12 Month Rolling Forecast Template

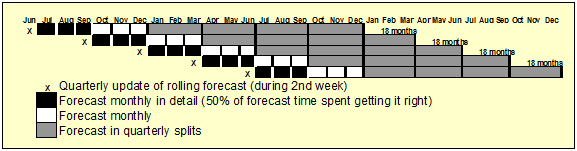

Spend the majority of the time on the next twelve months producing a 12 month rolling forecast with a quick review of the remaining years.

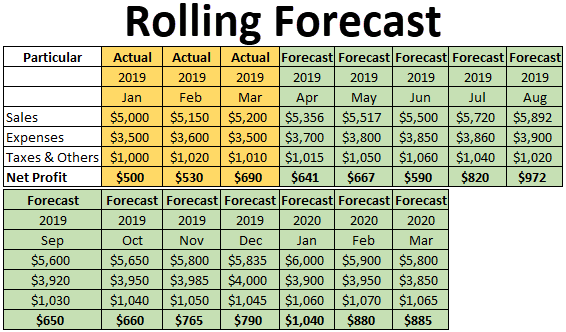

12 month rolling forecast template. I am also planning to upgrade my gantt chart templates include rolling month setup. Unlike static budgets that predict the future for a fixed time frame for example january to december a rolling forecast is regularly updated throughout the year to reflect any changes. Each month revise the rest of the forecast whenever it is apparent from the emerging pattern of actual results that the original forecast is wrong. Identify the end goal and start with the end in mind.

Planning takes place at the front line. Actual results for. By utilizing the eight steps below companies can build rolling forecasts more effectively. Steps for creating a rolling forecast.

It should be done in a sequential order to avoid missteps and rework. We must be able to not only provide annual comparisons ie. This excel templates file size is 25 kb. I have once used the rolling month set up in a forecasting spreadsheet where we made cash flow projections for a startup we were planning to acquire.

Where would you use such a rolling month setup. It is a continuous process based on 12 month rolling forecasts and quarterly plans within a clear strategic framework. Where would you use automatic rolling months. Normally they encompass a period of 12 or 18 months.

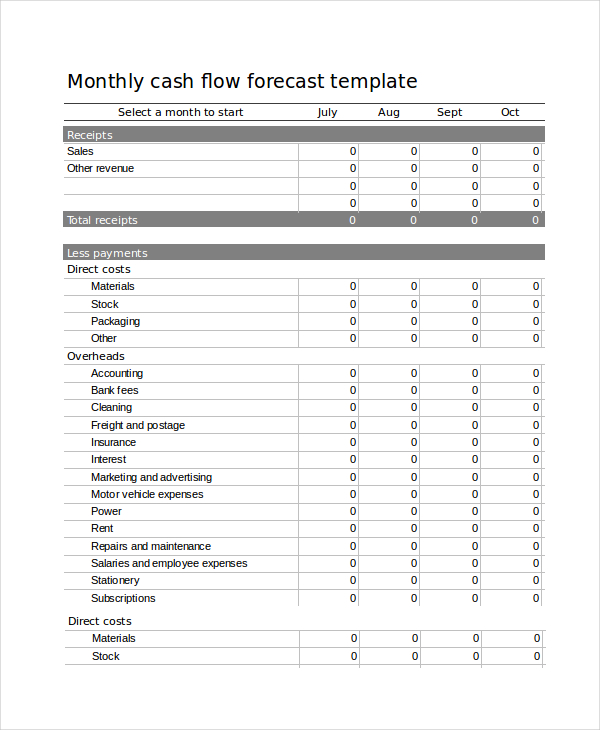

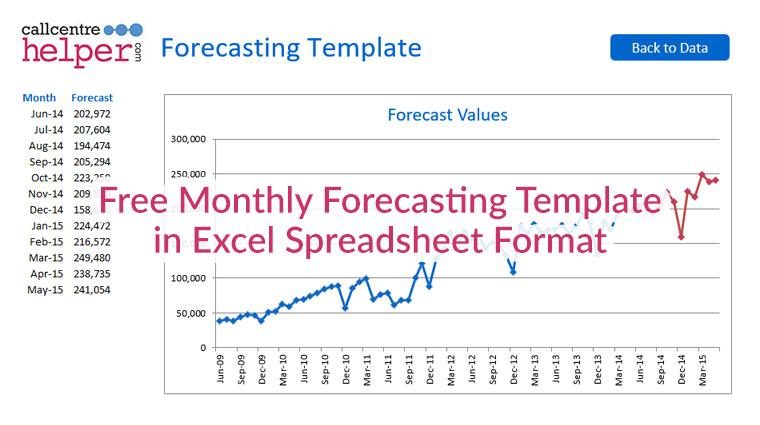

Revise the rest of the forecast. The forecast is rolled forward every time there is a month of historical data to input. Rolling forecasts work best when key cash flow drivers are modeled explicitly and directly drive. This ms excel templates can be opened using microsoft office excel 2003 or newer and you can get it in business budgets excel category.

