Credit Counseling Certificate

Most states require debt management credit counseling and debt settlement service providers become certified.

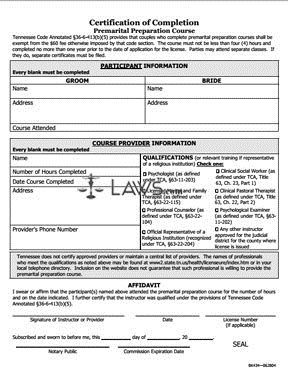

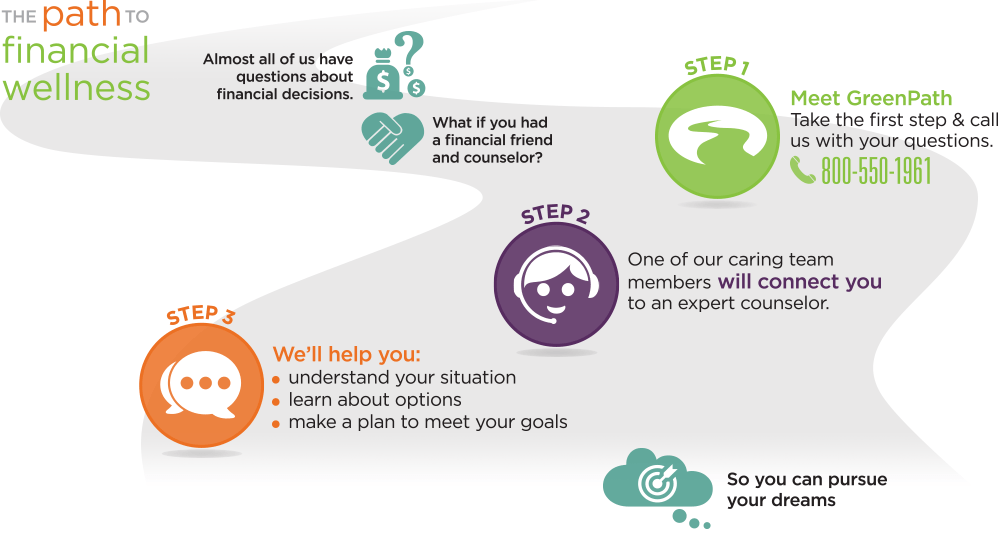

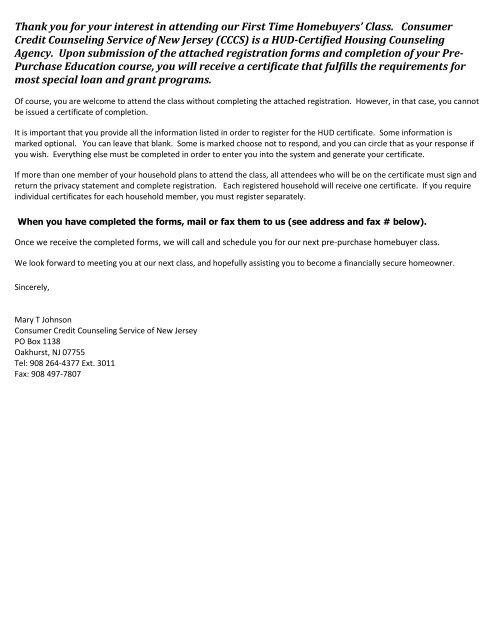

Credit counseling certificate. To get your certification youll need to complete a credit counseling session that typically lasts 60 to 90 minutes. Ccci offers credit counselor certification services to non certified and certified credit counselors across the country. Non profit consumer education services inc. Trustee approved non profit organization.

Cesi is approved by the executive office of us. In such cases the credit counseling agency is physically located in another state or judicial district but is approved to provide credit counseling in the requested state or judicial district. Before you file for bankruptcy you need to take a credit counseling course that has been approved for new york bankruptcy filers. Credit counseling certificate programs provide working financial professionals with a better understanding of how to help clients negotiate debt and improve credit.

Receive your certificate immediately after completing the course. Once you complete the course you will receive a certificate that you must file along with your bankruptcy petition. Trustees to issue certificates in compliance with the bankruptcy code. Before you file for a chapter 7 or chapter 13 bankruptcy a credit counseling certificate is required by law.

A credit counseling certificate is also known as a bankruptcy certificate. They may acquire certification upon completing the program and training. Credit counselor certification inc. To receive these credit counseling certificates you must complete two courses from a debt relief agency that is approved by the department of justice.

The credit counseling certification must be issued by a non profit credit counseling agency or debt relief company like accc that has been approved by the us.