Utah Resale Certificate

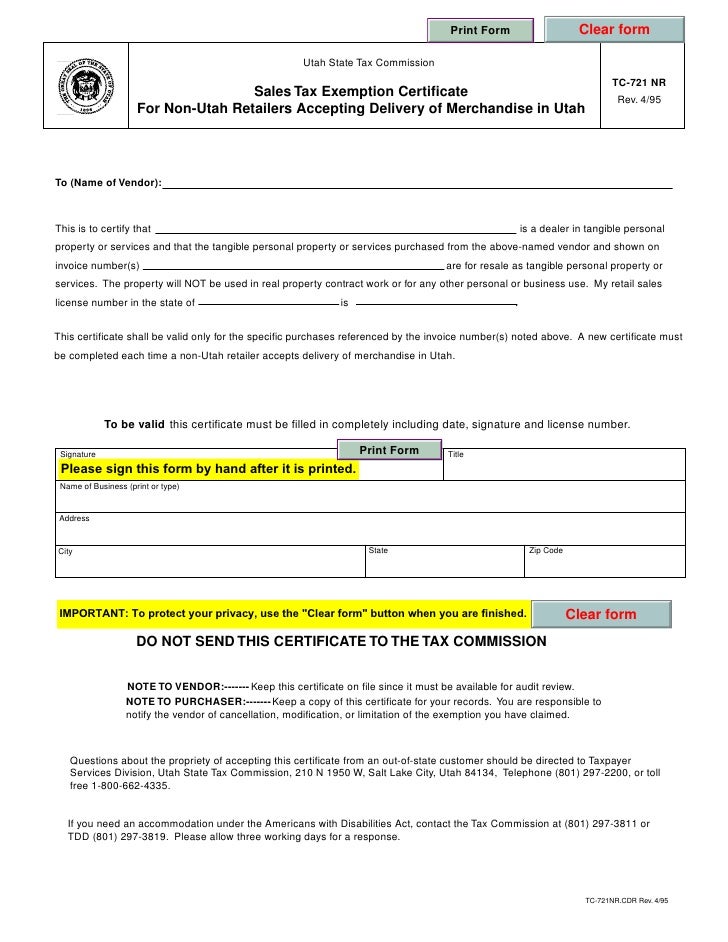

This certificate is only valid for the products or services shown on the invoices listed above.

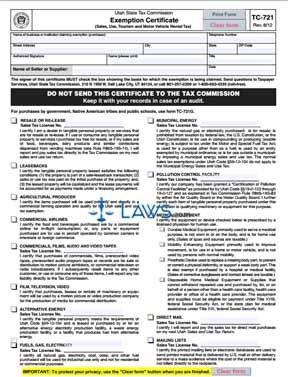

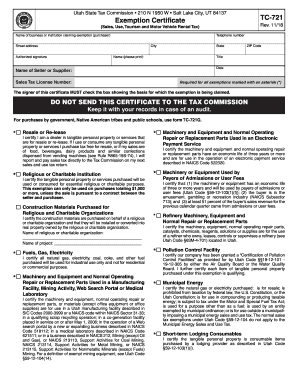

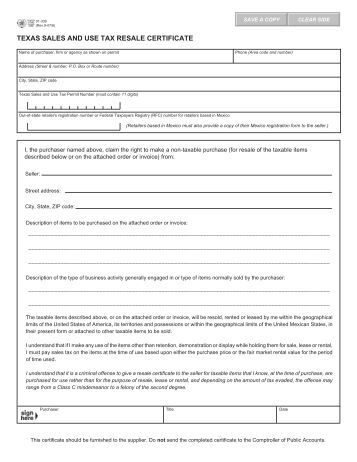

Utah resale certificate. Resale or re lease i certify i am a dealer in tangible personal property or services that are for resale or re lease. Utah state tax commission subject. Mary smith or m smith or smith. If i use or consume any tangible personal.

