1099 Fill In Template

Create your sample print save or send in a few clicks.

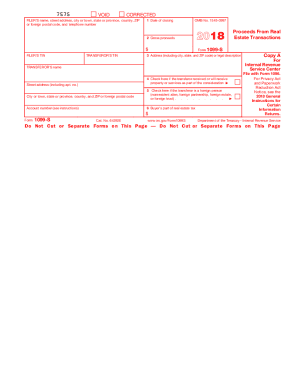

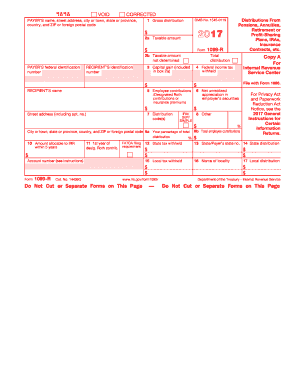

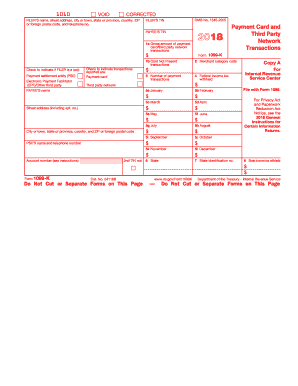

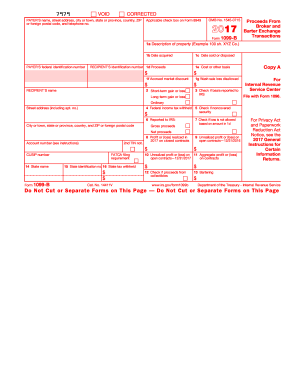

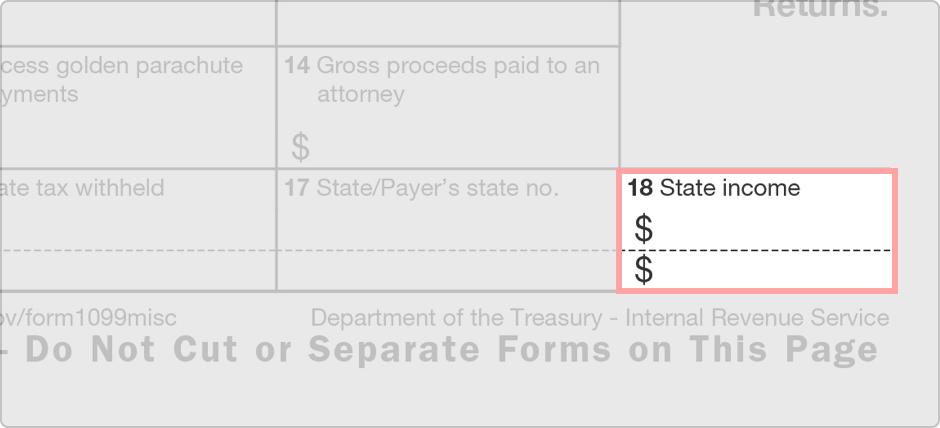

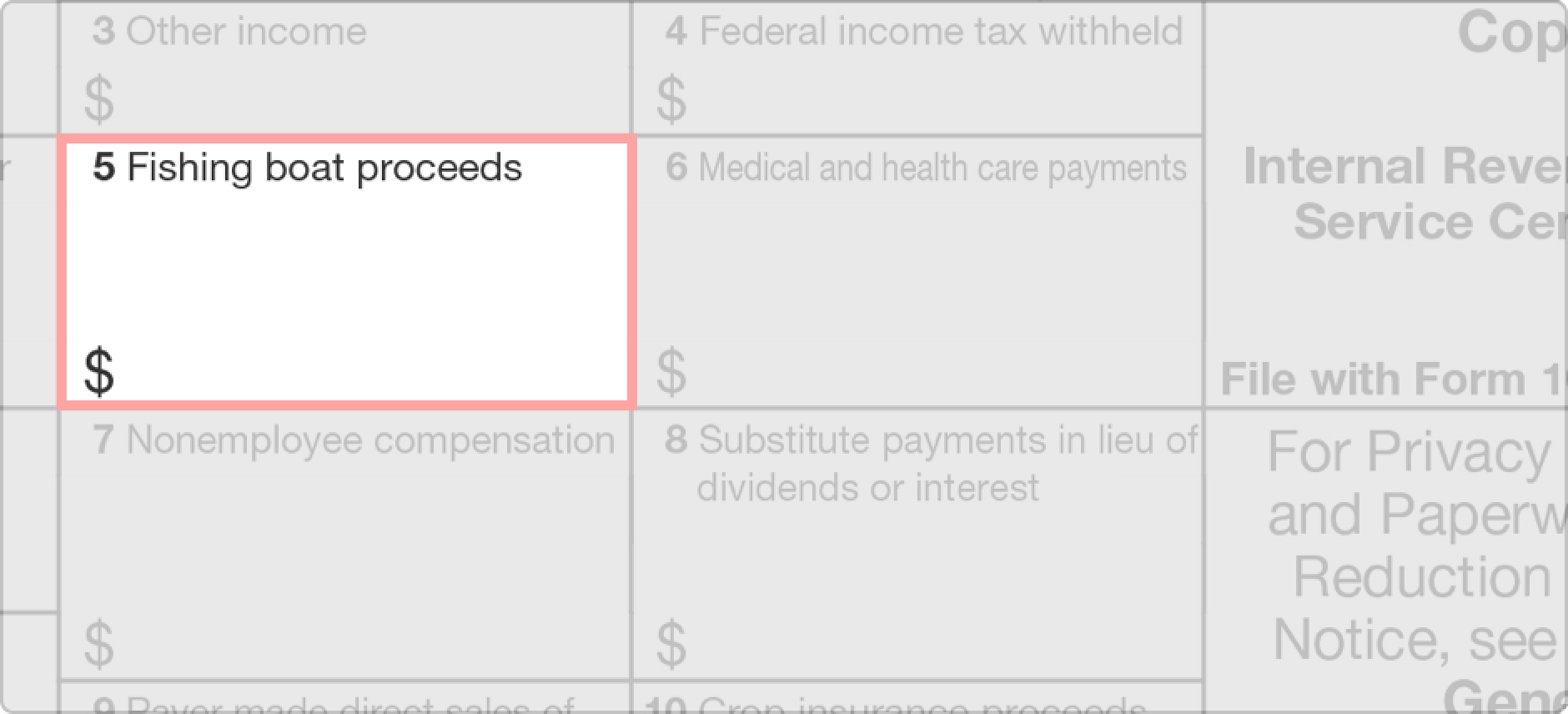

1099 fill in template. 1099 misc 1099 misc form is used for self employed or independent conductors. Report payments of 10 or more in gross royalties or 600 or more in rents or for other specfied purposes. About form 1099 misc miscellaneous income internal revenue service. Report payment information to the irs and the person or business that received the payment.

Here you will find the fillable and editable blank in pdf. Its purpose is to report to the internal revenue service how much interest income you accrued over the tax year. Online service compatible with any pc or mobile os. Form 1099 misc is used to report rents royalties prizes and awards and other fixed determinable income.

Irs fill in pdf forms use some of the features provided with adobe acrobat software such as the ability to save the data you input document rights. It must be filled for every income of 600 or more during the tax year. Remember that this form is required if you earn 10 or more in interest income. A 1099 int form is a relatively simple tax document.

The official printed version of copy a of this irs form is scannable but the online version of it printed from this website is not. As with many tax forms even a brief document like the 1099 int can be intimidating. Currently there is no computation validation or verification of the information you enter and you are still responsible for entering all required information. Fill out 1099 misc for 2019 a 1099 form is a tax form used for independent contractors or freelancers.

Print and file copy a downloaded from this website. It must be filled for every income of 600 or more during the tax year. Payers use form 1099 misc miscellaneous income to. Looking for a printable form 1099 misc and independent contractors.

Report payments made in the course of a trade or business to a person whos not an employee.