Dispute Letter To Credit Bureau Template

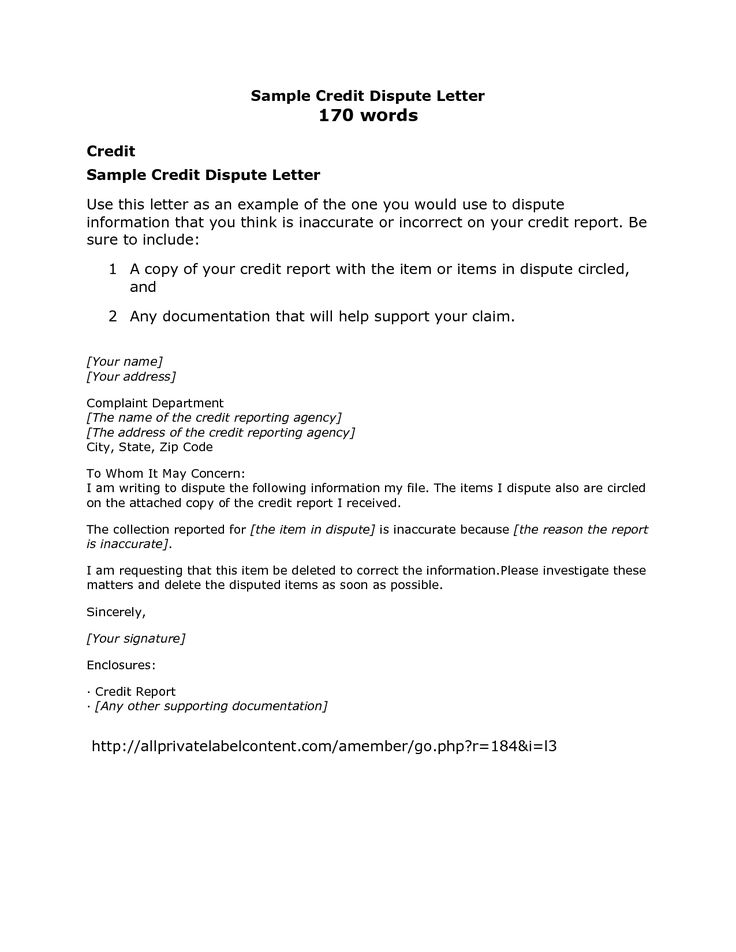

The following letter is a copy of the ftcs sample dispute letter provided for your convenience.

Dispute letter to credit bureau template. Transunion llc consumer dispute center po. You may want to enclose a copy of your report with the items in question circled. Use this letter to request an update to or a deletion of inaccurate information on your credit report. To stop business collection agencies calls you will need to send a cease and desist correspondence.

Choose items to dispute. Increasing your fico is easy with this template to dispute credit report letter to get bad marks wiped clean. Credit dispute letters can be a sent either by mail or online. Table of contents step 1.

