Tax Preparation Worksheet Pdf

Number accounting method date business started cash accrual other.

Tax preparation worksheet pdf. Tax preparation worksheet page 2 of 2 estimated payments. Days in tax period d. 01 922 instructions for completing texas sales and use tax return pdf 01 922s instrucciones para llenar la declaracon de impuestos sobre las ventas y uso pdf 01 118 texas sales and use tax prepayment report pdf 01 142 texas off road heavy duty diesel equipment surcharge return pdf 01 143 texas fireworks tax return pdf. Day breaking news individual taxpayers business taxpayers tax professionals frequently visited links get help wheres my refund tax credits unclaimed property vendor.

Highlight the areas that apply to you and make sure you have that information available. Transmission of return does not take place until an authorization form is signed and returned to our office. Wills are important legal documents. This is a reminder that state offices are closed monday january 20 2020 in observance of martin luther king jr.

When youre ready to prepare your tax return using turbotax software youll be surprised at how much time youll save by organizing your information beforehand. Insolvency worksheet pdf format household goods inventory worksheet excel format. Computation of marital deduction under transitional rule applicable to pre 91281 wills interactive. Days in average year c.

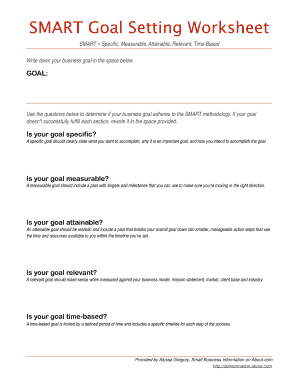

The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We use cookies to collect information about how you use govuk. Small business tax preparation checklist. Pdf td1 ws 20epdf pdf fillablesaveable td1 ws fill 20epdf.

The worksheets and other pages are not included in the pdf until the 2019 online editions become available in december 2019. For example you can download teacher lesson plans factinfo sheets worksheets and assessments. It includes definitions of some legal terms you need to know. Before you fill out this worksheet take the time to read the self help guide on wills.

Valid receipt for 2016 tax preparation fees from a tax preparer other than hr block must be presented prior to completion of initial tax office interview. Form 165 must be used to amend tax years prior to 2015. Interested in learning more about the basic concepts behind taxes. Download our 12 month expense worksheet excel worksheet.

Whether or not an item is listed on this worksheet is not. This form is authorized as outlined under the tax or fee act imposing the tax or fee for which this form is filed. Tax return routing sheet pdf tax season resources for cpas. Worksheets these are not all inclusive worksheets but only a guide for the information that your tax preparer will need.

Tax client income and expense questions intake page 2 of 7 please note. The problem with that is reducing tax liabilities minimizes taxable income and makes qualifying for a loan more challenging. Sample tax return engagement. Once youre back in the return select tax tools left column and then print center.

To qualify tax return must be paid for and filed during this period. A new client is an individual who did not use hr block office services to prepare his or her 2016 tax return. In order for an books magazines expense to be deductible it must be considered an. These summarized worksheets that i have designed can not be compared to those of any other tax preparation company.

For your personal deductions we have prepared forms for you to fill out. Then click on the other links in that paragraph for fillable pdf versions of our forms and worksheets pertaining to your client type onto which you can type your tax information straight from your computer. 2019 2020 tax return checklist. Number owners address city state zip type of business employer id.

Download worksheet as pdf contact us. Each tax return is different so processing time will varyto check your refund status go to wwwrevenuestatemnus after july 1 and type wheres my refund into the search box. For each area the taxpayer has checked a box below there should be corresponding back up provided. We have created over 25 worksheets forms and checklists to serve as guidance to possible deductions.

Rental real estate deductions word document salvation army valuation guide for non cash charitable donation tax preparation checklist for individuals. Self assessment tax return forms and helpsheets for the current tax year. The following worksheets are to assist the taxpayer in gathering the information necessary for the preparer to complete an accurate tax return. Interest real property taxes utilities etc.

