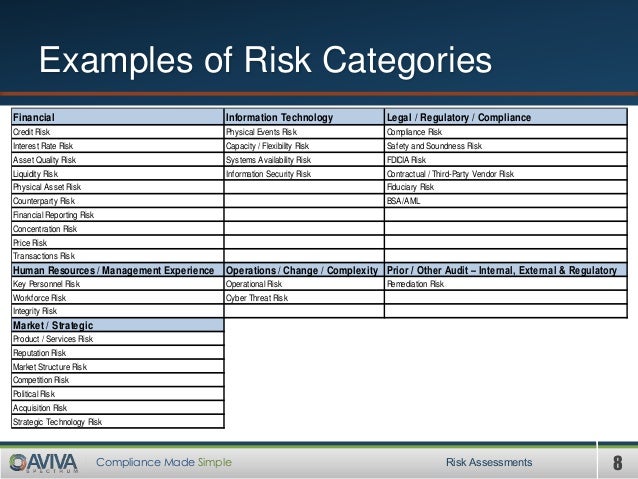

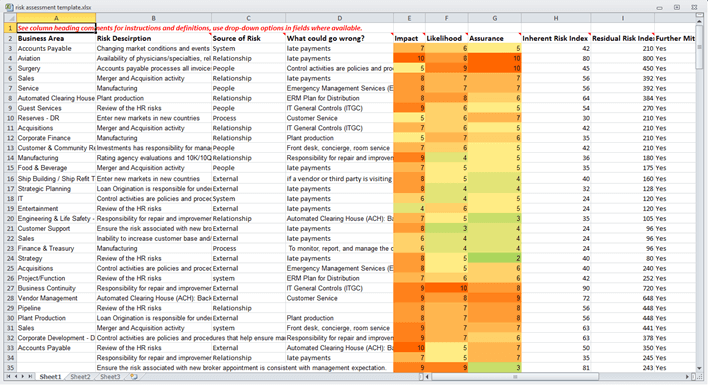

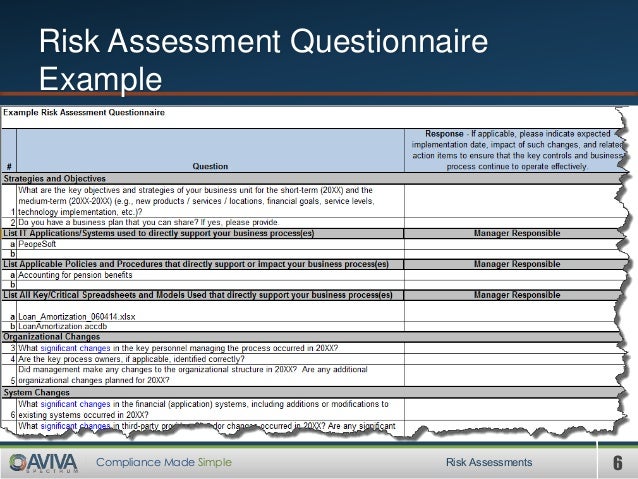

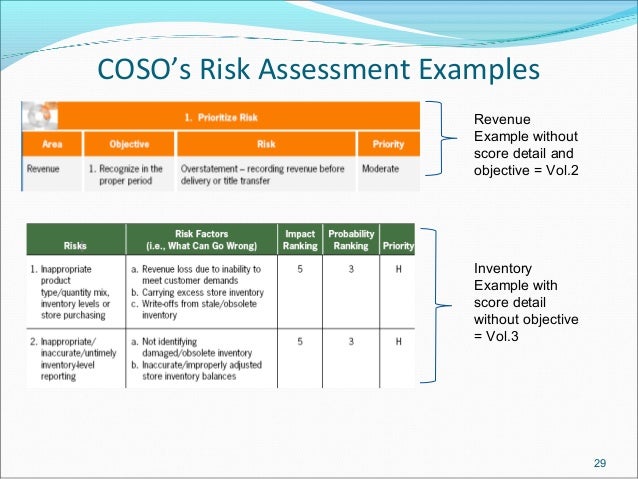

Sox risk assessment template. And risk assessment is the identification and analysis of relevant risks to achievement of the objectives the sox guidance states several hierarchical levels at which risk assessment may occur such as entity account assertion process and transaction class. Objectives risks and controls may be analyzed at each of these levels. As we begin to close out 2018 the most important part of your sox program that needs to be re evaluated and updated is the sox risk assessment. Tdrb assessment methods assign responsibility for significant accounts notes and processes require disclosure accountnote ownerssponsors in each significant business unit complete a high level risk based assessment certify controls report control deficiencies and assign a residual risk rating score.

Sarbanes oxley section 404 an introduction on may 27 2003 the securities and exchange commission sec voted to adopt final rules on managements report on internal control over financial reporting as mandated by section 404 of the sarbanes oxley act of 2002. Coso 2013sox lessons learned and whats next. Fraud risk assessment robust sox documentation well defined processes. Ii 26 assume company a which reports on a calendar year plans to go public this year and is expecting a capitalization below the 75 million accelerated filer threshold.

The sox risk assessment if not performed correctly could result in unnecessary work for your team management and external auditors leading to over worked team members and excessive costs. For a company to confirm that the 17 principles and 5 components discussed in coso 2013 part 1 framework overview are present and functioning these principles must be mapped to relevant sox key controls that are operating effectivelyat a2q2 we have created a coso mapping template where a company can match key sox controls to each component principle and. Risk assessment is rolled forward annually by lower level. Satisby the requirement of the sarbanes oxley lay and many others laws and regulations.

An organization must do a detailed assessment of the risks involved with any business process and then determine the likelihood of that risk occurring and the severity of the risk if it should occur.