Young Life Tax Receipt

Young life is made up of people like you who know that life was meant to be fully lived.

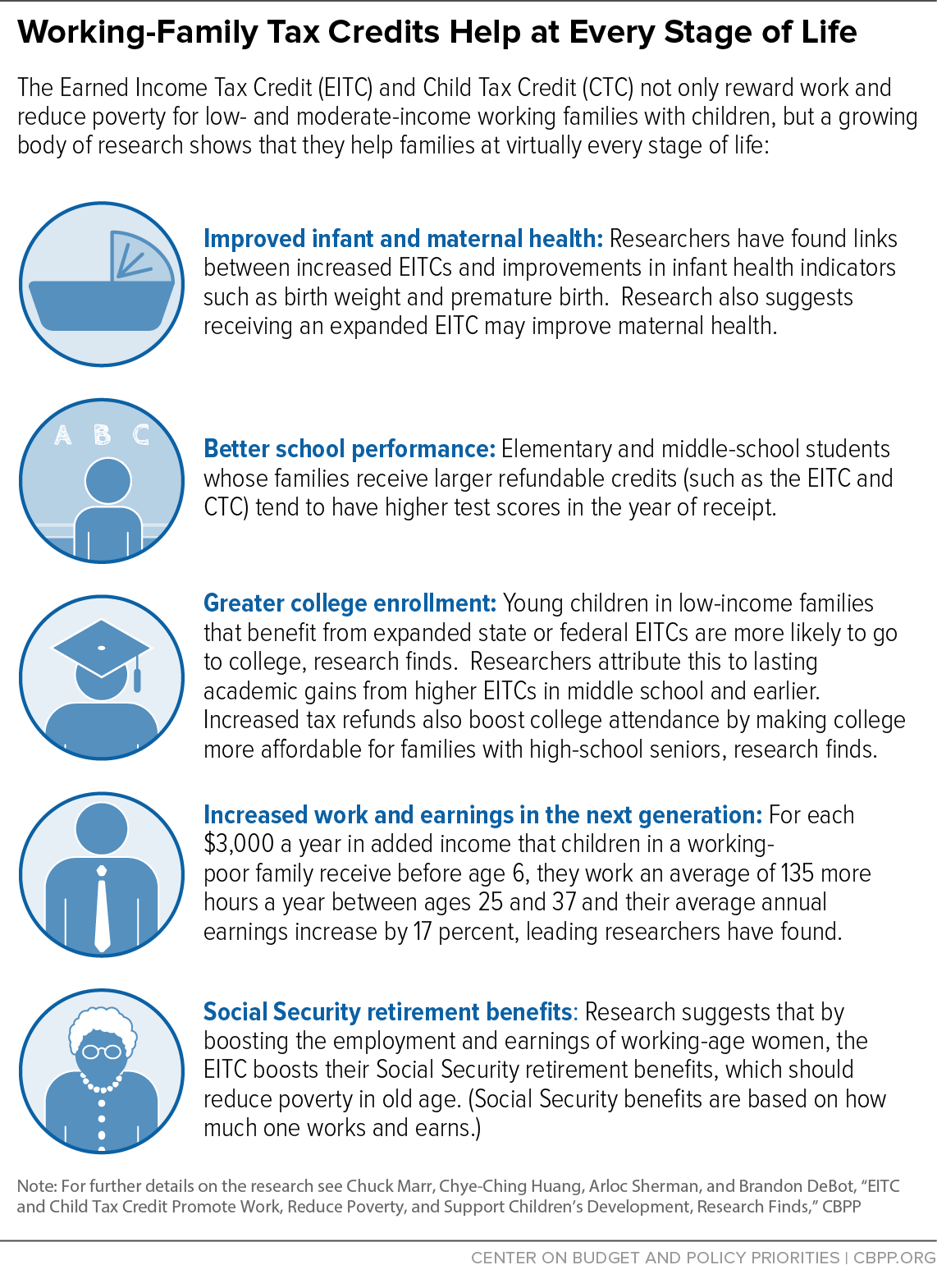

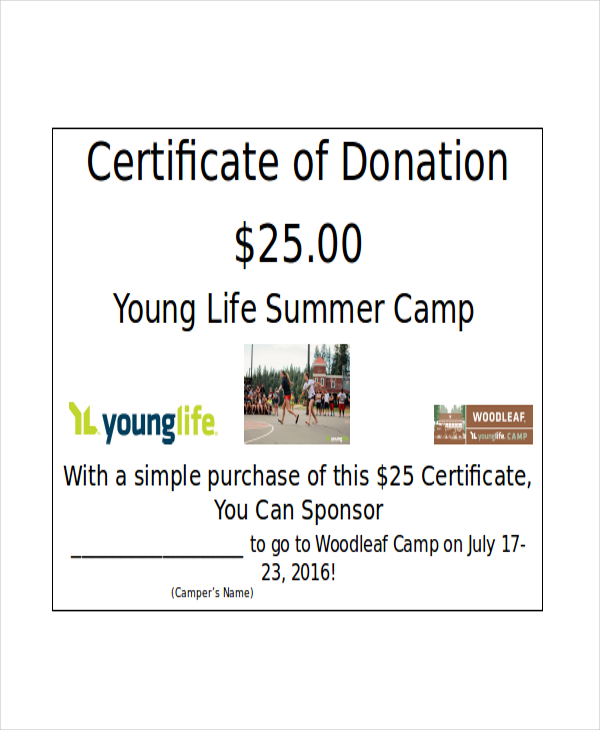

Young life tax receipt. All donations are tax deductible. Department of taxation and finance instructions for form ct 400 estimated tax for corporations ct 400 i. As an alternative to making a donation please consider playing in the event. Young life is a member of the canadian council of christian charities.

Once the stock gift is received in the young life account at richardson gmp you will be issued a tax receipt for the fair market value of the stock as of the date of its arrival. Receipts tax for your second preceding year exceeds 1000 but. Most of the funds given to young life each year come from individuals and organizations who are committed to making a difference in the lives of kids in their communities. Young life of canada is a registered charity in the united states and is therefore able to issue a us tax receipt for our american supporters.

Young life protects the confidentiality of your personal information. And as a non profit your gift to young life may be tax deductible. Gifts must be received by midnight eastern time on december 31 to be counted toward that tax year. The event consists of lunch at 12pm golf starting at 1 pm followed by an open bar and dinner all for 150.

If youre in middle school high school or college theres a seat at the table here for you. To give by cheque and receive a us tax receipt please contact young life income processing at 719 381 1985 and they will be able to direct you on how to designate your cheque and where to send it. Young life is a 501 c 3 non profit organization. In many ways young life is a grass roots organization.

Young life is a non profit tax exempt organization so you will receive a tax deductible receipt for tax purposes. And if youre an adult who cares about kids there are tons of ways to get involved. Contributions are tax deductible as permitted by law. If you have other questions about gifting securities and the tax advantages please contact mike manning vp of development mmanning at younglifeca.

Workplace donations are deducted from employees pre tax income by the payroll department and directly deposited to young life removing the fuss from charitable donations and reducing your taxable income at the same time.