Tax Payment Receipt

Our goal is to create a hub of information for clay county taxpayers.

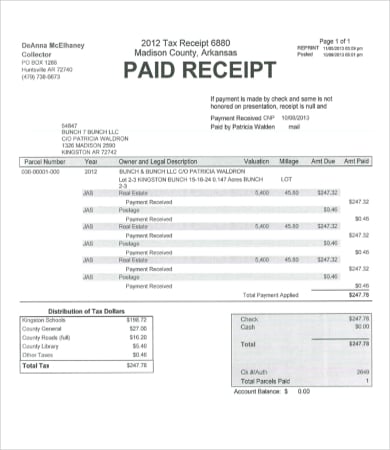

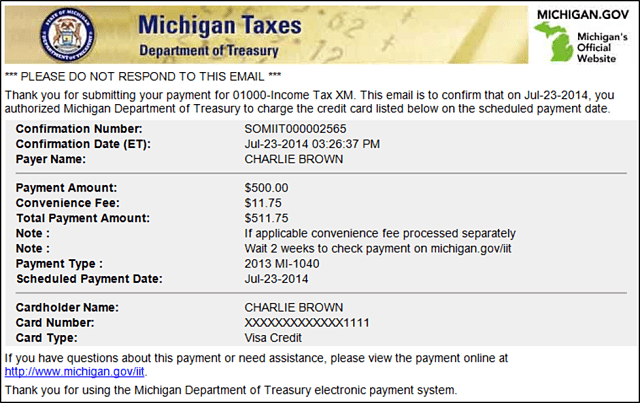

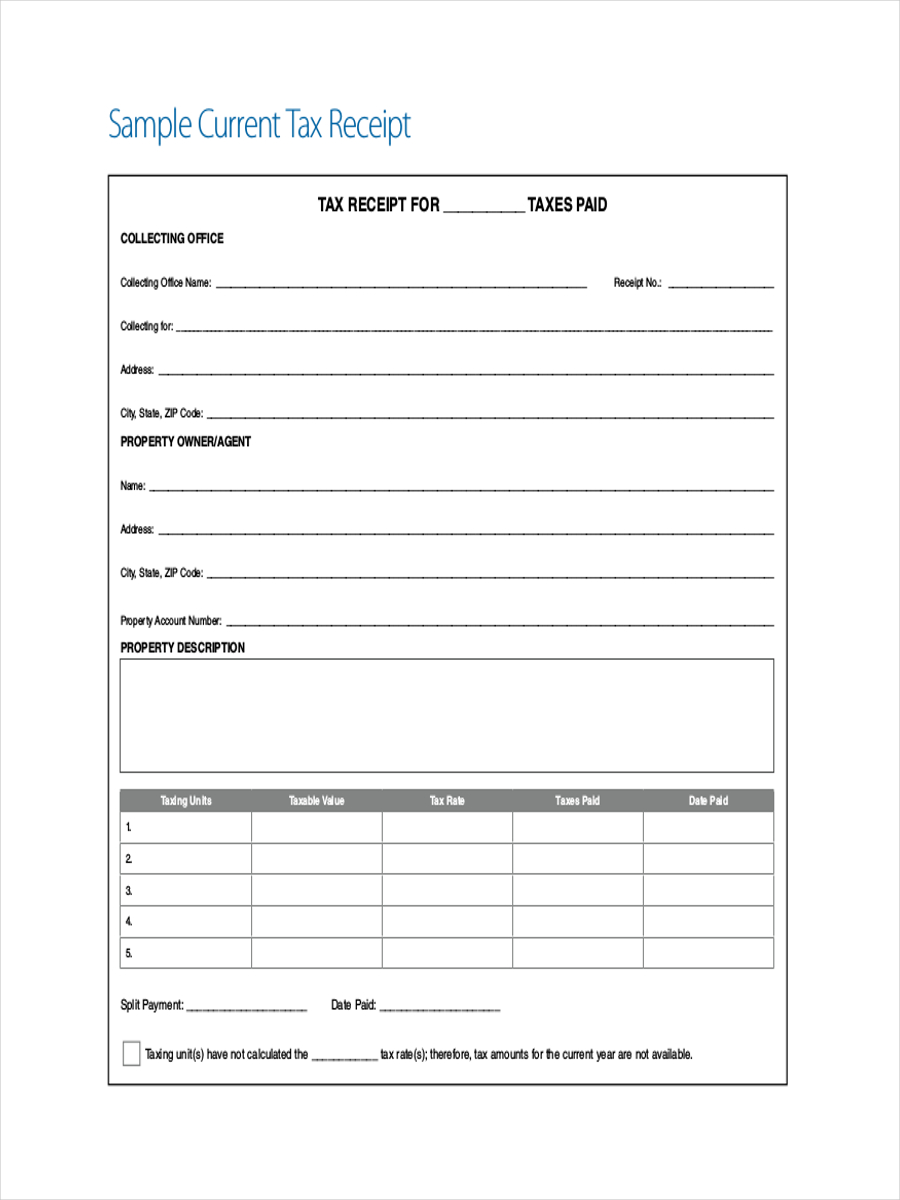

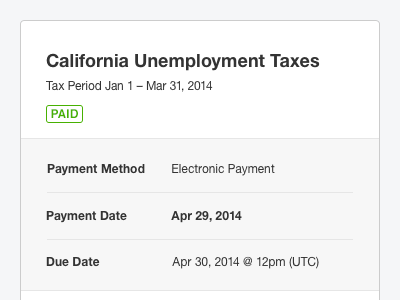

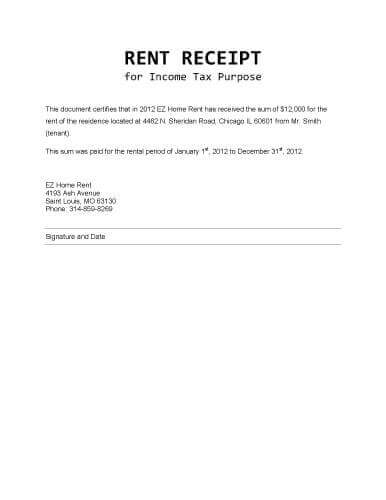

Tax payment receipt. Tax payment peace of mind. For proof of payment we will provide you with a confirmation number and digital time stamp on your receipt. Tax receipts can be found on the current statement page or by clicking on the property tax receipts button. This website is a public resource of general information.

Claycountymotax is a joint resource provided and maintained by lydia mcevoy clay county collector and cathy rinehart clay county assessor. To download your property tax payment receiptchallan and application please white list this