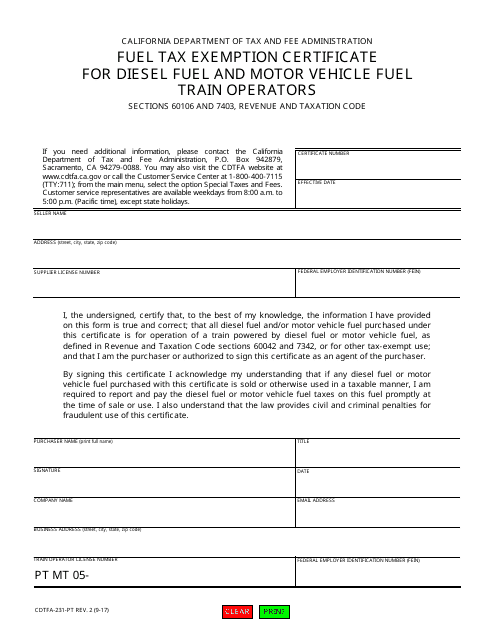

California Exemption Certificate

Address aptste room po box or pmb no.

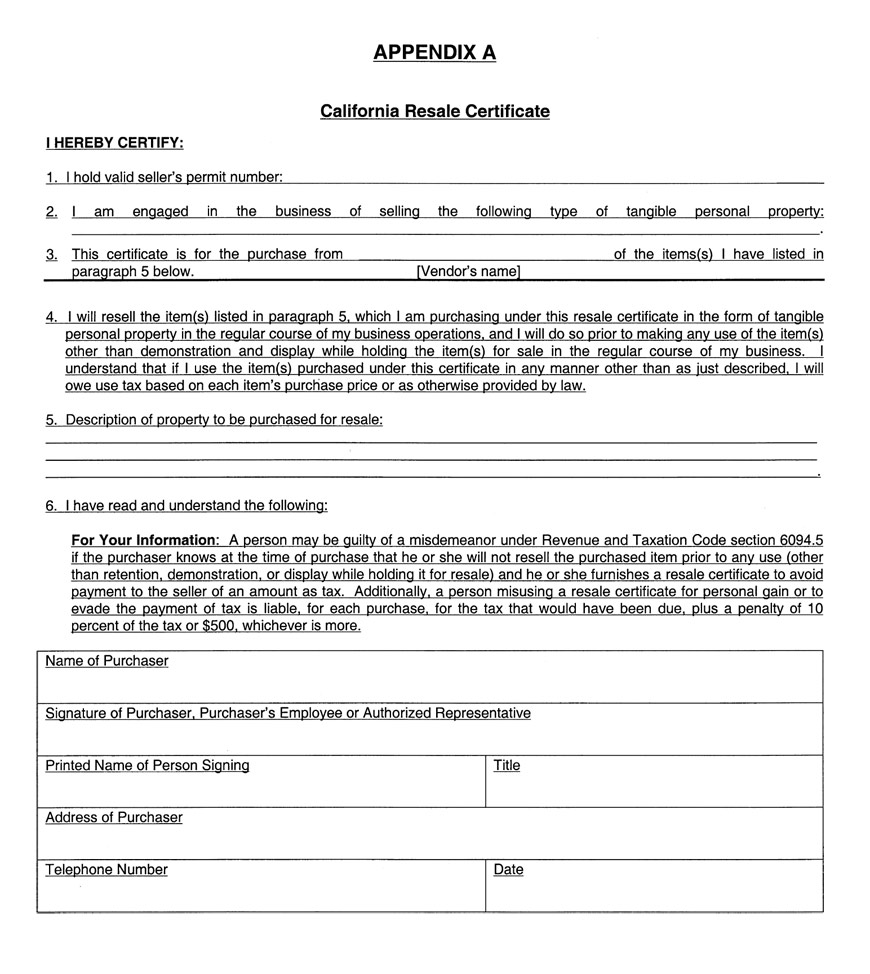

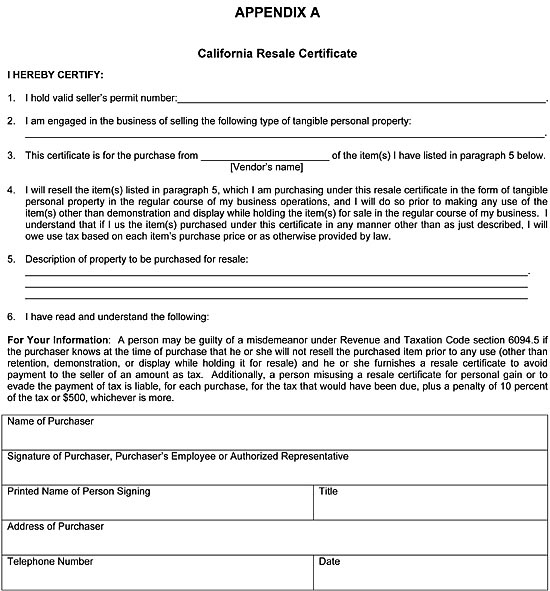

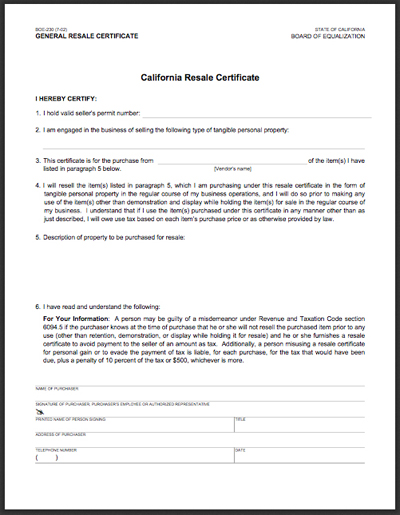

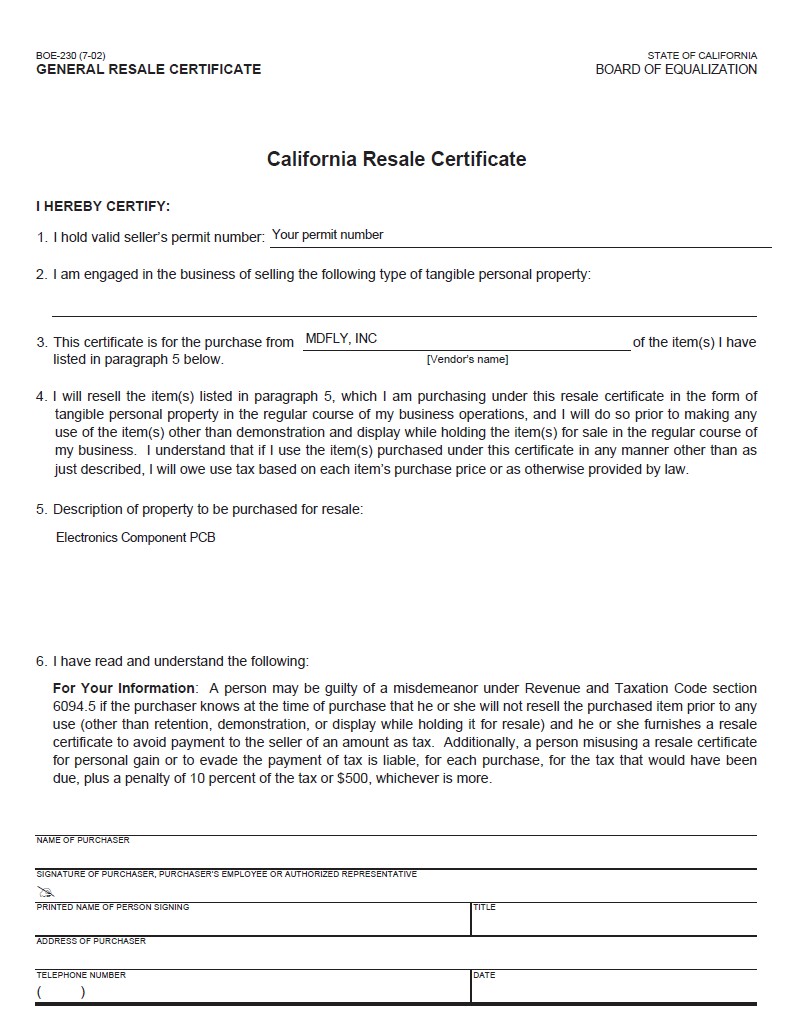

California exemption certificate. 2020 withholding exemption certificate california form 590 the payee completes this form and submits it to the withholding agent. Ca sos file no. Additionally a person misusing a resale certificate for personal gain or to evade the payment of tax is liable for each purchase for the tax that would have been. For more information go to ftbcagov and search for backup withholding.

