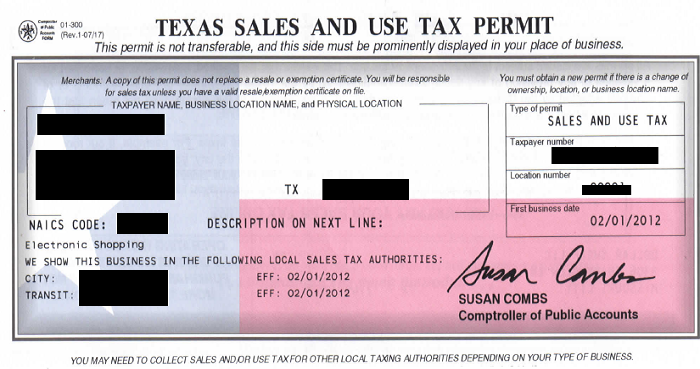

Texas Exemption Certificate

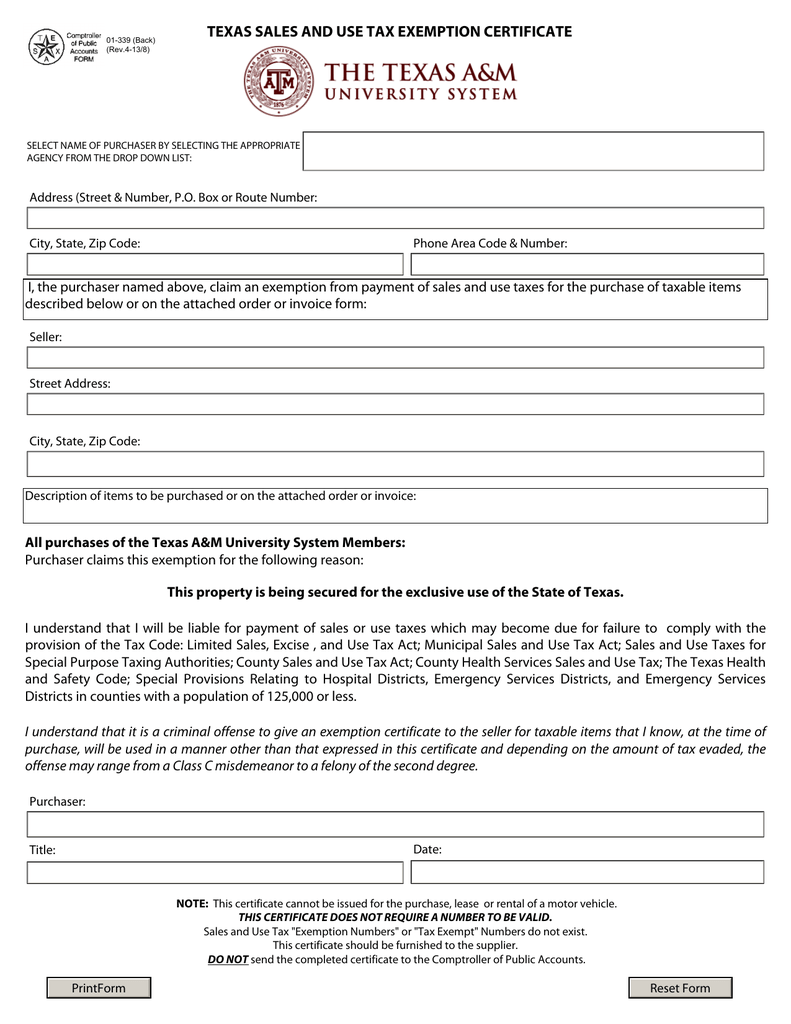

Texas sales and use tax exemption certificate.

