Basic Independent Contractor Agreement Template

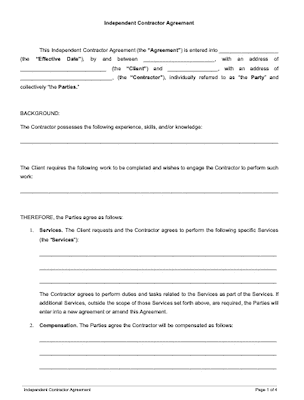

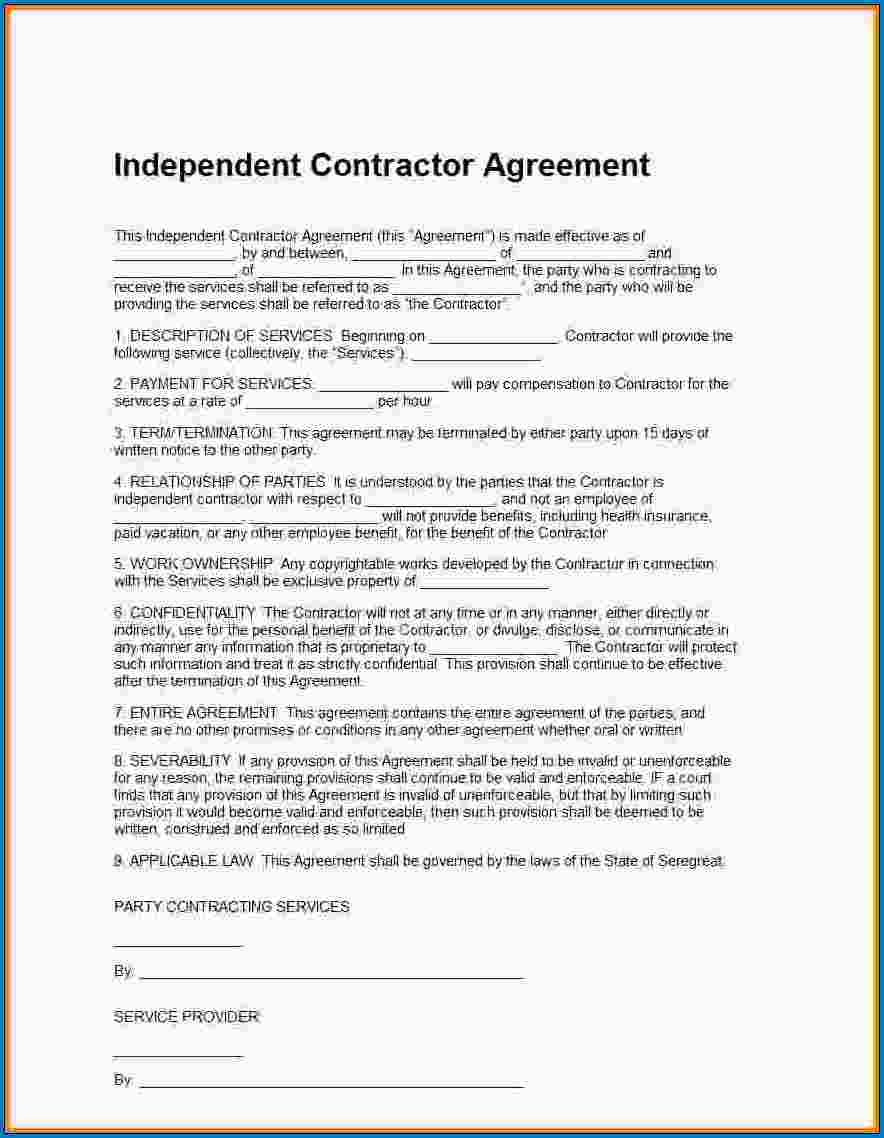

An independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables compensation and any additional clauses.

