Tax Refund Receipt

Keep these documents as well.

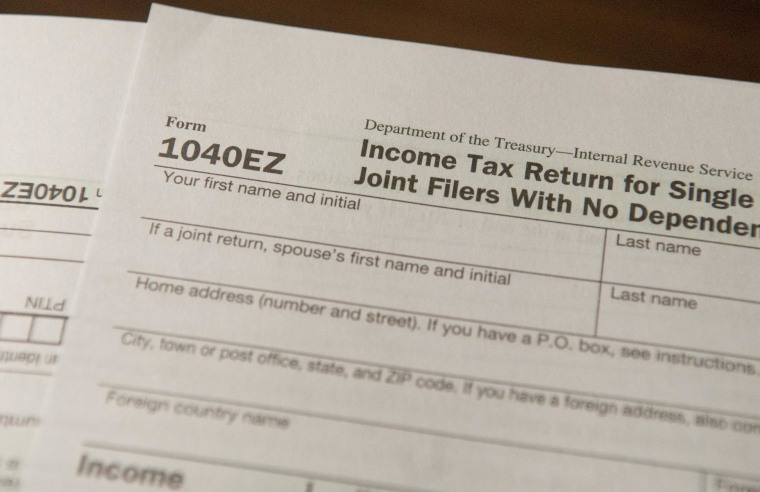

Tax refund receipt. You should only call if it has been. If you filed a paper return please allow 4 weeks before checking the status. The irs issues more than 9 out of 10 refunds in less than 21 days. Here is a chart of when you can expect your tax refund for when the return was accepted based on e filing.

The return acknowledgement process for the form 8038 series return is automated. Refund information for the most current tax year you filed will generally be available within 24 hours after we acknowledge receipt of your e filed return. Fastest tax refund with e file and direct deposit. This is an estimate based on past years trends but based on early information does seem accurate for about 90 of taxpayers.

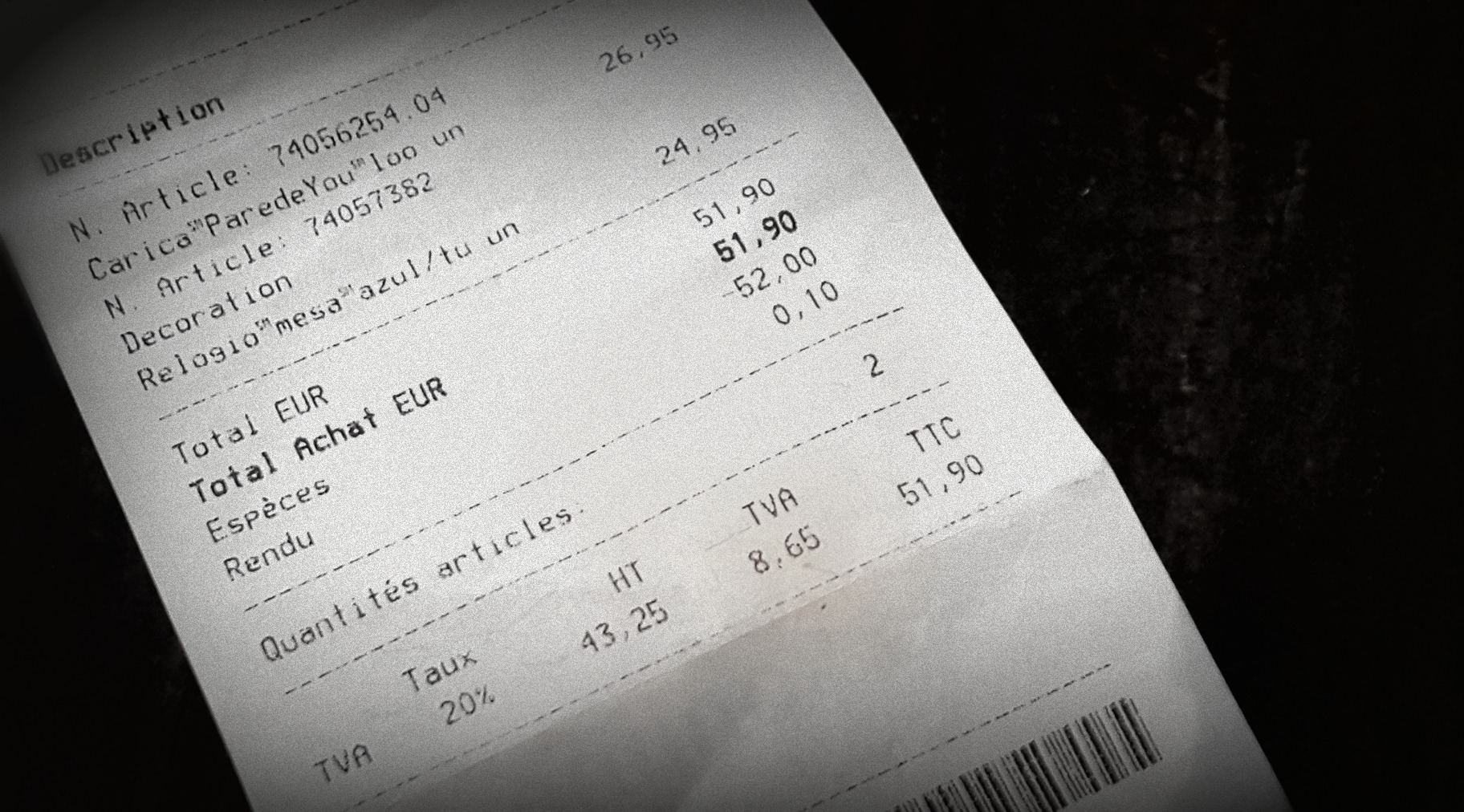

2020 irs refund schedule chart. In texas you need to have a minimum of 12 tax per receipt or combined receipts from the same brand stores. Do not include an acknowledgement copy with your form 8038 series return filing. The irs issues most refunds in less than 21 days although some require additional time.

Tax refund time frames will vary. You may check the status of your expected tax refund by calling the irs refund hotline at 800 829 1954. Tax receipts to keep. It will not be returned as an acknowledgement and may delay processing or cause a duplicate filing.

Many taxpayers qualify for common eligible deductions that could require proof in the form of a receipt. 6 weeks or more since you mailed your return or when. Also as always you can use the link after the calendar to get your specific refund status. Take advantage of these 16 commonly missed tax deductions.

Form 8038 series receipt acknowledgements. A 3999 refund processing service fee applies to this payment method. Pay for additional turbotax services out of your federal refund. Technically in texas with 825 sales tax you need to purchase for at least for 150 usd in a single store or brand outlet to be eligible for the refund.