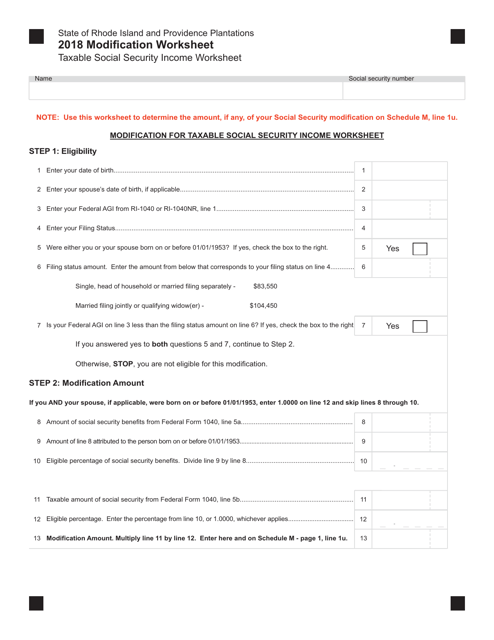

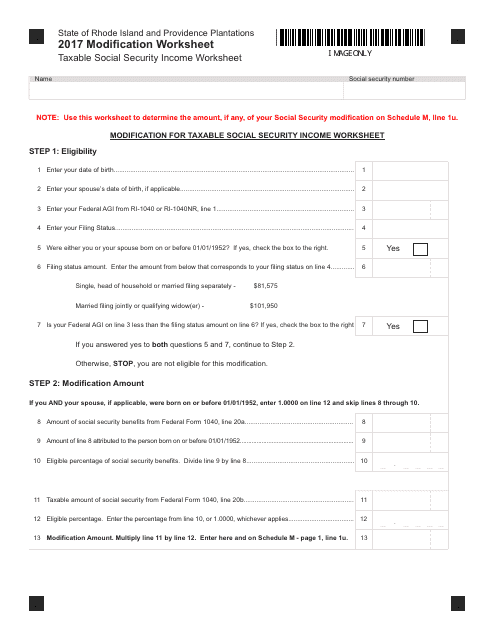

Taxable Social Security Worksheet

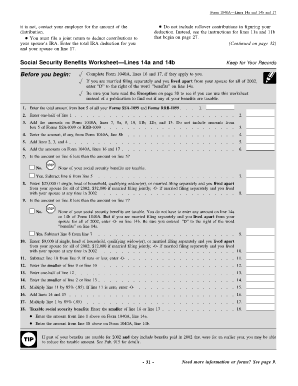

Theres a worksheet in irs publication 915 link opens pdf that can help determine whether your social security.

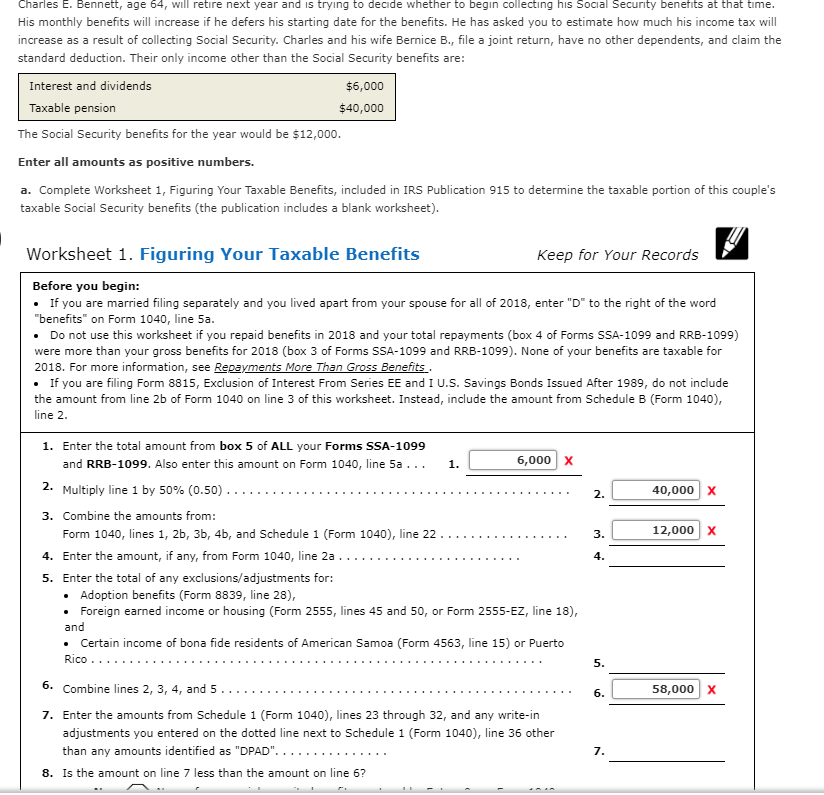

Taxable social security worksheet. It is prepared through the joint efforts of the irs the social security administration ssa and the us. 575 pension and annuity income. This publication also doesnt cover the tax rules for for eign social security benefits. She completes worksheet 2 to find the taxable part of the lump.