The withholding agent keeps this form with their records. Certain states require forms for cba purchase cards and cba travel cards. Form 590 does not apply to payments of backup withholding. This ia a resale certificate which is a special type of sales tax exemption certificate intended for use by businesses or individuals who are purchasing goods which will be resold.

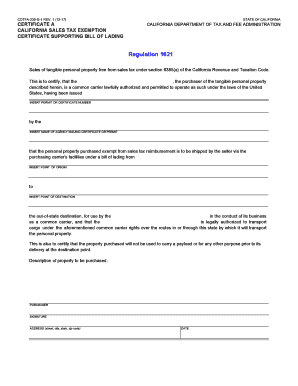

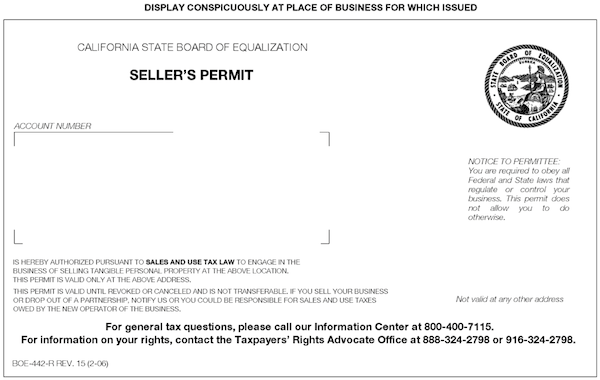

Use form 590 withholding exemption certificate to certify an exemption from nonresident withholding. Withholding agent information name name ssn or itin fein ca corp no. Certificate of exemption sales to the united states and its instrumentalities civilian welfare funds 16201. The taxpayer transparency and fairness act of 2017 which took effect july 1 2017 restructured the state board of equalization and separated its functions among three separate entities to guarantee impartiality equity and efficiency in tax appeals protect civil service employees ensure fair tax collection statewide and uphold the california taxpayers bill of rights.

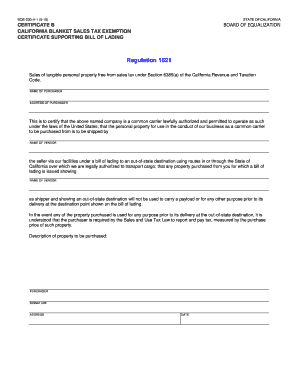

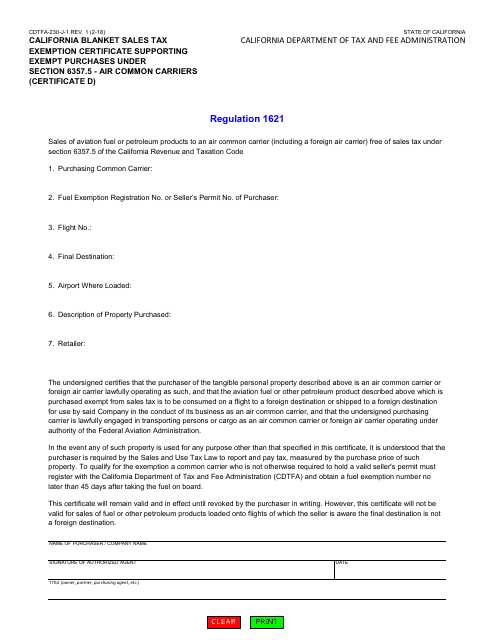

California department of. Certification of exemption for mobilehome residence purchase. California does permit the use of a blanket resale certificate which means a single certificate on file with the vendor can be re used for all exempt purchases made from that vendor. Tax and fee administration.

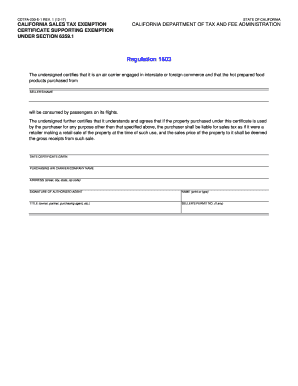

Form 590 does not apply to payments for wages to employees. California sales tax exemption certificate supporting exemption under section 63591. This is a partial exemption from sales and use taxes at the rate of 41875 percent from july 1 2014 to december 31 2016 and at the. Centrally billed account cba cards are exempt from state taxes in every state.

In the event any of such property is used for any purpose other than that specified in the certificate it is understood that the purchaser is required by the sales and use tax law to report and pay tax measured by the purchase price of such property. Partial exemption certificate for manufacturing research and development equipment. Certificate to avoid payment to the seller of an amount as tax.