Report a problem or mistake on this page. There are over 300 ways to save taxes and are presented to you free of charge. Preparation of my personal income tax return. To the best of my knowledge the information enclosed in this client tax organizer is correct and includes all income deductions and other information necessary for the preparation of this years income tax returns for which i have adequate records.

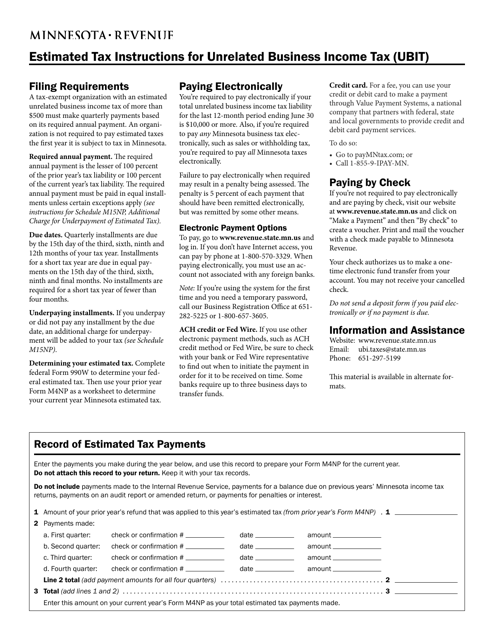

Your answer will be used only for statistical purposes. Before you begin to prepare your income tax return go through the following checklist. Estimated tax payments gather all paperwork related to tax payments made during year including state federal property etc. Instructions for 2019 sales use and withholding taxes amended monthlyquarterly return form 5092 note.

Sample tax return engagement letter for an estate tax return interactive resource r202. Id tax year ordinary supplies the purpose of this worksheet is to help you organize advertising your tax deductible business expenses. An e file authorization form 8879 must be signed by the tax payer. As business owners self employed borrowers goal is to maximize income yet reduce tax liability.

Taking the time to review and complete these worksheets can definitely have a major impact on the end result of your income tax return. Your tax preparer will only need the annual amounts but most clients find it easier to fill out monthly. Before you begin to prepare your income tax return go through the following checklist. Many members of the clergy are paid a cash housing allowance which they use to pay the expenses related to their homes eg.

If you think you might need to file a nonresident income tax return instead read the first few pages of the form 1040nr instructions booklet. Worksheet for your will read me first. Click on the year and click on downloadprint return pdf the pdf download for tax year 2018 will only include the forms and schedules needed to file your tax return. Tax season offers plenty of challenges especially when it comes to gathering up all that documentation that needs to be handy while working on your tax return.

Day care providers worksheet download pdf version. Notice for employers instead of giving paper copies of form td1 to your employees. Rental property income worksheet download excel version. Use this form to correct the 2019 sales use and withholding taxes monthlyquarterly return form 5080 that was initially filed for the tax period.

Confused about tax terms and forms. Once you understand the general information complete this worksheet. Heritage income tax offers a full range of tax preparation services. Gift tax calculation worksheet interactive worksheet w103.

Td1 ws worksheet for the 2020 personal tax credits return. Necessary to prepare and e file your taxes. Tax return questionnaire 2019 tax year page 2 of 18 3. Tax worksheets new change to.

May not be combined with other offers. The hows of taxes includes 14 self paced modules offering a step by step approach to tax preparation. If you paid any estimated taxes for 2013 please list the date and amount paid date federal date state date state. Personal and small business records.

Self employement income worksheet download pdf version download word version. Tax preparation checklist for businesses. You can select from the forms listed below or from the sub menus under personal deductions and youll be presented with a online pdf form that you can fill out then print out and bring with you to your appointment. Annualized rent real property machinery and equipment used in manufacturing and processing.

Franchise tax short period return worksheets rv f1322401 118 do not file with return. Notice to the reader. If you had compliant health insurance through an employer plan private policy or with a government plan and provide form 1095 b 1095 c or other proof of insurance document. Below on this page you will find the free printable 1040 form and 1040 instructions booklet pdf files.