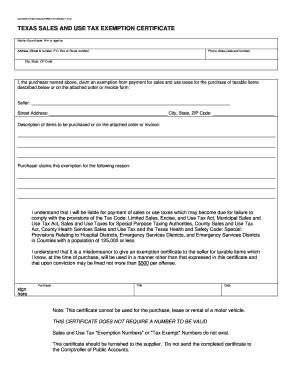

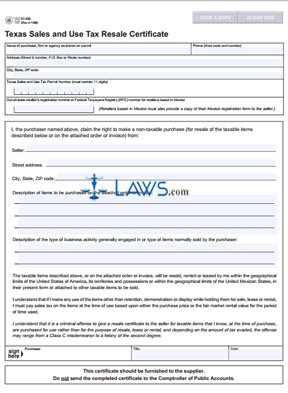

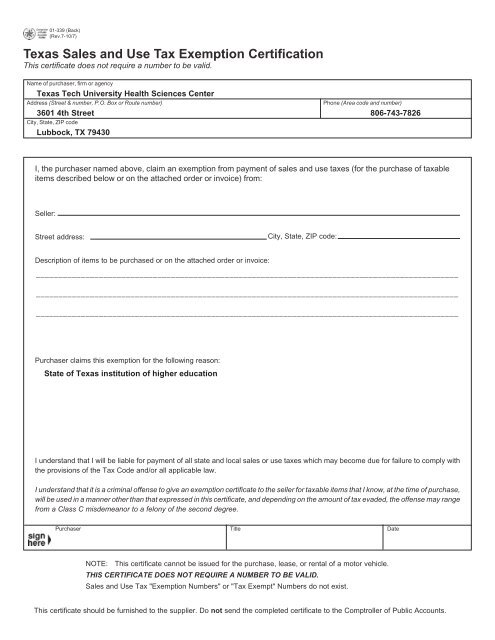

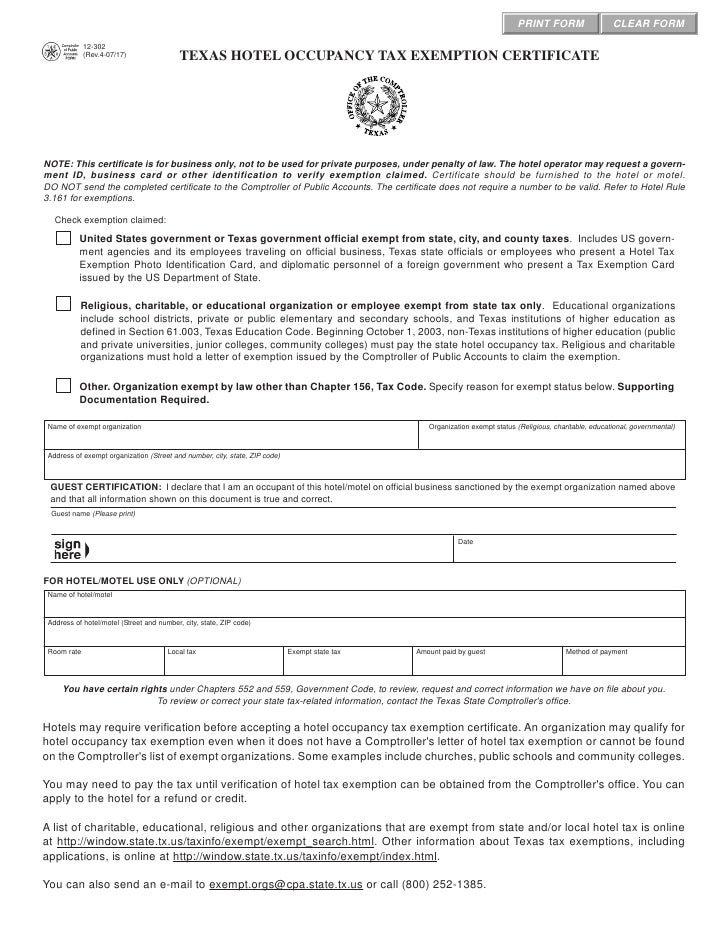

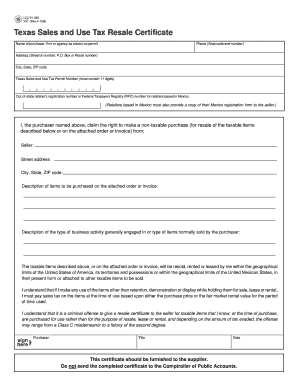

Texas exemption certificate. 01 339pmd 01 339 back rev7 107 save a copy clear side texas sales and use tax exemption certification this certificate does not require a number to be valid. This certificate is used to claim an exemption from sales and use tax in texas when people conducting business need to purchase lease or rent any type of agricultural item that they need in order to produce agricultural products to be sold to the public. 01 339 texas sales and use tax resale certificate exemption certification pdf 12 302 texas hotel occupancy tax exemption certification. For other texas sales tax exemption certificates go here.

If your address has changed. To apply for exemption complete ap 204 and reference the statutory citation that establishes the exemption. The forms listed below are pdf files. Texas applications for tax exemption.

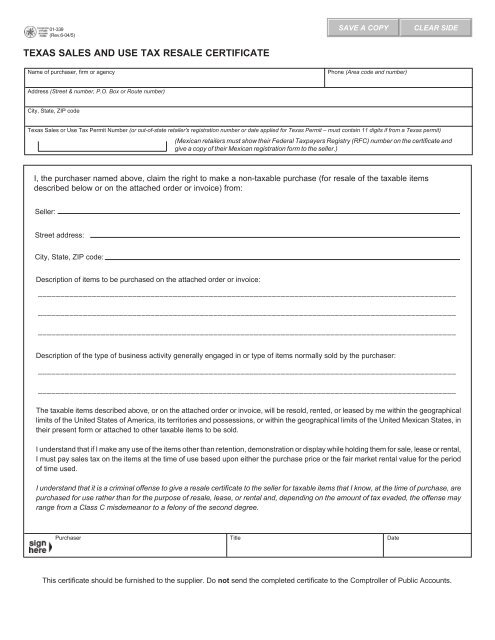

They include graphics fillable form fields scripts and functionality that work best with the free adobe reader. Texas sales and use tax forms. Before purchasing items fill out a sales tax exemption certificate form 01 339. The sales and use tax resale certificate does not apply for most production companies applying for the exemption.

Name of purchaser firm or agency address street number po. Box or route number phone area code and number city state zip code. Box or route number phone area code and number city state zip code. Exemptions may be established under other chapters of texas law such as an exemption created and supported by language in the texas local government code texas transportation code etc.

Sales and use tax exemption certificate document title. 01 907 texas aircraft exemption certification out of state registration and use pdf 01 917 statement of occasional sale pdf. This certificate does not require a number to be valid. Texas sales and use tax exemption certification.

If you are a retailer making purchases for resale or need to make a purchase that is exempt from the texas sales tax you need the appropriate texas sales tax exemption certificate before you can begin making tax free purchases. Purchaser claims this exemption for the following reason. I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase. This certificate does not require a number to be valid.

If you do not file electronically please use the preprinted forms we mail to our taxpayers. How to claim sales tax exemptions. Name of purchaser firm or agency address street number po. This page explains how to make tax free purchases in texas and lists nine texas sales tax exemption forms available for download.

Texas sales and use tax exemption certification.