Stl Personal Property Tax Receipt

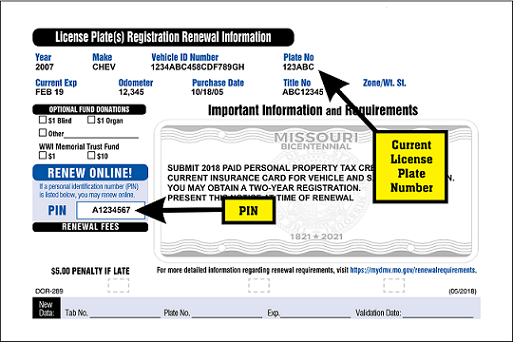

When you pay your taxes the collectors office will send you a tax receipt by mail after your payment has posted to your account.

Stl personal property tax receipt. The value of your personal property is assessed by the assessors office. The official paid personal property tax receipt needed for license renewal will be mailed from the collectors office. Welcome to the city of st. Each taxing authority provides their individual tax rates to the collector of revenue who combines those rates into individual tax bills.

The responsibility of the collector of revenue is to collect real estate taxes personal property taxes earnings taxes and waterrefuse bills fairly and efficiently. Please allow 5 business days for mail time and for updating the state database. Louis missouri collector of revenues web page. 2019 data is available.

These tax bills are mailed to citizens in november and taxes are due by december 31st of each year. Obtaining a property tax receipt. All online payments pay a traffic ticket shelterpavilion reservation acquire a divorce record purchase a copy of a birth or death certificate and more. You may click on this collectors link to access their contact information.

Personal property owners residing in saint louis county on january 1 are required by state law to declare personal property including any state titled vehicles boats aircraft and livestock. If you have any questions you can contact the collector of revenue by calling 314 622 4105 or use the email form. To view the tax rates adopted by each taxing authority in st. 2019 data is available.

The online payment transaction receipt is not sufficient for license plate renewal. The personal property department collects taxes on all motorized vehicles boats recreational vehicles and motorcycles. Property tax receipts are obtained from the county collector or city collector if you live in st. I am gregg daly collector of revenue for the city of st.

Louis county resident use the st. The information on the declaration form is used to correctly prepare the personal property tax bills mailed later in the year. Tax start page visit both your personal property and real estate tax pages enter your address and check your amounts. Louis county personal property tax lookup.

Louis city in which the property is located and taxes paid. If you did not file a personal property declaration with your local assessor. After the payment has posted which can take up to five business days for online and telephone payments personal property tax receipts are available either by mail.