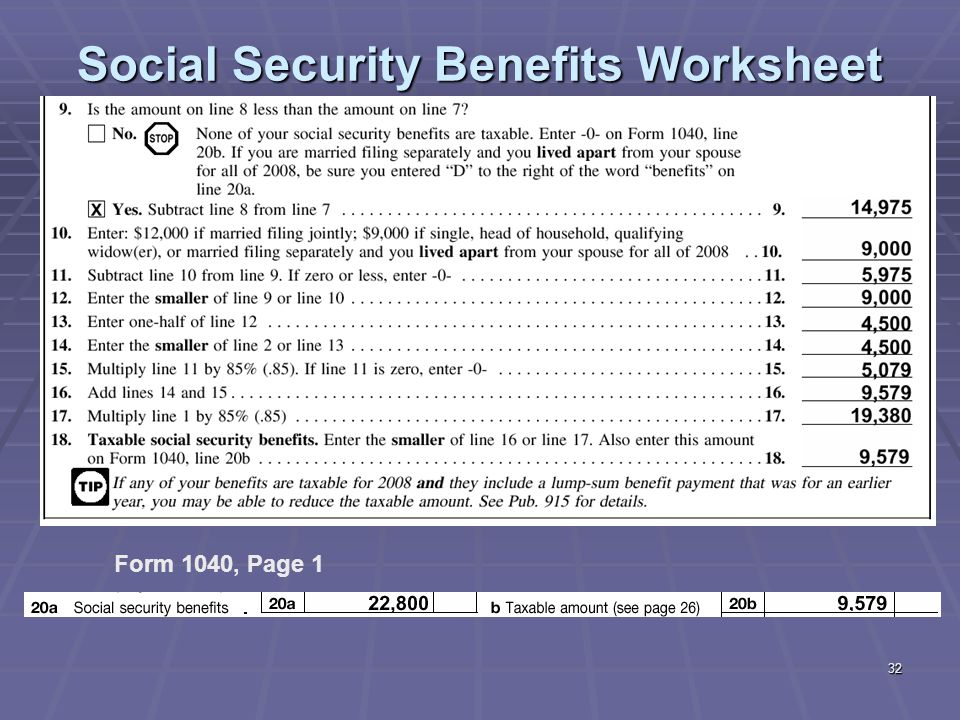

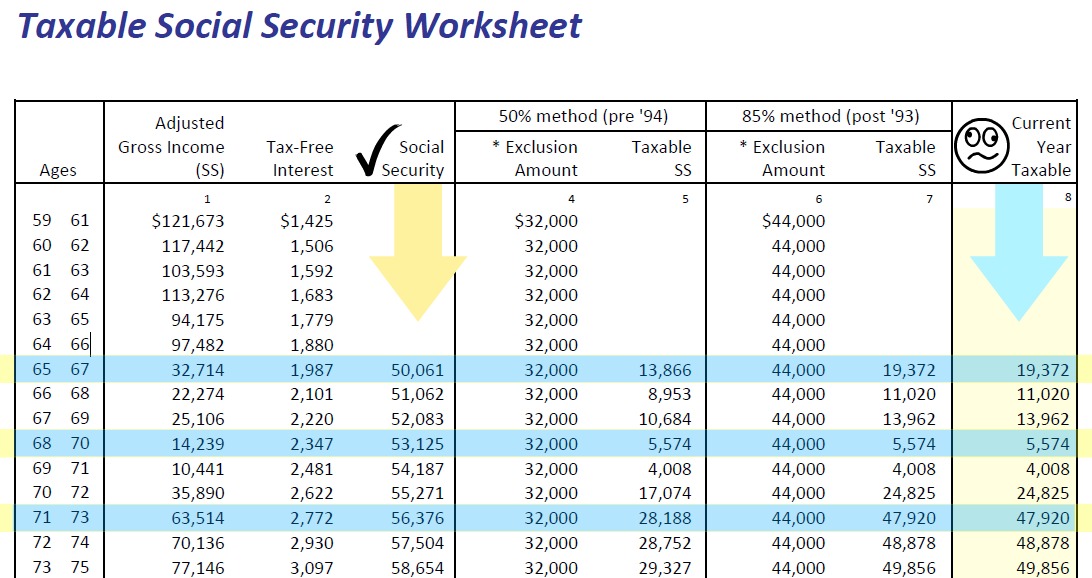

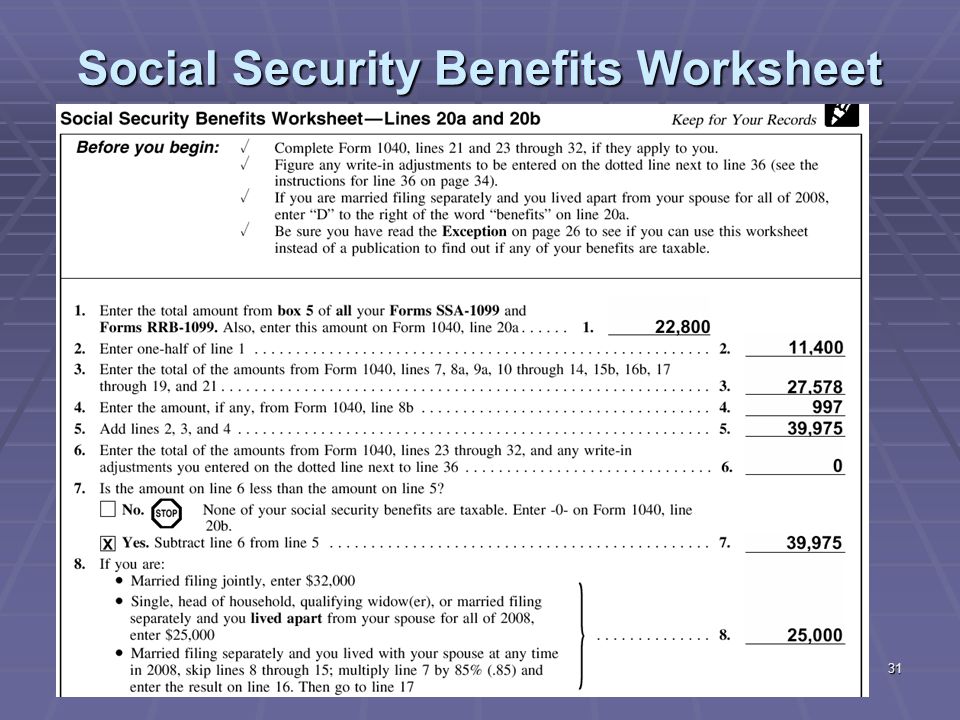

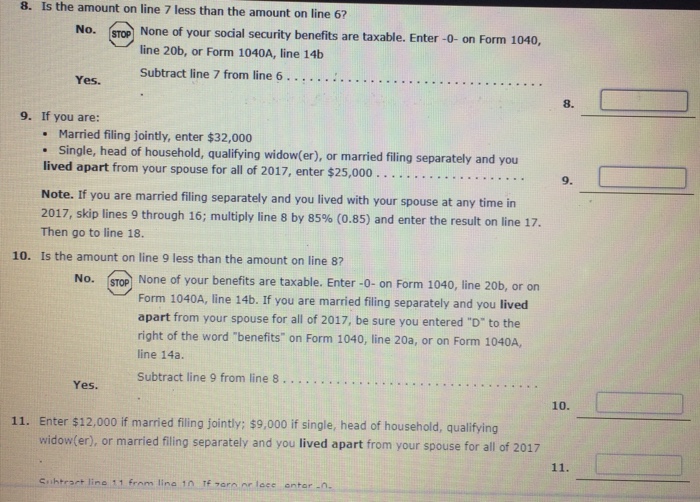

Depending on your income up to 85 of your social security benefits may be taxable. If none of your benefits are taxable but you must otherwise file a tax return do the following. Tax or trea ted as a us. Social security benefits worksheet 2019 if you are concerned about a huge tax bill at the conclusion of the calendar year you can earn tax payments on your social security income throughout the year.

If you have other sources of retirement income such as a 401k or a part time job then you should expect to pay income taxes on your social security benefits. Showing top 8 worksheets in the category 2019 social security. Keep for your records. Whether or not you have to pay taxes on your social security benefits depends on your income level.

Social security benefits worksheet taxable amount if your income is modest it is likely that none of your social security benefits are taxable. Figure any write in adjustments to be entered on the dotted line next to schedule 1 line 36 see the instructions for schedule 1 line 36. Some of the worksheets displayed are benefits retirement reminders railroad equivalent 1 30 of 107 2019 form w 4 your retirement benefit how its figured 2019 form w 4 2019 form w 4 form w 4p for teachers retirement system of the state of 2019 form w 4. The simplest answer is yes social security is taxable.

Social security benefit under a tax treaty. Here are some examples of social security income and how much is taxable and how much is not note these examples are for 2018 returns. This publication explains the federal income tax rules for social security benefits and equivalent tier 1 railroad retirement benefits. These benefits are taxable as annuities unless they are exempt from us.

If you are married filing separately and you lived apart from your spouse for all of 2018 enter d to. Social security benefits worksheetlines 5a and 5b. Railroad retirement board rrb. Your benefits may be taxable see irs pub.

915 and social security benefits in your 2019 federal income tax return instructions.

%20screen%201.jpg)