How To Store Business Receipts

There are many benefits that come along with organizing receipts in the cloud.

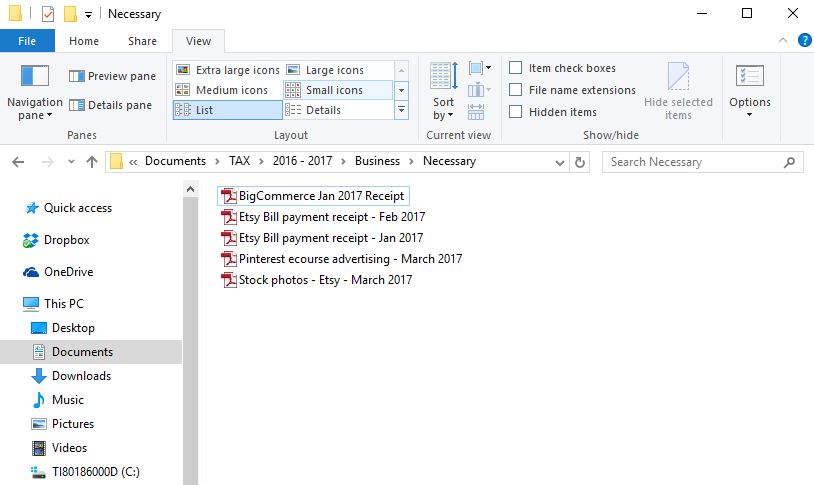

How to store business receipts. Yes the irs can come knocking for documentation and audit you up to six years back in some cases. You need to be connected to the internet in order to input data as the mobile app uses the cloud to store your receipts. When you go paperless theres little risk of receipts getting lost fading or getting damaged. When you have a plan in place to organize all those papers you can clear out quite a bit of office clutter and know where to find documents in case you get a notice from the irs or your state.

Scan receipts and keep them at least six years. Storing your receipts electronically protects you from the possibility of ink fading or damage that makes the text unreadable. By faustine rohr lacoste published november 25 2019 traditionally issuing and storing paper receipts has been one of the more painful parts of running a business. This is a good thing for those who dont have storage space available on their phones.

Organizing receipts in the cloud. However hoping that the ink on your home depot receipt hasnt faded away is a whole other issue. How to organize business receipts and paperwork as a business owner receipts copies of invoices bills and other paperwork can pile up quickly making our desks cluttered and offices messy. How to store digital receipts for your business expenses.

Fortunately technology is making it easier than ever to digitize and store your documents in the cloud. Just remember to get a clear picture of the entire receipt and ensure you can see the date address of the business and total purchase amount.