Kannada Exemption Certificate Format

The seller does not fraudulently fail to collect the tax due.

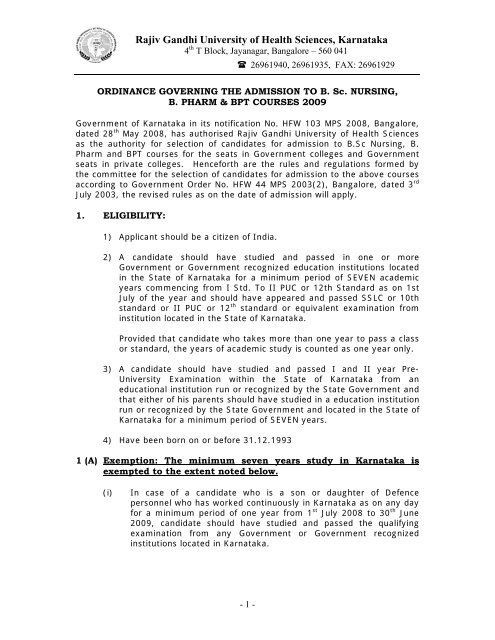

Kannada exemption certificate format. Box or route number phone area code and number city state zip code. All items selected in this section are exempt from state and local sales and use tax under section 144030 rsmo. Provided that a government servant who has passed on or before the eight day of july 1982 the examination specified in clause a in which kannada is one of the subjects in a composite paper shall on obtaining a certificate of exemption under sub rule 5 be deemed to have passed the kannada language examination under these rules. The purchaser claims an entity based exemption on a purchase made at a sellers location in a state that allows the exemption.

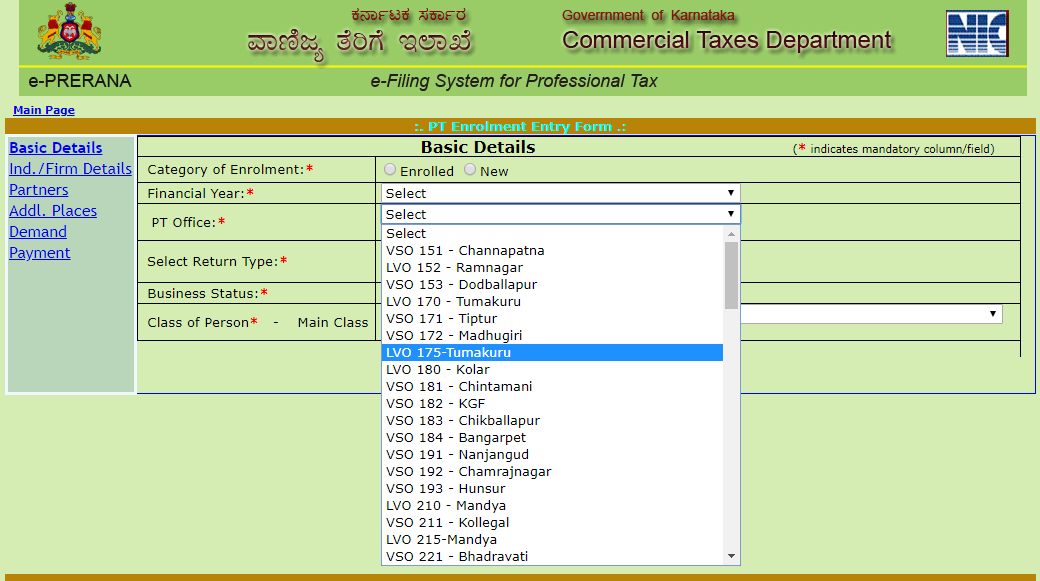

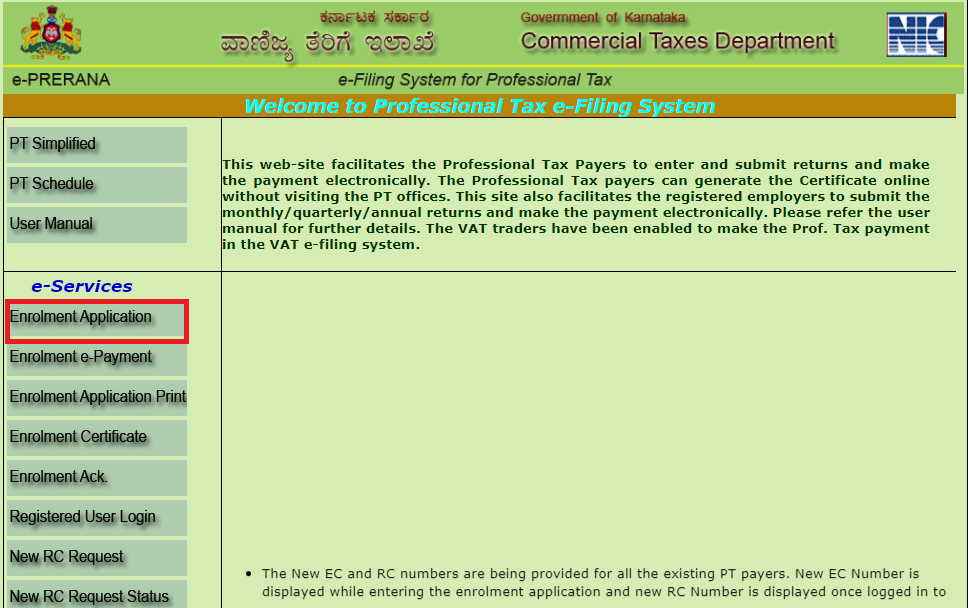

Ingredient or component parts. Name of purchaser firm or agency address street number po. Exemption certificate sales use tourism and motor vehicle rental tax name of business or institution claiming exemption purchaser telephone number street address city state zip code authorized signature name please print title name of seller or supplier. This certificate does not require a number to be valid.

