Tax Certificate Ga

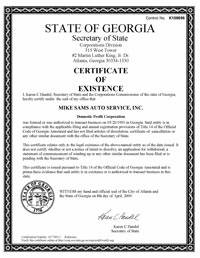

Any individual or entity meeting the definition of a dealer in ocga.

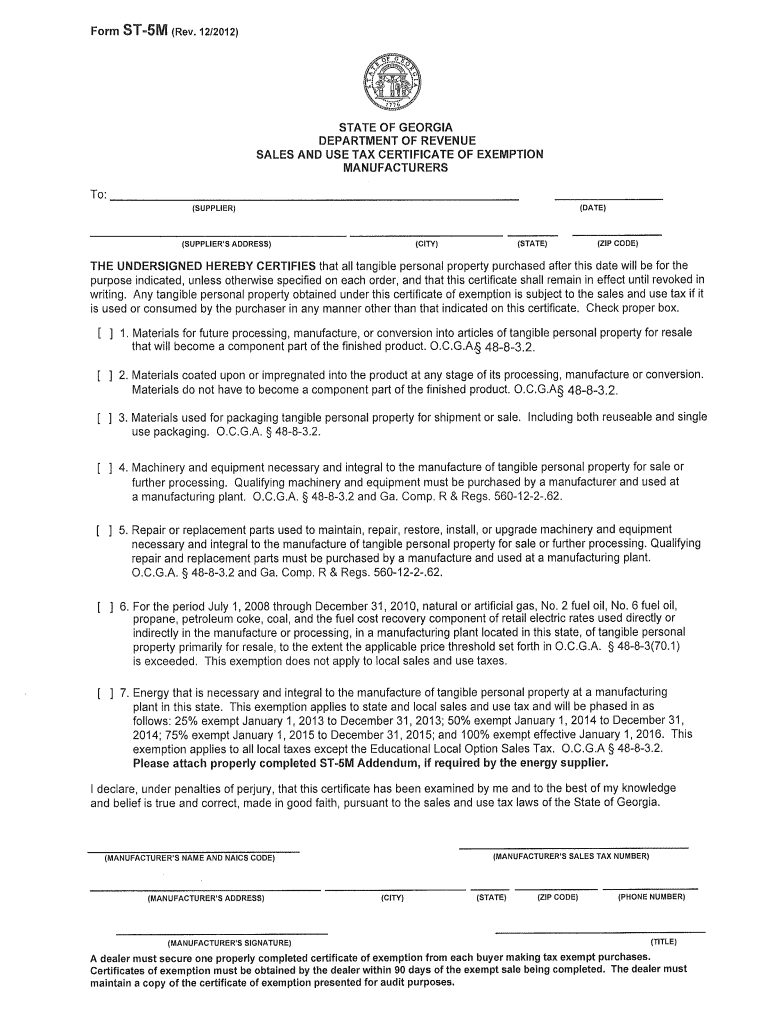

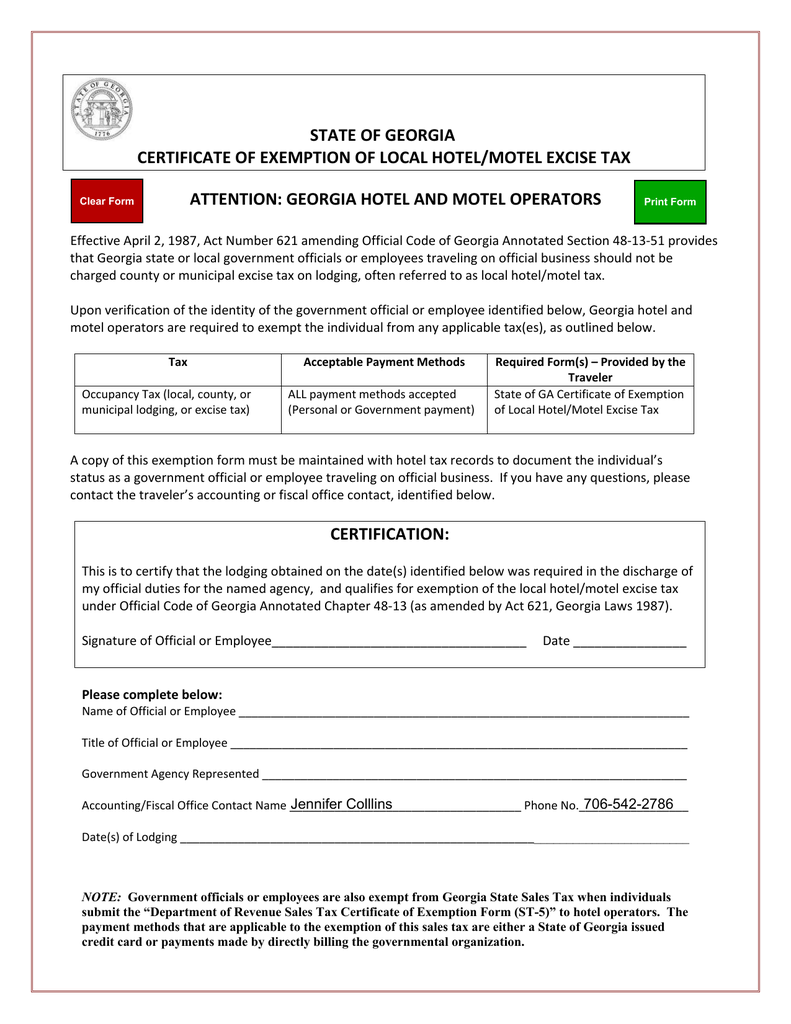

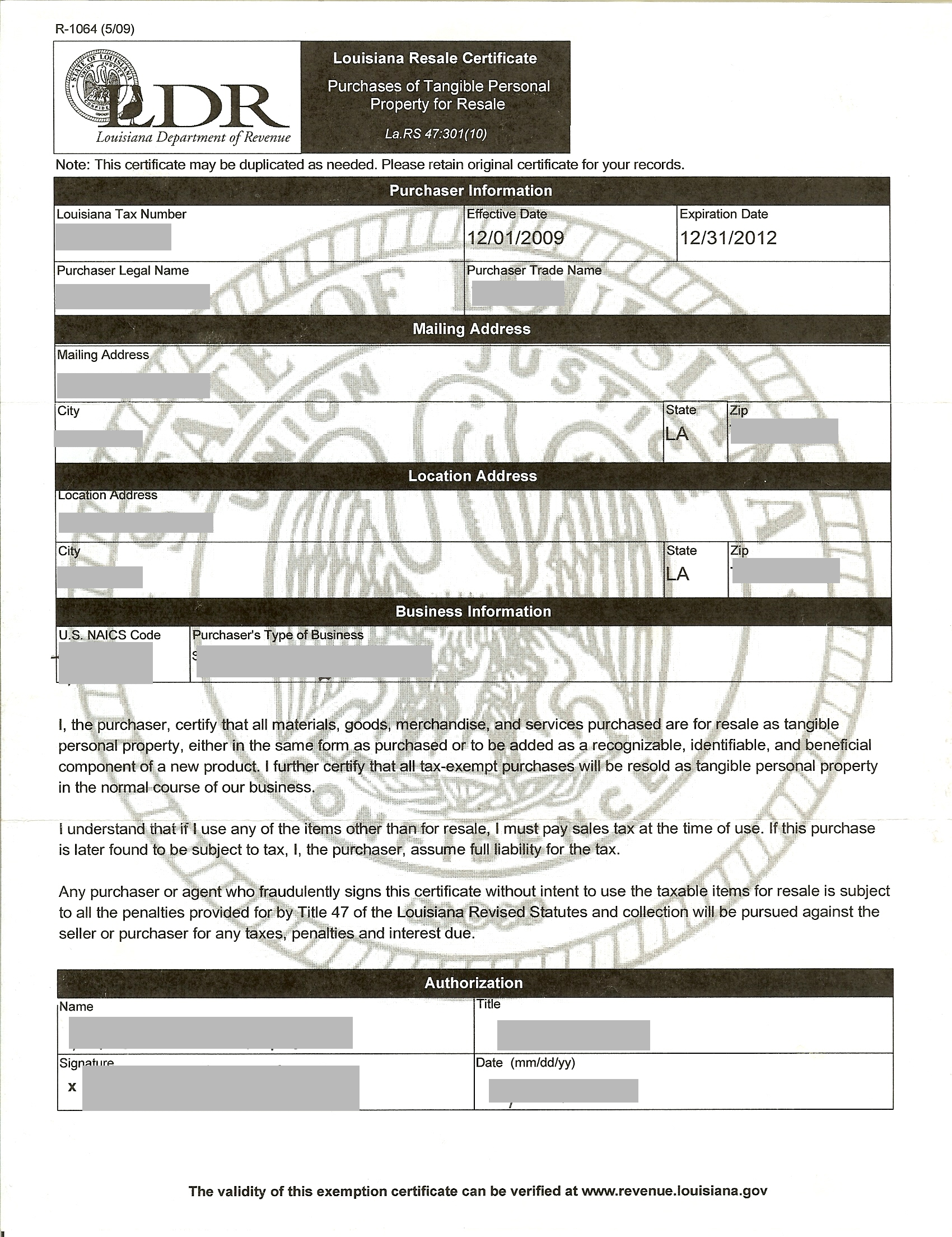

Tax certificate ga. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales tax free purchases. 48 8 2 is required to register for a sales and use tax number regardless of whether all sales will be online out of state wholesale or exempt from tax. In georgia this process involves presenting a georgia sales tax certificate of exemption to the merchant from whom youre buying the merchandise to be resold. If you buy products at retail in order to resell them you can often avoid paying sales tax when purchasing those products.

You will need to present this certificate to the vendor from whom you are making the exempt purchase it is up to the vendor to verify that you are indeed qualified to make a tax exempt purchase. Any entity that conducts business within georgia may be required to register for one or more tax specific identification numbers permits andor licenses. After your online submission you should receive your specific tax account number within 15 minutes by email. Effective march 8th 2018 sales tax certificates.

Georgia tax deed auctions are on the first tuesday of any month as determined by the county treasurer. Online registration is available through georgia tax center gtc a secure electronic customer self service portal. Call 1 800 georgia to verify that a website is an official website of the state of georgia. The site is secure.

How to use sales tax exemption certificates in georgia. Will no longer use color bonded certificate paper with a watermark. Rates due dates tips for completing the sales and use tax return on gtc filing and remittance requirements sales tax id verification tool sales use tax georgia department of revenue skip to main content. The https ensures that any information you provide is encrypted and transmitted securely.