What Receipts To Keep And For How Long

Shred the receipts if the two match up.

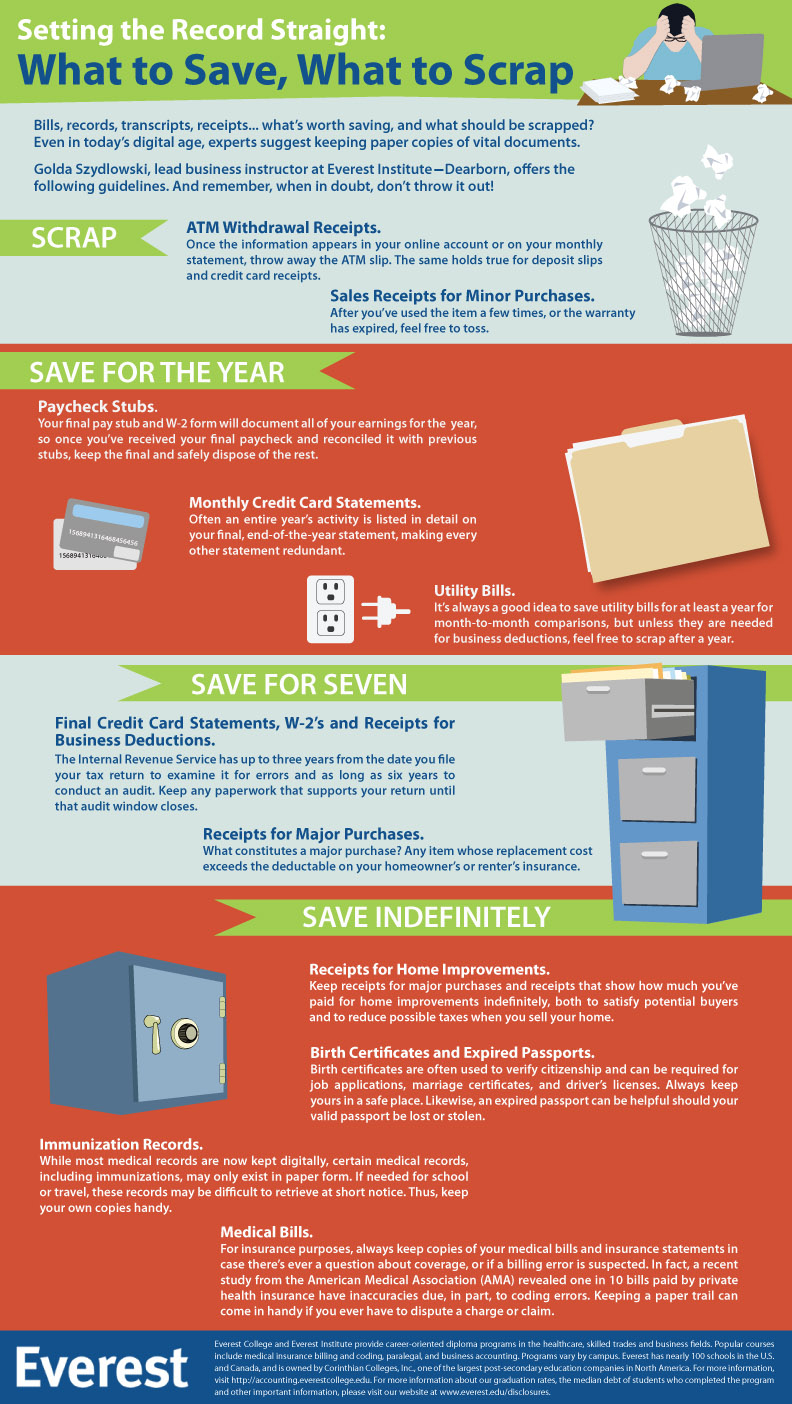

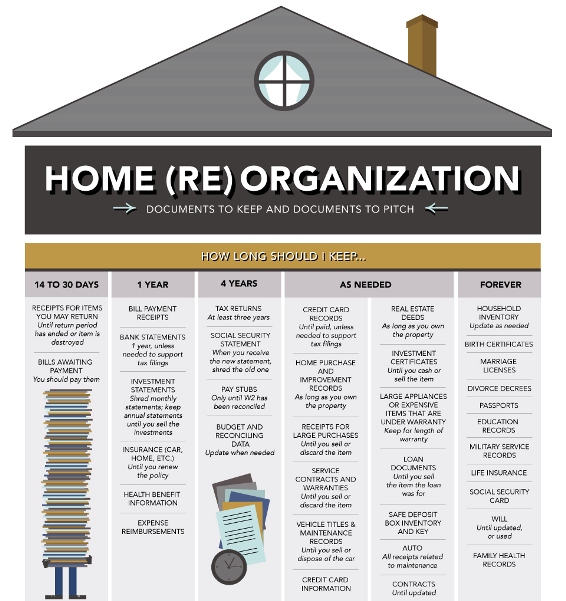

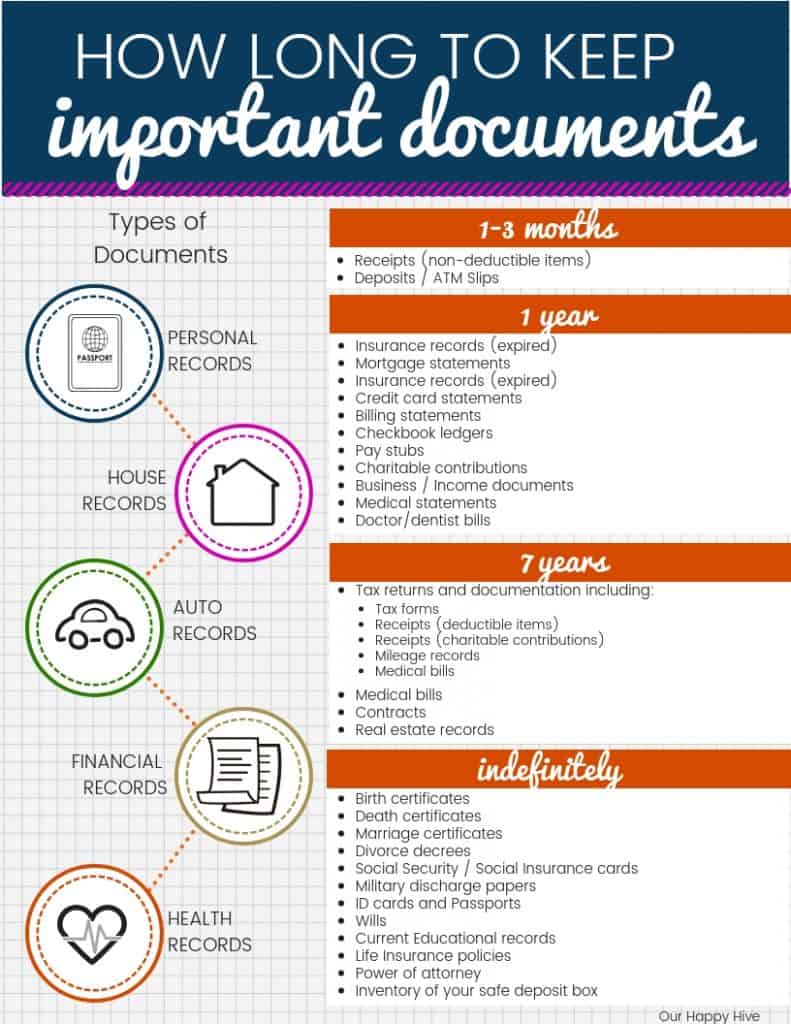

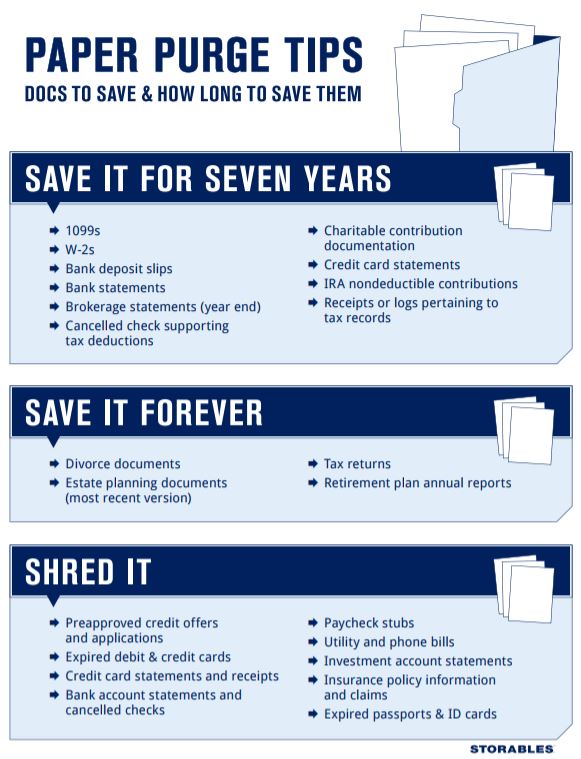

What receipts to keep and for how long. Documents for gross receipts include the following. Having lot of receipts in your drawer can result in clutter and disorganization. If you havent already opted to go paperless you might be swimming in a flood of receipts bills pay stubs tax forms and other financial documents. Records that you need to keep only for the calendar year or less papers that you need to save for seven years the typical window during which your tax return may be audited and papers that you should hang onto indefinitely.