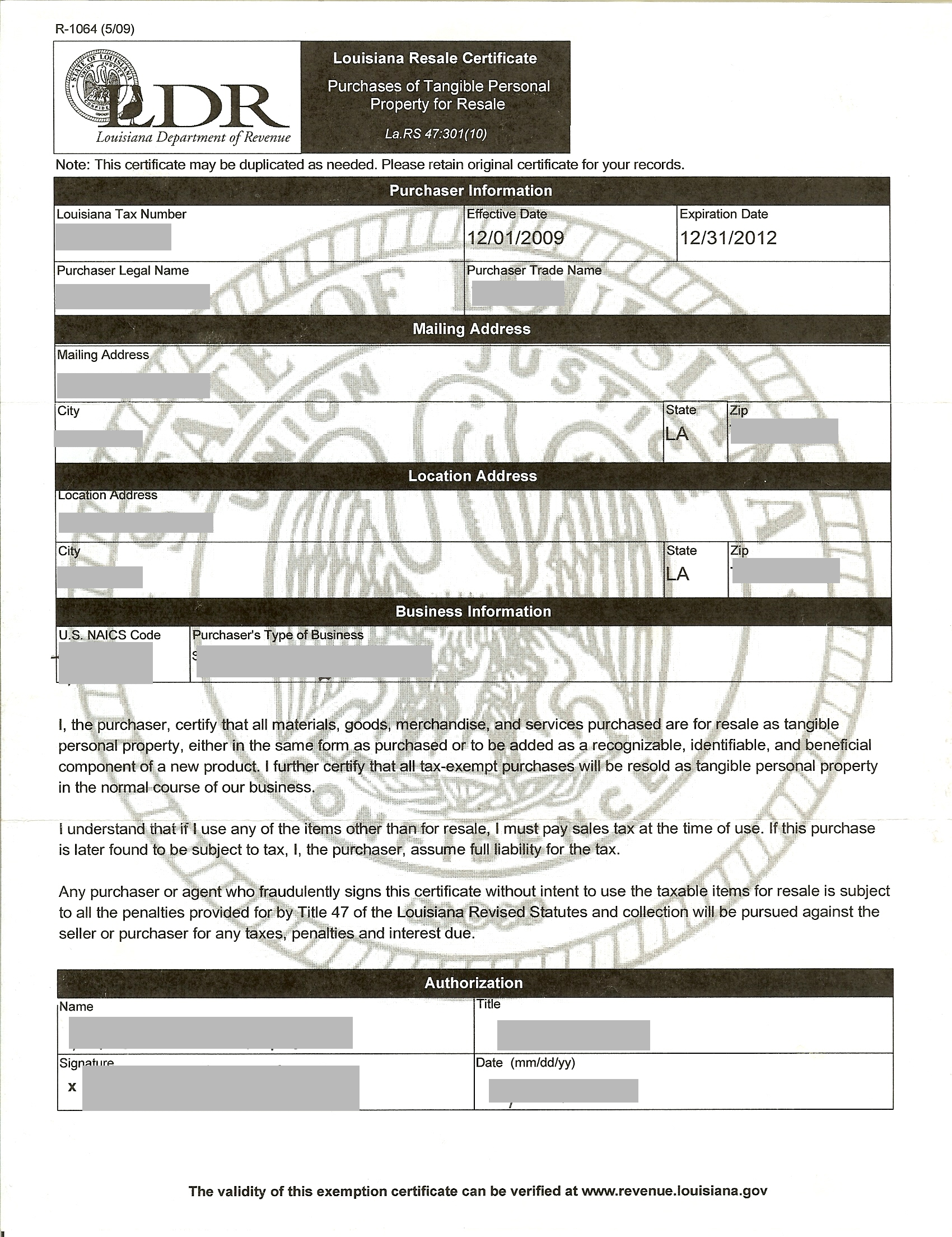

A utah state resale certificate can be used to purchase items at wholesale costs and will allow you to resell those items. Your sales tax rate depends on where you are doing business in utah and the type of business you are conducting. Tc 721 utah sales tax exemption certificate author. The property will not be used in real property contract work or for any personal or business use.

Search results beginning with name examples. This certificate is used to collect sales tax from your clients and to avoid paying sales tax to your supplier. Licensee lookup verification system. What is my sales tax rate.

If you wish to buy items for resale in the state of utah present your vendor with utah form tc 721 exemption certificate. Utah division of occupational and professional licensing. Utah also accepts the multi state uniform sales use tax exemptionresale certificate. Businesses shipping goods into utah can look up their customers tax rate by address or zip code at taputahgov.

How to use a utah resale certificate. Exemption certificate sales use tourism and motor vehicle rental tax. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the utah sales tax you need the appropriate utah sales tax exemption certificate before you can begin making tax free purchases. The non utah retailer must complete a new certificate.

Information current as of 01142020. Click the image for a fillable utah resale certificate form. Utah sales tax resale certificate number.