Tax Deed Certificates

Tax lien investing involves purchasing tax lien certificates primarily to earn interest and if available in the locale penalty income.

Tax deed certificates. Once tax deed begins all outstanding taxes are rolled into one amount plus any accrued interest costs and charges. State where tax deed sales are used to collect delinquent property taxes do not allow its local taxing authorities to conduct tax lien sales even though a lien is placed on the. Florida tax lien certificates are sold at florida county tax sales on or before june 1st of each year. New certificate holders must contact the tax collectors office and complete a w 9 or w 8 form if they have not already done so.

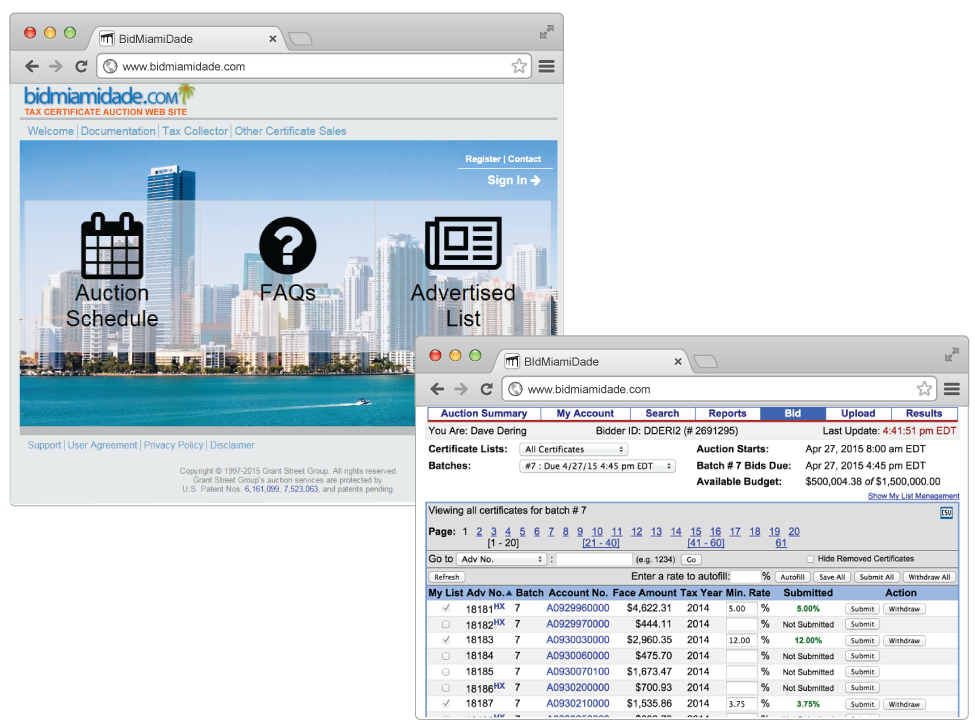

This auction is referred to as a tax certificate sale fs 197432. Once the deadline in the letter passes the certificate holder may start the tax deed process anytime. Once delinquent the tax collector holds an auction in order to pay off the taxes. Florida tax lien certificates are sold to the bidder willing to accept the lowest interest rate.

You must register with the city if you own a property with ground floor or second floor commercial premises storefronts. This could happen as a result of the buyer successfully bidding on the property at a tax deed sale. Each year real estate taxes are to be paid by a predetermined date to avoid becoming delinquent. Tax certificates sold through this tax sale must be held two years before a tax deed application can be submitted.

This applies to all tax class two and four property owners with ground floor or second floor storefronts. Tax deed certificates tax deed is the proper way to describe a deed granted to a tax sale buyer which gives the tax sale buyer title to the property. This combination will become the new amount due. The maximum interest rate awarded on florida tax lien certificates is 18 per annum.

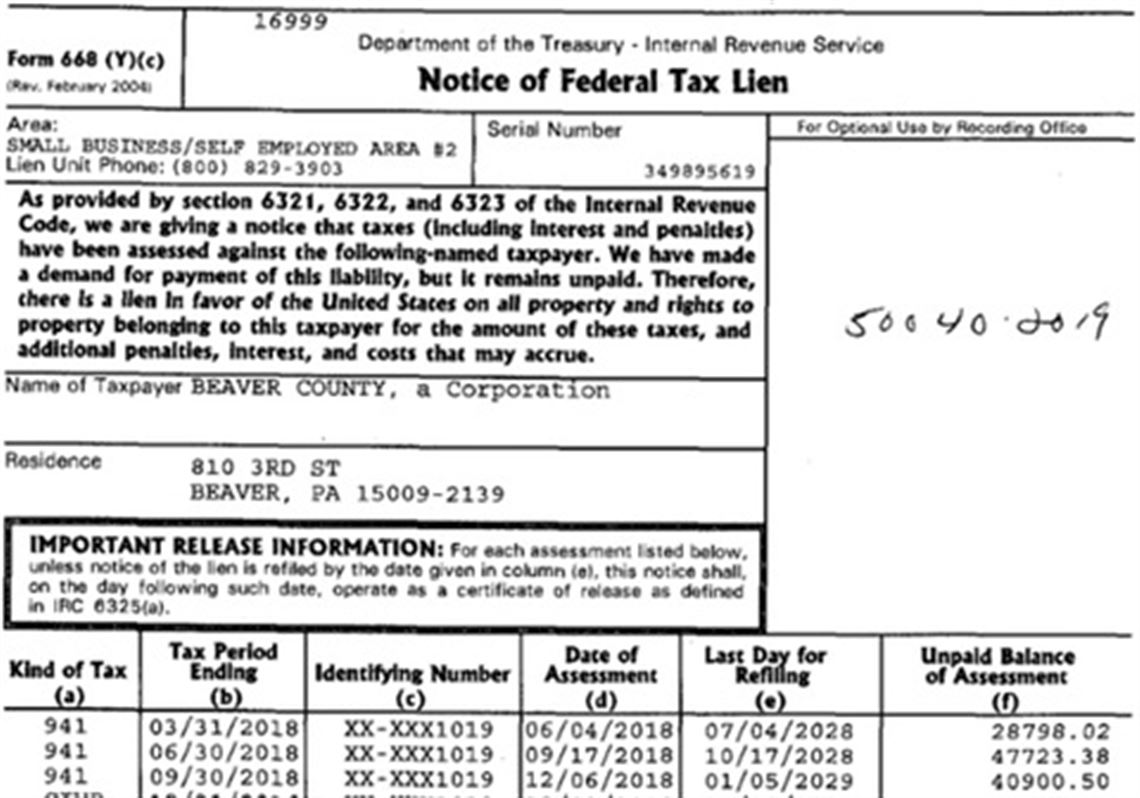

Individually owned certificates may be transferred by endorsement at any time before they are redeemed or a tax deed application is made for a fee of 225 per tax certificate. A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. A tax deed has started on my property. A tax certificate is a lien on the property.

The certificate holder is an independent investor who actually pays the taxes for a property owner in exchange for a competitive bid rate of return on the investment. Property records acris new for calendar year 2020 storefront registry. Bidding is based upon the amount of annual interest to be earned by the certificate buyer.