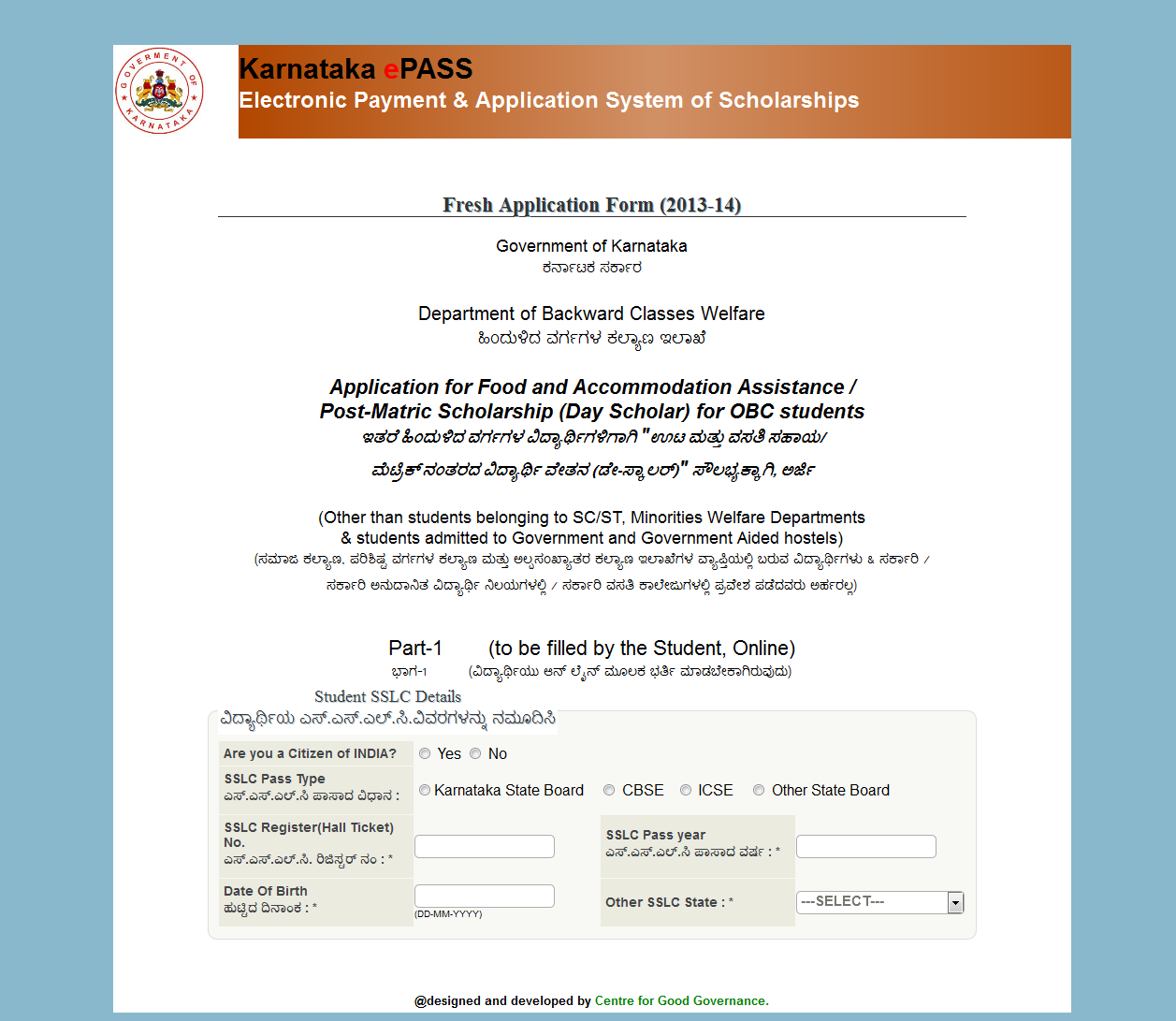

2because form 990 n must be filed electronically a paper version may not be filed and is not available for download. The requirement also applies to form pr 78ssta. When the appropriate certificate is used and all the blanks are accurately filled out the certificate may be accepted by a retailer. Certificates used in sales use tax regulations.

1because form 8871 must be filed electronically a paper version of form 8871 may not be filed and is not available for download. Check the appropriate box for the type of exemption to be claimed. The fully completed exemption certificate is provided to the seller at the time of sale. Do not use this form for claiming an exemption on the registration of a vehicle.

Provide this exemption certificate or the data elements required on the form to a state that would otherwise be due tax on this sale. I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable. This page includes links to the sample exemption certificates that are included in regulations and to the regulations themselves. It is important to read the regulations to determine whether.

Texas sales and use tax exemption certification. To claim an exemption from tax for a motor vehicle trailer semi trailer or tractor with the pa department of transportation bureau of motor vehicles use one of the following forms. The purchaser will be held liable for any tax and interest and possibly civil and criminal penalties imposed by the member state if. Form mv 1application for certificate of title first time registrations.