site for allowing pop ups in the browser settings. To return to the main county website click here. Pay1040s payment verification system allows you to retrieve your electronic receipts from prior federal tax payments made through our system.

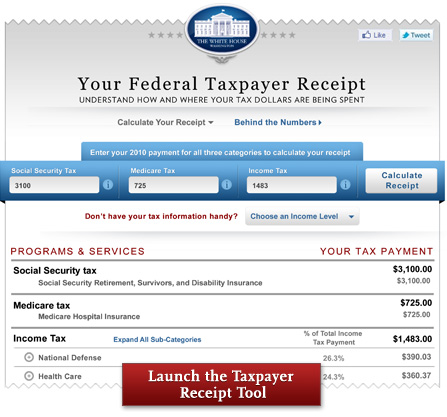

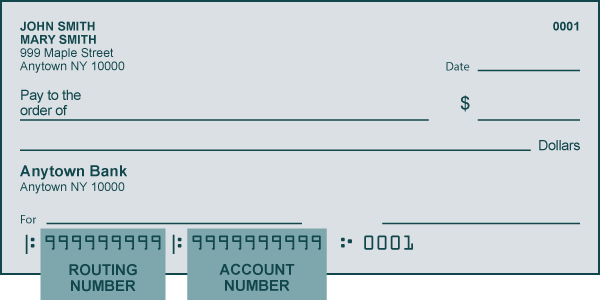

If you have suggestions please contact us here. Paying the irs with a debit card is now faster and less expensive than sending a check via certified mail with a return receipt. Challan noitns 282 payment of securities transaction tax estate duty wealth tax gift tax interest tax expenditureother tax hotel receipt tax and commodities transaction tax. Lexington county makes no warranty representation or guaranty as to the content sequence accuracy timeliness or completeness of any of the database information provided herein.

