Offer In Compromise Letter Template

Instant access to 1900 business and legal forms.

Offer in compromise letter template. This form outlines the agreement between the taxpayer to pay a certain amount to cancel their outstanding. Read these steps to ensure you are completing the necessary steps and including the right information. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them. Harbaugh really entered into a was a partial payment installment agreement not an offer in compromise.

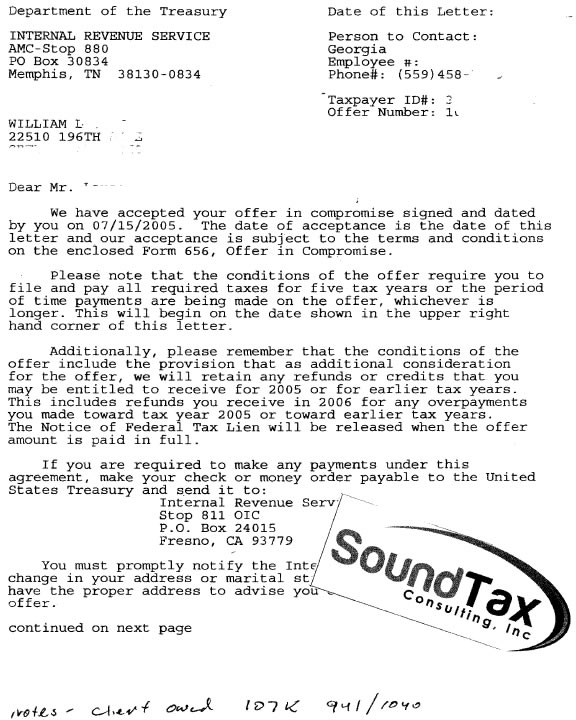

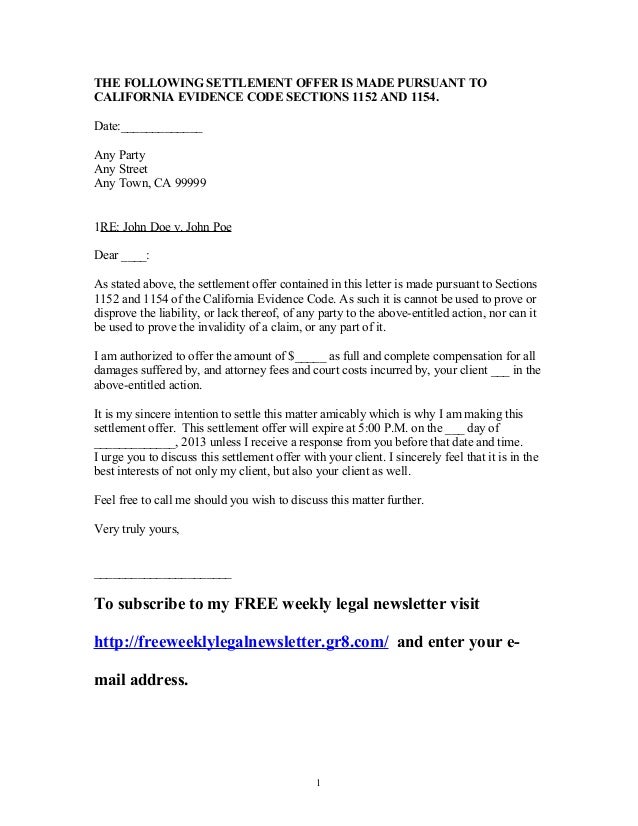

Writing a letter of explanation to the irs after receiving a notice can be a daunting task whether its for penalty waivers adjusted refunds or for cp 2000. An offer in compromise oic is a type of agreement between both the taxpayer and the internal revenue service or the california state tax agencies outlining and settling the taxpayers tax liabilities for less than the current balance due owed. Generally the government accepts an offer in compromise when it doubts that it can collect the full amount of a tax liability from a taxpayer in a reasonable time. Cookies help us maximise your experience on our website.

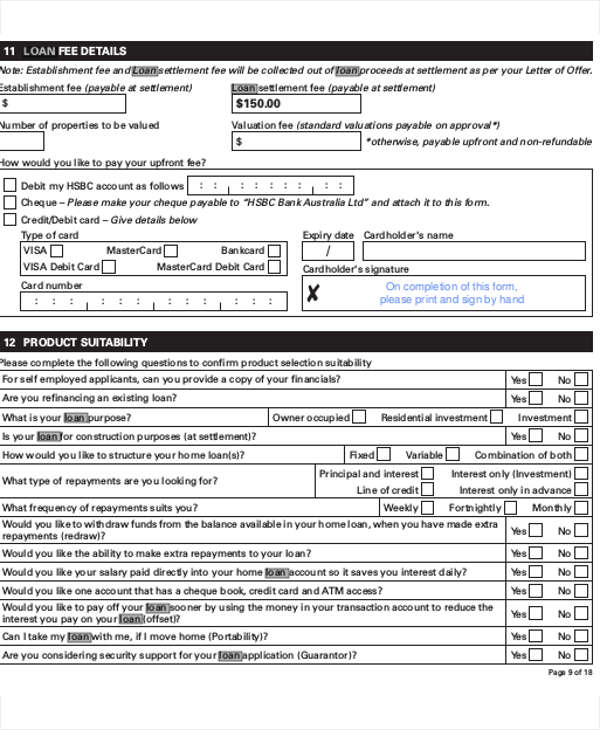

Form 656 offer in compromise this is the form required to make the offer. Sample letter to the irs on an offer in compromise answered by a verified tax professional we use cookies to give you the best possible experience on our website. Simply fill in the blanks and print in minutes. An offer in compromise is an attempt to settle a tax debt though the term is also used in cases where a borrower is attempting to settle a loan balance.

Offer in compromise attorney what is an offer in compromise. Agreement to compromise debt free sample and example letters. Agreement to compromise debt template download now. In technical terms what mr.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. Download samples of professional document drafts in word doc and excel xls format. Applying for offer in compromise. By continuing you agree to our use of cookies.

Notification effective immediately all offer applications must be received on the form 656 with a revision date on or after august 14 2019. If the taxpayers liabilities can be fully paid through the utilization of an. The irs employee the taxpayer spoke with was not even authorized to settle debts through an offer in compromise. Why your irs offer in compromise acceptance letter must be in writing.

Sample letters for agreement to compromise debt isampleletter. Call 720 398 6088 to schedule a thorough analysis of your tax situation and reclaim your dignity and peace of mind.