Va Irrrl Comparison Worksheet

Youve probably heard that the va interest rate reduction refinance loan is the most popular refinance option for va home loans.

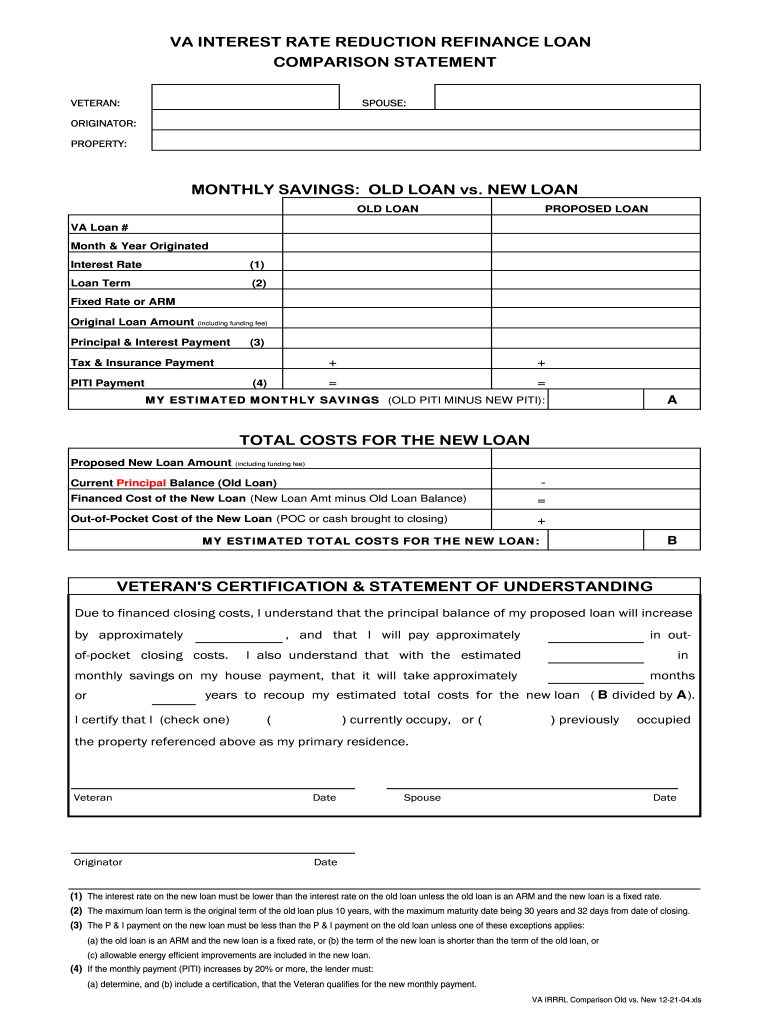

Va irrrl comparison worksheet. Lenders may use this sample document provided it is on the lenders letterhead. Interest rate reduction refinancing loan worksheet created date. 552006 110149 am. Lenders must include with every interest rate reduction refinance loan a statement signed by the borrowers showing they understand the effects of the refinance.

If you would like to talk with a va mortgage specialist and compare the benefits of doing a va irrrl refinance loan call 855 956 4040 now for a free va refinance consultation. The consumer financial protection bureau and va issued their first warning order to service members and veterans with va home loans. Va irrrl net tangible benefit worksheet. Va irrrl safe harbor worksheet.