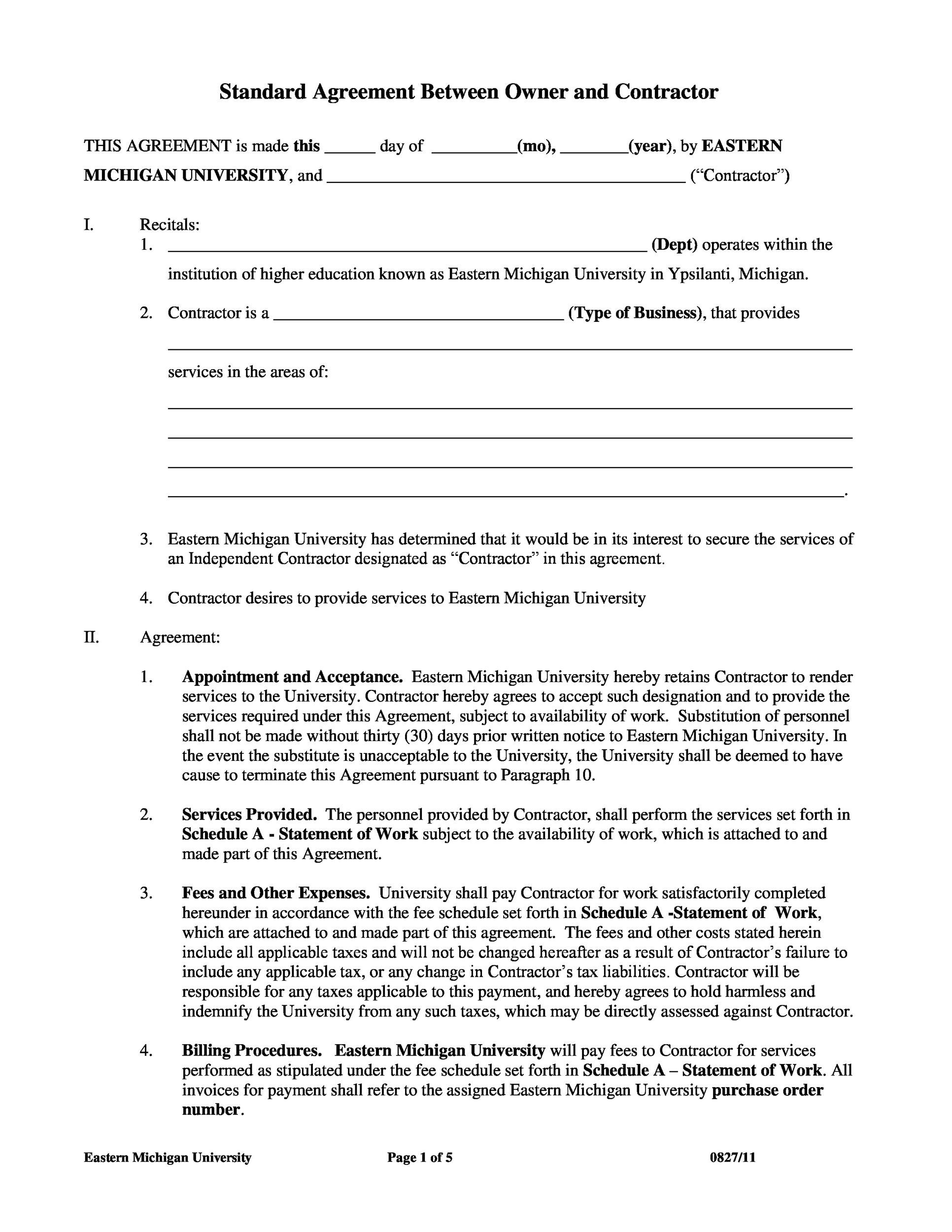

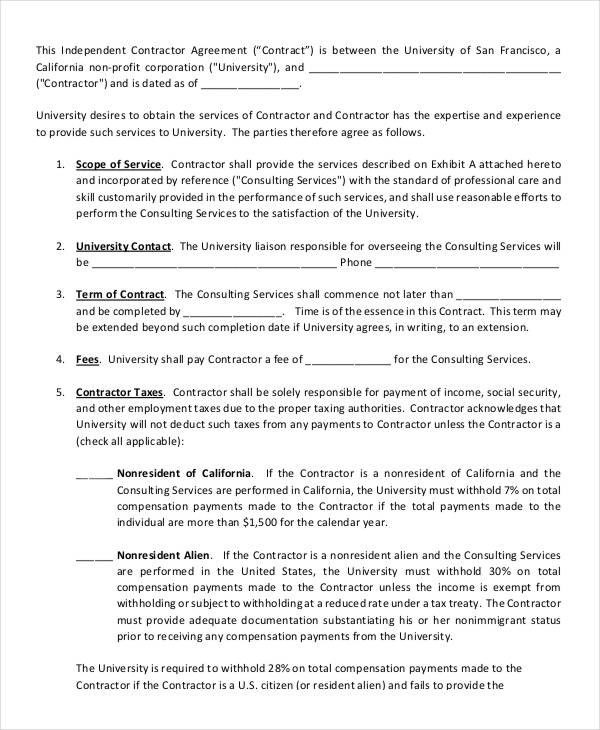

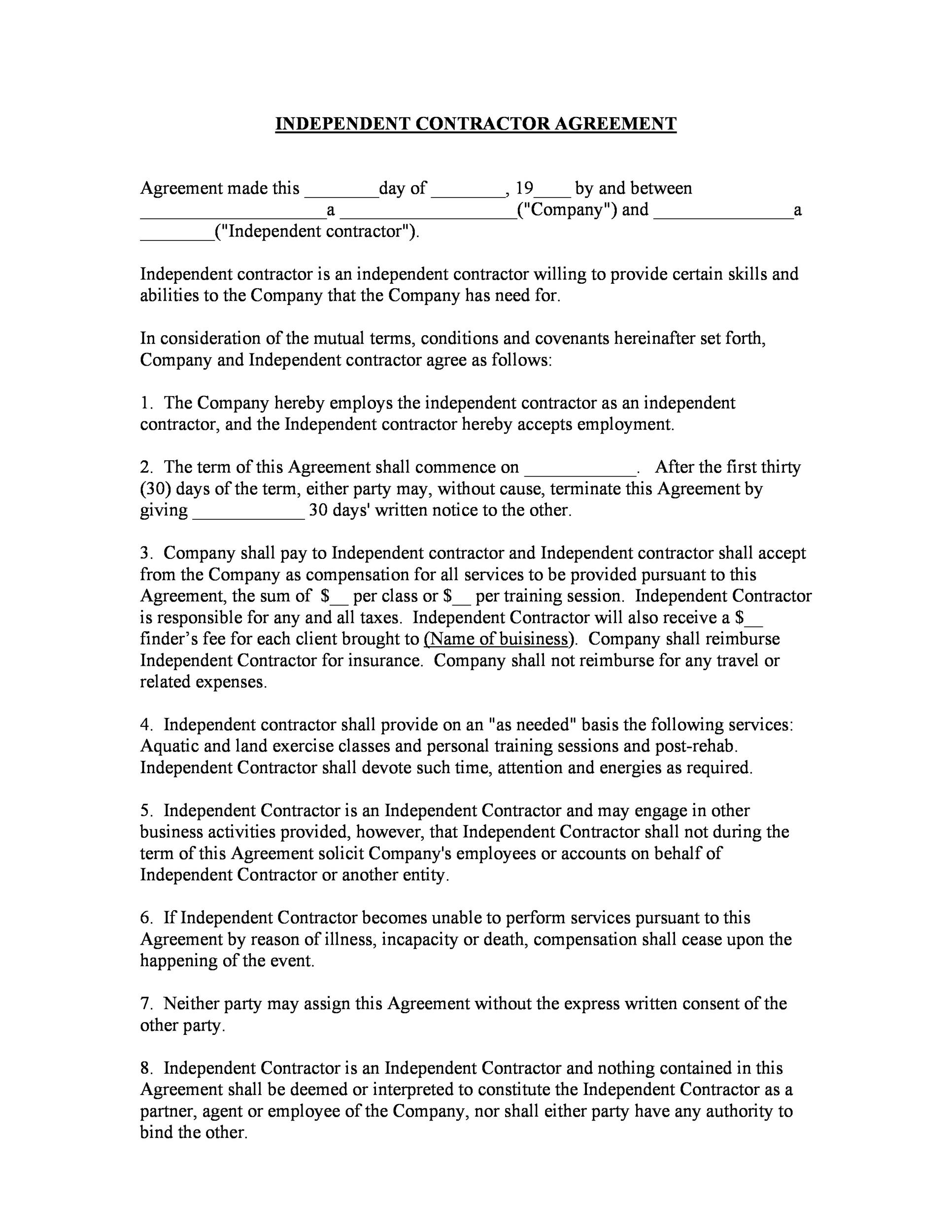

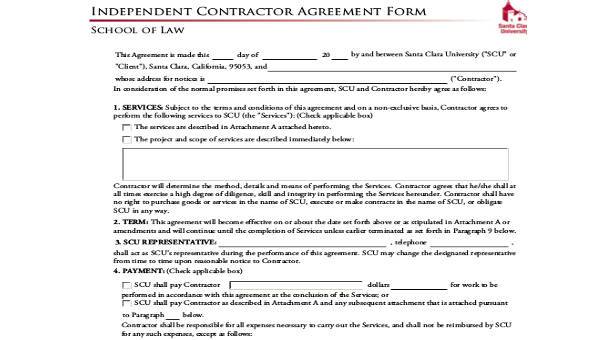

Basic independent contractor agreement template. In providing the services under this agreement it is expressly agreed that the contractor is acting as an independent contractor and not as an employee. Understanding independent contractor agreement. Section 5 independent contractor status. This agreement governs the relationship between a company and an independent contractor.