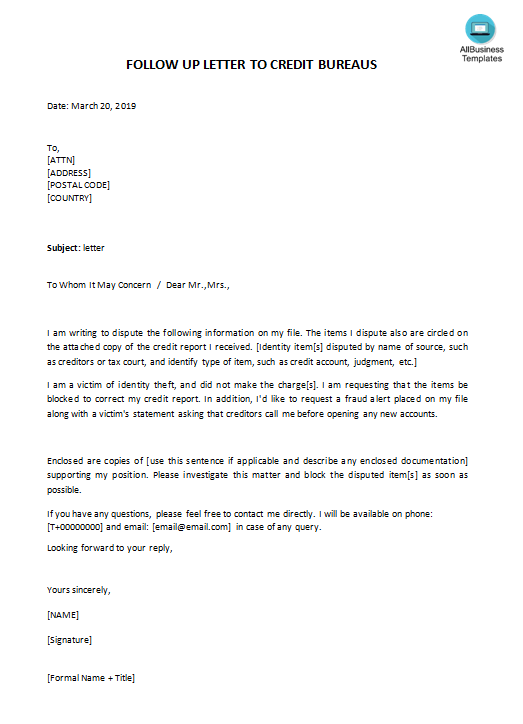

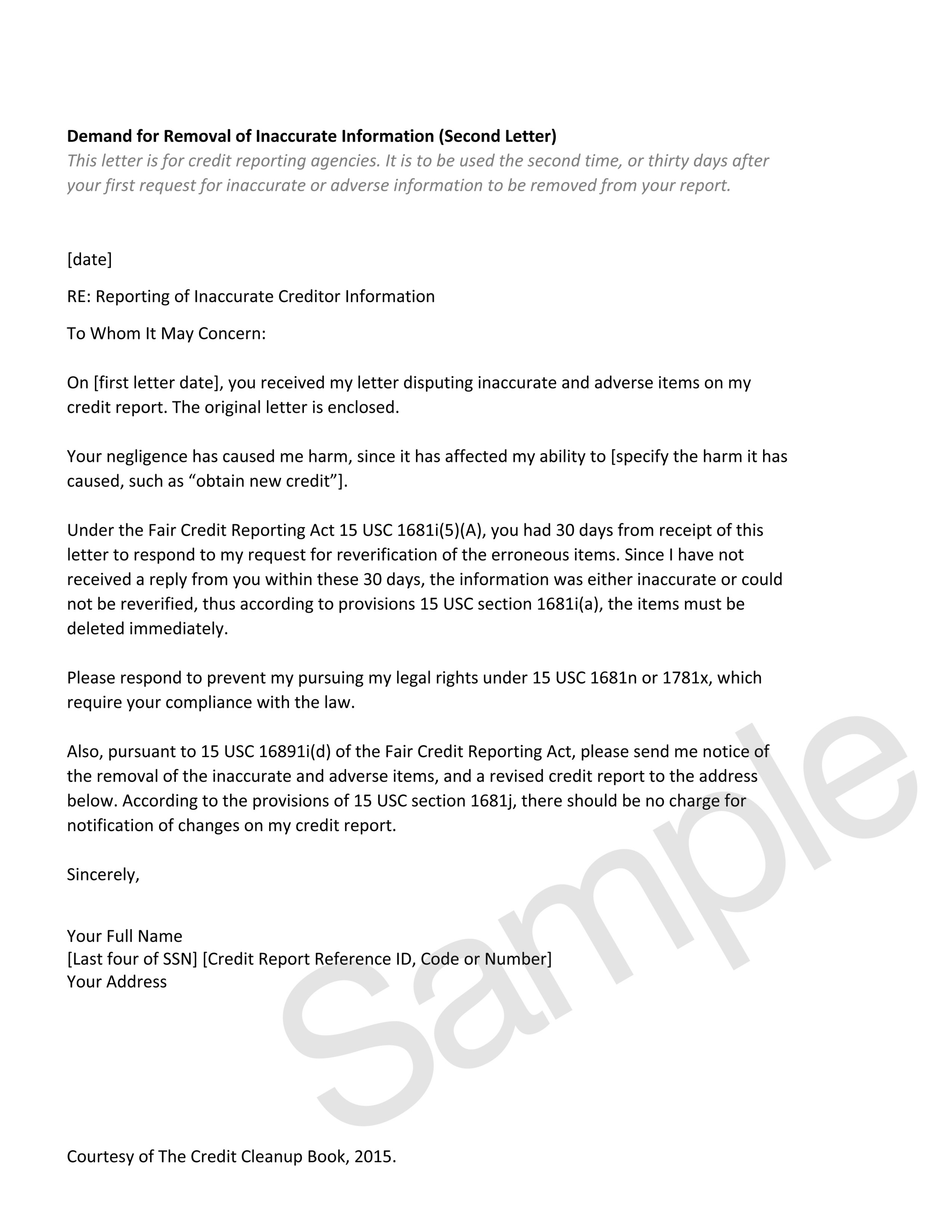

Mail the dispute form with your letter to. When you send a credit dispute letter to any of the credit bureaus by law they must investigate and resolve your dispute within 30 days. I am writing to dispute the following information in my file. If you send any information with the letter send copies and keep your originals.

Keep a copy of the letter for your records. Replace the bold statements with your information. However certified mail is the always the better option. You may consider return receipt requested for proof that the credit reporting company received it.

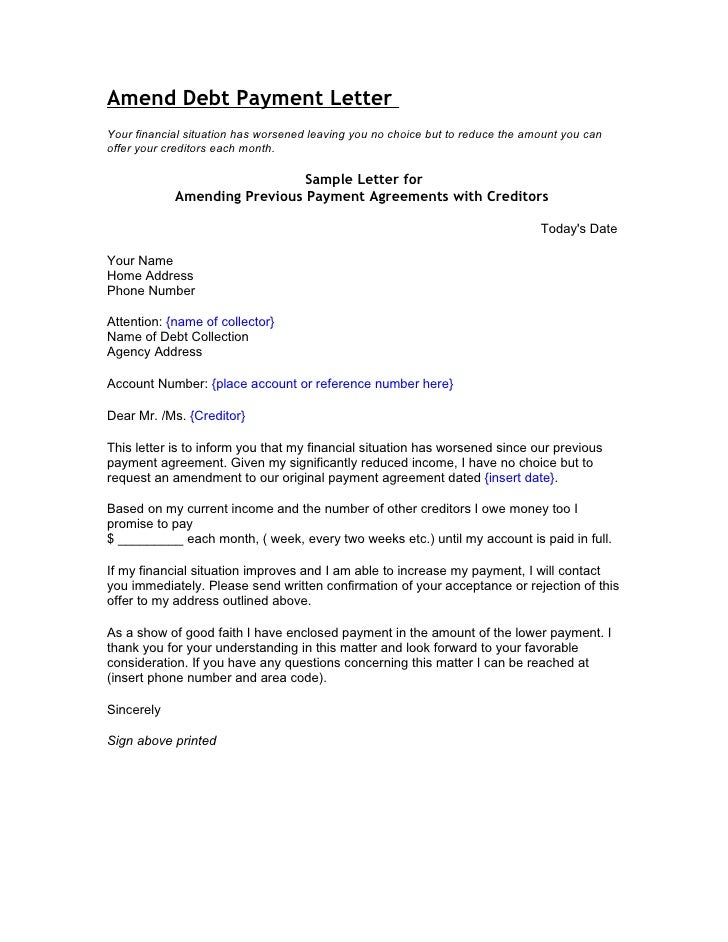

Your name your address your city state zip code date complaint department insert the bureaus address dear sir or madam. Transunion is certainly one of 3 major credit scoring bureaus in the usa the other two being equifax and experian. Your letter should clearly identify each item in your report you dispute state the facts and explain why you dispute the information and request that it be removed or corrected. Send your letter by certified mail return receipt requested so you can document what the credit reporting company received.

Choose reason for disputing each item. Use this stop and abstain dispute letter to credit bureau template to end debt collection phone calls. Sample letter for a credit bureau dispute. The ftc found that one in five people have a mistake on their credit report a mistake that means youre paying higher rates than you should.

This is a sample credit report dispute letter that you can send to credit bureaus. Wait for 30 days for the dispute completion.

:max_bytes(150000):strip_icc()/960563v1-5ba433644cedfd0050c28bf1.png)