W 4 Printable

Irs w 4 form 2020 printable.

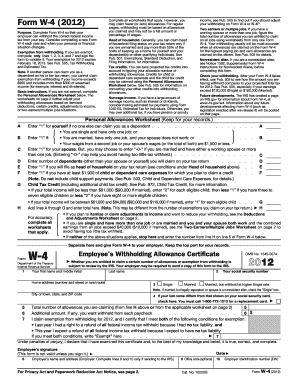

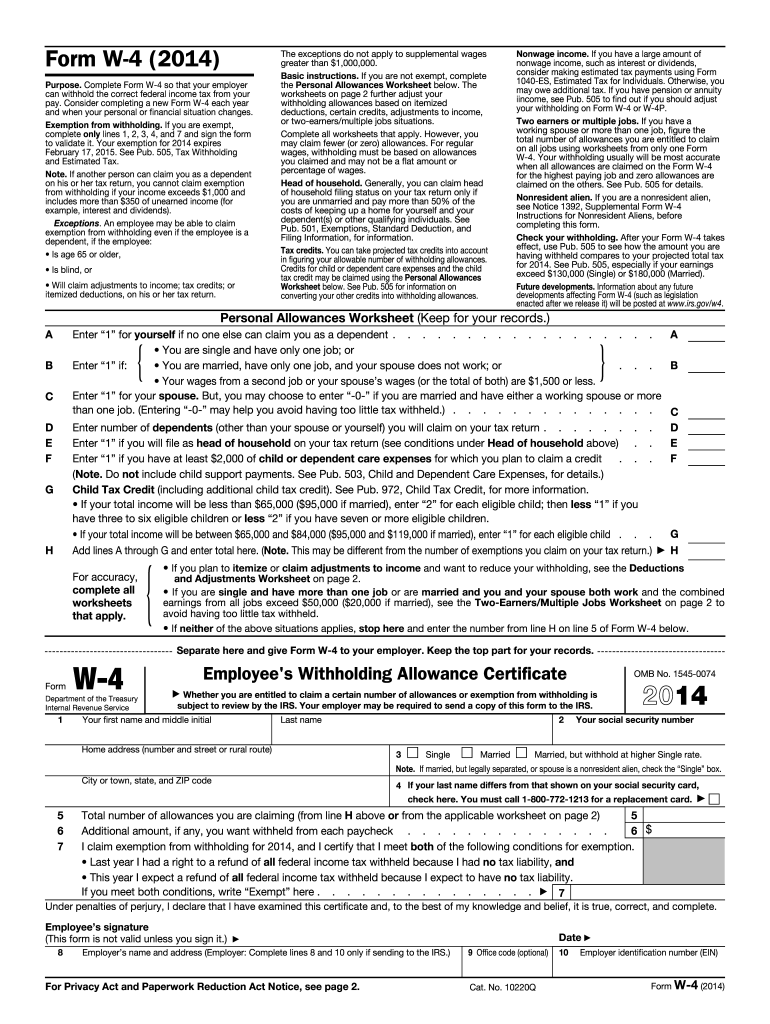

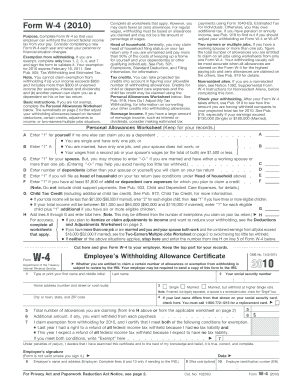

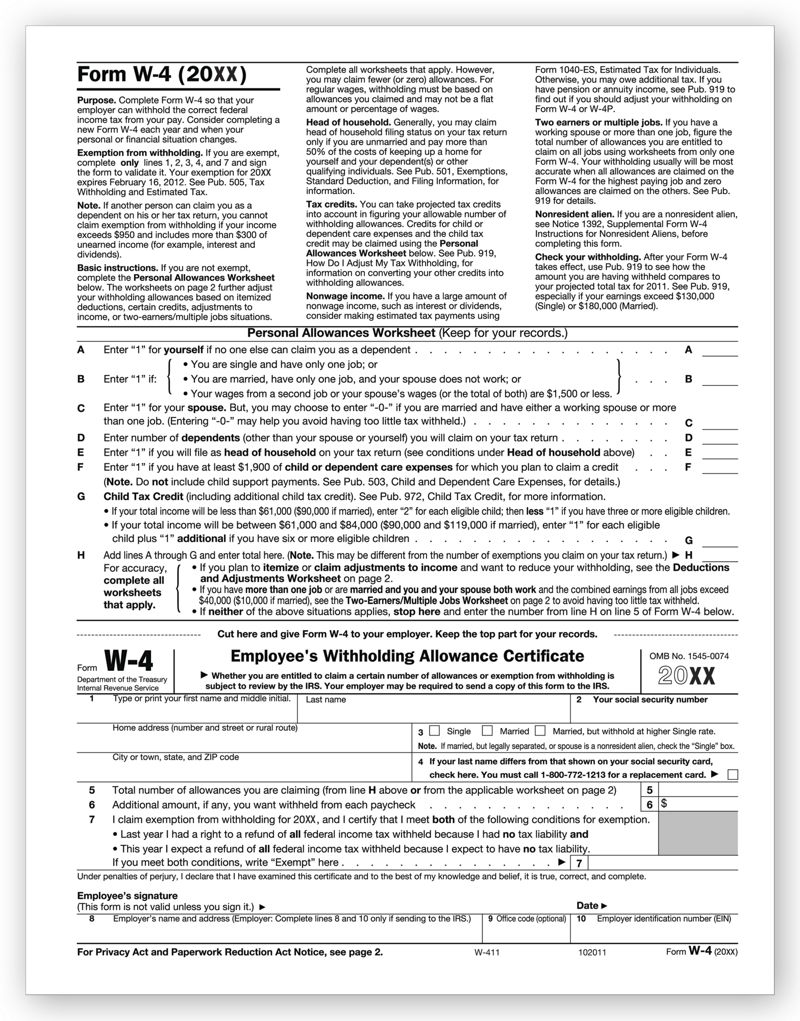

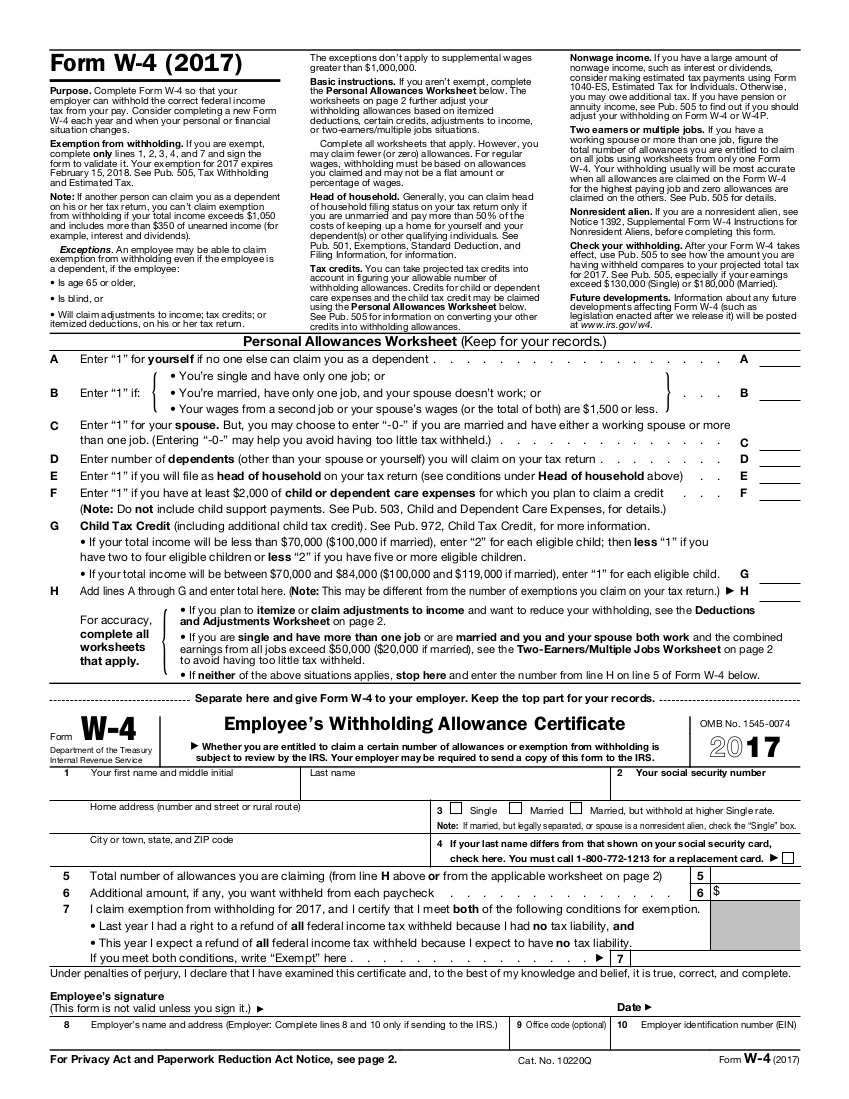

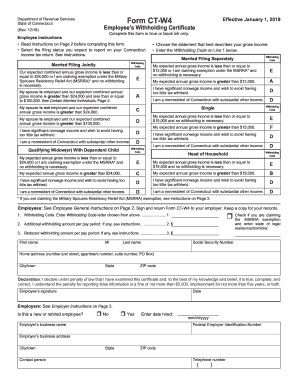

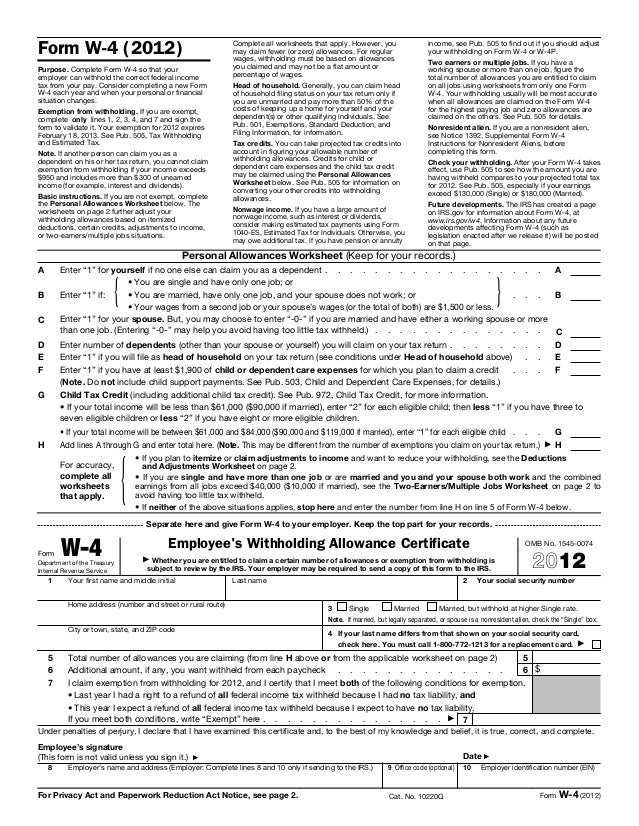

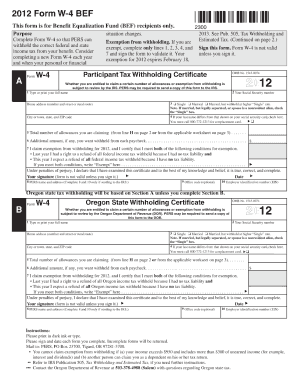

W 4 printable. Forms w 4 filed for all other jobs. The w 4 and w 2 forms are all related to the employees income and taxes while the i 9 form verifies the identification and legal authorization of the employees to work in the united states. W 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay. Form w 4 sp employees withholding certificate spanish version 2020 01022020 form w 4p.

Form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employees pay. Withholding certificate for pension or annuity payments 2019 02042019 form w 4p. For example if you earn 60000 per year and your spouse earns 20000 you should complete the worksheets to determine what to enter on lines 5 and 6 of your form w 4 and your spouse should enter zero 0 on lines 5 and 6 of his or her form w 4. Give form w 4 to your employer.

Employees withholding allowance certificate also known as the w 4 form is one of the most crucial tax forms that you will be filing and giving it your employer. The irs works with the treasury department on form w 4 employees withholding allowance certificate whenever it needs an update. The complete form w 4 is a four page form but the only part that matters is the bottom of the first page which you will have to separate and give it to your employer. Enter personal information a.

Your withholding is subject to review by the irs. Leave a comment on free printable w 4 form. As the internal revenue service requires everyone to pay their taxes throughout the year gradually this piece of paper is very. Information about form w 4 employees withholding certificate including recent updates related forms and instructions on how to file.

There is likely going to be a new form for 2020 but it appears to be more detailed and complex as it takes more time than expected and it is something unusual for the irs.