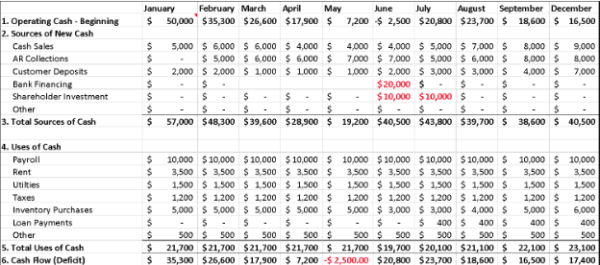

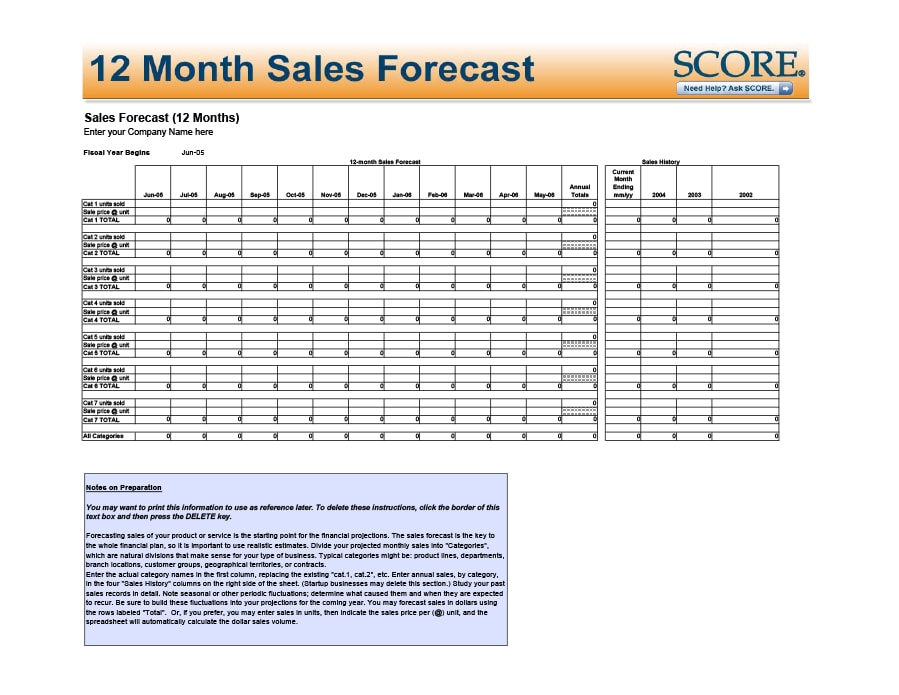

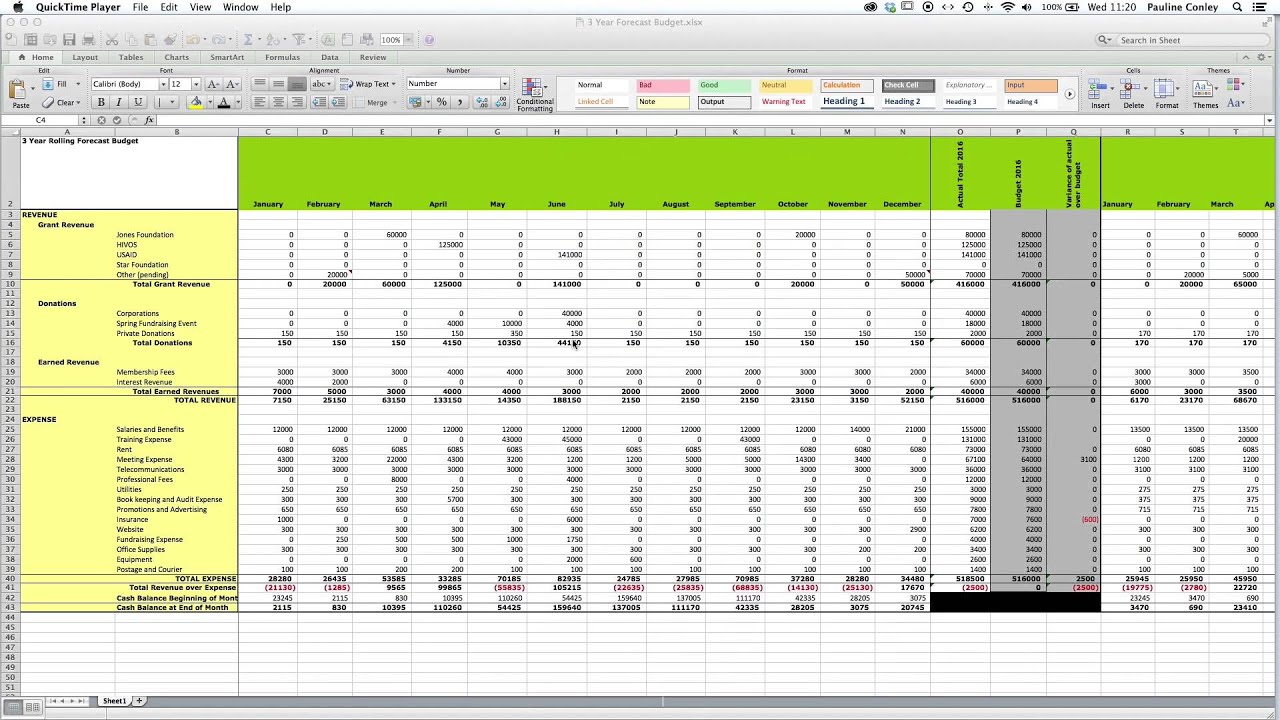

12 months 18 months etc. Download rolling business budget and forecast. The screenshot below shows an example of a 12 month rolling cash forecast. In this blog post we take a look at the different types of forecast templates and in what situations they are useful.

How will this year compare to last year where will we end up for this year but we also need to provide how this 121518 month rolling plan compares to the 121518 actual results. The benefits of monthly cash forecasts is the longer term visibility for planning purposes. With a rolling cash flow forecast the number of periods in the forecast remains constant eg. With rolling forecasts we need to also roll in the actual and shift the comparison periods.