The reader should not rely on the data provided. Social security number or itin. The united states postal service postmark determines the timeliness of payment. All payment options the tax office accepts both full and partial payment of property taxes.

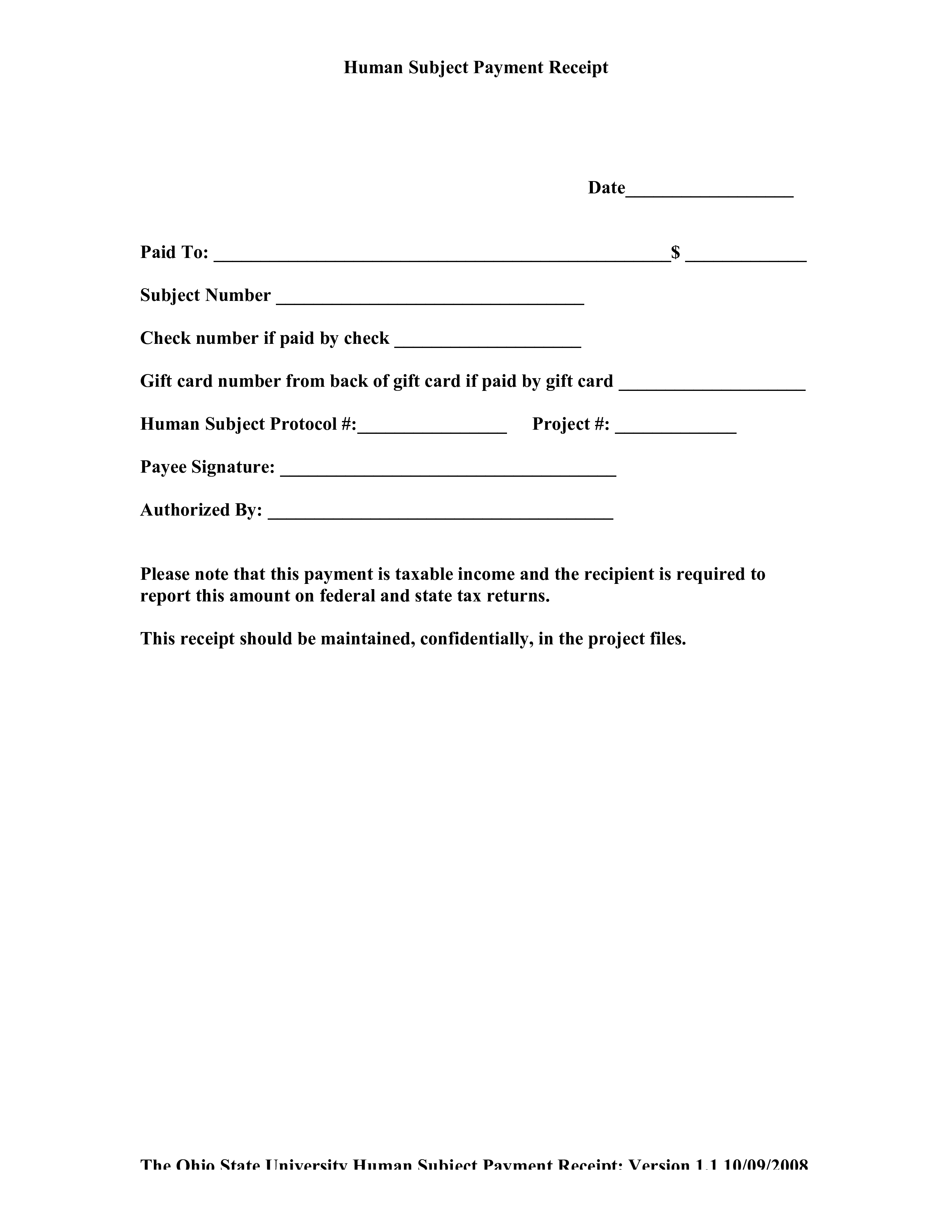

Select vat cst tot vatgst entertainment tax profession tax luxury tax entry tax vehicles entry tax goods hrbt rdcess select act. When you receive a paid property tax receipt make a copy of it at that time and keep a duplicate file of all your paid property receipts. Keep good track of your property tax payments and receipts to start with. Pay taxesprint dmv receipt.

Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than december 31 each year.