Keep for your records. Iwe understand it is myour responsibility to include any and all information concerning income deductions and other information necessary for the preparation of my our personal income tax return. Alimony donations taxes gambling. Not every category will apply to you so just pick those that do and make sure you have that information available.

Many of the materials that are part of the understanding taxes program can be downloaded as adobe acrobat pdfs. A new client is an individual who did not use hr block office services to prepare his or her 2016 tax return. Estimated tax for individuals department of the treasury internal revenue service purpose of this package use form 1040 es to figure and pay your estimated tax for 2019. Tax preparation worksheet 2017.

Many free tax preparation sites operate by receiving grant money or other federal financial assistance. Tell us whether you accept cookies. Taxable year taxpayer name account nofein worksheet 1 annualize rent description a. The data from the following questions may be used by this site to apply for these grants or to support continued receipt of financial funding.

General ledger your ledger should list out contents of every expense category you plan to deduct from your small business tax return. Located in portsmouth virginia we serve the entire hampton roads area including the cities of chesapeake virginia beach norfolk suffolk newport news and hampton. Provide a copy of the return. The minnesota department of revenue reviews every return to verify the information on the return and make sure the right refund goes to the right person.

Small business tax worksheet business name tax year or calendar year ended business address city state zip owners name owners taxpayer id. Before you start e filing download or print this page as you collect forms receipts documents etc. Fortunately a tax preparation checklist can make light of the situation and help you discover whats needed to proceed when ready. Taxpayer date spouse date ctorg06 12 04 19.

Individual tax filing season officially kicks off january 27 2020. These are the official irs forms along with any supporting schedules worksheets and tax tables for. The tax return form and notes have been added for tax year 2018 to 2019 and the self assessment returns address for wales has been updated. Small business worksheet client.

Signature date this worksheet provides a way for you to organize your credit and deduction information only. I have not overstated these deductions and acknowledge that false information on a tax return could constitute a federal crime. Income tax preparation checklist worksheet. Tax preparation checklist income tax information w 2s interest 1099 int or substitute dividend slips 1099 div or substitute stock sales 1099 b or broker statement self employment income and expenses sale of a personal residence rental income and expenses sale of any business assets gambling or lottery winnings w 2g for some winnings.

Sign back in to your account and scroll down and select amend change return you will not be amending this is just a way to get you back into your tax return select amend using turbotax online. If you miss an important form income deduction etc on your tax return you will have to prepare a tax amendment. Posts related to tax preparation worksheet pdf. 6 april 2018 the 2017 to 2018 form and notes have been.

Understanding taxes can take the mystery out of taxes. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self employment interest dividends rents alimony etc. Disclosure of this. If a dependent filed a return for 2019.

Valid receipt for 2016 tax preparation fees from a tax preparer other than hr block must be presented prior to completion of initial tax office interview. Llc s corp small business worksheet please use this worksheet to give us business income and expenses plus critical supplemental information for preparation of your tax returns. Offer valid for tax preparation fees for new clients only. E filing is mandatory for tax returns prepared by a professional tax preparer.

Form 709 organizer fillable pdf resource r201. Here are the steps to print your return and all worksheets. Clergy tax worksheet parsonage allowance. In addition you can download a powerpoint presentation that introduces each theme in the whys of taxes.

Better yet attach the list to a folder of your tax documents and check items off as you add them to the folder. Tax preparation worksheet download pdf version download excel version. Offer period march 1 25 2018 at participating offices only. Tax preparation interview worksheet.

Tax exempt dividend income from mutual funds stocks bring 1099 div payer amount personal income tax worksheet 2017. Tax preparation worksheet pdf. Our cash flow analysis worksheets promote ease and accuracy in determining self employed borrowers income. Farm worksheet download pdf version download word version.

If you want us to prepare a return for a tax year. February 28 2019 by role.

/Form1040EZ-5b4cccb0c9e77c003756297c.jpg)

:max_bytes(150000):strip_icc()/how-to-fill-out-form-w-4-3193169-final-5b64a71d46e0fb0050775430.png)