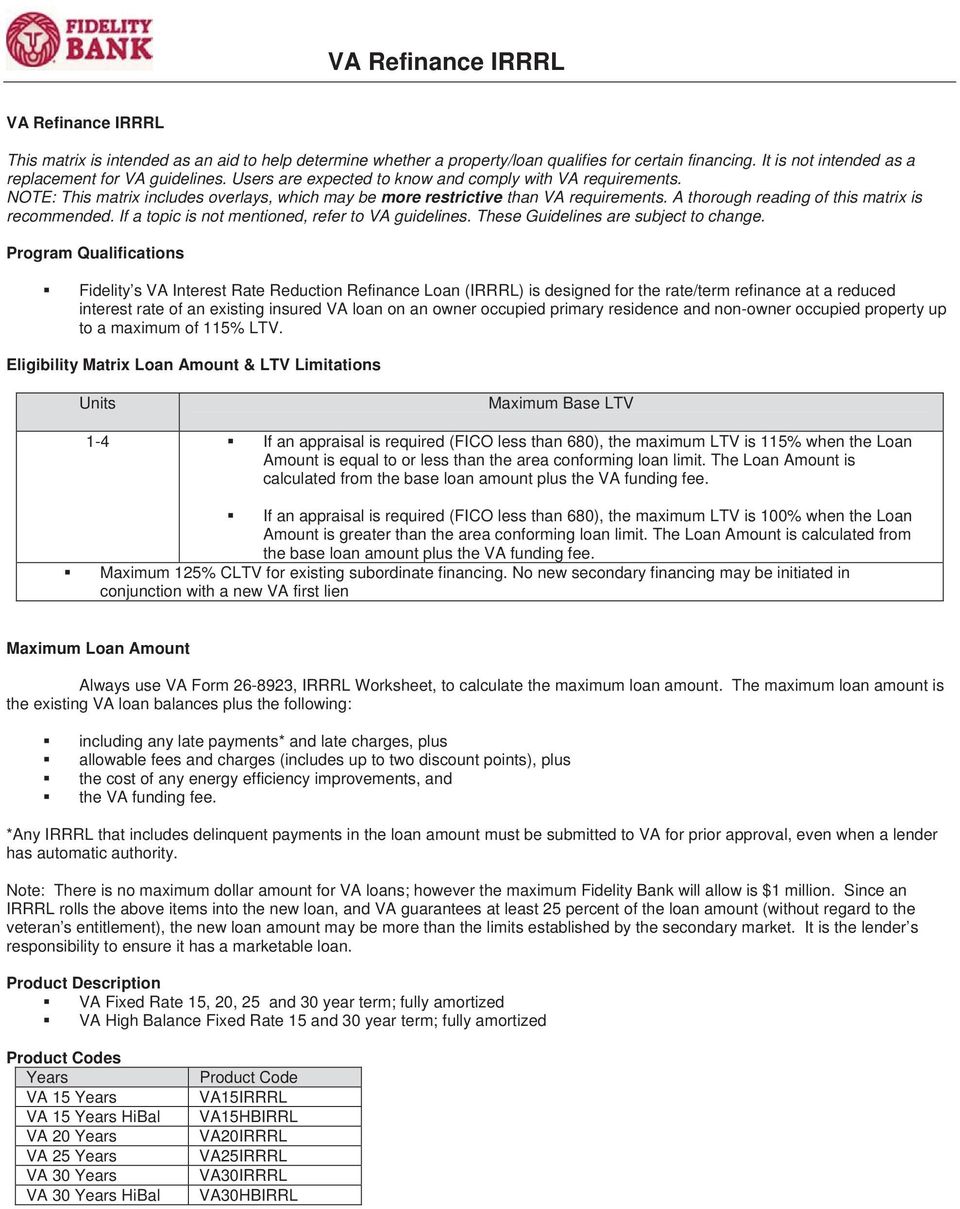

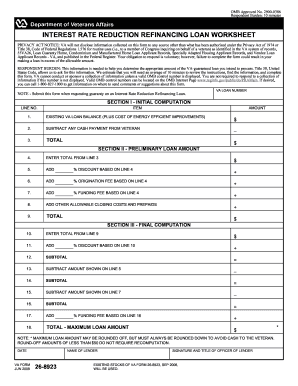

New loan comparison and certification. If you have a va home loan then there is a good chance that you have already come into contact with unsolicited offers to refinance your mortgage that appear official and may sound too good to be true. See va lenders handbook chapter 4 section 17. Maximum loan always use va form 26 8923 irrrl worksheet to calculate the maximum loan amount.

Va cannot conduct or sponsor a collection of information unless a valid omb control number is displayed. Va irrrl loan comparison worksheet. Va pamphlet 26 7 revised. Va irrrl cost recoupment worksheet this worksheet is required for all va interest rate reduction refinance loans.

You might have also heard about the va irrrl worksheet. You are not required to respond to a collection of information if this number is not displayed. The irrrl worksheet is a tool generally used by lenders and is not something the typical borrower or veteran would get much use out of completing. Va rate reduction certification author.

Tax preparation worksheet pdf. Valid omb control numbers can be located on the omb internet page. Months to recoup the following calculates the total number of months to recoup all fees and charges financed as part of the loan or paid at closing.

.jpg?width=800&name=EMA%20Purchase%20Worksheet%20(picture%208.17.19).jpg)