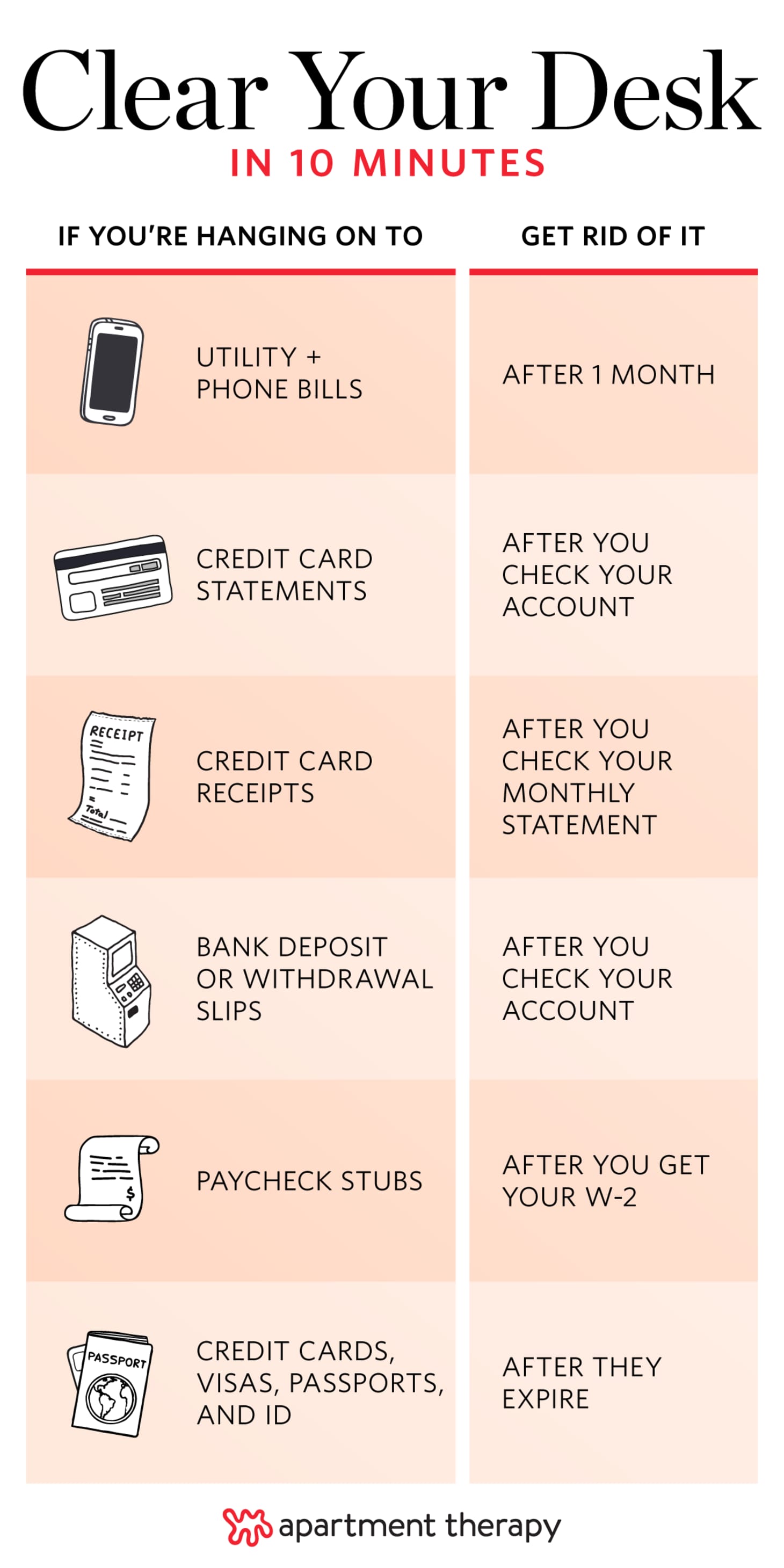

Keep until warranty expires or can no longer return or exchange. Keep until you get the next statement showing that you paid unless you need it for tax purposes. Nearly all of your financial papers can be divided into three categories. Keep annual statements related to your taxes for at least seven years.

Some financial documents need to be kept but others can be shredded and tossed. Keeping receipts is a good habit but how long should one keep a receipt. Bills credit card receipts atm slips investment. Length of time to keep and why.

Housing records specifically receipts that show improvements should be kept for as long as you own your home plus six years. But it doesnt have to be that way. You should keep supporting documents that show the amounts and sources of your gross receipts. Heres a guide on what to keep and for how long.

Just how long do you need to keep your taxes receipts bank statements and other important documents. Each type of document is different so youll want to be sure to keep all of your paperwork long enough before you fire up the shredder even if you think youre done with them. Its generally worth keeping receipts from restaurants at least long enough to check them against your card statement if you left a tip on your card. What personal documents should you keep and for how long.

There is a chance that the tip can be altered or misread and youll need your receipt to dispute it. The length of time by which any receipt will be kept depends on the kind of bills that were paid. Keep your original receipts until you get your monthly statement. Sales receipts unless needed for tax purposes and then keep for 3 years what to keep for 1 month.

The following are some of the types of records you should keep. You can reduce the capital expense and associated taxes by itemizing the improvements along with the proof of their costs. They provide proof of income from interest bearing accounts and can be a record of tax related transactions. Its better to figure out which one are more important.

Gross receipts are the income you receive from your business. Utility and phone bills. Toss verified receipts and atm slips.