Tax Form 8962 Printable

It is used to report your credit amount on your tax return and reconcile the advance credit payments made on your behalf.

Tax form 8962 printable. Well help you create or correct the form in turbotax. Form 8962 omb no. A pdf of the latest irs form 8962 can be downloaded below or found on the us. To speed the process try out online blanks in pdf.

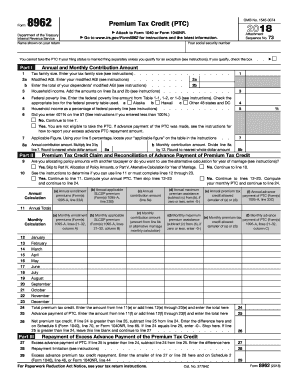

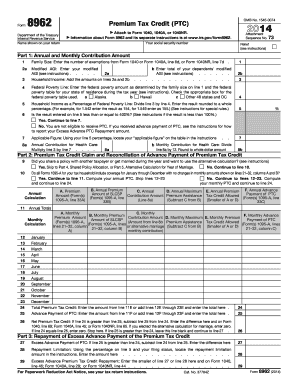

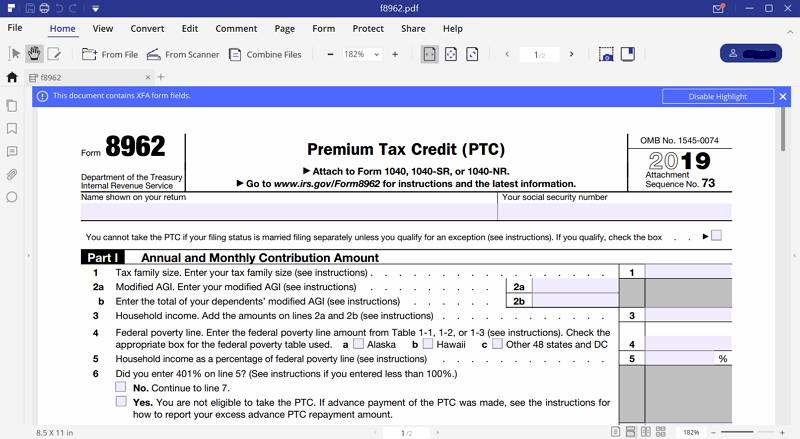

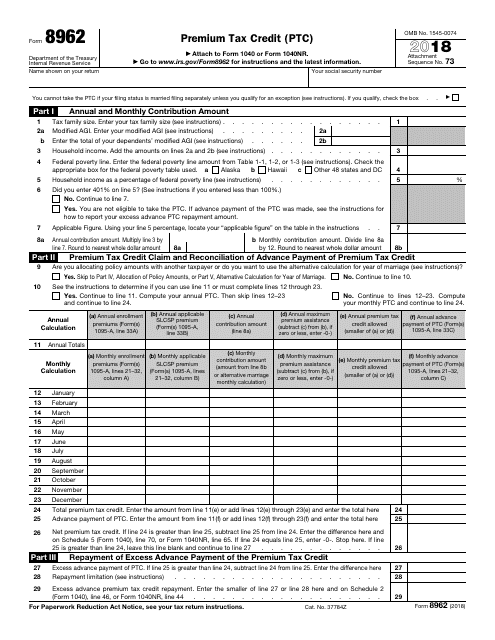

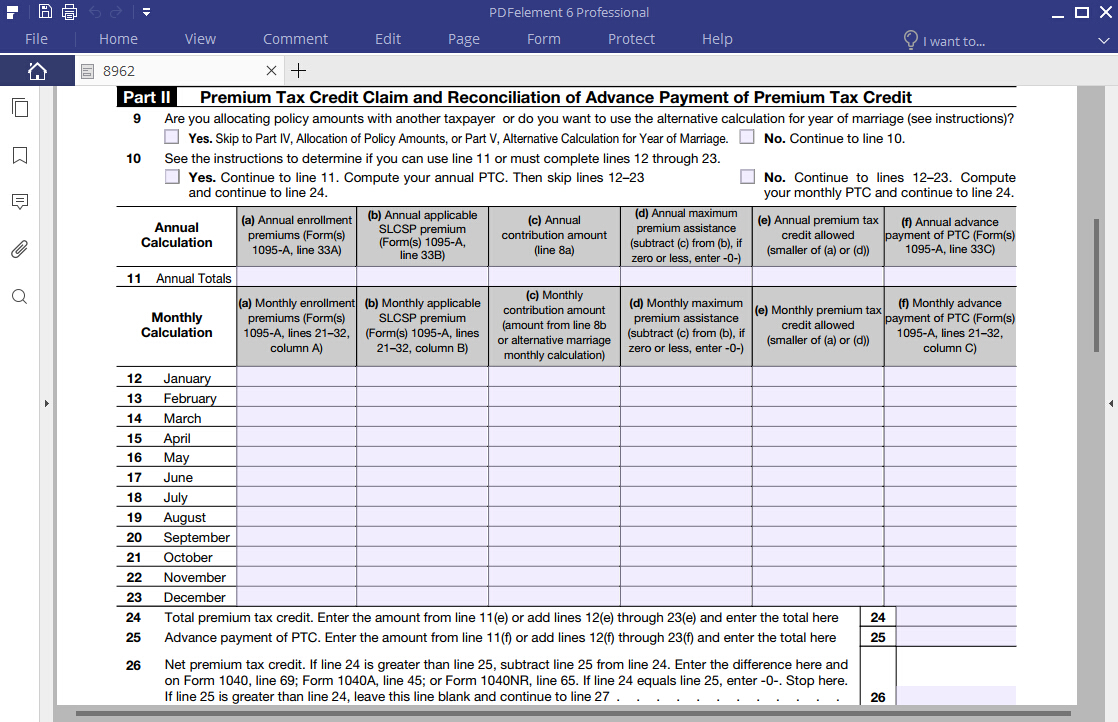

1545 0074 premium tax credit ptc department of the treasury internal revenue service name shown on your return 2018 attach to form 1040 or form 1040nr. For most us individual tax payers your 2019 federal income tax forms are due on april 15 2020 for income earned january 1 2019 through december 31 2019. Form 8962 premium tax credit is required when someone on your tax return had health insurance in 2018 through healthcaregov or a state marketplace and took the advance premium tax credit to lower their monthly premium. Premium tax credit claim and reconciliation of advance payment of premium tax credit.

Steps to fill out online 8962 irs form. You can apply digital irs form 8962 to learn your ptc amount. The irs is requesting form 8962 for 2018. Use form 8962 to.

Are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage see instructions. Department of the treasury internal revenue service issued form also known as the premium tax credit ptc. Form 8962 department of the treasury. Department of the treasury internal revenue service forms and publications website.

Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. Printable 2019 federal tax forms are listed below along with their most commonly filed supporting irs schedules worksheets 2019 tax tables and instructions for easy one page access.