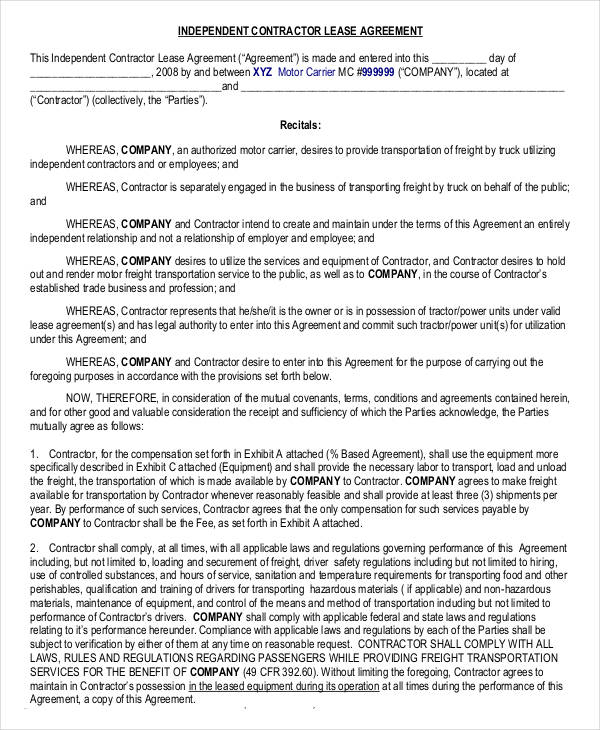

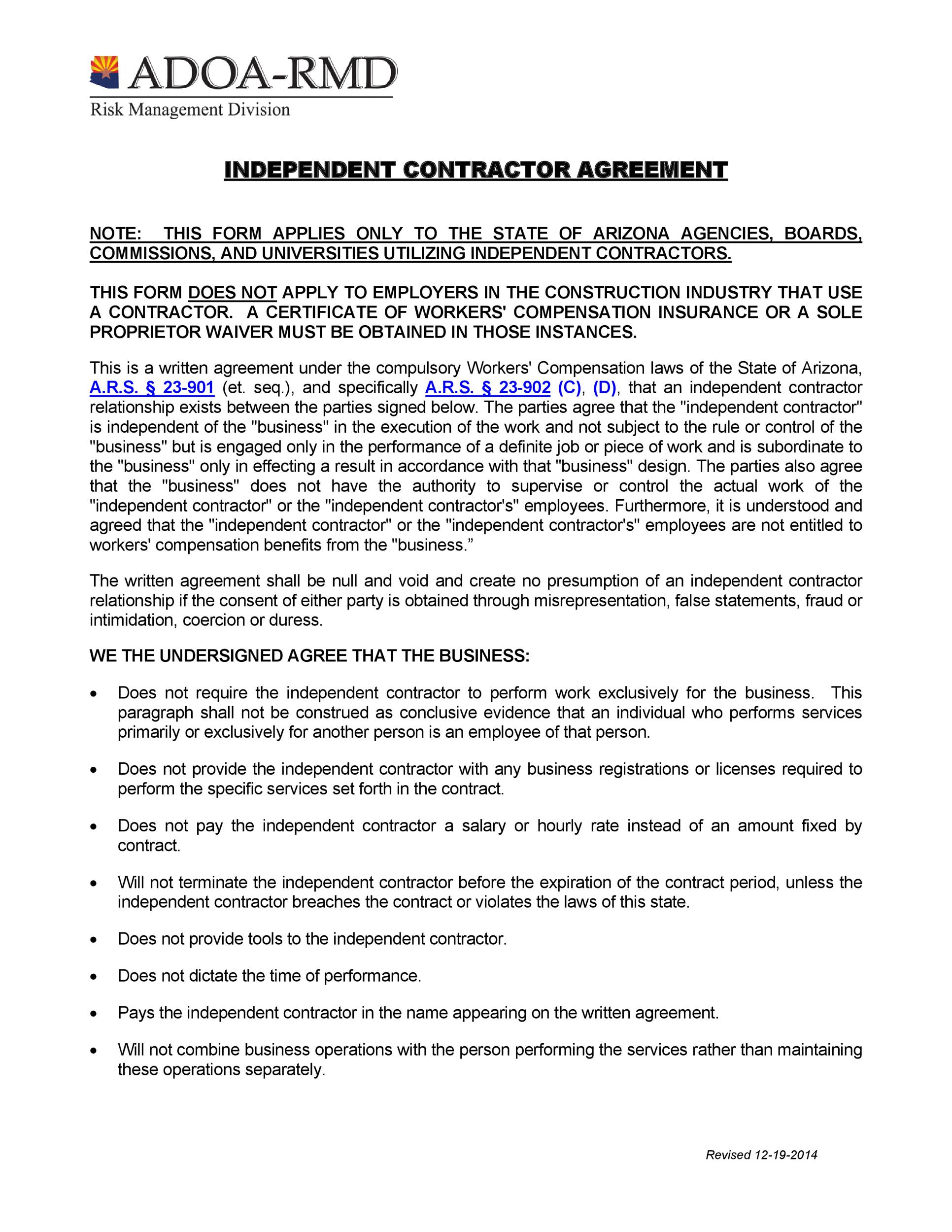

An independent contractor is a person who runs his own business and provides services to other individuals and companies without working directly for any employer. A written contract between two parties an independent contractor agreement is used for a specific service or projectto complete a task or project one company hires another company for a short period using an independent contractor agreement. Some provisions may need to be altered in accordance with local law. Download 10 free independent contractor agreement templates to help yourself in preparing independent contractor agreement.

You can also explore services contract templates to see more options. Contractor is an independent contractor and neither contractor nor contractors employees or contract personnel are or shall be deemed clients employees. Free template and instructions provided. This template favors the companyclient and should be edited to reflect the particulars of the deal for which it is used.

Contractor shall have no authority to bind or otherwise obligate contractor in any manner nor shall contractor represent to anyone that it has a right to do so. Contractor acknowledges that he is an independent contractor and is not an agent partner joint venturer nor employee of company. Independent contractor agreement pdf sample. In accordance with the internal revenue service irs an independent contractor is not an employee and therefore the client will not be responsible for tax withholdings.

Client will not require contractor to rent or purchase any equipment product or service as a condition of entering into this agreement. Contractors relationship with client will be that of an independent contractor and nothing in this agreement is intended to or should be construed to create a partnership agency joint venture or employment relationship. The contractor and the client acknowledge that this agreement does not create a partnership or joint venture between them and is exclusively a contract for.